Introduction

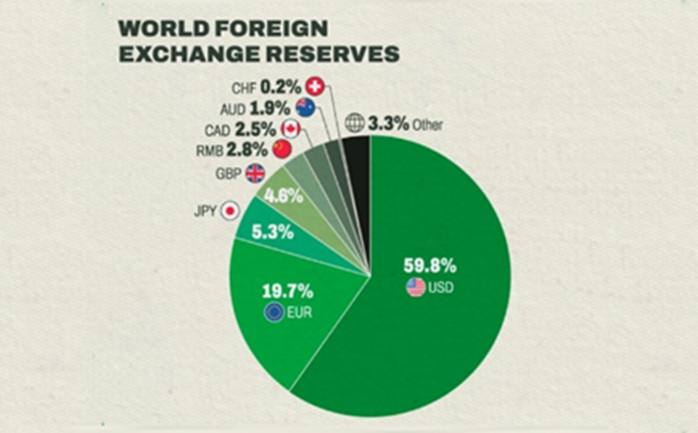

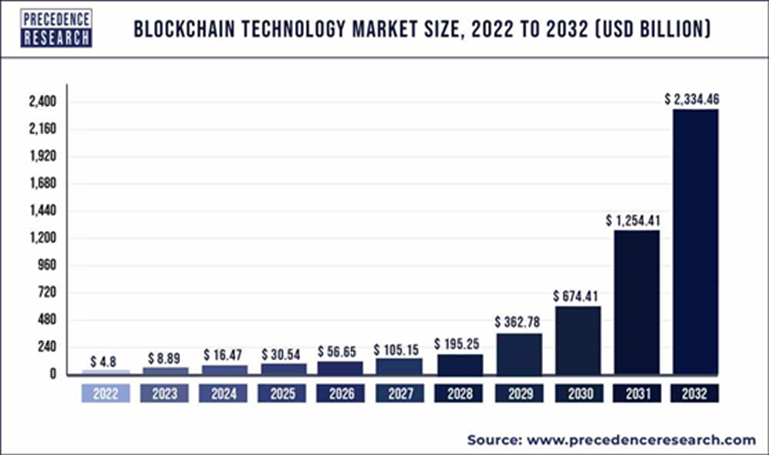

The "BRICS" (comprised originally of Brazil, Russia, India, China and South Africa), have joined forces to create a unified payment system based on the innovative technologies of digital currencies and blockchain. This ambitious move is not just a technological breakthrough; it also represents a strategic maneuver aimed at strengthening financial autonomy, reducing their dependence on dominant currencies such as the US dollar, and bypassing traditional banking networks such as SWIFT, which is a source of vulnerability for these nations due to geopolitical tensions.

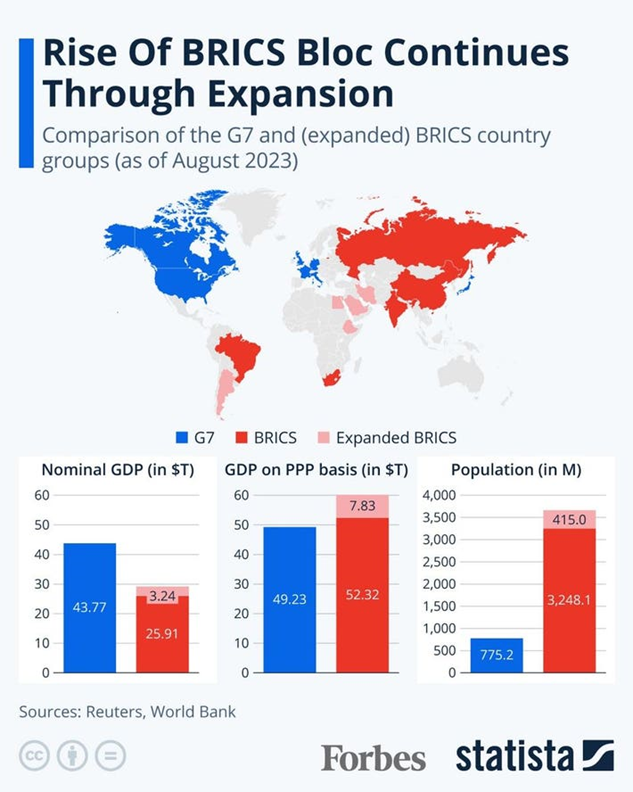

This initiative cannot be overstated. Collectively, the BRICS represent a substantial share of the world's population and economic output. Their economies are growing fast, and they control a high proportion of the world's raw materials. By proposing a payment system based on digital currencies and blockchain technology, the BRICS bloc is positioning itself at the forefront of financial innovation, aiming to create a more inclusive, efficient and secure global financial infrastructure. This initiative reflects a broader trend towards de-dollarization and the search for alternative financial channels capable of supporting the dynamic needs of emerging economies and ensuring their resilience in the face of external shocks and manipulations, as well as possible collapses in geopolitical relations.

.png)