The earnings season began this week, with several banks already reporting results. Among the large-cap names, JPMorgan, Goldman Sachs, Citigroup, Wells Fargo, and Morgan Stanley have reported, while State Street is scheduled to report today. Among regional banks, First Horizon, Synovus Financial, and Home BancShares have released their results.

Fundamentals reported by regional banks — as well as larger peers with overlapping business lines — have been supported by sequential loan growth, positive margin trends, and controlled expenses. More importantly, reported credit trends remain healthy, and management commentary so far has not indicated any deterioration in core credit metrics. For the larger banks, fee income has also been strong, driven primarily by investment banking activity.

What are the biggest movers lately within regional banks and for what reasons?

First Horizon shares are down 13% over the past 10 days following management comments that they would consider opportunistic, in-footprint M&A in 2026 and beyond. Investors had previously viewed First Horizon as a potential near-term seller, so this was perceived as a shift in messaging. While the comment acknowledges a more active M&A environment, it appears to have been a communication misstep, not one related to any credit concerns.

Western Alliance (-19% over the past 10 days), with approximately $87 billion in assets, disclosed in an 8-K filing yesterday that it has filed a lawsuit against a borrower (Cantor Group V, LLC) alleging fraud on a revolving credit facility note financing. The credit is secured by commercial real estate loans and cash proceeds, and Western Alliance believes the collateral fully covers the obligation. The exposure represents about 1.6% of tangible common equity. While not material to the balance sheet, this development is likely to raise questions about loan book quality ahead of the 3Q25 results.

Zions Bancorporation (ZION, -17% over the past 10 days), with approximately $89 billion in assets, disclosed in an 8-K filing that it recently became aware of legal actions by two other banks against parties apparently affiliated with its borrowers. This prompted an internal review of the related borrowers at California Bank & Trust, Zions’ C&I lending division. During the review, the bank determined that the borrowers had made misrepresentations. As a result, Zions will record a $60 million provision (covering the full amount of the loans) and a $50 million charge-off, both to be reflected in the 3Q25 results. The bank intends to pursue legal options to recover any losses. The exposure represents about 1.1% of tangible common equity. While the development will draw investor scrutiny, Zions maintains adequate capital levels.

Overall, regional banks remain well reserved for potential losses, having strengthened capital positions since 2023. However, these credit stress events are likely to invite greater scrutiny from investors and regulators.

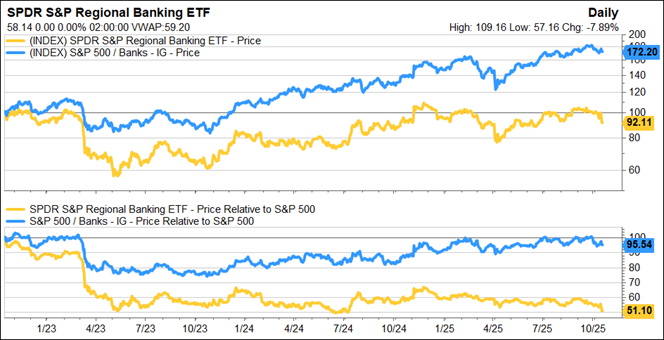

The large bank index has largely recovered from the April 2023 Silicon Valley Bank event, while regional banks have not:

Other companies with significant exposure to the private market

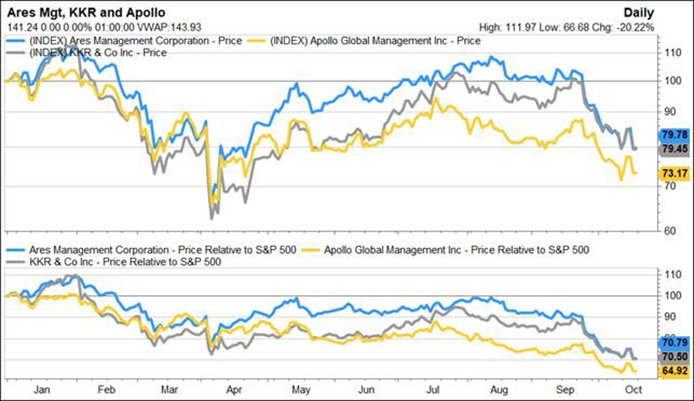

Companies such as Apollo, KKR, and Ares have significant exposure to the private credit market, with the first two having well over 50% of AUM in that segment and KKR around 40%. While these firms have reported solid earnings so far, investors have become increasingly cautious about the associated risks. Share price performance reflects these concerns, as these companies have underperformed this year, following a strong run in 2024 ahead of the US presidential election.

Our take

These events are undoubtedly affecting sentiment, as they are increasingly viewed not as isolated incidents but as part of a broader pattern following the collapses of auto-parts maker First Brands and auto lender Tricolor, both of which left credit investors nursing losses and are now under US Department of Justice scrutiny.

Yesterday’s announcement is likely to reignite credit concerns across the banking sector, even though reported credit metrics remain benign among banks that have released results so far.

Meanwhile, investors in the $2 trillion leveraged loan market have warned that the abrupt collapse of First Brands Group could be an early warning sign for a market where rushed deals and limited due diligence have become increasingly common. We continue to advocate focusing on quality companies, as pockets of credit stress are likely to emerge during this normalization period, as market volatility returns.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Inflation remains Americans’ top concern while Swiss inflation hit zero. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, Big Tech carries the S&P 500. Each week, the Syz investment team takes you through the last seven days in seven charts.

Nvidia posts exceptional earnings, yet a dramatic Thursday sell-off raises questions: do investors still fear an AI bubble?

.png)