Jerome Powell spoke yesterday in the US Senate to present the Fed’s semi-annual monetary policy report. The Fed’s Chair took this opportunity to reiterate the commitment of the Fed in bringing inflation lower: “Our overarching focus is using our tools to bring inflation back down to our 2 percent goal and to keep longer-term inflation expectations well anchored. […] We will stay the course until the job is done”

So far, the job is not done. Inflation is running at 5-to-6%, still way above the Fed’s 2% target.

So far, the job is not done. Inflation is running at 5-to-6%, still way above the Fed’s 2% target. Admittedly, inflation had been slowing down since its Summer 2022 peak, mostly because of the decline in energy prices and the easing of supply chain bottlenecks. However, prices of services have continued to rise faster than desired, a likely consequence of strong wage growth and record low unemployment.

In January, the Fed had slowed down the pace of its rate hike cycle started in March 2022. A 25bp rate hike, following multiple 75bp & 50bp hikes in 2022, suggested two things: 1/the end of the rate hike cycle was getting close as large rate hikes were no longer necessary 2/the Fed was willing to do smaller steps to avoid “overtightening” and risking causing unnecessary damages to the economy.

Since then, economic data have undermined this view. Economic activity, that had slowed down in late 2022, appears to have picked up sharply in the service sector since the beginning of the year. The job market remains extremely tight, with not only a surprisingly large number of job creations in January, but also upward revisions in past job creation data that point to an even-tighter job market than what could be expected. The unemployment rate stands at its lowest level in more than five decades. Wage growth and labor cost are still running too high for allowing a slowdown in inflation, and various gauges of inflation have surprised to the upside recently.

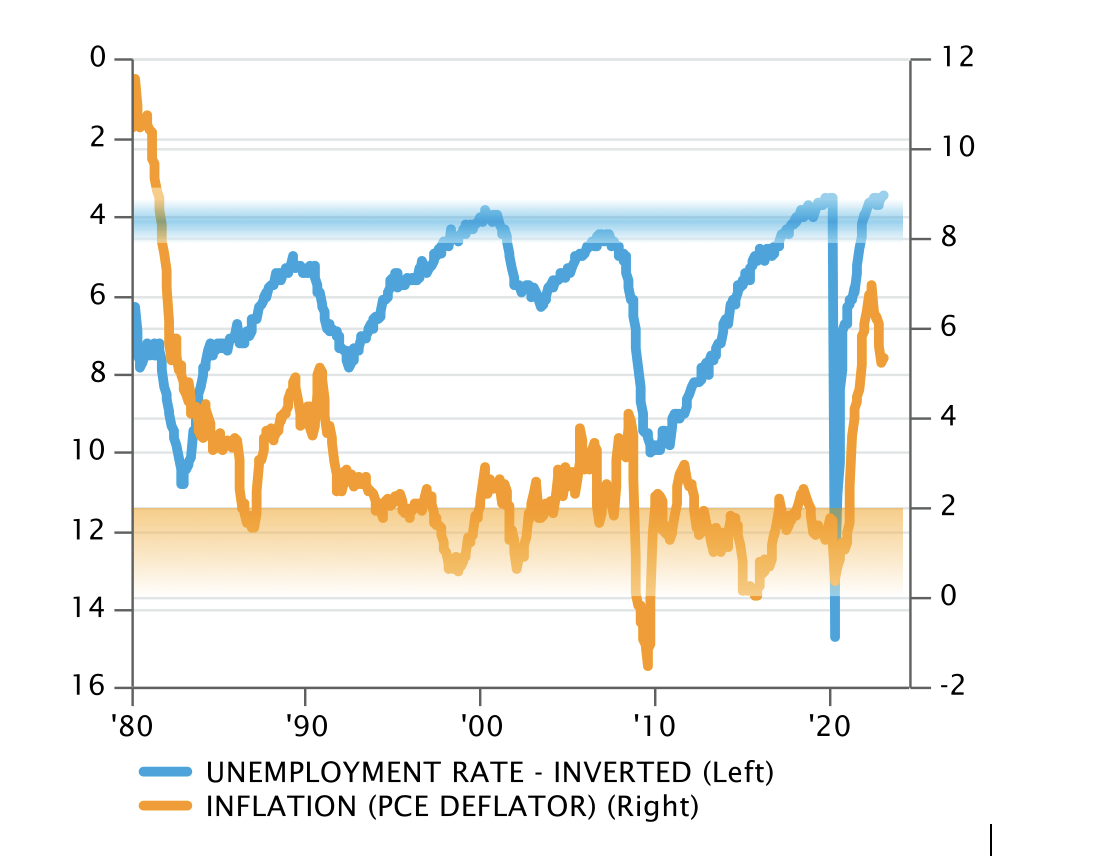

Fed’s dual Inflation and Employment mandate

Source: Banque Syz, Factset

Source: Banque Syz, Factset

As repeated by Jerome Powell, the dual mandate of the Fed is to promote maximum employment and stable prices. The Fed is currently missing on this mandate, too high inflation likely being the result of employment being above it “sustainable maximum”. There may have been hopes, until recently, that even if levels were not in line with the mandate, the trend was going in the right direction, allowing for a relaxation in the Fed’s stance. Based on most recent data, even the trend of inflation and employment cannot be seen as reassuring by the Fed.

In that context, yesterday’s testimony was an opportunity to provide an update on the Fed’s views and outlook. And Jerome Powell didn’t waste it: “We continue to anticipate that ongoing increases in the target range for the federal funds rate will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. […] the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes. Restoring price stability will likely require that we maintain a restrictive stance of monetary policy for some time. The historical record cautions strongly against prematurely loosening policy. We will stay the course until the job is done.”

Said differently, the Fed is serious about bringing inflation down, it will continue to hike rates as much, and as fast, as it is necessary, and it will keep rates high until it is sure that inflationary pressures have been dampened. And if coming data confirm the job market’s tightness and the persistence of inflationary pressures, faster rate hikes are to be expected.

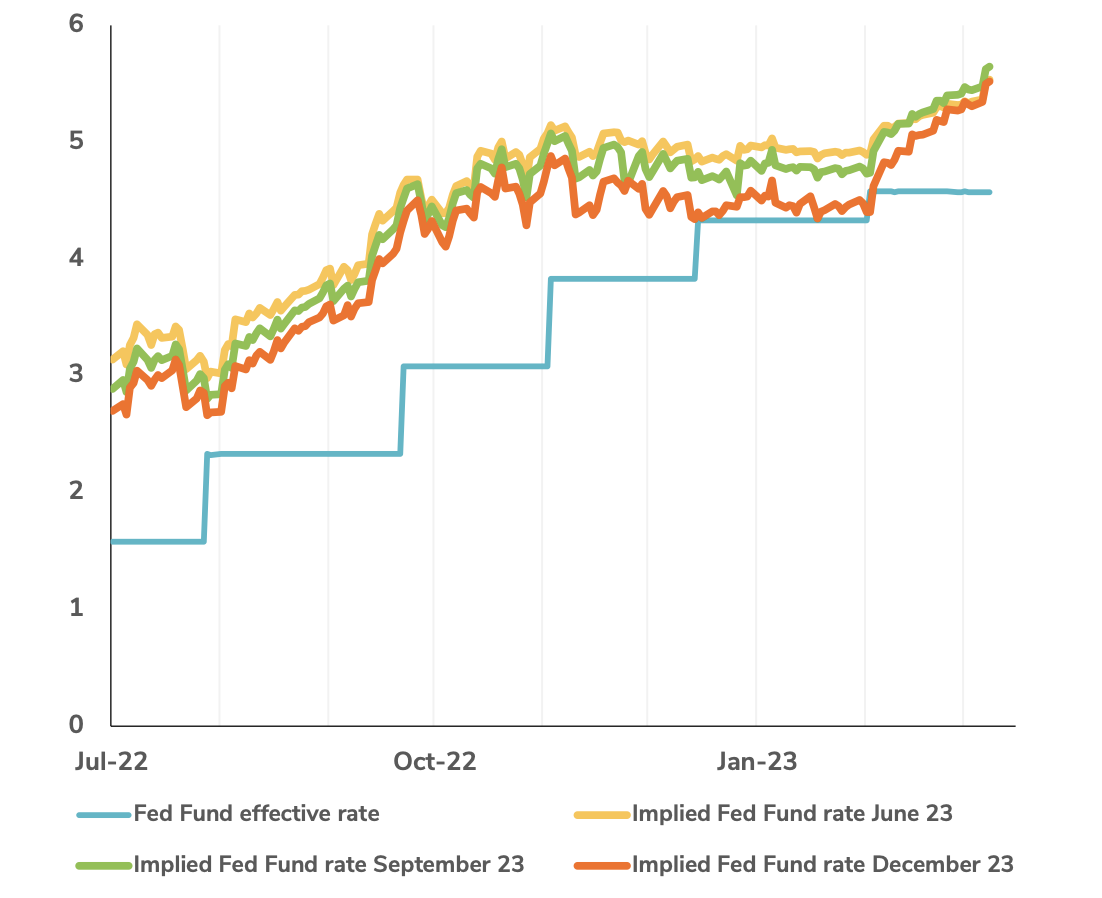

Financial markets have taken note: while a 25bp hike was long seen as “a done deal” at the next Fed meeting (22 March), the probability of a 50bp hike has increased to a 70% chance after Powell’s speech. Beyond the next meeting, the expected peak in Fed Fund rates, or “terminal rate”, has also jumped to its highest level of the cycle, above 5.6%. And subsequent rate cuts that had been priced for the second half of this year have been postponed to 2024. Employment data on Friday, and Inflation data next week, could spur an additional repricing of future Fed Fund expectations if they continue to show a combination of strong job market and persistent inflationary pressures.

Implied Future Fed Fund rates for June, September and December 2023

Source: Banque Syz, Bloomberg

Source: Banque Syz, Bloomberg

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Flash note

.png)