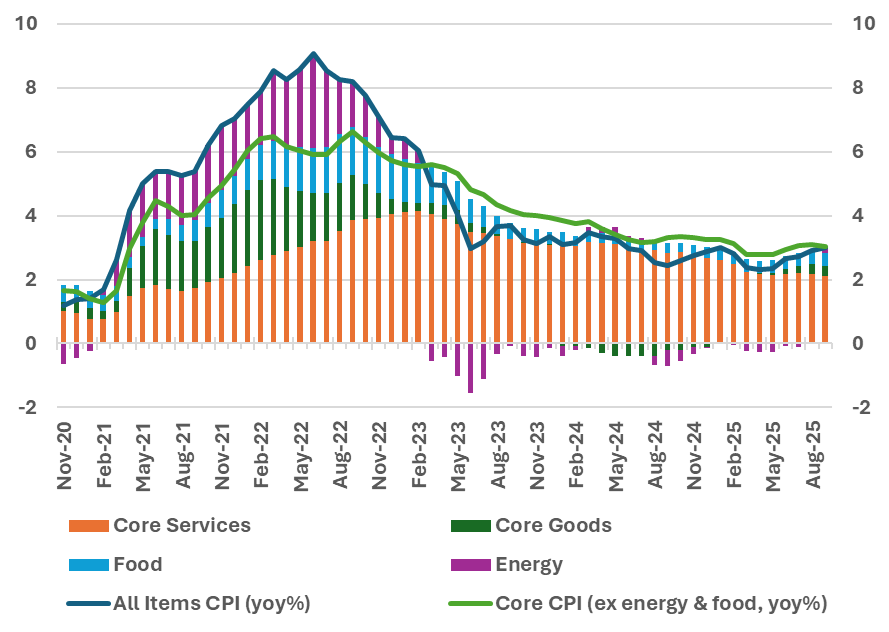

In spite of the US government shutdown, US consumer data (CPI) for September was finally released, given its importance in measuring the ‘cost of living’ in the US social benefit system. The US inflation data came in slightly lower than expected, which was a relief for financial markets. Nevertheless, headline inflation crept up from 2.9% to 3.0% - below the expected 3.1%. Core inflation, excluding volatile food and energy prices, which was expected to stay steady, declined to 3.0% from 3.1%. This should clear the way for the FED to conduct another rate cut at the upcoming FOMC meeting next Wednesday (29th October). The majority of the FOMC members will likely agree to lower its key rate by 25 basis points, although the so called “super core inflation” that focuses on underlying domestic price pressures – the measure once dubbed by the Fed-Chair Jerome Powell to be the most watched inflation data for monetary policy – did stay at elevated levels of 3.2% compared to the September prices a year ago (YoY). ‘Super core inflation’ also accelerated further in comparison to the release from August (+0.35% month-on-month). It will be interesting to see if there is any FOMC dissent in the press statement and how Powell will explain the rate cut this time during the press conference, potentially calling it a ‘risk-management cut’ again.

What will the Fed do after the next (very likely) key rate cut in October?

Although markets price further rate cuts in December, and at least another 2 in the first half of 2026, we do not see the December rate cut as a done deal yet. Even the so called “dovish” Fed Governor Christopher Waller, usually advocating for more cuts this year, said in a recent speech:

“While I feel confident, based on what I know today, that monetary policy should take another step toward a more neutral setting at the FOMC's next meeting, the path of appropriate policy beyond that point will be influenced by how the conflict between data on economic activity and the labour market is resolved and the expected path of inflation.”

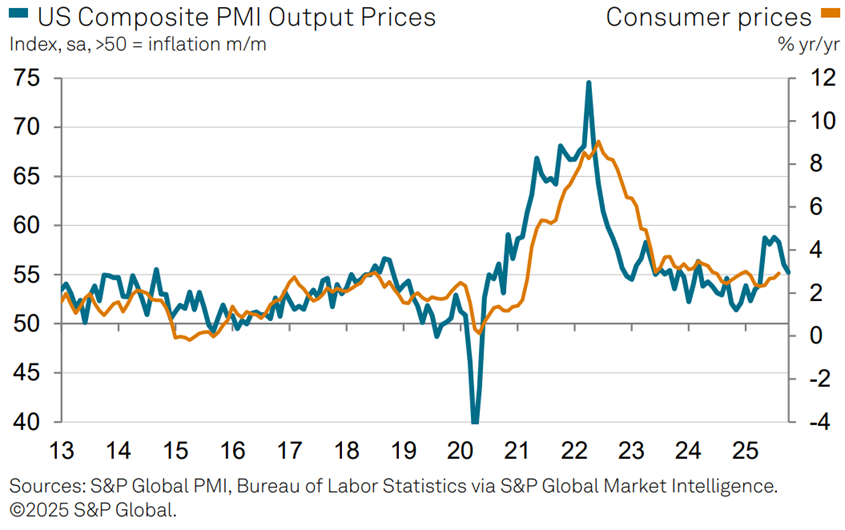

However, another Fed rate cut in December is now also our base case, as today’s ‘flash’ PMI data release showed a decrease in its inflation indicators. The PMIs were another important new data point for the US economy, as most other data is missing due to the government shutdown. The survey painted a picture of good business sentiment in the US, indicating solid current economic activity. Both sectors were improving: the service sector rose from already positive levels to even higher ones, while the manufacturing sector is recovering from weaker levels, showing a positive increase of incoming work.

Goldilocks or no Goldilocks in the US?

The PMI showed a picture close to a so called ‘Goldilocks-scenario’, with good economic activity while price pressures are kept in check. The new ‘flash’ PMI release indicates a decrease in inflationary pressures, as shown in the chart below. In addition, the PMI indicator for job creation showed a slight improvement in the service sector from previously weak levels, while the manufacturing sector continues to struggle to add more employees given the uncertain outlook. However, the PMI survey conveys the picture of a US economy that is not too warm, but also not too cold, with positive signs of a further ‘warm-up’ in economic activity.

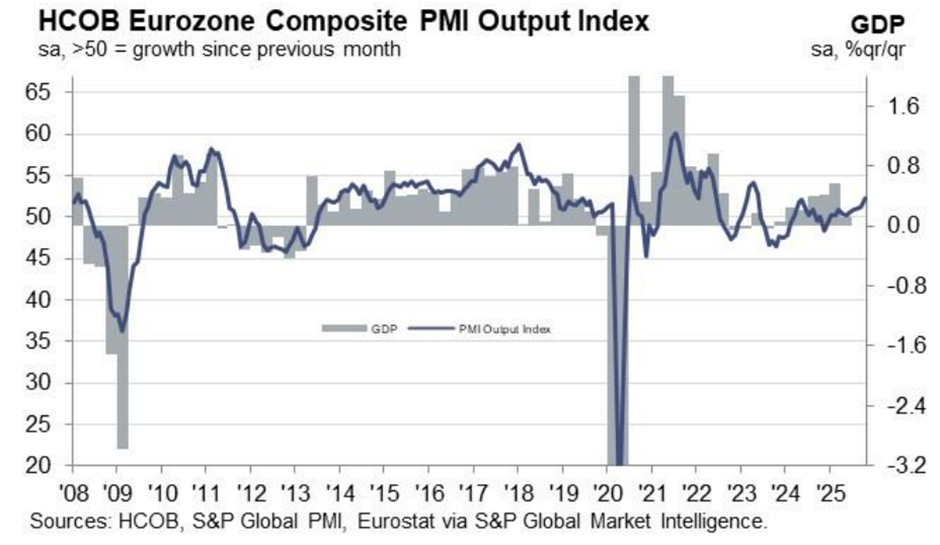

Germany fights its way back to growth, while France still has a hard time

In Europe, the flash PMIs were released and showed a positive picture for the Eurozone economy, with activity indicators for the service sector accelerating even more and manufacturing data now also leaving “contraction” levels again. Unfortunately, the news could have been even better for Europe had the French contribution not have been so weak, currently reaching an 8-month low. Yet, there are signals that positive effects of the German fiscal stimulus are being felt in the economy, particularly in the manufacturing sector, confirming our view that the Eurozone economy remains on track for a gradual recovery.

Chart 1: US “headline” inflation ticks up, but less than expected

Chart 2: US purchasing manager survey points to substantially abating price pressures

Chart 3: Europe’s business sentiment gets more positive

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Meanwhile, the Korean stock market surges to new levels. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, bitcoin and software equities are moving like twins. Each week, the Syz investment team takes you through the last seven days in seven charts.

While gold, silver and platinum were the best performing commodities over the past year, they took a hit at the end of last week. Each week, the Syz investment team takes you through the last seven days in seven charts.

.png)