What happened last week?

Central banks: The U.S. inflation reports (CPI, PPI) released last week showed further signs of easing price pressures. However, as Fed's Waller reiterated, the level of inflation remains high and there is "still work to do." Market expectations did not change over the week, with still an 80% chance of a 25 bps rate hike at the May meeting. The FOMC minutes showed that the terminal rate could be lower than expected as recent developments in the banking sector could have a negative impact on economic activity. In Europe, remarks by ECB members at the International Monetary Fund's spring meetings have prompted markets to consider a rate increase of more than 25 bps at the next meeting. A 50 bps rate hike is now being considered and the odds are likely to rise further if April core inflation is again high. But in general, central banks are taking a break from tightening monetary policy as seen last week with central banks in Canada (unchanged at 4.5%), Korea (3.5%) and Peru (7.75%).

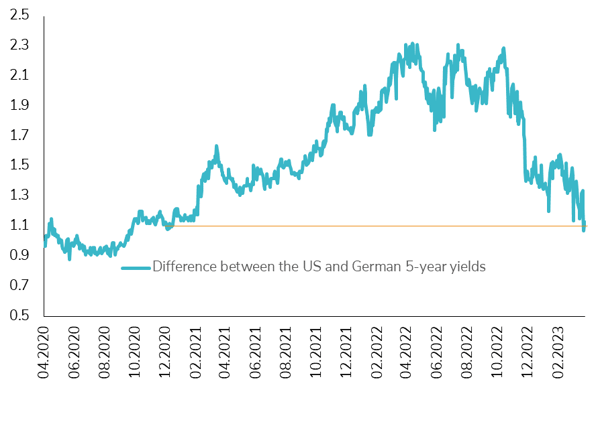

Rates: Despite a nearly 12 bps increase in U.S. rates, the slope of the U.S. yield curve remained unchanged over the week. The U.S. two-year yield ended the week at 4.10%, while the U.S. 10-year yield ended at 3.52%. Pressure on rates is expected to continue as the latest report from the University of Michigan showed an increase in the one-year inflation forecast from 3.6% to 4.6%, moving back to the highest level since November 2022. After reaching nearly 200 bps a month ago, the MOVE index, which measures interest rate volatility, has declined significantly since then and ended the week at 118 bps. European rates sharply underperformed U.S. rates, with the German yield curve rising more than 30 bps on the front end of the curve, while the long end rose 25 bps. The total return on German government bonds turned negative (-0.8%) in April. Peripheral yields continue to underperform, with the difference between Italian and German 10-year yields increasing by 8 bps this month to 188 bps.

Credit: The sharp rise in global rates had a negative impact on the performance of credit indices. U.S. Investment Grade (IG) bonds fell 1.2%, despite a 6 bps credit spread tightening over the week. U.S. High Yield bonds again performed very well, gaining 0.8% on the week. Lower rate volatility and improving investor sentiment are driving high yield's performance so far. U.S. high yield credit spreads are now tighter ytd, which does not reflect a near-term recession risk. In Europe, IG bonds posted a loss of 0.8%, outperforming their U.S. counterparts as credit spreads tightened 10 bps over the week. European high yield bonds managed to post a weekly gain despite the significant rise in the front end of the yield curve. European high yield spreads tightened by 30 bps, ending the week at 485 bps. Overall sentiment in the bank subordinated debt market improved again last week with a 1% gain for the iboxx CoCo Liquid developped market AT1 index. The index is now only down 2% year to date, after losing 13% during the Credit Suisse crisis.

Emerging market: The weakening dollar and solid Chinese economic data (Chinese exports rose for the first time in 6 months) continue to benefit emerging markets. Emerging market sovereign and corporate credit spreads tightened further last week by 10bps and 12bps to 405bps and 364bps respectively. Both posted a slightly negative performance (-0.1%) but only because of the significant rise in US rates. Finally, emerging market sovereign bonds in local currency were the big winners of the week with a gain of 0.8%.

.png)