Investing in digital assets through a discretionary mandate involves at least two major decisions. The first is to consider digital assets as an investable asset class. If the answer to the first question is positive, then the next step is to select the investment vehicle(s) that meet the criteria set by the management mandate.

The Future of Digital Assets

Syz Bank is among the traditional financial players who believe that digital assets have a place in an investment portfolio. Our offering of cryptocurrency custody and execution services for Swiss and international clients aligns with this belief. The long-term goal is to become a leading "crypto" player in private banking, enabling our clients to intuitively and securely allocate a portion of their portfolio to digital assets.

As we witnessed in 2022, traditional diversified portfolios consisting of stocks and bonds can face challenging years. The current market environment invites investors to consider new management approaches. In a high inflation regime, the diversification properties of the bond portion are much less effective than before, as the correlation between stocks and bonds tends to be positive. What are the new options considered by investors? Gold, commodities, hedge funds, and other alternative investments (private debt, real estate, etc.) are among them. But what about digital assets?

For skeptics like Nouriel Roubini, cryptocurrencies cannot be considered investable assets. His argument is that traditional assets have cash flows (profits, dividends, coupons) or utility that can be used to determine their fundamental value. In contrast, according to Nouriel Roubini, cryptocurrencies have neither income nor utility.

While we do not dispute most of his arguments, our perspective on digital assets is resolutely more constructive. We categorize digital assets into three groups: 1) bitcoin (as a store of value); 2) "altcoins" such as Ether, which we consider both as "liquid" venture capital and a source of high returns through staking; 3) tokenized assets, which will eventually introduce real assets (real estate, venture capital, etc.) into portfolios in the form of digital tokens.

As shown in the lower part of the table below, these three categories can fulfill different roles in a portfolio, whether it is capital growth, yield generation, or diversification.

Below, we delve into further details about the characteristics of these three categories.

Bitcoin: A "Superior" Store of Value

Bitcoin is neither a fraud, a scam, nor a currency for criminals. It is a technological advancement that allows the transfer of money from point A to point B on the Internet without the need for a bank or intermediary, and in an ultra-secure manner. In nearly 15 years of existence, no one has been able to attack the network and disrupt or manipulate even a single transaction. While its creator remains unknown to this day, Bitcoin has no secrets because it is an open and transparent network that can be used by everyone.

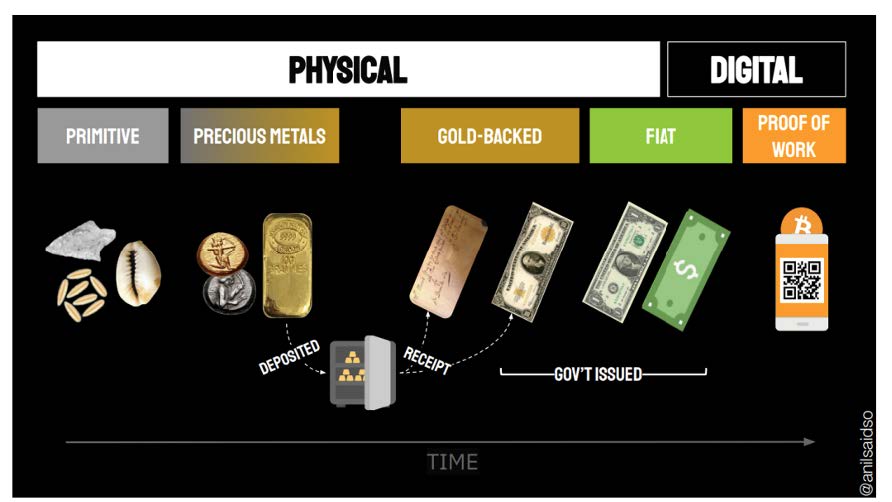

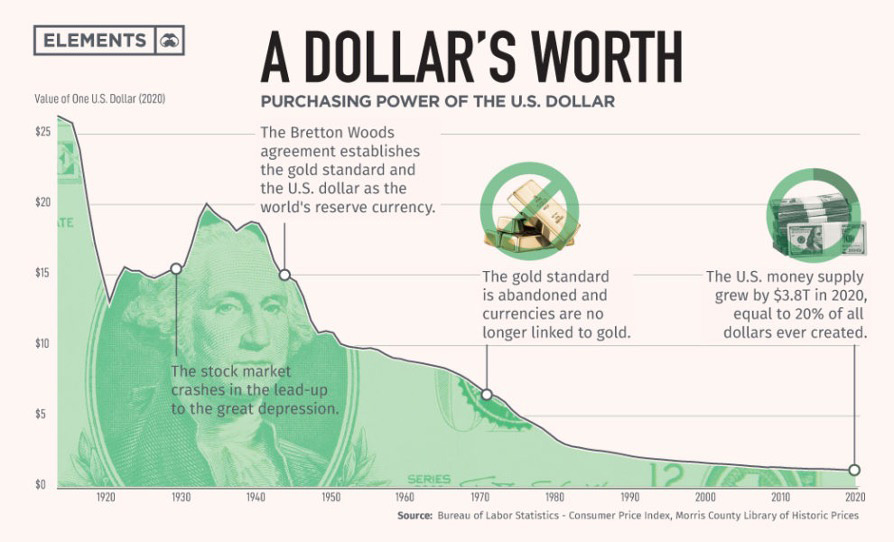

But to understand Bitcoin, one must first delve into the history of money. From primitive times until the early 1970s, there was a link between money and a scarce asset that required a certain amount of work or energy to produce. And when banknotes were introduced, they were backed by physical gold. It was only since 1971 that the link between money and an asset produced through an energy source was abruptly severed. Since then, money has been created through government debt issuance without any limit (except for the US debt ceiling, which has already been raised about a hundred times).

This unlimited monetary expansion has generated speculative bubbles (real estate, stocks, etc.), prompting central banks to issue even more debt and banknotes to stimulate the economy. It is no coincidence that Bitcoin emerged in 2008, the year of the great financial crisis...

This forward escape by central banks has led to the continuous depreciation of so-called "fiat" currencies. The loss of purchasing power of the US dollar is not a "bug" but rather a characteristic of the "fiat" system. Indeed, this devaluation of the currency forces households to spend on goods and services or invest in risky assets rather than hoarding.

But there is a third way: store of value. The most well-known is gold, whose real value tends to depreciate very little despite an annual increase in production of about 2%.

From our perspective, Bitcoin is also a store of value but with unique properties:

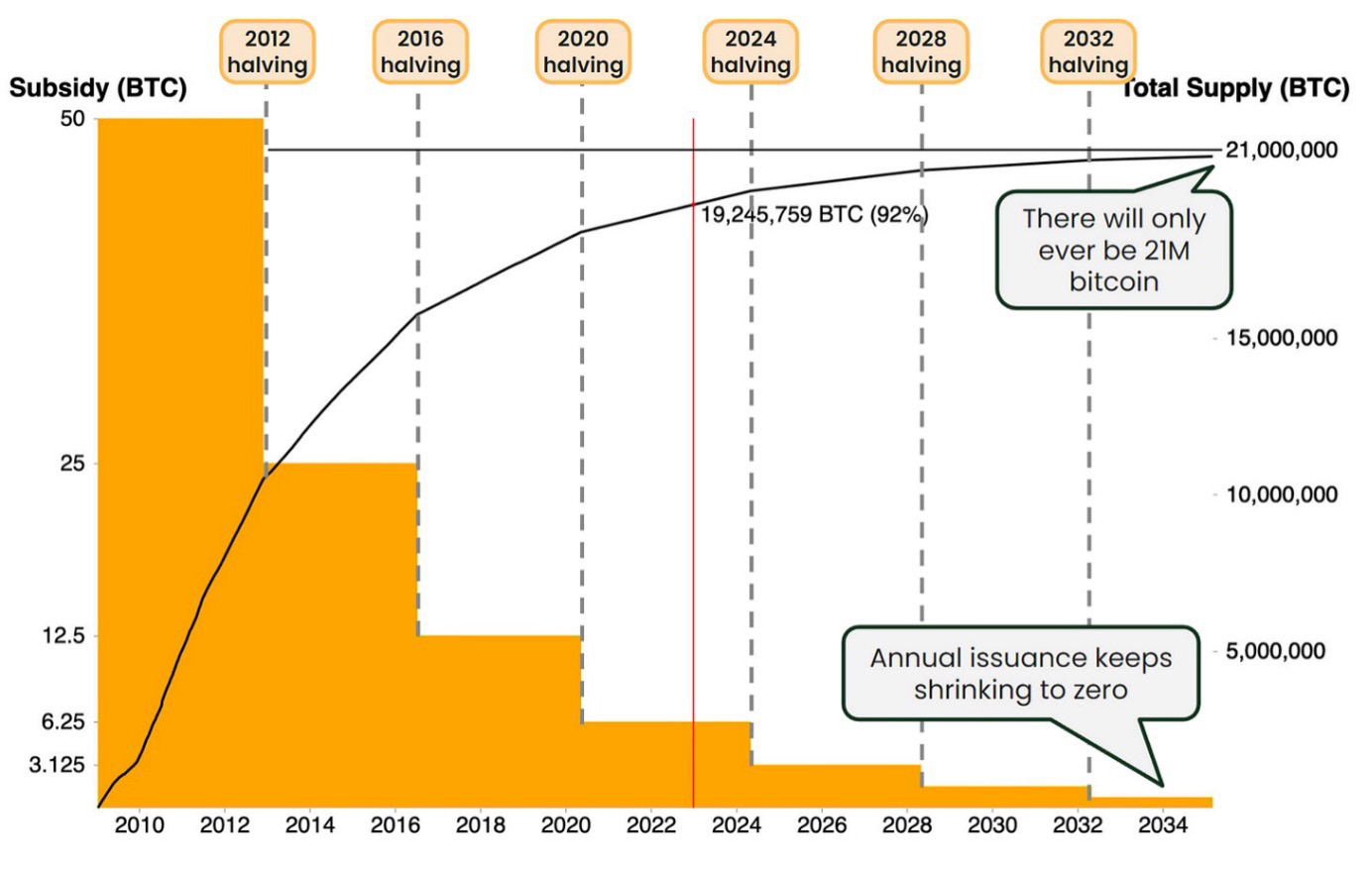

1) Scarcity effect: The supply of Bitcoin is limited over time (21 million by 2140). 19 million tokens have already been mined, and the production rate slows down every four years. Through an adjustment mechanism, an increase in the number of miners does not result in an increase in the supply of Bitcoin (unlike gold) but contributes to increased network security.

2) Proof of work: Bitcoin mining re-establishes a connection between the issuance of currency and the effort required.

3) Decentralization: Bitcoin is not controlled by an individual or a state but by its users worldwide through a peer-to-peer system. It is the first system that allows for a separation between the central bank and the currency. In the Middle Ages, the state and the clergy were linked because the church was the sole source of truth. The invention of the printing press changed everything because it became possible to acquire knowledge through books, facilitating the subsequent separation of the state and the clergy. Today, Bitcoin technology can enable a currency to break free from central banks.

4) Bitcoin is borderless, transferable with a click, cannot be confiscated, and is resistant to censorship.

For all these reasons, Bitcoin can assume the role of a store of value in a portfolio. Its volatility is much higher than that of gold, which can be explained by the fact that we are still at the early stage of adoption while its supply continues to become scarcer.

In a world where the inflation rate is expected to remain relatively high, scarce assets have their place in a portfolio. It is worth noting that there are currently only 0.002 BTC per person in the world, and the number of millionaires exceeds the number of bitcoins currently available.

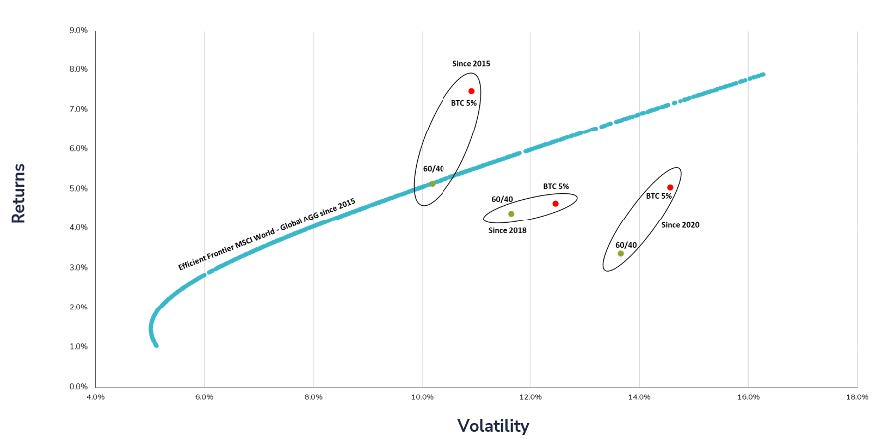

What about Bitcoin's diversification properties? Certainly, BTC collapsed in 2022 at the same time as stocks and bonds. However, it is important to recall the unique circumstances of 2022 (deflation of all asset bubbles) and also highlight that over longer time horizons, adding 5% of Bitcoin (rebalanced monthly) to a 60-40 portfolio has significantly improved the risk-return profile of the portfolio.

Efficient frontier: improving the risk/return profile of a 60-40 portfolio (equities/bonds) after including bitcoin, over different time periods.

Altcoins: liquid venture capital and high

returns through staking

Beyond bitcoin, more than 10,000 cryptocurrencies

("altcoins") are listed in various segments: Layer1, DeFi, GameFi, NFT, etc. With the exception of stablecoins, their volatility is often higher than that of bitcoin. With the exception of stablecoins, their volatility is often higher than that of bitcoin. Many of these protocols offer very high growth prospects, but at the cost of considerable risk. This type of investment can be seen as the equivalent of venture capital, but in an "ultra-liquid" form. While it is possible to lose a lot of money in private equity, their valuation is only known once or twice a year. With altcoins, it's 24/7...

Despite Mr Roubini's claims, many altcoins do have a certain usefulness. Take ether, for example. The Ethereum blockchain enables the realization of numerous projects

to which revenues (gas fees) are attached. Like many companies, it publishes results that include the revenues generated by the blockchain. In the first two weeks of May, these revenues amounted to over $270 million. It is therefore possible to calculate a price/revenue ratio for ether. It currently stands at 60x, double that of Nvidia shares, but with a much higher growth rate.

Altcoins also pay generous returns via staking, a kind of reward paid to altcoin holders who contribute to the smooth running of a blockchain. These returns generally range from 5 to 15%.

Tokenization: real assets 2.0

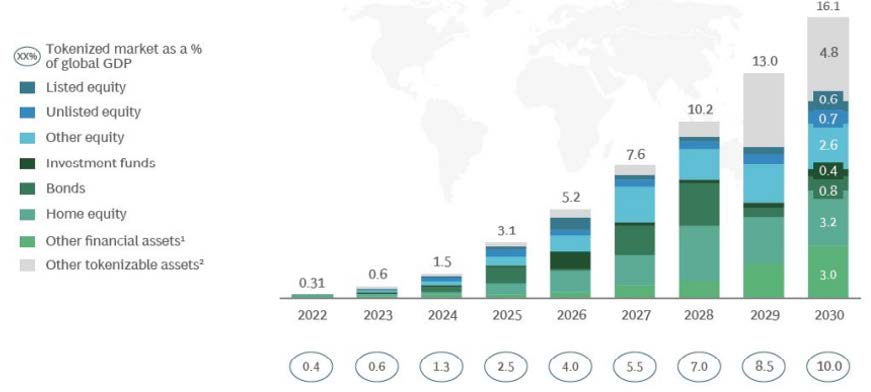

Blockchain offers the potential to disrupt many sectors by creating digital tokens that can represent ownership of a business or real asset through a process known as tokenization. According to the Boston Consulting Group, tokenization represents an opportunity worth almost $16 trillion by 2030 (see chart below). It will certainly be many years before tokenized assets can be included in discretionary portfolios, as the ecosystem (regulation, intermediaries, exchange platforms) is not yet complete.

It should be noted, however, that Switzerland is relatively favourable to tokenization; the Swiss Code of Obligations grants tokenized assets the same rights as traditional assets via the DLT (Distributed Ledger Technology) law.

Despite a favorable investment thesis on digital assets, there are many obstacles to their inclusion in a discretionary management mandate. These include

• Bitcoin's outperformance of traditional assets in the past is due to a few idiosyncratic rallies;

• Volatility can be extreme;

• The investment thesis is not easy to explain and remains controversial;

• The liquidity of many altcoins is relatively low;

• Fund managers face counterparty and custodian risks;

• It will take a few years for tokenized assets to become mainstream;

• Regulatory uncertainty remains high.

As far as regulation is concerned, let's recall the principles of SwissBanking's management mandate, which stipulates that "Investments in non-traditional investments (...) are permitted for portfolio diversification purposes, provided they are structured according to the fund-of-funds principle (...) or the multi-management principle".

In this context, we are considering a first step in the inclusion of digital assets in mandates: investing in a fund of hedge funds on cryptos, to be co-managed by Syz Capital and CMCC Global (Crest). It will enable investment in digital assets with lower volatility, while respecting the rules of the mandate.

As regulations evolve and volatility falls, other investment vehicles may be considered over the next few years.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

President Donald Trump signed an executive order relating to cryptocurrencies. The US is now one step closer to the creation of a strategic bitcoin reserve. Overview below.

"There are decades where nothing happens; and there are weeks where decades happen." - Vladimir Ilyich Lenin

Solana and Ethereum are two dominant blockchains in the crypto sector, each boasting robust DeFi ecosystems and a plethora of diverse applications. The two blockchains are often seen as competitors. How do they compare?

.png)