#1: The rebound of crypto assets in Q1

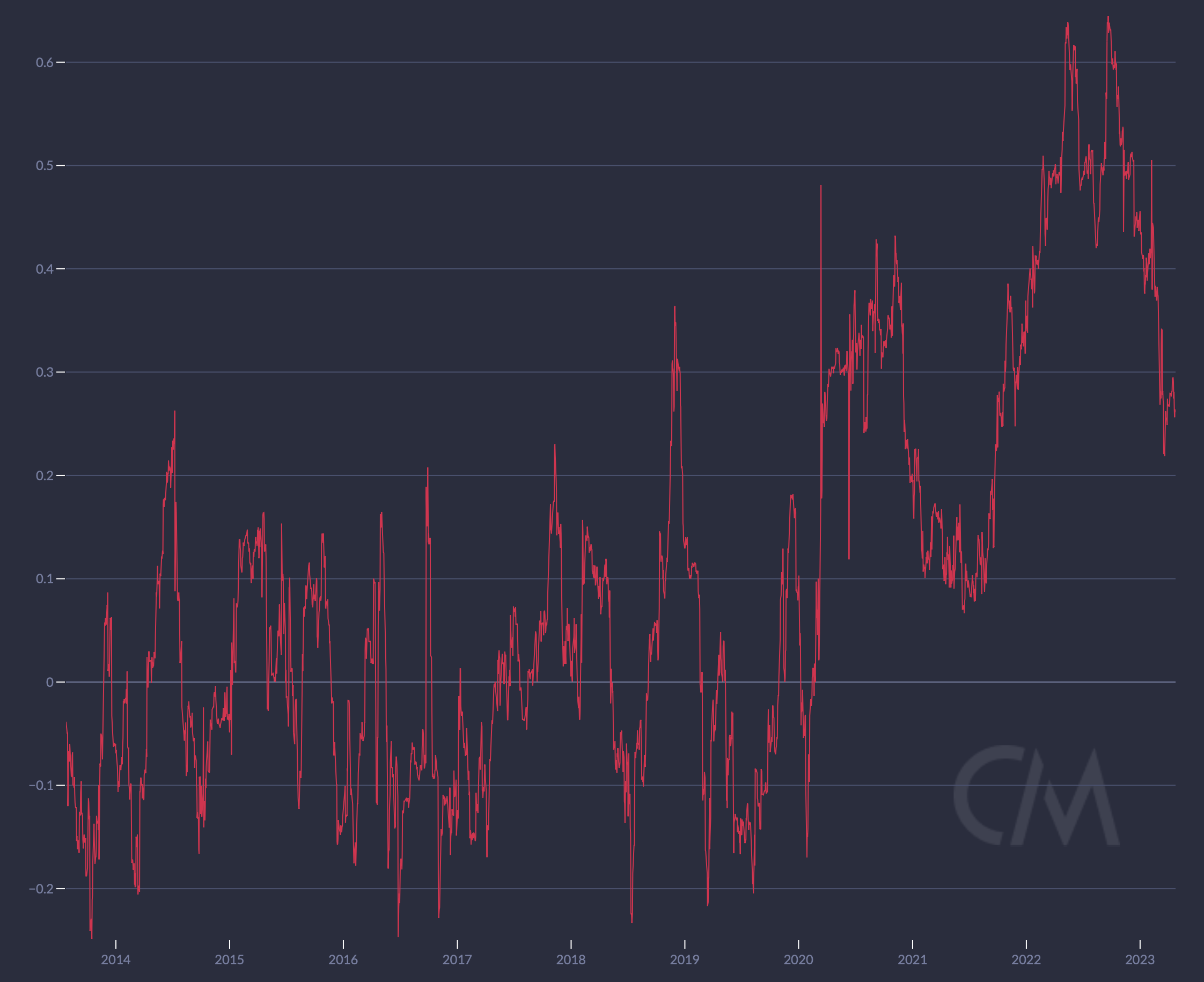

After the sharp decline experienced in 2022, the crypto market is off to a strong start this year, with bitcoin (BTC) testing $30,000 and ending the first quarter up 72%. This rebound comes amidst a greater risk appetite from investors, with the Nasdaq posting a 17% increase over the same period.

In addition to improved market sentiment, we should also note the emergence of new, buoyant themes within the crypto ecosystem: artificial intelligence, "Bitcoin Ordinals" (see point 7) as well as the growing interest in Chinese crypto currencies.

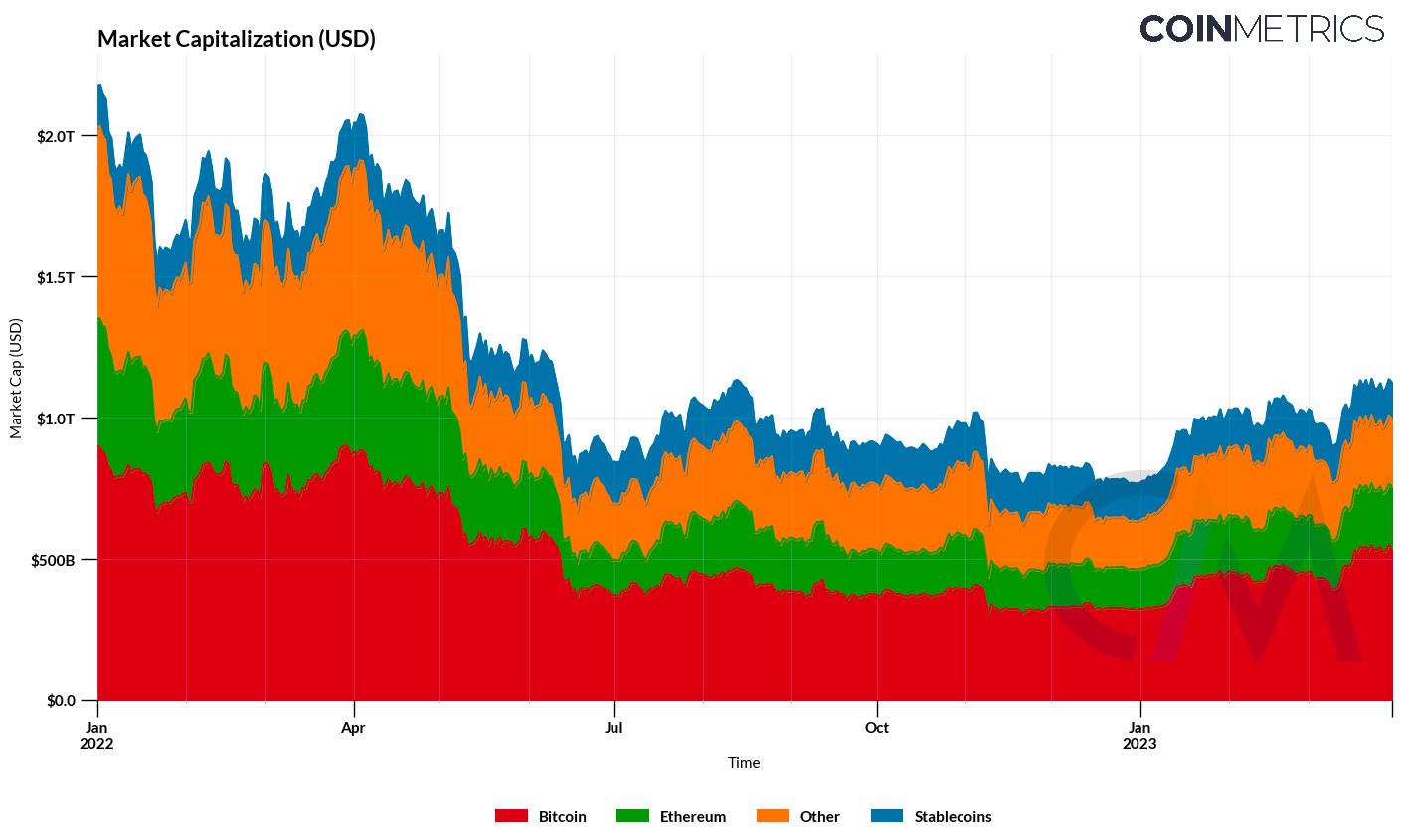

The market capitalization of digital assets has reached $1.2 trillion, the highest level since the summer of 2022.

Some of the most spectacular performances in Q1 include:

- FlexCoin (FLEX; +5064%; approx. $400 million capitalization) is the native token of CoinFLEX, a crypto-currency derivatives exchange platform, with decentralized finance (DeFi) offerings including "staking" products;

- Conflux (CFX; +1726%; market cap approx. $600 million), a Layer 1 blockchain whose mission is to solve the blockchain trilemma of decentralization, security and scalability;

- SingularityNET (AGIX; +812%; market cap approximately $400 million) is the native token of the SingularityNET exchange, a decentralized marketplace for artificial intelligence (AI).

Crypto assets market cap in June 2022

Sources: Coin Metrics datonomy, Coin Metrics Network Data

.png)