Introduction

The AI headlines are getting louder – and the numbers are staggering. In recent weeks we have seen announcements of deals and partnerships running well into the $100 billion-plus range, involving the industry’s most influential players, from Oracle and Nvidia to SoftBank and OpenAI. The scale of these commitments has reignited a familiar question: is this the start of a bubble, or the early innings of a structural, multi-year investment cycle?

Our view is clear. Unlike the dot-com bubble, when financing raced ahead of revenues, today’s AI build-out is underpinned by visible demand, early monetisation and the deep balance sheets of the world’s largest technology companies. What we are witnessing is not froth, but a once-in-a-generation hardware super-cycle.

The datacentre boom just keeps growing

At the start of 2025, when technology giants were committing tens of billions to data centre investment, many investors remained cautious, worried about uncertain monetisation and the risk of oversupply. Since then, the narrative has shifted: companies are now reporting tangible revenue growth and productivity gains from AI, while at the same time warning of capacity constraints.

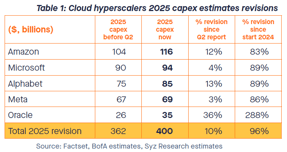

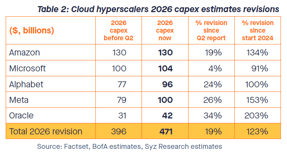

Over the summer, all five of the largest data centre builders raised their capital expenditure guidance. The revisions were striking, with expectations rising by an additional $41 billion this year (up 11%) and $75 billion next year (up 19%). And investors rewarded these higher spending plans.

These estimate revisions confirm that the AI capex boom is real. And it is spreading well beyond the hyperscale “big five”. Neo-cloud players such as CoreWeave and Nebius, Chinese giants like Alibaba, Tencent and ByteDance, as well as a growing wave of sovereign AI projects driven by governments worldwide are all adding to the momentum.

Executives at both Nvidia and Broadcom – the two companies at the heart of AI chips game – argue this is just the start of a multi-year super-cycle. Nvidia’s CEO has spoken of $3–4 trillion in AI spend by 2030, while Broadcom’s boss has tied his compensation to lifting AI revenues six-fold in five years. And Meta’s Mark Zuckerberg has been blunt: the bigger risk is under-investing, even if that means “misspending a couple of hundred billion dollars”.

Who pays for all this? Capital is plentiful

Most of the increase in datacentre spending so far has been driven by the four US hyperscalers: Microsoft, Alphabet, Amazon and Meta. These companies simply do not need to worry about financing. All remain exceptionally well-funded, with net cash positions and immense free-cash-flow generation. If they were to increase leverage only modestly – for example to 1x net debt to EBITDA – that alone could unlock another $1 trillion of capacity.

Oracle, by contrast, has less flexibility, with leverage at 4x Net Debt to EBITDA, and negative free cash flow because of heavy investment. It is no surprise, then, that it tapped the debt markets. What is remarkable however is the reception: Oracle’s $18 billion bond issue this month was oversubscribed nearly fivefold, with peak demand reaching $88 billion. Appetite for exposure to AI infrastructure is enormous.

The same enthusiasm is visible elsewhere. SoftBank has emerged as a key backer of Project Stargate; sovereign wealth funds in Asia and the Middle East are deploying capital aggressively; and BlackRock, Microsoft and Nvidia have joined forces behind a $100 billion AI infrastructure fund.

Start-ups such as CoreWeave and Nebius illustrate the other side of the story. Lacking the cash-generating core businesses of the hyperscalers, they finance their GPU-heavy data centres with debt, often pledging the chips themselves as collateral. This model carries risks, but their ability to sign major commercial deals suggests demand (and trust in the cycle) is strong enough to support it.

In short: capital is not a constraint. But unlike during the dot-com era, when investment far outstripped demand, today’s AI build-out is backed by clear monetisation, robust business models and balance sheets that provide real margin of safety.

Circular financing or strategic vision?

Some investors are now questioning the very nature of the mega-deals being announced. The concern is whether these are genuine, sustainable business arrangements or simply a form of circular financing reminiscent of the dot-com bubble, where companies propped each other up with vendor credit and overextended commitments.

Oracle is a case in point. The company recently stunned the market by forecasting that its cloud business could grow tenfold, from $15 billion today to $144 billion in just a few years. Much of this growth is tied to a colossal contract with OpenAI worth over $300 billion. Skeptics argue this creates a huge counterparty risk: OpenAI, despite its lofty $0.5 trillion valuation, still has limited revenues. If it cannot fund the contract, Oracle could be left with costly, underutilised infrastructure.

Nvidia’s partnership with OpenAI has drawn similar scrutiny. The deal envisages deploying 10 gigawatts of Nvidia systems, with Nvidia itself pledging up to $100 billion in investment. Critics see this as Nvidia financing its own demand – a case of vendor-backed purchases echoing the telecoms boom of the late 1990s.

But in our view, these transactions are better understood as strategic positioning. Oracle secures a long-term anchor client that gives both credibility and predictability. Far from increasing risk, it locks in revenues that justify the upfront spend. The alternative - sitting out the AI race - would arguably be riskier. AI’s economics depend on immense, sustained compute power, meaning that costs remain high rather than falling. This makes long-term supply agreements both rational and essential.

Nvidia’s partnership with OpenAI also has a clear strategic rationale. By enabling OpenAI to become its largest client, Nvidia secures years of guaranteed demand and strengthens its position as the indispensable provider of AI compute. If the investment allows OpenAI to buy $300–500 billion of Nvidia hardware over time, the return on capital could be highly attractive. It also gives Nvidia a productive use for its fast-growing cash pile, recycling it back into the ecosystem that fuels its own growth.

Although at first glance these deals may resemble vendor financing, their substance is different. They strengthen the AI supply chain, creating stable, long-term partnerships in which providers, customers, and investors are aligned. Far from being speculative froth, they reflect a deliberate effort by the industry’s leaders to secure their position in the AI economy for the next decade.

Conclusion: a hardware super-cycle in motion

The debate over whether AI investment represents a bubble is fading. The evidence now points clearly in the opposite direction. Demand is real, monetisation is already visible, supply remains constrained, and financing is abundant.

What we are seeing is most probably not speculative fluff, but a once-in-a-generation digital infrastructure super-cycle that is likely to run throughout the rest of the decade. The beneficiaries will extend far beyond the hyperscalers and chipmakers, to every layer of the technology stack and eventually the broader economy.

Far from worrying about overspending, investors may come to see under-investment as the greater risk.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Meanwhile, the Korean stock market surges to new levels. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, bitcoin and software equities are moving like twins. Each week, the Syz investment team takes you through the last seven days in seven charts.

While gold, silver and platinum were the best performing commodities over the past year, they took a hit at the end of last week. Each week, the Syz investment team takes you through the last seven days in seven charts.

.png)