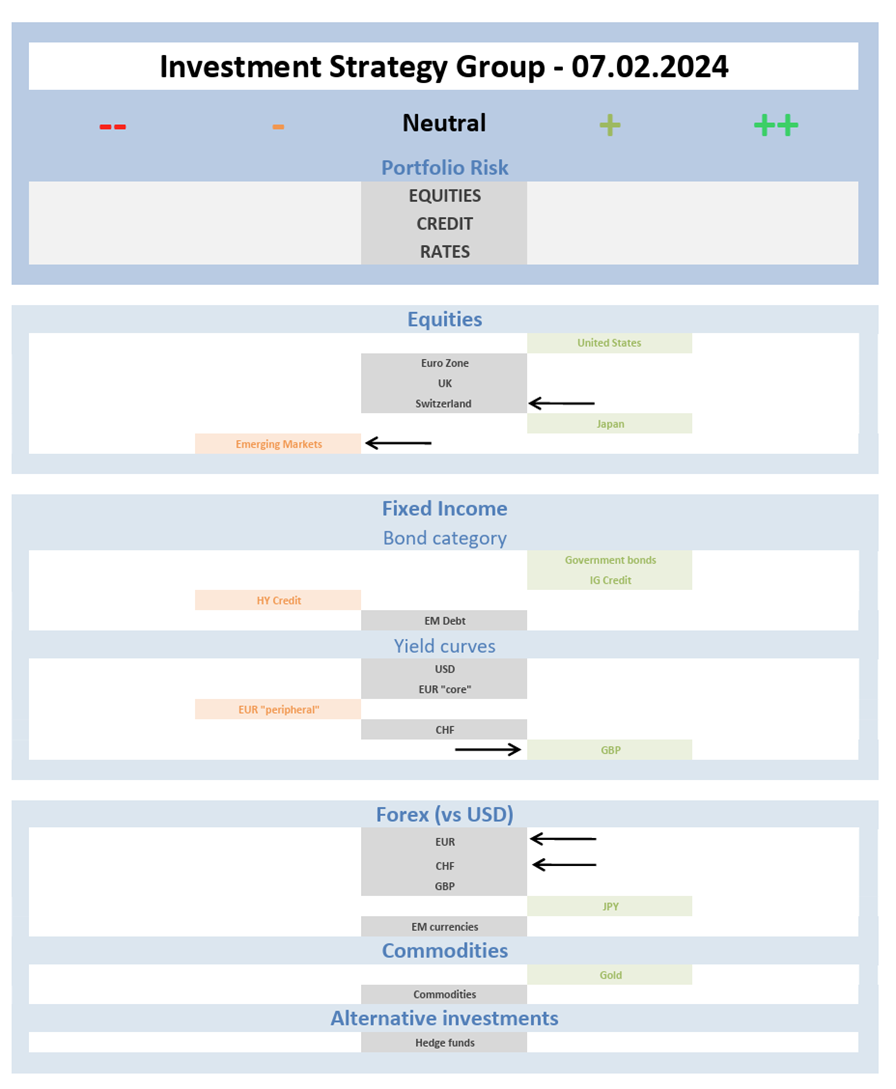

EQUITIES

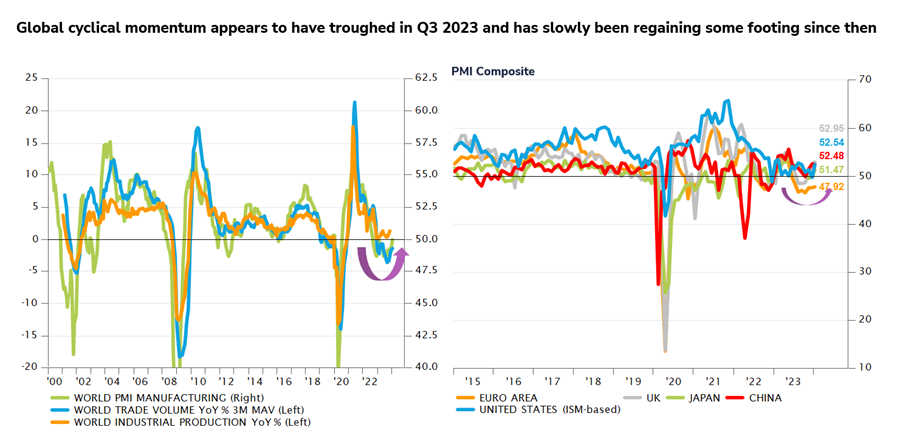

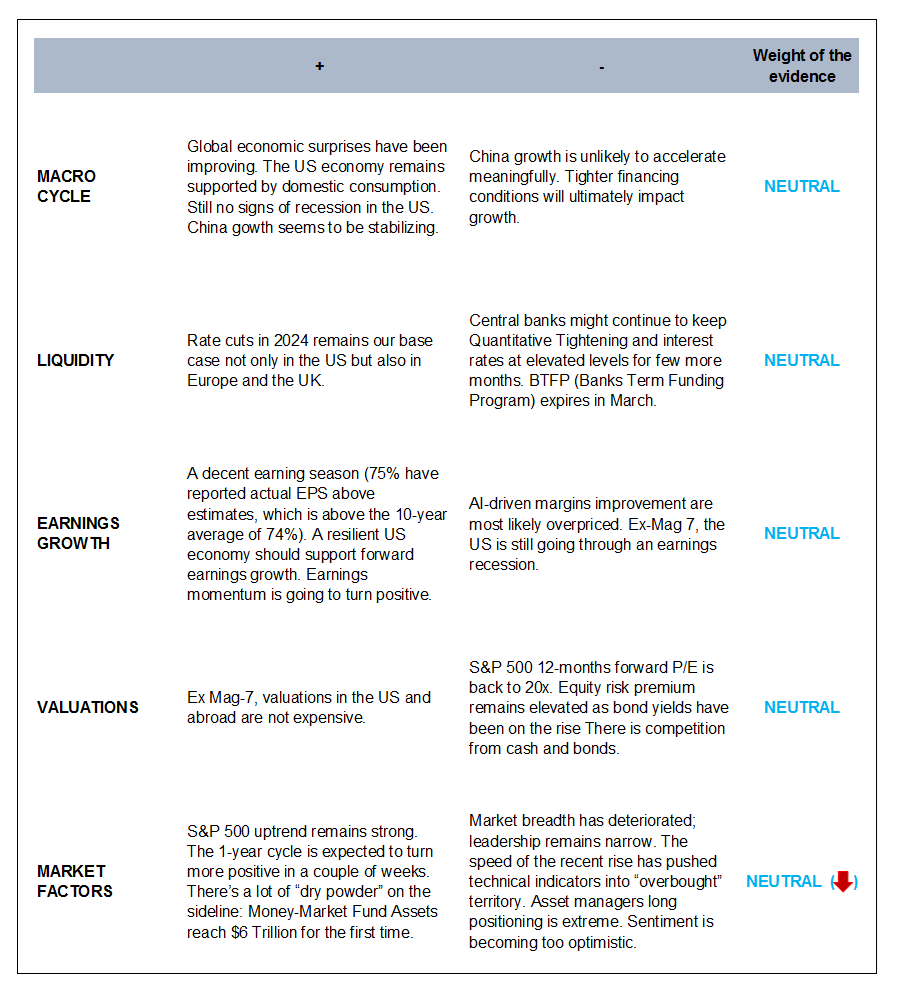

We remain NEUTRAL on equities as we think the strong performance of the past few months reflects the improving outlook as the market sentiment appears stretched on the positive side.

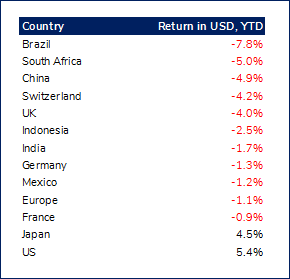

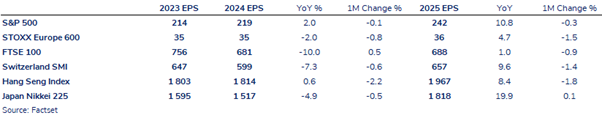

From a region/country standpoint, we keep our slight preference for the US and Japan as earning growth are expected to continue this year and next.

We are now neutral on Swiss equities as the strong Swiss franc is a headwind. We also keep our neutral stance on the Eurozone/UK as earning momentum remains muted.

We are under exposed emerging markets and Chinese equities as the dollar remains strong and, in the case of China, the lack of confidence of consumer and corporate as well as the weak market momentum keeps us at bay for the time being.

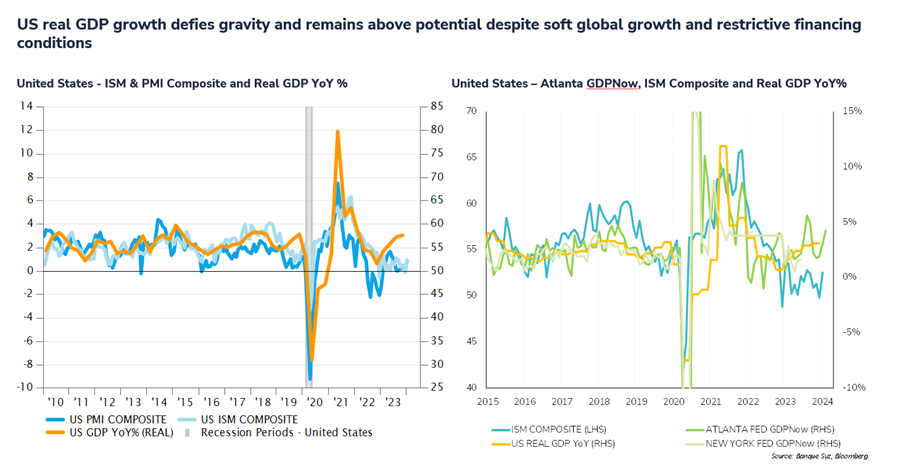

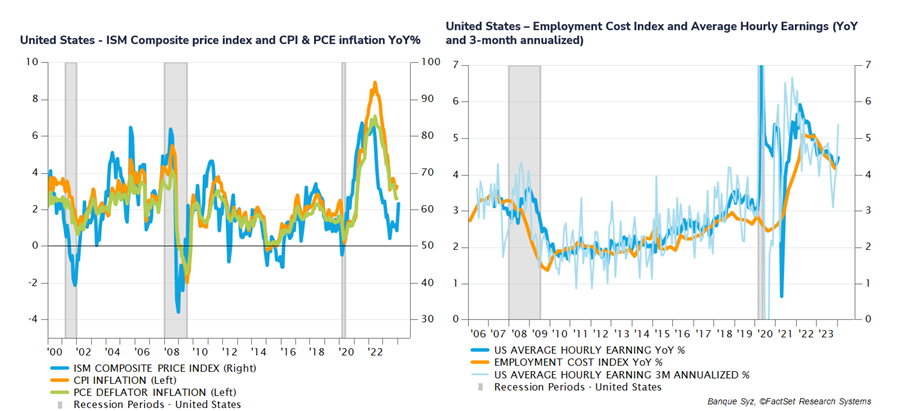

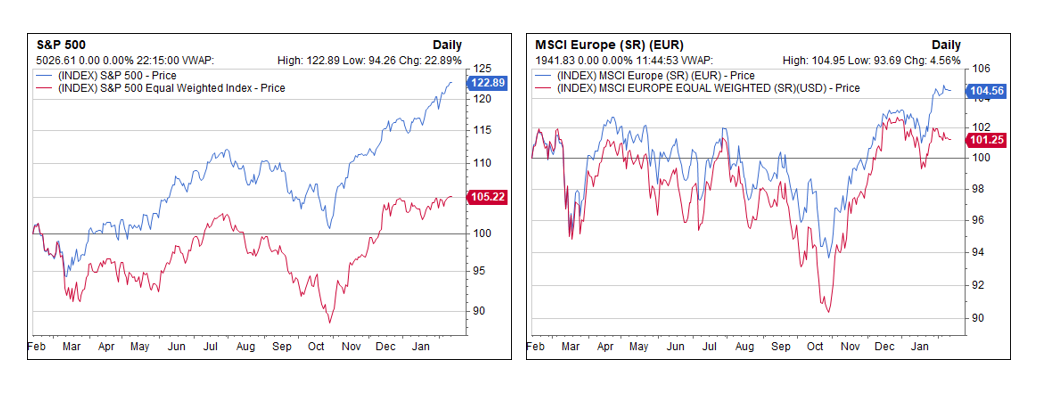

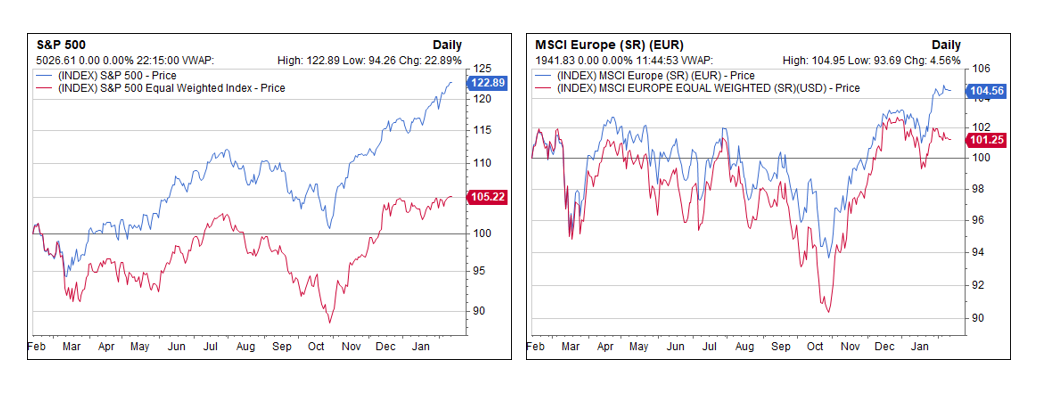

In the US, the concentration effect has continued lately but we are seeing a weakening in the market breath while the risk in commercial real estate and regional banks remains.

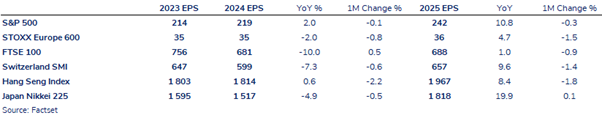

Looking at earnings expectations, the US will likely need to see more contribution outside the mega-caps to grow to deliver double-digit EPS growth next year. Earning revisions are negative across the board with Europe, Switzerland, and China the most negative for next year.

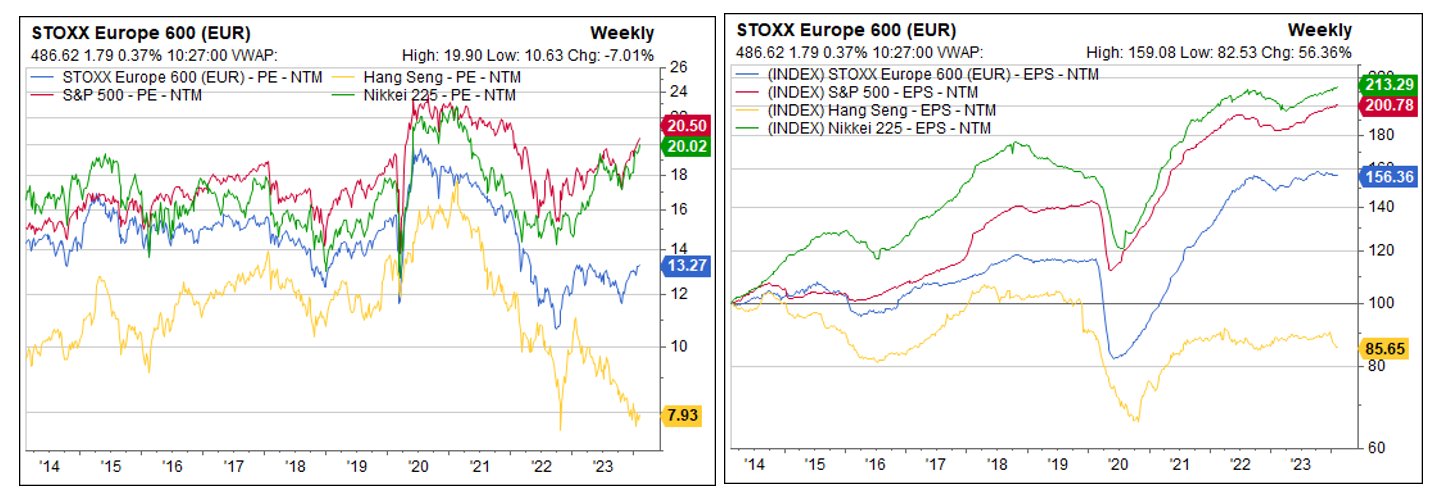

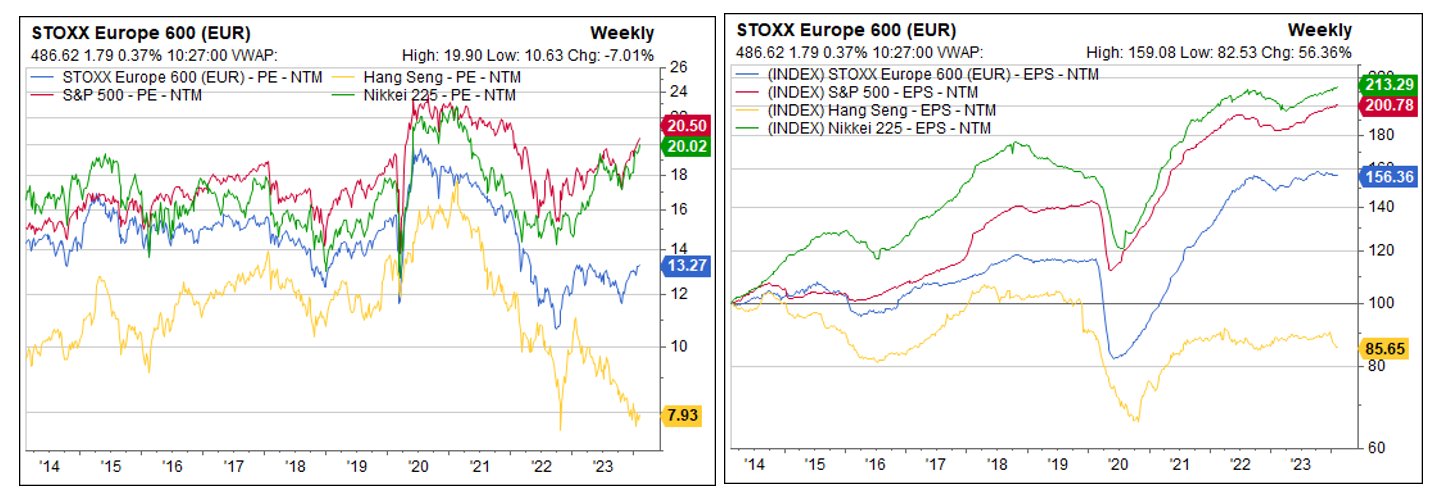

On the valuation side, Chinese equities are cheap, but the earning cycle is poor while we are again on the expensive side for US equities in aggregate at PE 20x, but adjusted for the concentration, the S&P500 equal weight PE stands at 16x which is more in-line with history.

FIXED INCOME

Within the realm of Fixed Income, we continue to hold a neutral outlook towards rates and credit, leaning slightly towards the positive for Investment Grade bonds and slightly negative for High Yield. Our analysis reveals nuanced positions across various segments.

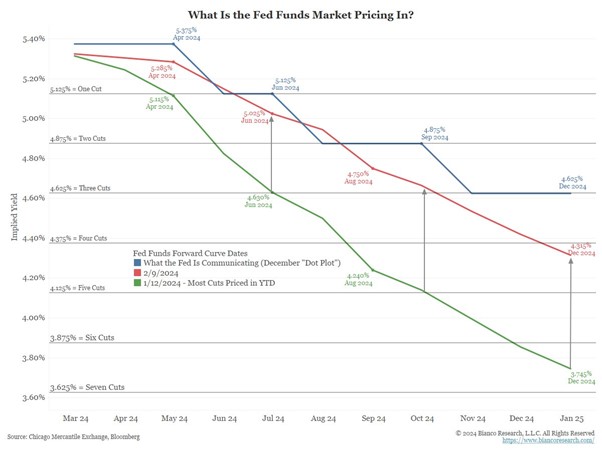

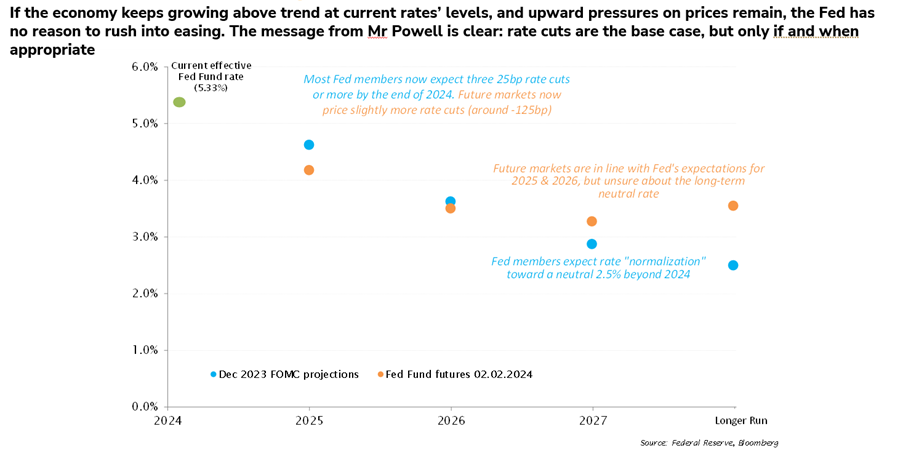

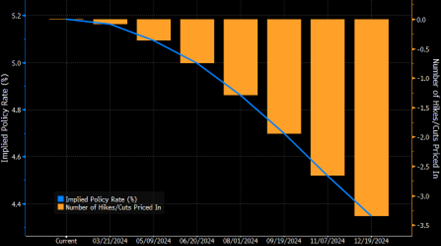

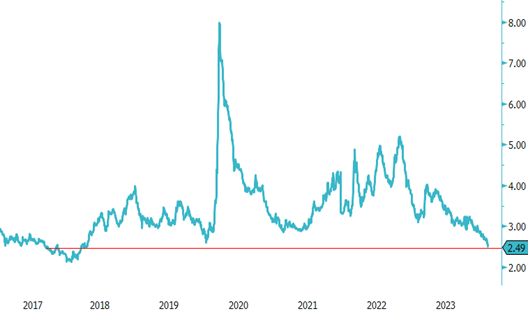

Our stance on government bonds is differentiated by maturity. We are favoruable towards securities with maturities under 10 years, motivated by high real yields, a peak in central bank tightening, a trend towards disinflation, and their relative value against equities, alongside improving correlations. Conversely, we approach bonds with maturities over 10 years with caution due to an array of risks. The inverted yield curve and negative term premiums lessen the attractiveness of long-term bonds, especially as interest rate volatility remains pronounced. Despite initial concerns over the supply of long bonds in early 2024, recent successful auctions, notably the largest 10-year US Treasury to date, and Treasury Secretary Yellen's reassurances about supply stability offer some optimism. Although quantitative tightening currently influences the market, a slowdown is anticipated. The resilient economy's potential to delay central bank rate cuts contrasts with market expectations for cuts in the first half of the year.

Balancing the scales: positive vs. negative factors in bond investments

Source: Syz CIO office

In Europe, our concern for the Eurozone's growth prospects and the potential slowdown in the ECB's rate hike cycle prompts a neutral view on EUR rates. The tightening of spreads in Euro Peripherals, especially between Italian and German 10-year yields, calls for caution. Nonetheless, the UK bond market stands out as an attractive opportunity, thanks to expected CPI decreases signalling inflationary relief and supporting the potential for Bank of England rate cuts by mid-2024. This backdrop, combined with appealing yields following recent market pullbacks, underscores the UK bond market as an attractive investment avenue. Additionally, the market does not anticipate a rate cut until the first half of 2024.

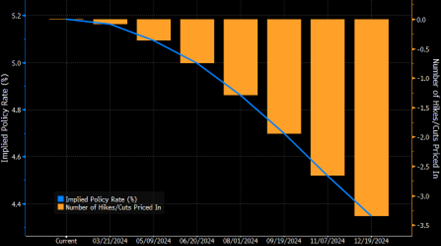

Market expectations for a UK rate cut:

Source: Bloomberg

.png)