Asset Allocation

EQUITIES

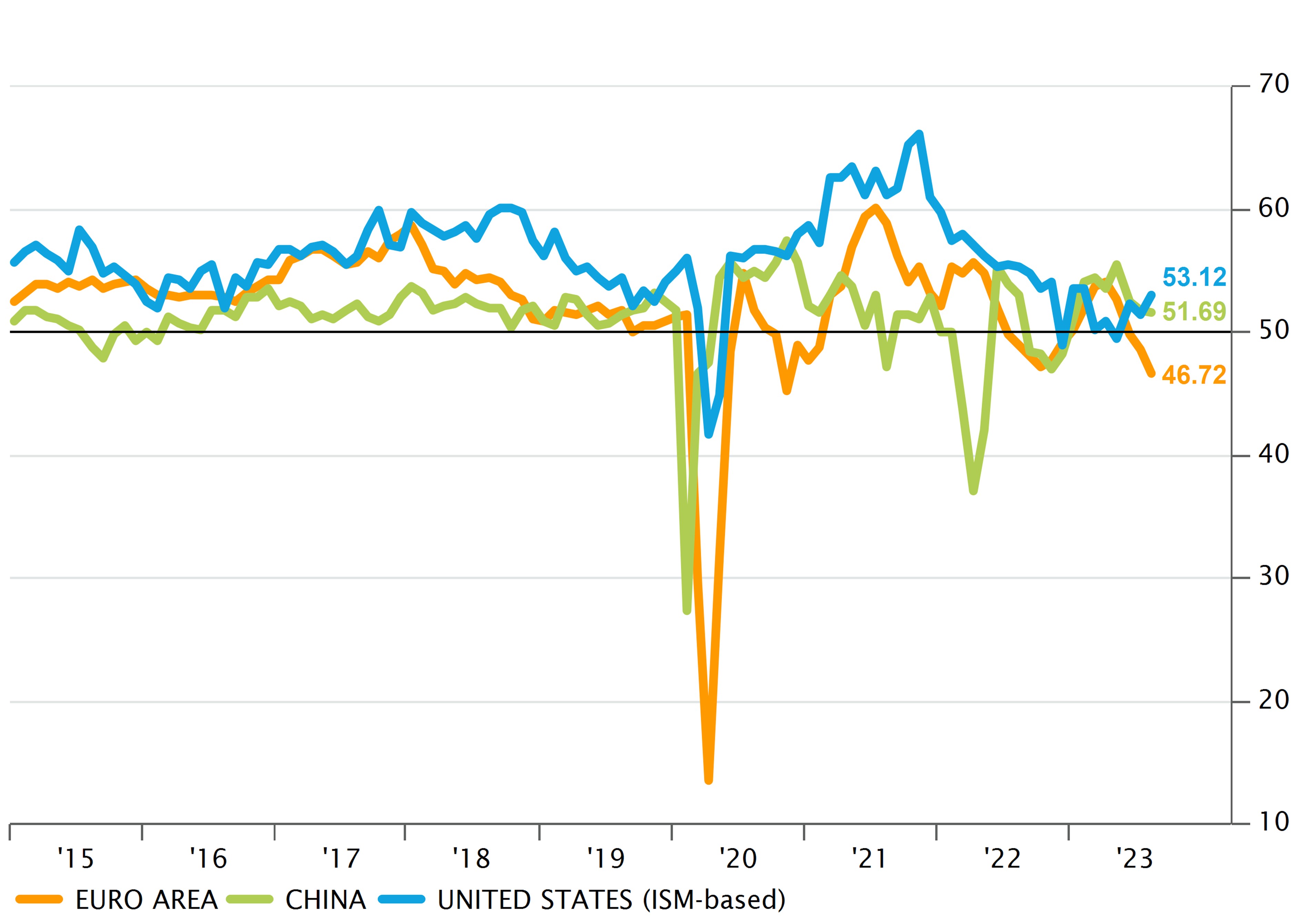

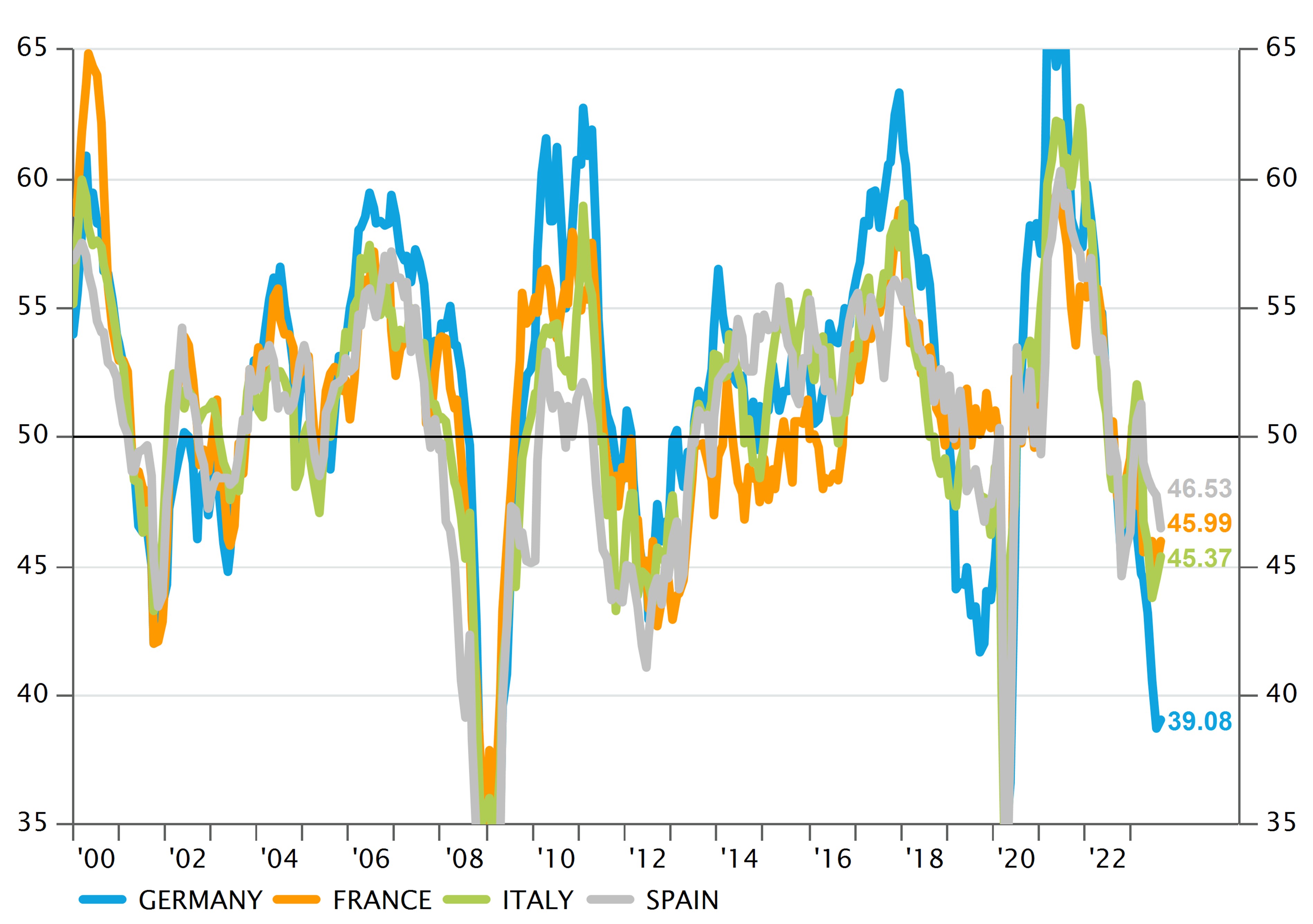

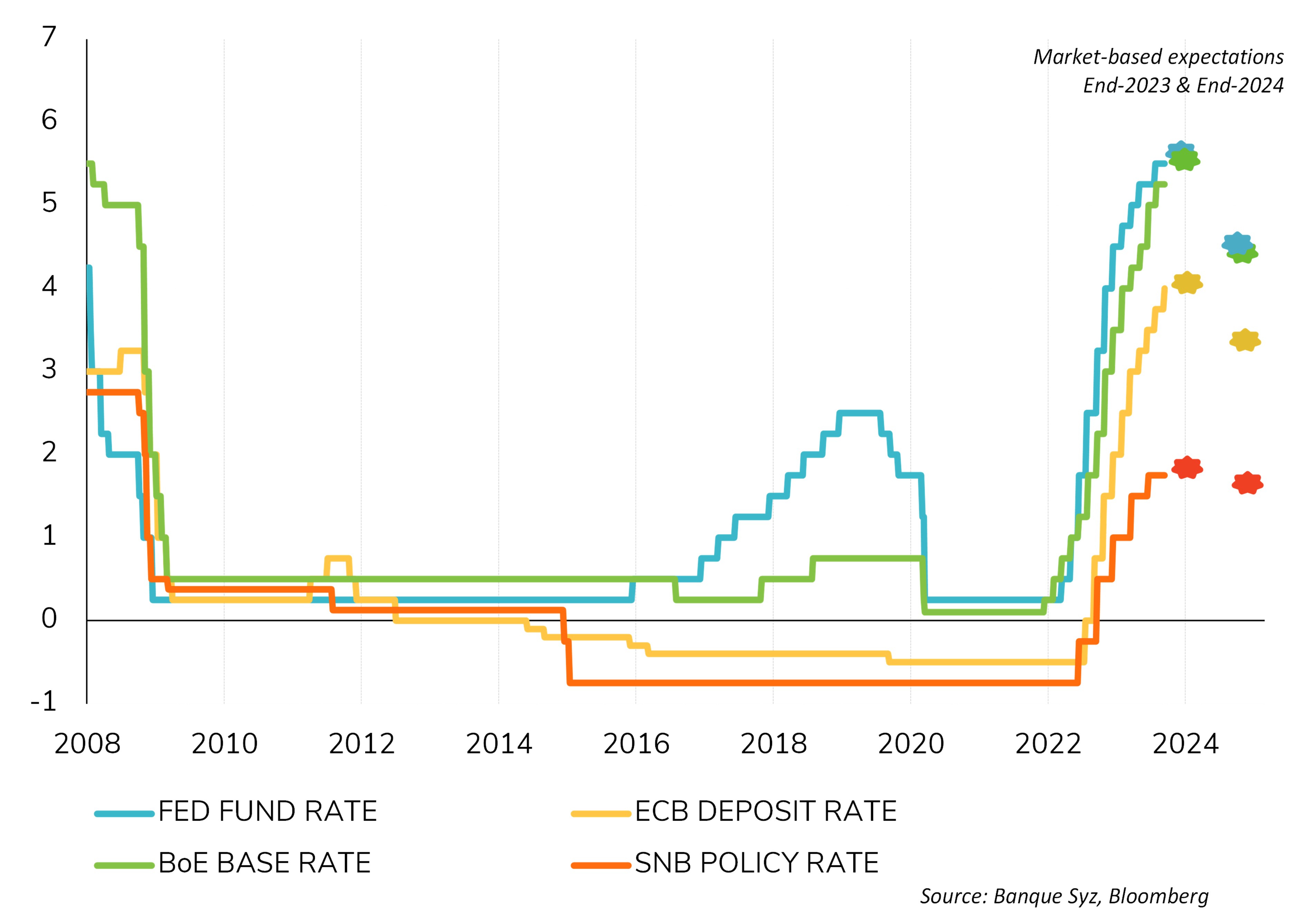

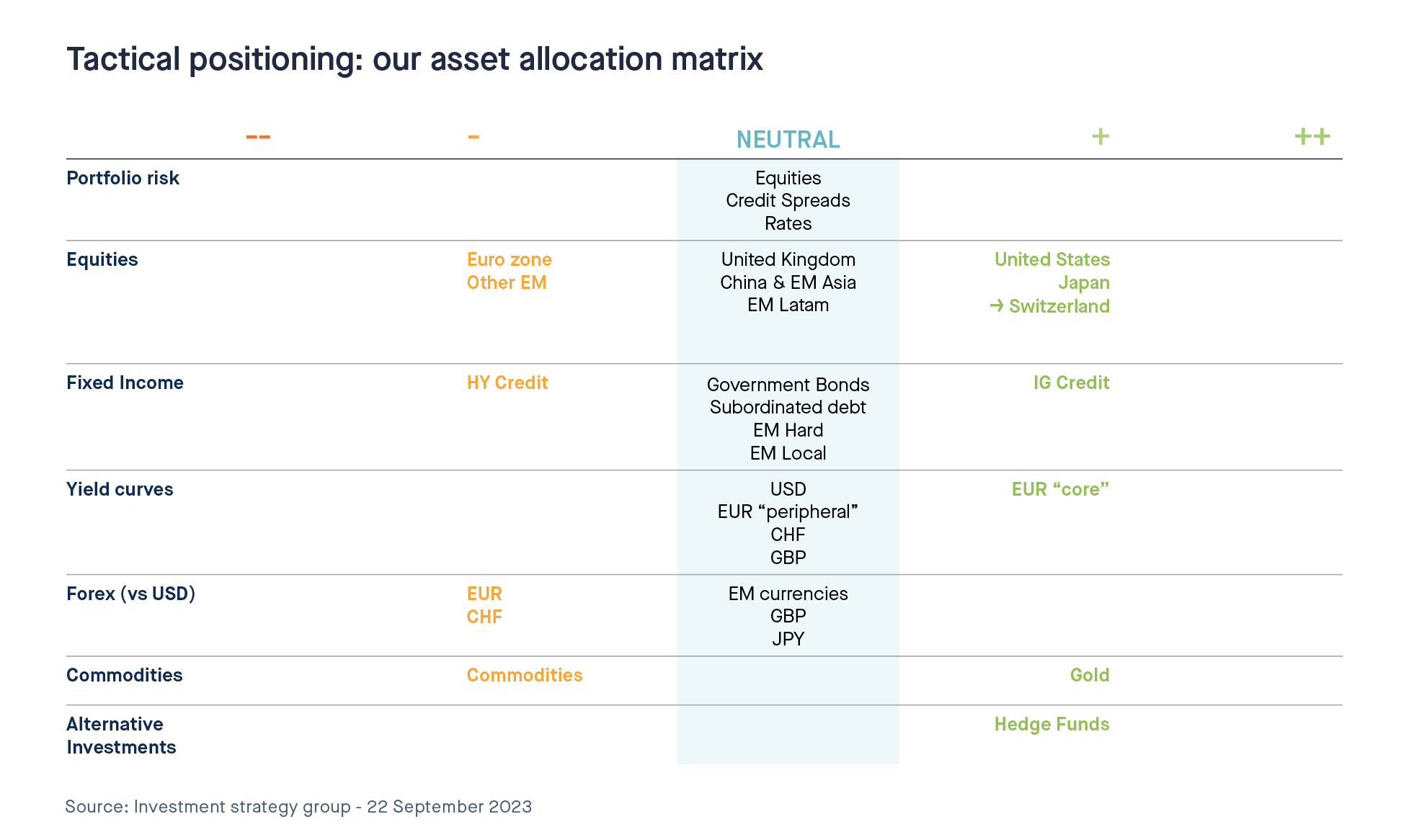

We have a NEUTRAL stance on equities with a slightly positive view on the US, Japan and Switzerland (upgraded from neutral), a neutral view on the UK, EM Latam and China/EM Asia and a slightly negative view on Eurozone and other EMs.

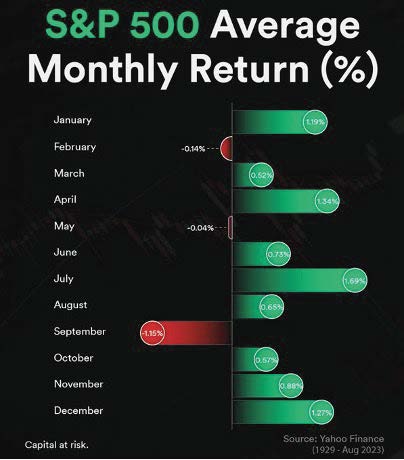

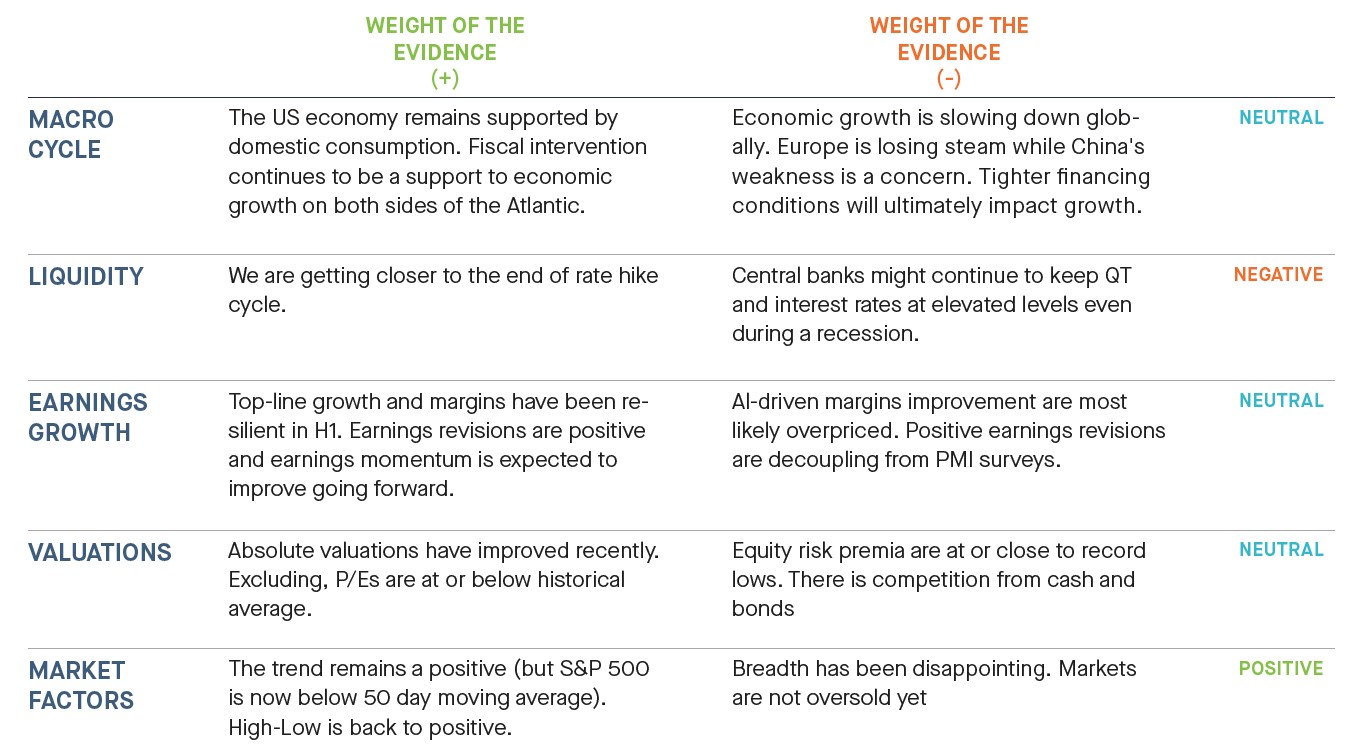

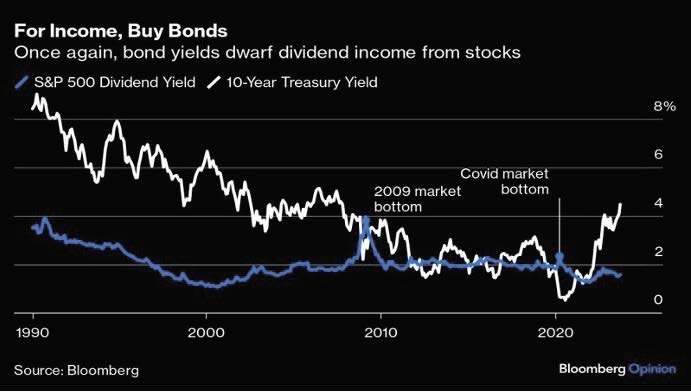

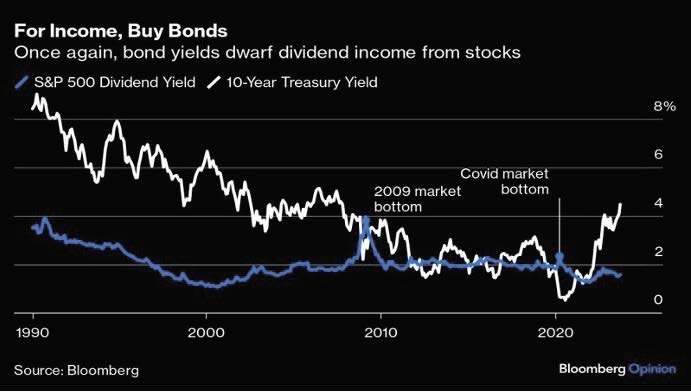

As mentioned earlier, earnings revision has been a tailwind for equities during the first 9 months of the year and if consensus is right, earnings momentum will turn positive in 3Q and 4Q this year. From a valuation perspective, US equities large caps remain expensive both on an absolute and relative basis. Importantly, cash and bond yields create significant competition for stocks. Treasury yields now surpass stock dividend yields by the widest margin since the Global Financial Crisis.

For income, buy bonds

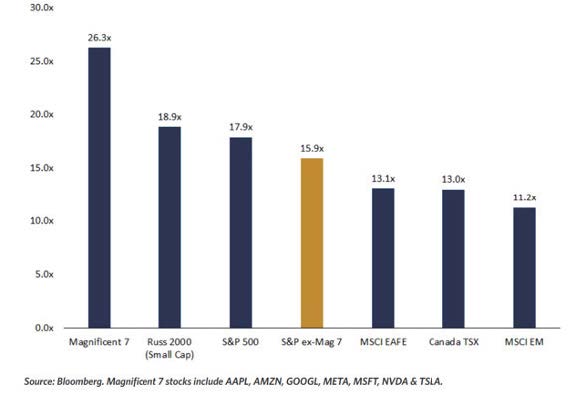

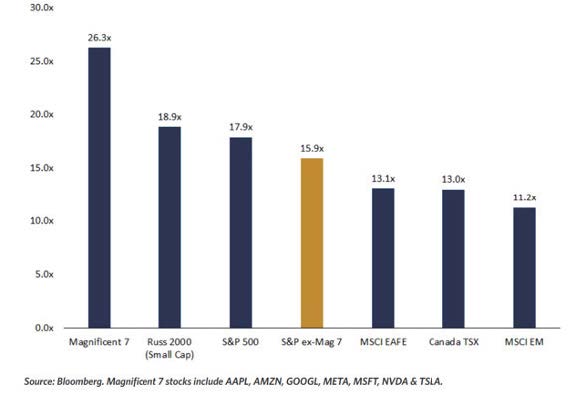

But this relative expensiveness is mainly explained by the high valuation multiples of the “Magnificent 7”. Valuations outside of this specific segment of the market appear less stretched (see chart below).

Valuations are more reasonable outside Technology (forward P/E ratio)

We are upgrading Swiss equities from neutral to positive due to their defensive characteristics and the fact the Swiss National Bank is probably at the end of its monetary policy tightening cycle.

FIXED INCOME

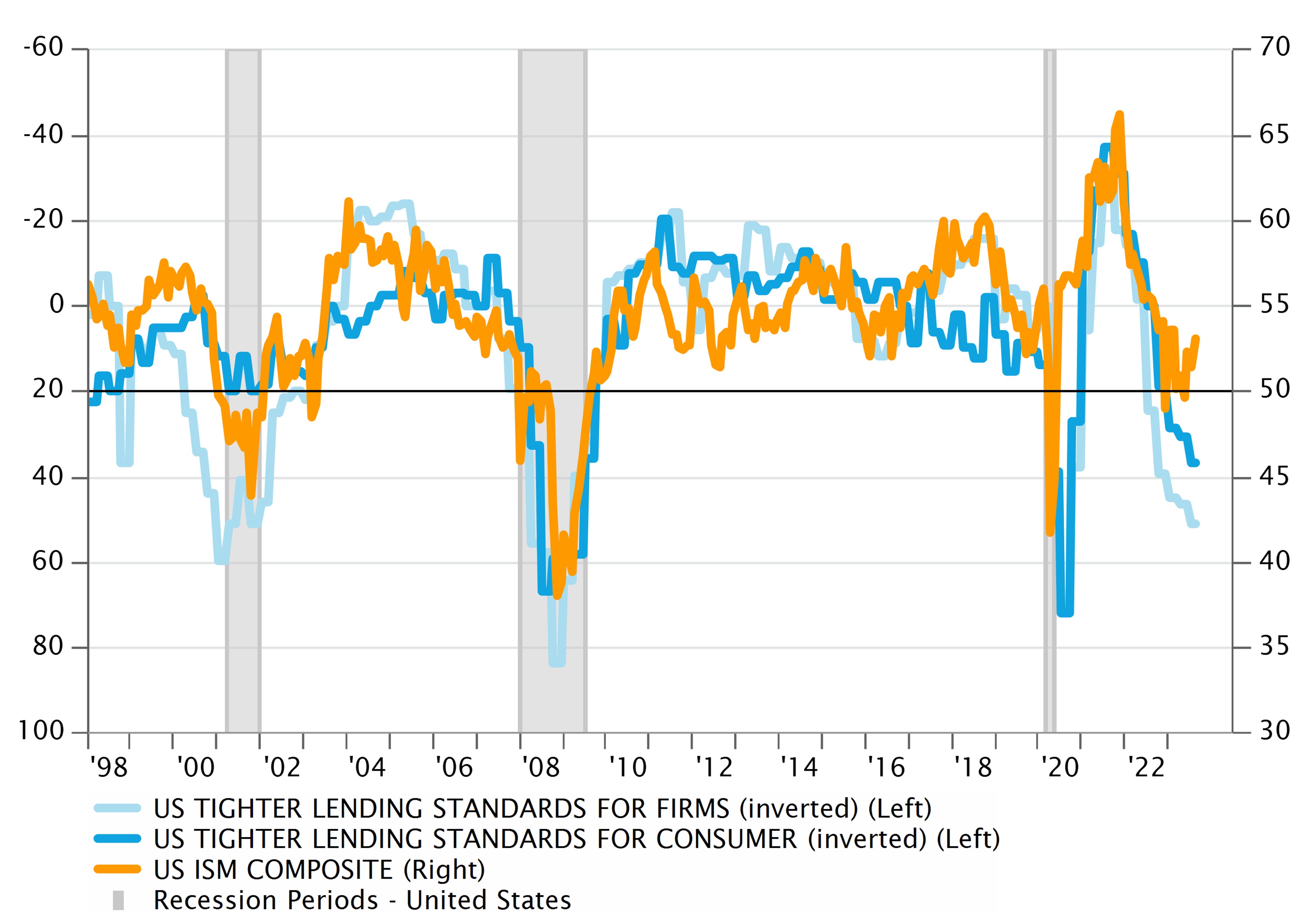

Within Fixed Income, we are maintaining a neutral stance on both Rates and Credit, with a slightly positive outlook on Investment Grade and a slightly negative view on High Yield.

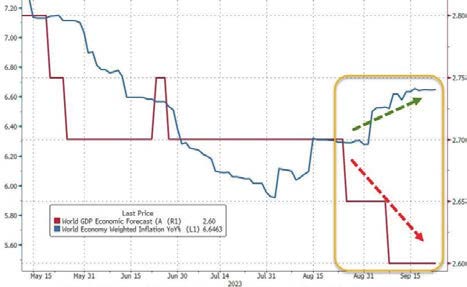

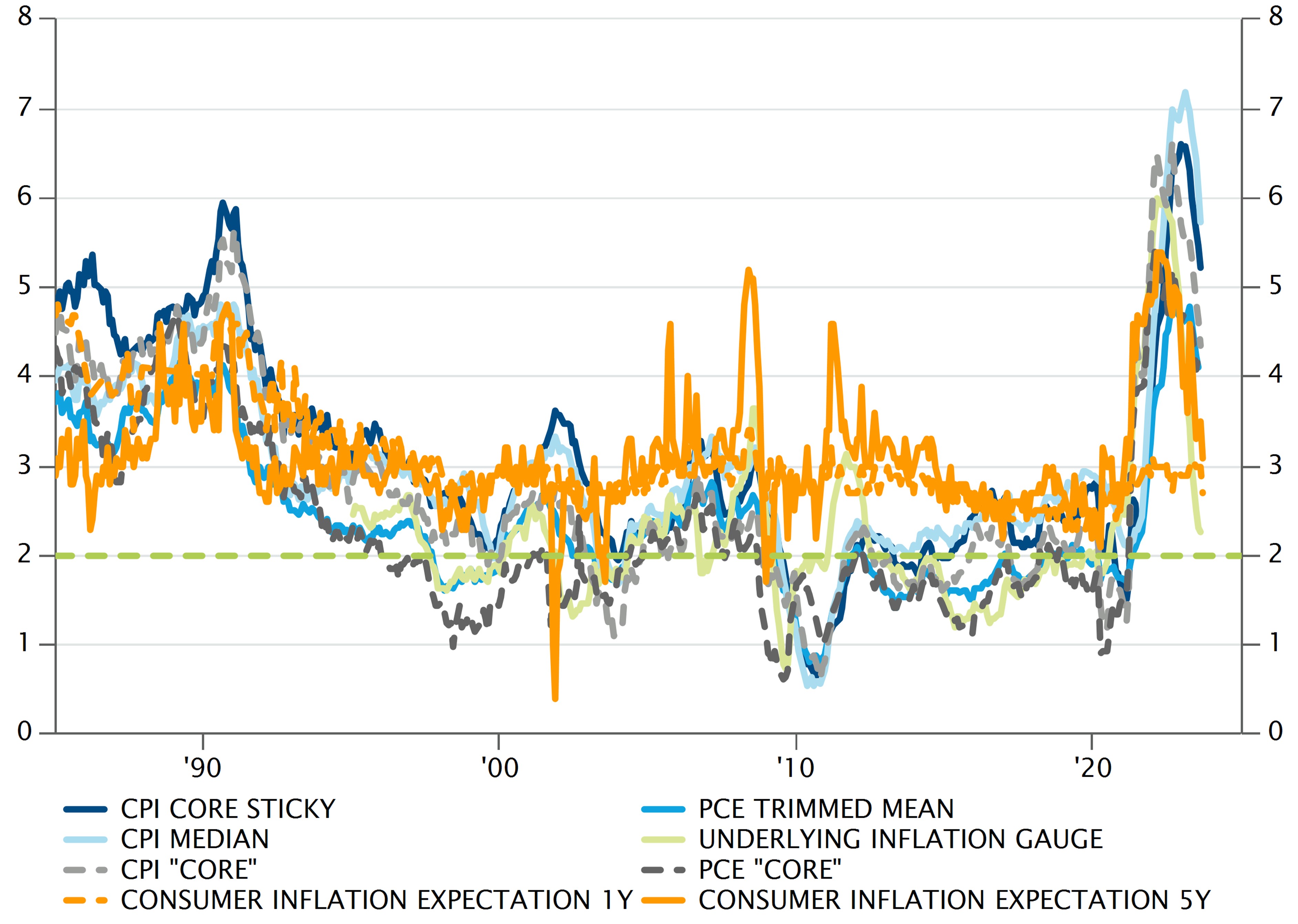

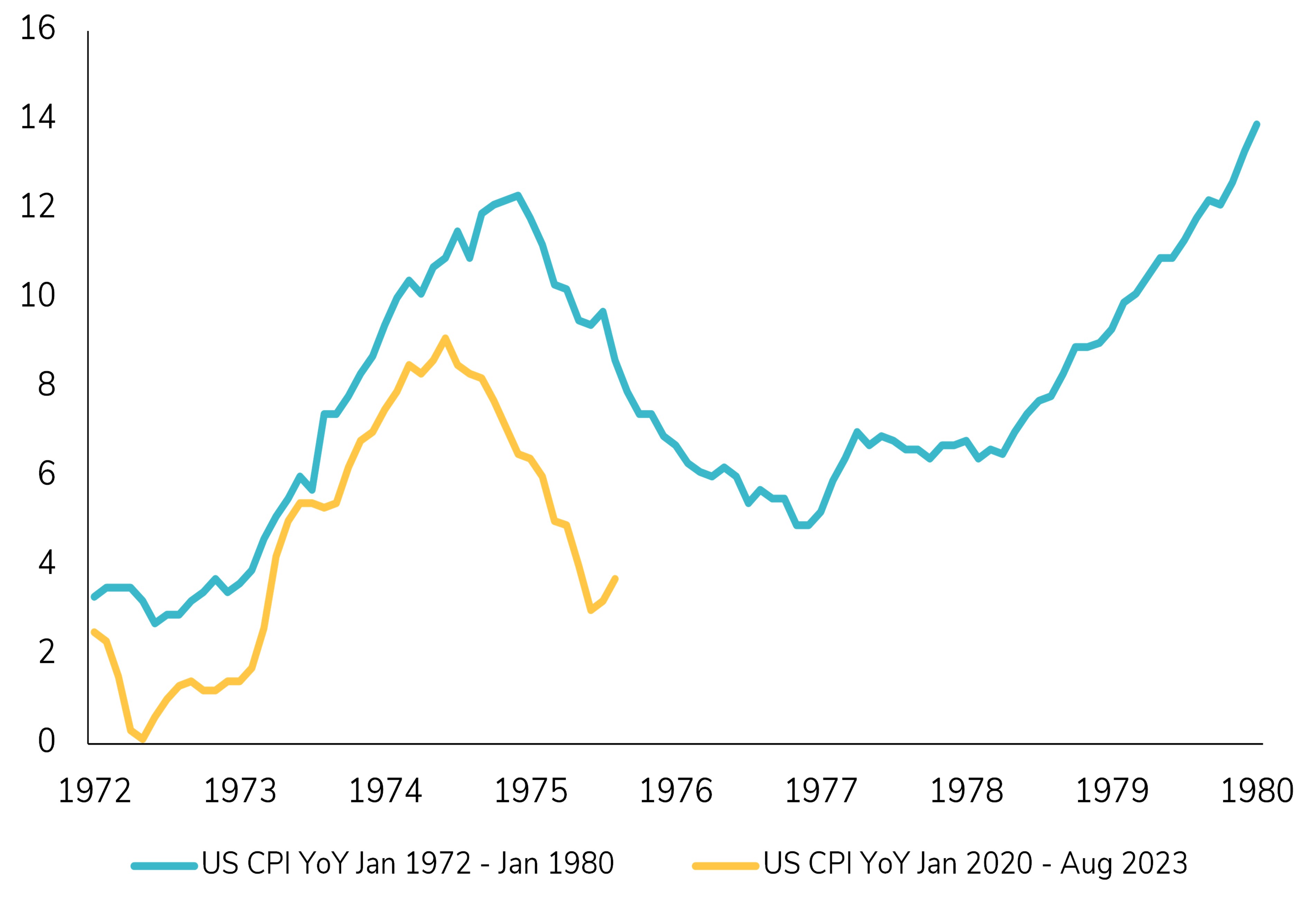

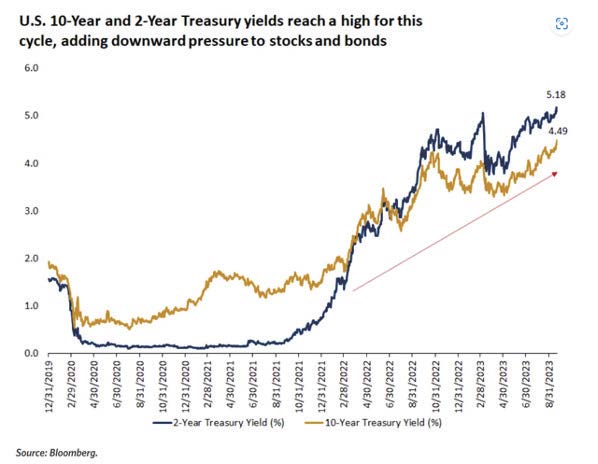

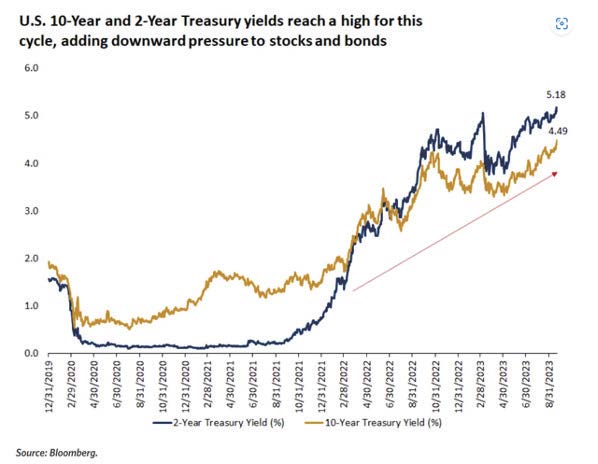

While last year's rise in interest rates was primarily due to concerns about inflation, this year, higher yields appear to be driven by the market's improved perception of economic growth potential, resulting in real interest rate levels not witnessed in decades. Conversely, we recognize the potential for lower rates due to a global growth slowdown. In this rate environment, we recommend gradually extending duration, as there is an attractive asymmetry in long-term rates, supported by expected moderation in growth and inflation. The resurgence of oil prices could temporarily weigh on short-term rates but increases the case for a long-term growth slowdown.

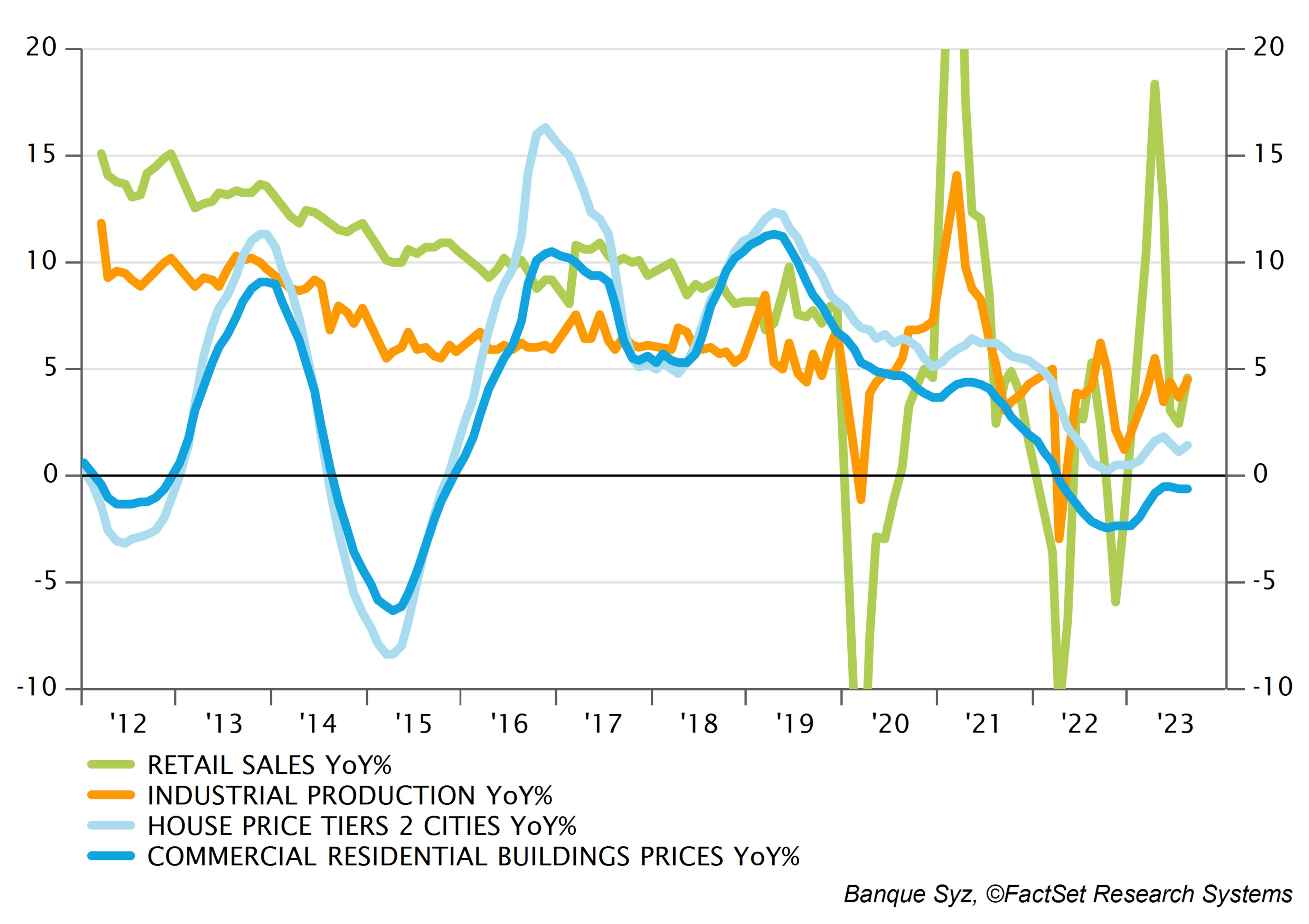

Considering our concerns about the Eurozone's growth outlook and the potential conclusion of the ECB rate hike cycle, we are adopting a neutral stance on EUR rates. Within the credit space, our neutral stance emphasizes high-quality corporate bonds. We are avoiding the pursuit of higher yields in the High Yield sector due to overpricing relative to risk. In Emerging Market debt, we maintain a vigilant stance due to valuation and potential risk considerations. Higher oil prices and a strong US dollar pose challenges for oil-importing EM nations, especially Asian countries, while some Latin American countries may benefit.

The Bloomberg dollar index (DXY)

Source: TME, Refinitiv

FOREX & ALTERNATIVES

On the forex side, we remain negative on EUR and CHF (versus USD) and neutral on JPY, GBP and EM currencies (versus USD). The dollar index ($DXY) golden cross is now in place.

US 2- and 10-year Treasury yields moved to new cycle highs following the Fed meeting

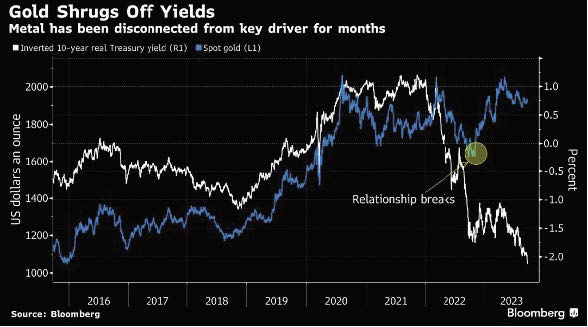

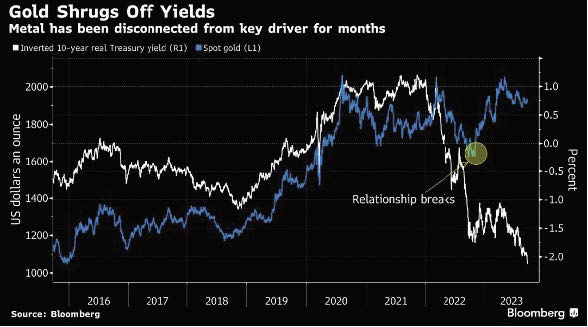

Within commodities, we remain positive on gold, which continues to exhibit low volatility with other asset classes and should be a beneficiary of any tail risk event. We note that a significant gap has opened up between gold and real yields. Why? 1) With debt sustainability having become an ever-increasing issue, the market anticipates that real interest rates cannot stay at this level for too long; 2) Investors buy gold as an insurance against adverse circumstances (inflation, recession, etc.). But for gold to appreciate in dollar, a drop in real yields is probably required. In the meantime, gold remains a true diversification asset.

We also maintain our positive view on Hedge Funds. We like well-established Global Macro funds that have a multi-portfolio managers approach. We cautiously like Relative Value funds but are wary of liquidity conditions. We like having a core position in a diversified systematic strategy with a long-term commitment. We prefer staying away from Equity long/short and directional funds as their beta is too high. We do not like Event Driven funds as we believe the merger & arbitrage landscape will be very challenging in 2023.

Gold shrugs off yields

.png)