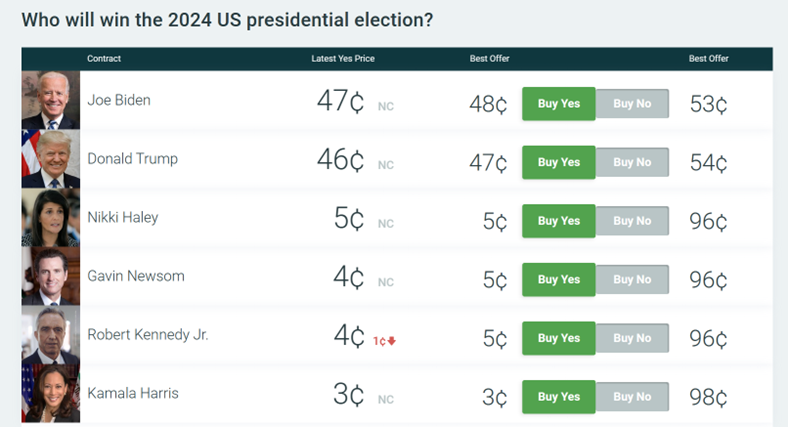

Another sector likely to benefit from a Republican victory is defence and immigration enforcement. Although the defence sector is less dependent on politics than it used to be, Trump has always been a strong supporter of increased military spending, which could benefit defence contractors and related industries.

With the number of illegal immigrants entering the U.S. at record levels, Trump's measures on border management will be a major issue of his presidency. If Trump wins, we can expect certain measures taken during his first term to return to the fore. For example, Trump has already promised to launch a massive deportation campaign, targeting gang members and drug traffickers for swift deportation. Prisons, such as private jails and detention centres, could therefore benefit from a Republican victory.

The student debt crisis has been a bone of contention in the U.S. under the Biden administration. In fact, it's one of the areas where the two candidates have very different views. If Trump is elected, companies active in the for-profit education sector could benefit from reduced regulatory risk. As for the likelihood of further easing of student loans, this seems unlikely.

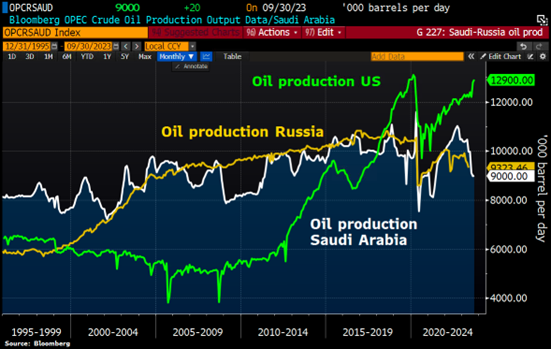

While the economic agenda of a Trump administration offers positive growth prospects for certain sectors, it's just as important to examine the potential negative impacts. One of the potential big losers from a Donald Trump comeback would be the renewable energy sector. Trump's focus on traditional energy sources such as oil and coal come at the expense of reduced support for green energy initiatives. This stance may result in reduced federal funding and incentives for clean energy projects, which could hinder the growth of the wind turbine and photovoltaic panel sector. With Trump already expected to withdraw from the Paris Agreement, a withdrawal - even a partial one - from Biden's Inflation Reduction Act (IRA) could represent a significant risk for companies in this sector. Conversely, Trump is likely to support nuclear power, the most efficient and reliable source of energy. Uranium could benefit from this.

Foreign trade is another area of concern under Trump's economic policies. His administration's protectionist stance, characterised by tariffs and the renegotiation of trade agreements, could lead to trade tensions and reduced global cooperation. Mr. Trump has already threatened to impose 10% tariffs on all imports into the United States. The first target of such a policy would be China, but Europe and Mexico could also become targets again, as well as the steel and lumber industry. While such policies aim to support domestic industries, they can also lead to retaliatory measures by trading partners and disrupt global supply chains.

This can have a negative impact on sectors heavily dependent on international trade, such as technology and manufacturing. In addition, protracted trade conflicts could lead to higher costs for US businesses and consumers, potentially dampening economic growth.

.png)