The big picture

Global equities are off to a strong start of the quarter. The sentiment was perhaps too negative as of the end of Q3, forcing hedge funds to cover shorts during the first week of October. A stabilization of the political situation in the UK, a decent earnings season and signs that both the US and the UK might avoid a deep recession next year were additional tailwinds propelling the tactical bounce further.

We note that not all segments of equity markets have been participating evenly to the market advance. Indeed, while the Dow Jones is up nearly 12% quarter-to-date, the Nasdaq is in negative territory as rising bond yields and disappointing earnings results by the FAANGs have weighed on the technology sector – especially the Mega Caps.

Several key geopolitical events can trigger large market moves in the weeks ahead –be it on the upside or the downside: the outcome of US mid-term elections, the G20 Summit and potential easing of Covid restrictions in China.

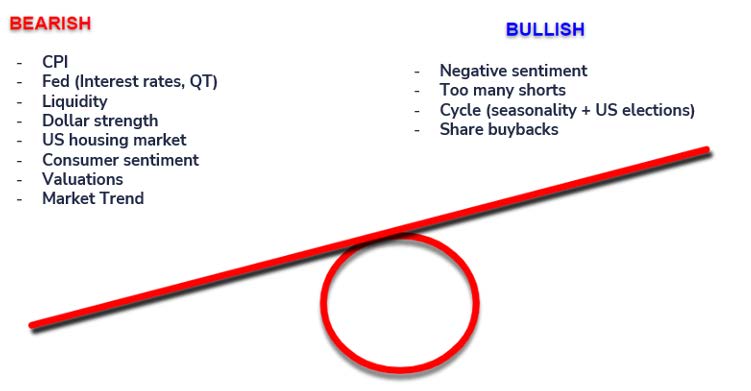

From a mid to long-term perspective, we believe that equity markets will have to climb a high wall of worries: central banks remain in a tightening mode, global liquidity conditions remain negative, valuations are still not cheap while interest-rate sensitive segments of the economy

(consumer loans, housing) face downside risks.

But while the medium-term trend remains unfavorable to equity markets, some short-term technical factors could prolong the Indian Summer which has started at the beginning of the quarter.

But while the medium-term trend remains unfavorable to equity markets, some short-term technical factors could prolong the Indian Summer which has started at the beginning of the quarter.

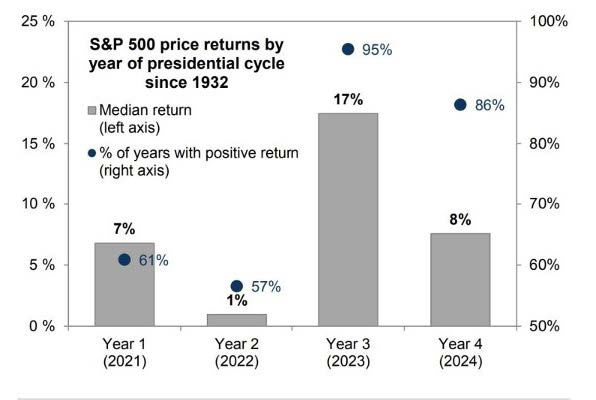

First, market positioning is still too defensive, which might push more investors to chase the rally. Second, the cycle (seasonality & the prospect of 2023 being year 3 of the US presidential cycle, see chart below) leads into more risk taking. Last but not least, many companies remain flushed with cash and with the share buyback blackout period being over, we could see more liquidity supporting stocks valuation in the coming weeks.

The 4-year Presidential cycle – historical returns for the S&P 500 by year

Source: Goldman Sachs

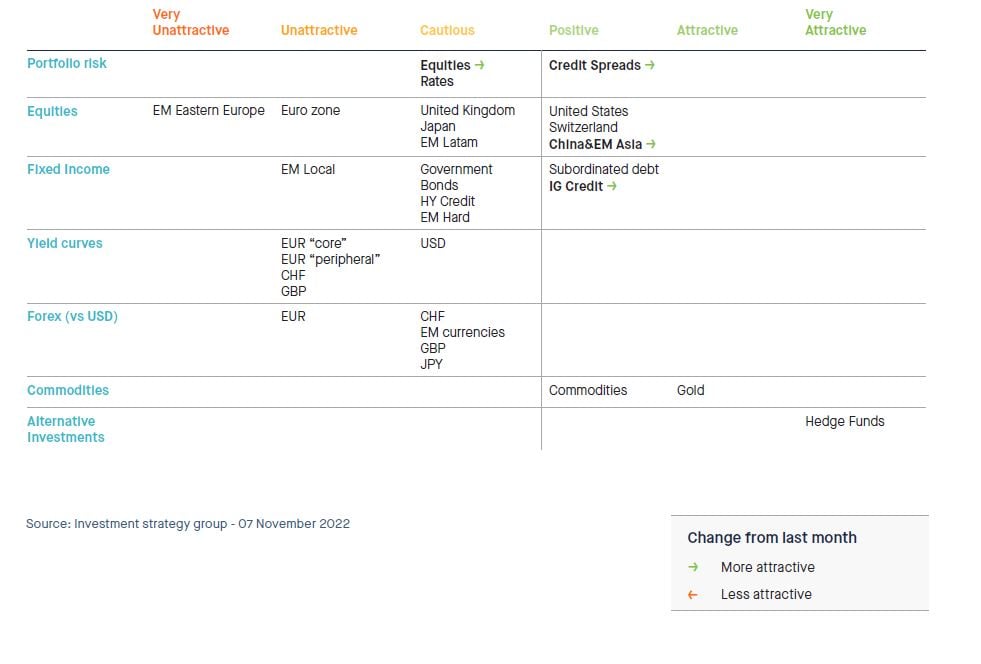

Our 1-month view: we have upgraded our global equities view from “unattractive” to “cautious”

- Based on the weight of the evidence (i.e. the aggregation of our fundamental and market indicators

– see next section), we are slightly increasing our exposure to equity markets. - From a regional standpoint, we are keeping a “positive” stance on US equities. We are cautious on UK,

- Japan and EM Latam equities. We are also upgrading our stance on EM Asia equities from “cautious” to “positive”.

- We are keeping an “unattractive” stance on Eurozone equities. Our least favored market remains EM Eastern Europe equities (very unattractive).

- Within Fixed Income, we are keeping a “cautious” stance on rates but upgraded our view on credit from “cautious” to “positive”. The double effect of widening spreads and rising yields has considerably improved the risk-reward of short to mid duration credit portfolios

– including Investment Grade. - We are keeping a “positive” view on Commodities (with a “preference” stance on Gold) as well as a “very attractive” view on hedge funds.

- In Forex, we are positive on the dollar against all currencies. We kept an “unattractive” stance on the euro as the Eurozone is facing a major energy crisis, which is worsening the fundamentals of the common currency.

Indicators review summary

Our tactical asset allocation process is based on five indicators. The macro and fundamental factors are still tilted towards a negative stance on risk assets. Earnings growth and equity valuations are “neutral” at best. The most dynamic factor of our process - market dynamics – has moved from “neutral” to “positive”.

On an aggregated basis, our indicators are pointing towards a “cautious” view on risk assets, which is a slight improvement compared to the last few months.

Indicator #1

Macro-economic cycle: Negative

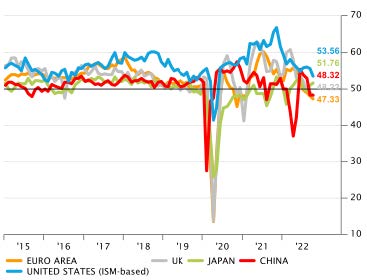

Economic growth continues to slow down across all large economic areas, except in the United States. Indeed, the US continues to expand firmly, led by domestic demand and services, even if some cyclical and rate-sensitive sectors (e.g Real Estate) are slowing down. Consumer spending keeps growing (even in real terms), supported by rising jobs and wages (as well as accumulated savings). Investment keeps growing overall, even if some sectors are already losing steam (e.g . Residential Real Estate).

European economies (UK included) already feel the impact of surging energy prices. And winter has not come yet. The energy-driven surge in inflation and the prospect of energy supply cuts or restrictions through the winter already heavily weigh on consumer and business sentiment, as well as on spending and investment. Switzerland stands out for the moment but will not be spared by Europe’s woes.

China is struggling with Covid resurgences and turbulences on the real estate market. Monetary policy easing tries to soften the blow, but only selectively and in a targeted way that aims to stabilize growth around its current low level rather than to engineer a strong recovery.

Slowing global growth and a rising US dollar weigh on most Emerging Market economies’ growth prospects, even if some (Brazil, India, commodity exporters) show signs of resilience.

Overall, we note that Economic surprises are no longer negative as the consensus already expects a significant economic slowdown.

With regards to inflation, pressures remain across all developed economies, even if the underlying sources may be different.

The increase in prices hit double-digit figures in Europe due to the energy crisis. Peak inflation has (probably) passed in the US, but not in Europe where energy could push inflation rates into double digit territory. Going forward, we expect inflation to be significantly above central bank’s target in the US and Europe. Upward wage dynamics remain in the US and Europe and central banks need to see some inflexion here to be able to consider a “pivot”. Asia is facing a milder inflation environment.

Overall, medium-term expectations are declining due to a global growth slowdown and hawkish central banks. Nevertheless, we still view the mix of declining growth and still elevated inflation as being negative for risk assets.

Global growth continues to slow down

Source: Banque Syz, FactSet

Indicator #2

Liquidity: Negative

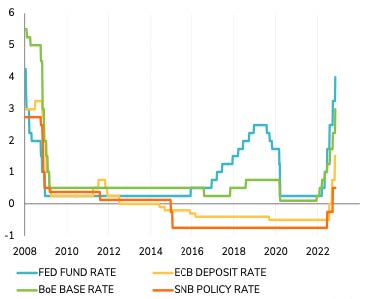

Central banks remain firmly on the path of rate hiking. To regain control on inflation, and preserve its credibility, the Fed has no choice but to tighten monetary policy until there are clear and tangible signs of a reversal in inflation dynamics.

If there is to be a pivot, it could rather be in Europe given the looming recession. Indeed, a recession (and corresponding fall in domestic demand) would dampen underlying inflationary trends. It seems imminent in Europe, not yet in the United States.

Still, despite the elevated recession risk in Europe, the ECB has to continue hiking for the moment. Indeed, wage dynamics are also on the rise in Europe, indirectly supported by fiscal intervention. And monetary policy normalization has barely started yet as the ECB is behind the curve.

Central banks are, at the same time, fighting existing inflationary trends and trying to offset the impact of fiscal interventions. Monetary policy is getting tighter across all economies, with higher rates and withdrawn liquidity.

As seen in the UK, the more the government would aim at supporting its economy with fiscal spending, the more the central bank would have to hike rates.

Overall, the liquidity environment remains negative for risk assets as most developed markets are facing more rate hikes, quantitative tightening and global liquidity reduction.

Monetary policy – The rate hike cycle is not over

Source: Banque Syz, FactSet

Indicator #3

Earnings growth: Neutral

US earnings season is nearly over as 85% of S&P 500 companies have already reported Q3 results: 70% beat EPS estimates while 71% beat sales estimates. The blended S&P 500 earnings growth rate is +2.2%, the lowest since Q3 2020. 50 companies published negative EPS guidance, 23 positive. We note that companies which are missing consensus estimates are severely punished. On average, those who missed on both earnings and revenues have underperformed the S&P 500 by nearly 7% the day that followed the release of earnings. Bloomberg notes that the outlook for US corporate profits outside the energy sector is deteriorating fast. Blended earnings estimates for the S&P 500 Ex-Energy Index have been slashed so much since June that they are now back to December 2021 levels (see chart below). While earnings growth has been a tailwind for equities in the first half of the year, this is no longer the case (albeit earnings growth is still expected to be slightly positive).

In Europe, there is still some room for downward revisions as well (despite a favorable forex effect).

S&P 500 ex-Energy Forward EPS

Source: J.P. Morgan

Indicator #4

Valuations: Neutral

Global equity valuations have de-rated this year. In the US, the S&P 500 multiple has de-rated by the same magnitude as seen in previous recessions. On a relative basis, Equity Risk Premium is a headwind now, as it has probably reached a bottom. We note that cash and bonds yields are becoming a competition for equities. Indeed, the differential between S&P 500 trailing earnings yields and 2-year bond yields has rarely been as large.

In Europe, absolute and relative valuations are cheaper than in the US but for a reason (energy crisis and higher recession risk).

Overall, this indicator remains ”neutral”. Equity markets are less expensive than last year but they are not cheap either.

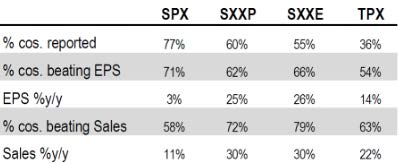

Q3 earnings season “Health check”

Source: Bloomberg

Indicator #5

MARKET DYNAMICS: Positive (from Neutral)

Our market dynamic indicators have improved from neutral to positive – and this applies to both our US and European proprietary models. While the market trend remains negative (with the 200-day moving average falling and the price remaining below it), other indicators have been improving over the last few weeks. An interesting signal is the gradual improvement of market participation (breadth); indeed, while tech mega-caps have been hit during the earnings season, small & mid-caps have been doing reasonably well, hence the positive signal for this indicator. We also note that this rally didn’t give overbought signals (RSI), which is another positive.

Asset Class Preferences

Equity allocation

Cautious (from Unattractive)

Risk assets are facing several headwinds: high inflation and rising rates which are weighing on global growth (with Europe already into an energy crisis), China reopening hampered by Covid and geopolitical tensions and high political uncertainty (US divided government, shockwaves in Europe from the war in Ukraine and sanctions on Russia). Meanwhile, fiscal intervention tries to cushion the blow from rising energy prices but given the high level of indebtedness of most developed countries, it seems that the market is less willing to finance fiscal deficits than in the past.

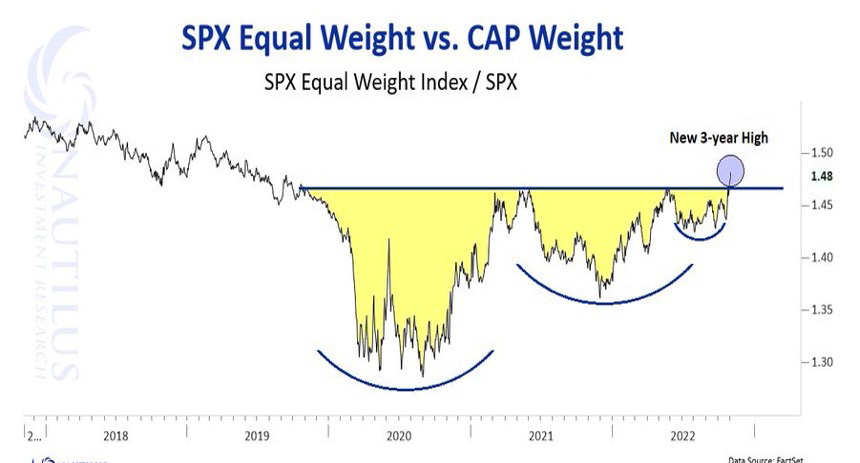

As mentioned earlier, there are several short-term tailwinds for the market. Seasonality and the US 4-year presidential cycle are both becoming positive for the rest of the year. Sentiment is still too pessimistic (which is a positive from a contrarian point of view) and the end of the share buyback blackout period implies we should see still decent company cash flows being reinvested into their stocks. Our market dynamic indicators have turned positive in part due to the improvement in breadth. Indeed, while large-caps tech stocks have been severely punished by the markets during Q3 earnings season, the value style continues to perform well as more stocks participate to the upside. As shown below, the S&P equal-weight index is now outperforming the S&P capitalization weighted index and stands at a 3-year high.

Overall, the weight of the evidence leads us to upgrade our stance to “cautious” on equities.

From a regional point of view, we are upgrading China & EM Asia from “cautious” to “positive”. Ever since the regulatory crackdown started with the cancelation of the Ant Group IPO, Chinese ADRs have been under intense stress, losing ~80% of their value. Overall, most of the decline so far is explained by geo-political factors rather than by fundamentals, which makes our bottom-up view on these stocks rather appealing. China ADRs remain very cheap in comparison to their US counterparts and growth/margins are still attractive even if cut in half.

Based on our house view on Chinese equities, we would encourage investors to add to this market.

Our stance on the other regions remains unchanged.

In terms of sectors, we confirm are remaining overweight in Energy and Healthcare and our underweight in Utilities and Real Estate. We are neutral on Information Technology.

S&P 500 Equal weight vs. capitalization weight

Source: Nautilus, Factset

Fixed income allocation

Cautious on Rates, Positive on Credit (from Cautious)

We kept an unchanged “cautious” stance on rates. Indeed, sovereign bond yields are rising across the board, as markets are pricing central bank rates higher (i.e higher real rates) and inflationary pressures remain high. Absolute yield levels remain supported by inflation and hawkish central banks; the bright spot remains the short end as the U.S. yield curve is deeply inverted. Within Government bonds, we do have a preference for USD over EUR where ECB needs to catch-up and energy-driven inflation is surging.

As for credit, we upgraded our view from “cautious” to “positive”. Investment Grade offers attractive absolute yields in USD and already priced in a lot of bad newin EUR. The carry of short-term high quality bonds now provides an attractive cushion against potential additional mark-to-market movements caused by rising yields. The bright spot can be found in Investment Grade bonds with short maturities (0-3y). While High Yield credit offers even more attractive yields, current spreads are not at extreme levels of cheapness.

Emerging Market Debt in USD is attractive in relative terms. Emerging Market Debt in local currency is not far from attractive levels. Nevertheless, we remain cautious on Emerging Markets bonds. Overall, valuations are attractive, supported by negative net supply, but large outflows continue to weigh on the asset class. Emerging market companies are used to dealing with high inflation and a strong dollar (2013 experience). EM Local debt has become more attractive as EM central banks tighten their monetary policy. Their aggressive strategy is starting to pay off (see lower inflation in Brazil).

We remain positive on subordinated. This matured and resilient asset class offers premiums despite solid capital position. Valuations remain cheap due to growth concerns and the Credit Suisse saga. Fundamentals benefit from rising interest rates.

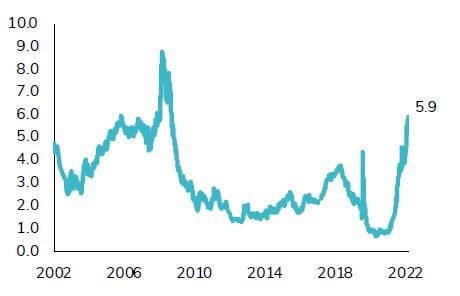

Bloomberg US Corporate Bond 1-5 year index - Yield to Worst

Source: Nautilus, Factset

Commodities

Positive overall. Keeping a preference stance on Gold

Over the last few months, commodities have moved from being overbought to oversold as recession fears nowdominate all markets. We remain positive on the asset class and see commodities as an attractive macro hedge. After years of capex underinvestment, many commodities are facing a supply shortage while demand is firm. The invasion of Ukraine by Russia and the sanctions are worsening the situation. Energy and commodities are needed for virtually everything, and Russia exports both massively. And unlike in 1973, it’s not just the price of oil, but the price of everything that is surging. Furthermore, the supply shock might be a long lasting one. Indeed, despite hopes of a resuming in negotiations between Russia and Ukraine, a stalemate with prolonged economic impacts still looks likely. We are thus positive on broad commodities. We kept our preference stance on Gold. Rising USD real rates continue to weigh on Gold prospects, but it can remain a potential inflation hedge and a safe haven in a highly uncertain environment.

Hedge Funds

Very attractive

Alternative strategies grab their chance to deliver value. After the pandemic, economies are adapting to the changing cost of capital. Investors need a more selective and active approach to investing. As interest rates rise, hedge funds are providing positive returns. Alternative strategies are benefiting from lower liquidity and higher interest rates.

In terms of hedge fund strategies, we are positive on equity hedge with low net exposure and a trading approach. We are also positive on macro and CTA.

Forex

The US dollar remains supported by yield differentials

Euro remains in a downward trend due to the ongoing energy crisis in Europe and the Fed’s resolute hawkish stance. The surge in energy prices and concerns around winter supply weigh on EUR prospects from several angles: macroeconomic growth prospects, inflation, interest rate differentials, external balance, flows of funds. The ECB is between a rock and a hard place, and fast rate hikes might not even be sufficient, especially as the Fed keeps hiking.

The Swiss franc is temporarily overwhelmed by the dollar’s strength, but the downside is nevertheless limited due to real rate differential and sound fundamentals, which plead for a firm Swiss franc over the medium term. Flight to safety from European assets is a powerful support. But faster Fed rate hikes compared to the SNB are supporting the USD in the short-run.

The sterling faces continuing downside risk as inflation surges and fiscal policy gets wild. The surge in energy prices and concerns around winter supply weighs on GBP prospects from several angles: macroeconomic growth prospects, inflation, interest rate differentials, external balance, flow of funds. The BoE has relaxed somewhat its stance with the return of fiscal “orthodoxy” by the Sunak government. From a fundamental standpoint, the yen’s additional downside risk is limited. However, the Japanese currency remains under pressure as long as the BoJ does not move. Growth momentum and monetary policy differentials continue to weigh on the yen vs the US dollar, the peak «rate differential» depends on the Fed as the BoJ is not inclined to move for the moment.

Cross-asset correlations and volatility

Monetary policy expectations are the main driver of bonds and equities at the moment, and correlations are positive and elevated among asset classes. The bond/equity correlation is in positive territory, implying no diversification in multi-asset portfolios. Volatility has diminished on both equity and bonds recently although it still remains high for bonds.

Tactical positioning: our asset allocation matrix

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

.png)