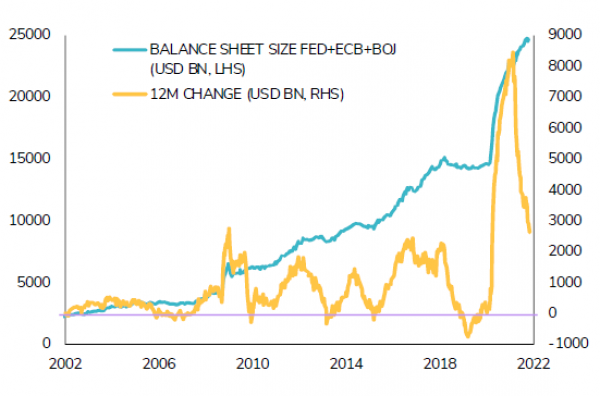

To the surprise of many, this blue-sky scenario hasn’t calmed the hyperactivity at central banks and governments. The Federal Reserve continues to hold US interest rates at 0% and continues to expand its balance sheet. US money supply has increased nearly 40% since 2020, its largest ever two-year increase. The US Federal Government continues to borrow and to spend trillions of dollars despite a looming debt ceiling. Most developed countries and central banks are following the US, with monetary base expansion, fiscal stimulus and ever-increasing debt levels.

As we enter a new year, the question for investors is whether the ‘goldilocks’ market and macroeconomic conditions in place since the second quarter of 2020 will continue. The current balance looks rather fragile. The global economy should not overheat, keeping key policy rates on hold, but should be strong enough to avoid sparking recession fears.

We believe that the worst of concerns about stagflation have mostly been priced into markets. We expect slower, though above potential, global economic growth in 2022. Ironically, some downside surprises to growth may be good news for investors. While inflation might stay sticky for a while, lower-than-expected growth will let central banks keep interest rates low in 2022. This would be positive for risk assets. We also expect earnings growth momentum to remain a tailwind for global equities.

While this ‘goldilocks’ scenario means that we favor an overweight stance on risk assets, we also believe that volatility may rise next year as markets face some downside risks. We call them the ‘three bears’ and the appearance of any one may trigger a meaningful market decline.

The first ‘bear’ is China. Its regulatory crackdowns should continue through 2022. In addition, we do not believe the Chinese authorities have any appetite to engineer a re-acceleration of growth. As such, China may continue to disappoint next year and weigh on global economic growth, perhaps a little more than expected. The delayed effects of deleveraging some parts of their economy, for example in real estate, also create an elevated risk for markets.

The second ‘bear’ is stubbornly high inflation. Supply bottlenecks and labor shortages have pushed inflation expectations to high levels in 2021. Persistent inflation would undermine purchasing power and consumer sentiment. While downward revisions to growth and production normalization reduce the risk of an inflationary spike in 2022, the longer inflation stays high, the more it becomes selffulfilling and puts the global economic recovery at risk.

The third ‘bear’ is a potential policy mistake. As we all know, the current equity bull market remains - to some extent - dependent on monetary and fiscal policies. Global central banks sound slightly less dovish and global fiscal policy has shifted to a tightening mode. While we believe that the market should be able to absorb a small and gradual monetary policy adjustment, the current context does not leave much room for a policy miscommunication. On the fiscal front, there is also a risk of disappointment, and a growing threat of another US debt ceiling.

We remain convinced that our disciplined and nimble investment approach will prove effective in helping our clients to achieve their risk-adjusted return targets. We also believe that the current macroeconomic environment of ample liquidity and creative disruption generates outstanding opportunities for investors on at least two levels. First, the world is going through an extraordinary period of innovation, in technology, healthcare, energy transition and many other sectors. A handful of industries and companies are being disrupted, paving the way for winners and losers. The second area of opportunities lies with market dislocation. A very high level of financial leverage, over-optimistic expectations and expensive valuations will spur market volatility and trigger some forced sell offs. This will create exceptional alpha opportunities for astute investors.

We wish you happy New Year and look forward to continuing the discussion with you in 2022.

Macroeconomic views: Normalisation ahead

The Covid pandemic has turned many seemingly entrenched ideas upside down in the past two years, and macroeconomic research has not been spared. Several economic data series have reached levels deemed impossible until this shock: double-digit percent changes in consumption or industrial production, first down and then back up, monthly changes by millions in employment figures, not to mention energy price swings, from negative oil prices in 2020 to surging natural gas prices in 2021.

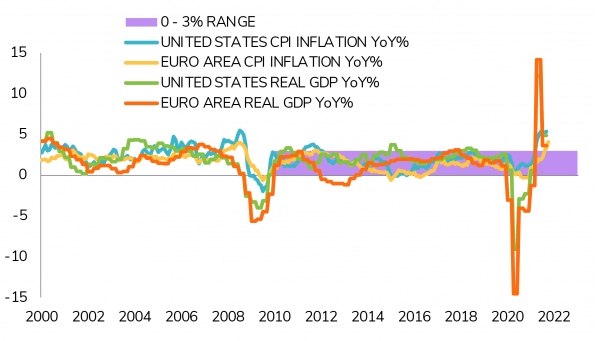

The recovery has been strong in 2021. Massive central bank and government support unleashed an unprecedented surge in demand as soon as vaccine rollouts made it possible to reopen economies. Global supply chains, designed for just-in-time adjustments, have been unable to cope with this sudden boom in demand, pushing up prices and reviving inflation fears. The magnitude of the rise in prices, and its potential negative impact on purchasing power and consumption in 2022, have even revived a word that, for most working economists in 2021, belongs to economic history books: stagflation. From an economic point of view, the past two years have been as ‘abnormal’ as one can imagine.

As we look toward to 2022, we believe that economic conditions will generally tend to converge back toward their pre-Covid trends. Most structural trends of the past decade have not in fact been altered by the pandemic and they continue to define the global economic outlook. Demographic growth continues to slow. Technology spreads ever deeper into our lives and maintains downward pressures on many prices. Ever rising debt still dampens the amplitude of economic cycles. In 2022, various crisis-related policies will gradually be phased out, while the impact of the reopening and its disruptions will slowly fade. In this context, the macroeconomic environment will increasingly appear ‘normal’ after two very abnormal years.

Uncertainties remain over any potential long-term pandemic impacts on economic trends, but we head toward 2022 with three convictions.

1. Global economic growth will remain firm and above trend

2021’s spectacular recovery was exceptional and GDP growth will tend to moderate toward more sustainable levels in 2022. However, economic dynamics will remain strong in developed economies. Continuing improvements in employment, business investment catchup, recovery in the sectors most affected by Covid and still supportive financial conditions will keep GDP growth rates comfortably above their long-term potential.

Fears of stagnation are therefore largely overdone at the global level. Among the large economies, China is the most at risk of experiencing below par expansion due to a combination of factors, such as softer growth in the real estate sector, restrictions in activity for the most polluting and energy-intensive industries, regulatory crackdowns on some sectors and tighter credit distribution. However, the government has the resources to fine-tune support and is likely capable of preventing an excessive slowdown in the world’s second largest economy.

2. Inflation will slow as the impact of 2021’s supply & demand shock fades

Let’s start with a few facts about the most hotly debated topic of 2021 on financial markets:

- Fact #1: Inflation as referred to by central banks and financial markets is the change of any given price, or basket of price, over the past 12 months.

- Fact #2: Inflation, and inflation expectations, have significantly increased in 2021 in most economies, to multi-year and sometimes multi-decade highs.

- Fact #3: The speed of this inflation increase was largely the consequence of the speed and strength of the economic recovery (base effects, combined supply and demand shock).

- Fact #4: After the rises recorded in 2021, if all prices were to remain at their elevated levels through next year, inflation will be zero at the end of 2022 (by definition). If prices pull back modestly from their current levels, a year from now, inflation will be negative.

- Fact #5: For the inflation rate to be as high as it is today, prices of goods and services next year have to record the same increases experienced in 2021. If they continue to rise, but only at half this year’s pace, 2022 inflation will be half this year’s.

Keeping in mind these few facts, we believe that inflationary concerns will fade away in 2022. Base effects on 12-month inflation numbers will decline. Upward pressure from surging demand will diminish as consumption patterns normalize. Upward pressure on prices from supply chain tensions and delivery bottlenecks will ease as capacities are adjusted and backlogs work through.

These factors should also drive energy prices and prevent a continuation of the sharp rise seen in 2021, as long as the supply side is not overly influenced by geopolitical factors.

In this context, we expect inflation rates to slow in developed economies and to converge toward central bank’s targets (2% in most cases) by the end of the year. Inflation dynamics in emerging economies might be more dispersed and subject to internal factors, such as domestic politic agendas or currency fluctuations.

An inflationary spiral such as we experienced in the 1970’s is highly unlikely, unless wages were to start being indexed at to inflation so as to preserve households’ real purchasing power, despite rising nominal prices. The trend in wages in 2022 will therefore be key for the inflation outlook. However, as governments’ crisis support to the unemployed ends, and conditions normalize in the job market, this is a low-probability risk and the wage rises witnessed in 2021 are likely to have been a recovery one-off rather than the beginning of a new trend.

3. Central banks and governments will phase out crisisrelated measures, but they will remain very supportive for economic activity

The swift, decisive and combined intervention of central banks and governments during the Covid crisis has been crucial in many ways. It helped to absorb the short-term impact of the shock and limited the destruction of production capacity that would have hampered the medium-term growth outlook. Lastly, the support engineered a turbocharged economic recovery as soon as most economic activities could be resumed. Faced with an unprecedented economic shock, the size of the liquidity injections, monetary policy easing and fiscal spending was unprecedented.

As disruptions caused by Covid fade and economic conditions normalize progressively, phasing out the monetary and fiscal crisis- related support is perfectly warranted and started in 2021. China, having led the Covid ‘cycle,’ has been the first large economy to normalize credit growth. The same trend will play out next year in developed economies on the fiscal side, with government spending declining as private consumption and investment continue to recover. Normalization will also play out on the monetary policy side, with the gradual ending of central banks’ liquidity injections. Short term rate hikes are even possible in Anglo-Saxon economies but remain a distant prospect for the euro area, Switzerland or Japan.

Gradually withdrawing some ultra-accommodative fiscal and monetary policies should not be confused with classic policy tightening. Financial conditions will remain very accommodative in 2022, and support the ongoing economic expansion, even with fewer liquidity injections and possibly slightly higher rates. In fact, the level of real interest rates in USD, EUR, CHF or GBP will remain negative, thus providing very attractive financing conditions for businesses, households and governments. While the risk of a policy mistake cannot be ruled out, central banks remain concerned by the downside risks to the economic outlook and are unlikely to act hastily unless inflation remains stubbornly high. The economic policy mix should remain very supportive of economic growth in 2022, and may even include easing in China, if needed.

We expect 2022 to be the year of ‘normalization’ after an incredibly volatile couple of years for the global economy. This is welcome for it signals the fading impact of Covid, rising employment, milder inflation, reductions to government deficits and less unconventional central bank policies. It also has a drawback: it also suggests a return to the ‘low-growth/low inflation/high debt’ environment that prevailed before the Covid crisis.

Asset allocation: A tactical approach to portfolio construction

For 2022, in line with our long-term investment style, we prefer a tactical approach based on structural convictions.

Consistent with our macro outlook we continue to favor equities in our asset allocation, as markets should be supported by strong earnings growth momentum. Despite sometimes challenging valuations, equities are still the most attractive asset class, given solid growth prospects and low interest rates. We expect this strong earnings growth to more than offset the gradual normalization of fiscal and monetary policy. In terms of sector allocation, we maintain our structural preference for quality growth stocks in information technology, consumer discretionary and healthcare. Tactically, in the current context, we are selectively exposed to cyclical sectors such as materials and industrial companies.

For the bond allocation in a portfolio, we begin 2022 with a cautious stance on both rate and spread risks. As a result, we apply a ‘laddered’ exposure, combining short-term emerging debt and structural positioning on medium-term investment grade credit. Given our positive outlook on equities, we also have some exposure to convertible bonds, which may offer attractive optionality. After a very difficult year, we expect 2022 to be more constructive for fixed income investors and we are ready to increase our duration once we get more clarity on central banks’ normalization path . We are however not in a hurry, as the risk of widening spreads, coupled with rising rates, remains.

In terms of decorrelated positions, we consider real assets such as gold and commodities offer an attractive risk/reward ratio in the market environment that we expect for 2022.

Finally, the main risks for 2022 relate to the phasing-out of central bank and government supports, in a context of high valuations. This merits some caution and selectivity in the size and composition of an equity allocation. We expect a more volatile market in 2022, and we recommend remaining tactical and in particular using option strategies to partially hedge portfolios. This optionality should provide asymmetric returns.

Equities: A return to stock-picking

At the beginning of 2021 we expected to see severely-punished sectors such as energy, banks, travel and leisure catch-up with the wider market in anticipation of efficient vaccination campaigns. A series of activity indicators, including mobility, air travel and consumer spending, show that economic normalization is well under way. Nevertheless, the path to full recovery remains uneven with discrepancies between geographies and sectors.

Several of 2021’s best performing equity sectors in the US, for example, were severely punished by markets in 2020. Energy and banks both more than doubled the broader market’s performance and are now above their pre-Covid levels. In addition, some of 2020’s star performers that benefited from lockdowns and the work-from-home economy, had a difficult 2021. Companies such as e-commerce giant Amazon, video communication champion Zoom or home fitness leader Peloton all felt 2021’s shift in consumer behavior. Understandably, shoppers were happy to return to brick- and-mortar retailers, while employees appreciated in-person meetings, and cyclists and runners enjoyed more social forms of their sports.

As in 2021, we expect the macroeconomic environment to remain supportive for equities. The asset class should benefit from low interest rates, modest-but-positive economic growth and ample liquidity.

As we move into 2022, the key sector-allocation question is whether some industries will continue to catch up, or will faster-growing companies take the lead again? We believe that 2022 will reward firms that are able to grow, independently of wider GDP growth. These businesses are found amongst the traditional technology players, in cloud or semi-conductor technologies, or software-as- a-service (SaaS), but also within more niche innovators such as healthcare and transportation.

After 2020’s global dislocation, 2021 reminded investors that local/ sector dislocations can be painful. We saw tough measures imposed by the Chinese government on sectors such as for-profit education and the broad technology sector. Many companies lost more than half of their market value in a few weeks.

But dislocations can also present tactical opportunities. While by definition a dislocation is unexpected, we believe that stubbornly high inflation (which is not our central scenario) would not affect all companies evenly. The good news is that most of the companies that we favor are price givers, not price takers. In other words, they enjoy pricing power and are able to transfer higher costs onto their customers. Indeed, they offer services or goods that few others can. Scarcity of materials and know-how both offer investment opportunities.

We believe that 2022 should prove a sound environment for stock pickers as earnings take center stage again. In 2021, the recovery’s rising tide lifted all boats but with markets at relatively high valuations, investors in 2022 have a narrower margin of safety and must select companies that won’t disappoint.

Inflation in 2021 rose more strongly and proved longer lasting than investors expected. What about 2022? Two factors behind 2021’s rise in inflation will no longer be valid next year: a very low starting point and the simultaneous supply/demand tensions. Inflationary cycles are generally linked to strong demand, as we saw in 2021, however next year should see demand softening. While demand will remain elevated, it will put less pressure on production costs. In addition, consumer confidence remains below its 2017-2019 levels. The main risk in our base scenario is from wage inflation pressures, but we should note that labor unions are not as strong as they were historically, and the pandemic has accelerated the digital transition.

The risk of a monetary or fiscal mistake or abrupt policy change is also important, especially for low quality issuers. The default rate was very low in 2021, thanks to subsidies and moratoria. A sudden withdrawal of support may impact highly-leveraged companies, especially in the B and CCC-rated segments.

Finally, regulatory changes in China, whether in the technology, education or real estate sectors, will provide more of an opportunity than a risk for bonds. Moreover, China’s integration into the World Governments Bond index (WGBI) since October 2021, will drive inflows. This should increase the pace of monthly purchases from foreign investors by almost 50% and will support the Chinese bond market. It will of course be necessary to remain selective and focus on high credit quality.

With this framework in place, what are our preferences for 2022? We continue to see value in subordinated debt and convertible bonds. These two asset classes have outperformed the overall bond market this year and we expect this trend to continue. Furthermore, both are below their historical valuation peaks. This is particularly true for convertible bonds from Asian issuers.

We continue to favor investment grade credit over high yield credit. High yield valuations appear to be ‘priced to perfection’ and may suffer from fiscal tightening and refinancing in the next 18 months. In investment grade credit, there was high activity from rating agencies mainly upgrading companies, especially those falling into the high yield category in 2020. Despite this, we still favor BBB issuers with short-to-medium-term maturities. Markets have strongly repriced monetary policy normalization at the front end of the yield curve, making it more attractive. In addition, we are unlikely to enter a long cycle of monetary tightening because in most developed markets, central banks will not be able to reach their neutral fund rate without undermining the economy. This is a return to normal after a unique situation in modern history.

What about government bonds? In a balanced portfolio, they continue to provide diversification and act as a haven asset in the event of a sudden drop in equity markets. We also remain comfortable with peripheral government bonds, but we are more prudent as they are more volatile.

Finally, we remain selective on emerging markets. 2021 was tough for emerging market fixed income investments but valuations improved and seem more attractive relative to other segments. In addition, several central banks are well underway with tightening monetary policy, which may destabilize the bond market in the short term, creating opportunities for selective and patient investors. Opportunities have already been taken, such as in Chinese real estate, and should pay off in the medium term; the wide-spread panic created great opportunities to generate positive performance in 2022.

In sum, volatility should remain high for rates and increase for credit spreads. Despite the low interest rate environment, bonds remain attractive, as long as investors do not limit themselves to a buy-and- hold approach, but remain agile and seize opportunities.

Private Markets: A derivative of public markets or a true alternative?

Financial history will remember 2021 as extraordinary for risk assets. Even if less visible than public markets, the year was significant for private equity, in terms of deals closed, valuations paid, and exits including high-profile technology IPOs. Moving into 2022, we expect growth to remain healthy but much of this is already priced in. Asset allocators will need to position themselves intelligently to capture the idiosyncratic returns that private markets can generate, and not be misled by an apparent portfolio diversification that, in reality, simply doubles-down on expensive risk premiums already present in their public portfolios.

Private markets enlarge and enrich our investment universe by offering investors access to attractive assets and companies not available in the public domain. It also allows investors to take a longer view, while avoiding the pitfalls of short-term thinking and poor decision-making when faced with mark-to-market volatility. Less efficient private investments can reward diligent investors for thorough analysis and well-executed value creation plans. Finally it allows investors to participate in success stories before such growth normalizes.

Cryptocurrencies aside, we expect the Nasdaq to be the clear winner of 2021. As success attracts success, most investors plan to increase their exposure to technology but also realize that listed tech companies are only the tip of the iceberg. As companies stay private for longer, investors may seek exposure to high-growth companies before they go public through an IPO. But the more they wait, the more valuation risk increases, especially in today’s cash-flooded environment. On the other hand, early-stage investing includes significant business and duration risk, which can only be mitigated by adequate diversification and the availability of follow- on capital. The right balance is probably somewhere between the two, but access to such opportunities requires specialized skills and networks.

Building a private market portfolio to spread risk across vintages takes time and discipline. No crisis or euphoria should side-track investors from achieving their strategic asset allocation goals. However, depending on the macro environment and valuation landscape, allocators may favor some more attractive segments. When there is ample liquidity and intense competition for deals, we spend time and resources on succession issues in family businesses or disposing of non-strategic assets. Complexity and small transaction sizes enable us to enter deals at more reasonable valuations, limiting our capital at risk.

In the context of market cycles, distressed investing is interesting. Record amounts of money were raised in the darkest days of the lockdown from a wide range of global allocators. Some were disappointed by short-lived opportunities with shallow volumes. Very few investors had time to accumulate quality assets at low prices before the first vaccines, and subsequent recovery hopes killed the trade. Nor did the anticipated bankruptcy wave materialise either, as moratoriums were imposed in most jurisdictions, preventing companies from filing. As these are lifted, selective opportunities may arise.

Despite this, we managed to take advantage of crisis-generated opportunities throughout the year, especially in our litigation funding strategies where we finance an increasing number of insolvency and business continuity claims. We believe this is one of the most compelling ways to benefit from the crisis with no market exposure, and another example of the diversification benefits that private markets can bring to a portfolio.

Hedge Funds: New opportunities in China

China’s increasing healthcare needs and medical innovations, driven by rising wealth and an aging population, are generating new opportunities. China’s population is currently spending a fraction of what developed countries are allocating to health care. As Chinese firms roll out broader access to health services, and finance biotechnology and medicines to meet demand, we believe that this will provide sound entry points for investors.

Recent months have underlined the need to invest in the most robust sectors of China’s economic evolution. Regulation and rapid growth have made that challenging, but we believe that the healthcare theme will generate returns. We are working with specialist managers in Hong Kong, mainland China and the US to follow developments and evaluate the potential of each innovation.

While China’s medical innovations still lag the progress of European and US developers, the resources devoted to improving healthcare mean that the sector looks poised to experience a wave of progress.

More widely, equity markets are reacting to normalizing monetary policy. Central banks’ emergency asset purchases lifted markets through the pandemic and undermined the incentive for investors to examine stocks’ fundamentals. This year we saw an extremely difficult environment on the short side due to the Reddit ‘short squeeze’ and a lack of dispersion between long and short positions. Large movements at the level of industry sectors followed macro themes. This made it the worst environment for generating alpha in more than a decade for equity managers.

All that has now changed as developed economies’ central banks discuss raising interest rates and tapering their asset purchases. In the meantime, many investors were reminded of the resilience that hedge funds can offer.

As a result, markets are paying more attention to earnings and company outlooks. Over the short term we therefore expect earnings surprises to translate into more volatility as investors begin to differentiate within sectors again. This is very positive for our stock pickers looking for alpha generation.

In the meantime, we see value in alternative UCITS funds. Their lower expected returns, mainly due to less leverage and concentration than classic hedge funds, is compensated by better liquidity. This flexibility allows us to be more trading oriented when managing an alternative UCITS funds portfolio.

Finally, we remain convinced in the value of convertible arbitrage and merger arbitrage strategies that can provide diversification, thanks to their lack of correlation with the wider market.

Trading: Effervescence rather than exuberance

This year has been a relatively quiet one for risk assets, as equity markets climbed the wall of worries (rates, China, etc.) to hit record levels. One of the big questions for traders is whether we are seeing sufficient exuberance to call a top in the markets. The picture is mixed.

For instance, market peaks are often characterized by heavy inflows into equity market funds. Exchange Traded Funds (ETFs) saw strong inflows in 2021, with US ETFs reaching USD 7 trillion having added USD 2 trillion over the last year. Overall, aggregate equity fund flows however were underwhelming, and money market mutual fund assets remained high as well. Initial Public Offering (IPO) activity, often seen as an indicator of unhealthy speculation, slowed considerably from earlier this year when the market was fueled by SPACs, or Special Purpose Acquisition Companies. Increased US regulatory scrutiny of these vehicles slowed the number of IPOs.

The surge in retail trading was interpreted by many as a sign that the bull market is close to exhaustion. The democratization of online platforms such as Robinhood, and the role played by social media investment platforms such as #WallStreetBets on Reddit, changed the balance of trading volumes between institutional and retail investors. Goldman Sachs, for instance, showed that half of all single stock option trades in the US were placed by retail investors. We should not forget that retail investors’ participation in the bull market between 2008 and 2020 was limited, so some rebalancing was long overdue.

Technical indicators showed that market breadth was as good as we have seen historically. Meanwhile, sector and style leadership has been a tale of two markets. In the first and last quarters of the year, cyclicals and high beta stocks outperformed thanks to rising bond yields. In between, the cyclical trade paused as defensive sectors outperformed on the back of declining bond yields. ‘Risk- on’ resumed its trend by the end of September along with some investors’ appetite for ‘meme’ stocks, although less so than in the first quarter. An interesting dichotomy also developed in the last months of the year - volatility in bond markets increased while equity volatility dampened. This seems to indicate that investors see the long-anticipated rate hike cycle as an issue for the bond market, but not for stocks, or at least not for now.

On the currency side, the main developed markets’ currencies traded within a narrow range and the Swiss franc stayed relatively strong against all major currencies. Market stress was concentrated in a few emerging market currencies such as the Brazilian real or the Turkish lira. The weakness of the Japanese yen can be interpreted as another sign that ‘risk-on’ prevails. Commodities proved the best performing asset class (beyond cryptocurrencies), but volumes remain far below their historical peaks.

Besides the traditional asset classes, 2021 may be remembered as a breakthrough year for cryptocurrencies and digital assets. Indeed, cryptocurrencies as an asset class moved from less than a trillion dollars in market capitalization to more than USD 3 trillion. Moreover, blockchain applications such as DeFi and NFTs (Non-Fungible Tokens) suddenly emerged. Finally, the year was characterized by a broader adoption of cryptocurrencies by the financial industry with the launch of the first Bitcoin ETF, the IPO of Coinbase, cryptocurrency custody and trading by large banks worldwide. The inclusion of cryptocurrencies in global portfolios is not only of interest to retail investors, high net worth individuals or hedge funds, but also institutions and corporates such as Tesla, Square or MicroStrategy. This took place despite a crash in crypto in May, following by a ban on Chinese miners and threats of tighter regulation worldwide.

All in all, there are indeed signs of effervescence among retail and institutional investors, but it may be premature to talk about exuberance. We wait to see whether 2022 continues along these lines.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

.png)