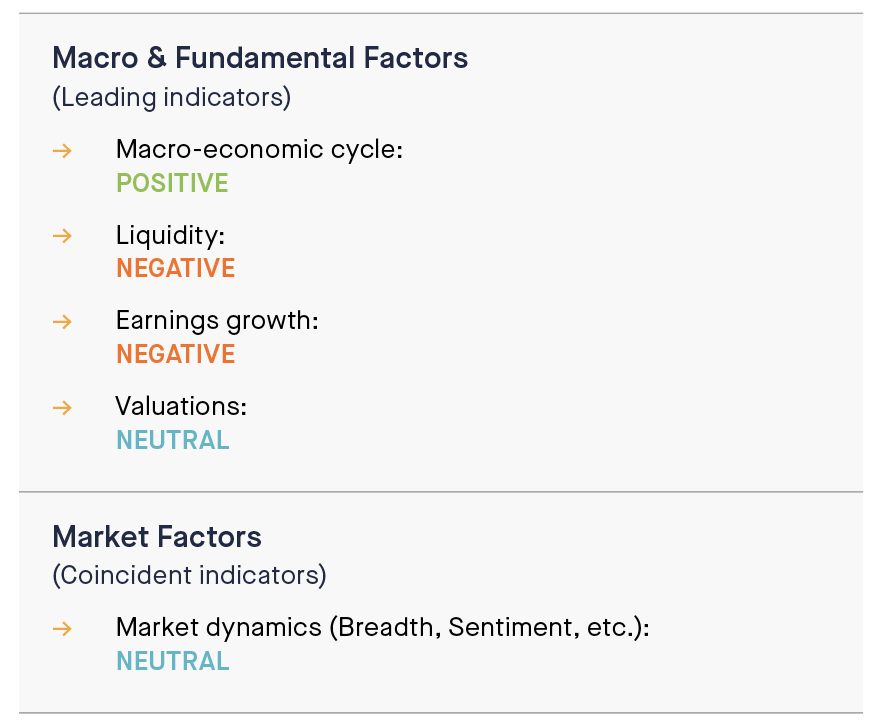

The recent developments in the US and European financial sectors have increased the risk of a faster-than-expected deterioration in macro dynamics, as well as the risk of financial stress. Those risks, if materialized, could fuel equity and bond volatility but also put upward pressures on credit spreads in the weeks and months ahead.

We however note that the swift central bank intervention on both sides of the Atlantic last week and the improvement in valuations due to the widening spreads imply that Investment Grade credit continues to offer value for the yield level it provides, especially for good quality issuers (A-rated and above) that would be less at risk of significant repricing in a risk-off scenario.

The combination of a less favourable macro environment but supportive valuations in the higher quality spectrum warrants an adjustment of our preferences on credit to reflect a more uncertain environment.

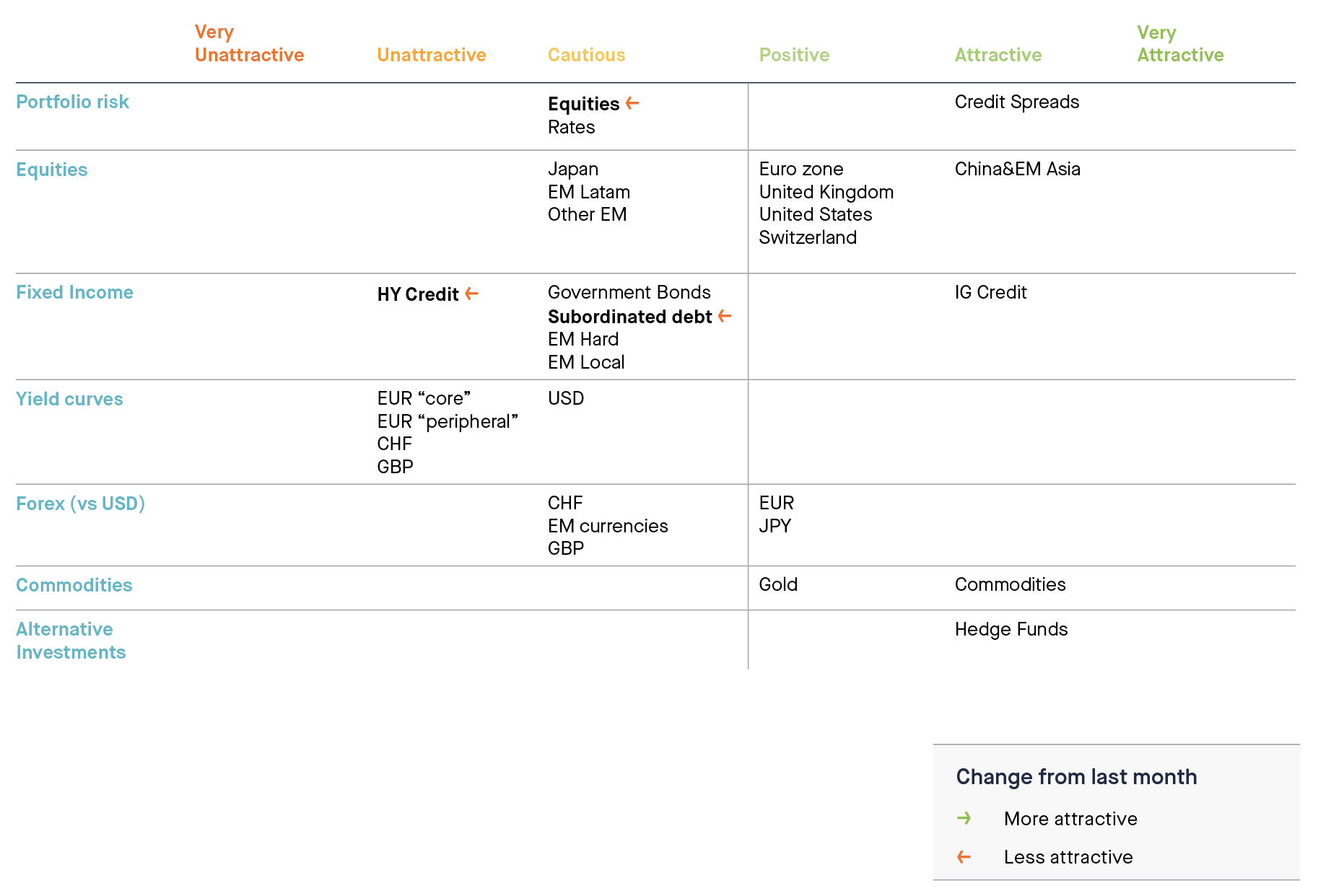

As such, we are further de-risking portfolios by downgrading our stance on credit from attractive to positive. We are downgrading Investment Grade Credit from Attractive to Positive, High Yield Credit from Cautious to Unattractive and Subordinated Debt from Positive to Cautious.

The big picture

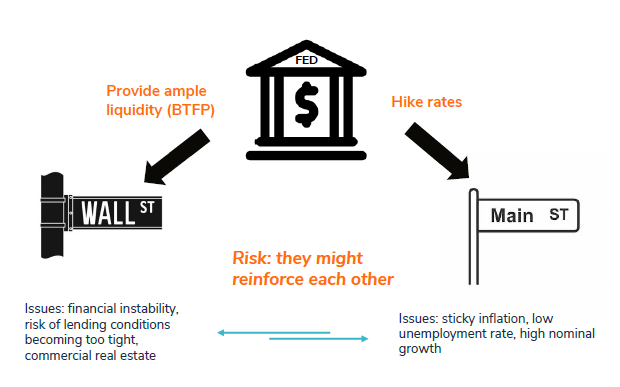

The collapse of Silicon Valley Bank (SVB), the largest bank failure since the 2008 financial crisis, and the fallout of Credit Suisse have raised concerns about potential contagion and a broader banking crisis. But so far, the US government's quick response in guaranteeing that deposits will remain available and the quasi bailout of Credit Suisse have been able to stabilize markets and prevent a broader bank run. Central banks have been sticking to their plans as the ECB, The Fed, SNB and BoE raised rates in line with expectations while signalling they are ready to provide ample liquidity to the financial system if needed.

.png)