What happened last week?

Central banks

The week was pivotal for central bank actions. Federal Reserve Chair Jerome Powell adeptly navigated market expectations by holding key rates steady and maintaining the outlook for three rate cuts in 2024, set at 4.6%, but revised upward the rate expectations for 2025, 2026, and the long-term target to 2.6%. The Fed's primary takeaway is a recognition that inflation deceleration is more gradual than expected, necessitating further evidence of sustained reduction towards the Fed's target before considering policy easing. Powell also indicated an impending slowdown in the pace of quantitative tightening (QT) though without providing specific details. Following the Fed, the Swiss National Bank (SNB) unexpectedly reduced its key interest rate by 0.25% to 1.5%, driven by a significant downward adjustment in their inflation outlook. This move signals a likelihood of continued easing in June and September. Concurrently, the Bank of England (BoE) adopted a surprisingly dovish stance. Despite maintaining the key rate at 5.25%, no BoE member advocated for an increase, marking the first unanimous stance against hikes since September 2021. This development has led to a recalibration of market expectations, with the prospect of a rate cut now being considered as early as June (60% chance) or even May (35% chance). Earlier, the Bank of Japan (BoJ) concluded its negative interest rate policy (NIRP) by implementing a modest 10bps hike in key rates and its yield curve control (YCC) policy, while committing to continued bond purchases to prevent erratic increases in JGB yields. The BoJ's stance opens the door for further rate hikes, with the market anticipating three additional adjustments of 10bps each by the end of 2024.

Credit

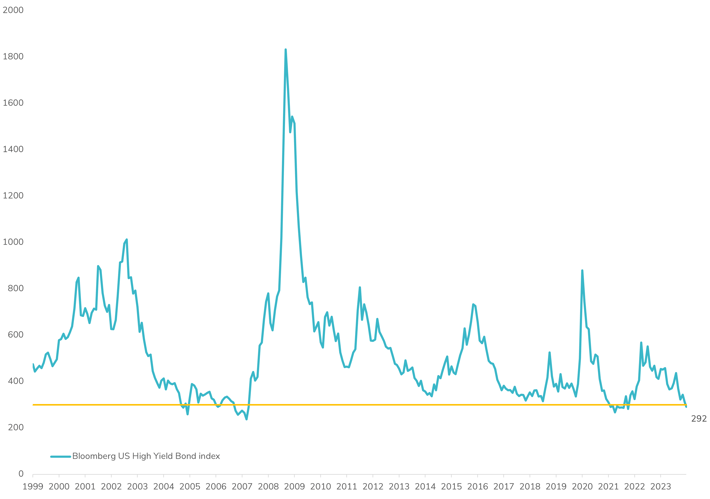

The credit market continues to exhibit resilience, with significant portions of the spectrum on both sides of the Atlantic demonstrating strong performance last week. In the U.S., Investment Grade (IG) bonds advanced with a +0.6% gain, while U.S. High Yield (HY) Corporate Bonds increased by 0.9%, buoyed by favorable rate movements and a positive outlook in U.S. equities. Remarkably, the spread of the Bloomberg U.S. High Yield bond index narrowed below 300bps, closing at its tightest point (292bps) since January 2022. Similarly, the Bloomberg IG corporate bond index's spread concluded at 88bps, the most compressed level since December 2021. This tightening is supported by robust year-to-date inflows, with USD IG funds attracting $44 billion (2.3% of start of year AUM) and HY funds securing $4.2 billion (1.4% of beginning of year AUM). Furthermore, concerns over the U.S. HY maturity wall have significantly subsided, with issuers reportedly reducing their 2024-2026 maturity wall by 40% from a year ago, marking one of the most aggressive maturity extensions in junk bond market history. In Europe, IG bonds mirrored the U.S. performance with a +0.6% weekly gain, driven by unprecedented demand for European corporate bonds. The subscription ratios for EUR IG bonds have reached their highest in a decade at 3.79 times, with the average maturity of IG supply extending to 9 years in March 2024, the longest since the onset of the pandemic. However, European High Yield faced challenges, particularly among the weakest issuers (CCC-rated), which saw a -0.7% decline over the week. This downturn was propelled by renewed credit concerns, highlighted by significant drops in the senior unsecured debt of Altice France following debt restructuring announcements and Ardagh Packaging exploring its debt structure. These incidents have wiped out the year-to-date gains of CCC-rated bonds in Europe, which stood at +7% before last week.

Rates

This week, in the wake of a series of central bank meetings, government bonds experienced a positive performance across the board. U.S. Treasuries led with a commendable gain of +0.7%, accompanied by a 10bps decrease in the yield of the 10-year U.S. Treasury. Notably, the U.S. yield curve (2s10s) observed a slight steepening by 5bps to -37bps. Following the Federal Reserve's reaffirmation of three anticipated rate cuts in 2024, a move aligned with market forecasts, attention has gravitated towards the longer end of the yield curve. This segment has witnessed the most significant monthly outflows since January 2022, as indicated by the iShares 20+ Year Treasury Bond ETF, highlighting investor hesitancy towards engaging with long-term Treasuries. Conversely, a significant drop in interest rate volatility, with the MOVE index descending to 90—the lowest since February 2022—signals a potential easing in market tensions, an essential indicator for multi-asset allocators monitoring shifts in market dynamics. In Europe, the bond performance mirrored that of the U.S., registering a +0.6% uplift for the iShares Core EUR Govt Bond ETF over the week. Peripheral spreads saw a modest widening, with the spread between the 10-year Italian and German yields expanding by 6bps to 130bps. This movement reflects a cautious market reaction to the broader European monetary landscape. The German 10-year government yield, in particular, benefited from the Swiss National Bank's unexpected rate cut, experiencing a 12bps decline to 2.32% over the week. This adjustment in the German yield underscores the interconnectedness of European bond markets and the potential for central bank policy decisions to influence yields across the continent.

Emerging market

Emerging market (EM) sovereign bonds emerged as the standout performers within EM fixed income, registering a +1.5% gain over the week. This uptick was bolstered by favorable movements in U.S. rates and a 10bps spread tightening to 325bps, marking the lowest level since January 2022. EM corporate bonds also posted a solid +0.6% gain, with spreads remaining stable throughout the week. A notable trend in Asia saw BoFA Asia EM corporate spreads tightening for 19 consecutive weeks, culminating in their lowest level since July 2007. Meanwhile, the People's Bank of China (PBOC) made significant adjustments to the daily reference rate, the most considerable shift since early February, hinting at Beijing's tacit approval for further currency depreciation amid an uneven economic recovery. Consequently, the 2-year China yield plummeted to 1.985% this week, the lowest since June 2020. The China real estate bond sector witnessed a pivotal moment as Fitch downgraded the state-backed developer Vanke, the country's second-largest by sales, to Junk status. In Latin America, both the Brazilian Central Bank (BCB) and the Bank of Mexico (Banxico) enacted key rate cuts. Banxico reduced its key rates by 25bps to 11%, marking the first cut since 2021, driven by positive inflation trends and a strengthening Peso. The BCB followed suit, lowering its key rate by 50bps to 10.75%, although adopting a more hawkish stance by shortening its forward guidance in light of rising inflation figures. The Brazilian real rate remains significantly restrictive at 7%, compared to the 4.5% neutral rate defined by the BCB. In Chile, investors in the mobile operator WOM have engaged a legal adviser in anticipation of potential debt negotiations, leading to a significant drop in the value of its USD bonds. Turkey's central bank delivered a surprise move, increasing its key rate by 5% to 50% and expanding its interest rate corridor to +/-300-bps from +/- 150 bps. This substantial hike, prompted by the Turkish Lira's recent weakness and a resurgence in inflation, underscores the country's ongoing economic challenges and the central bank's assertive response to stabilize the currency and curb inflationary pressures.

.png)