Key takeaways

• Despite heightened geopolitical instability, global equities advanced by 3% in January, supported by a "goldilocks" economic backdrop. 'Broadening’ was the word of the month with small caps leading and Nasdaq lagging. International markets outperformed US markets.

• Gold and silver prices rallied to record highs, only to crash on Friday following the nomination of a new Fed chair. Kevin Warsh is perceived as a “hawkish dove” who would aim at the central bank’s balance sheet reduction while cutting short term rates, thus potentially putting pressure on market liquidity. We disagree with this narrative.

• While we expect volatility to stay elevated in the short run, the fundamental pillars of broadening participation and accommodative policy support a constructive stance for Q1 2026. Global economic growth is doing fine, inflation is cooling down and earnings growth remains strong.

• We remain overweight equities with a preference for emerging markets and the US. We stay overweight gold and overweight commodities, underweight Govies 1-10 years , and neutral the dollar against all currencies.

THE BIG PICTURE

January in the rear view

Despite heightened geopolitical instability, January was characterised by a notable increase in investor risk appetite. While global bond markets remained largely stagnant, global equities advanced by 3%, supported by a "goldilocks" economic backdrop of resilient growth data and moderating inflation. This combination has bolstered expectations for real income gains, fuelling market optimism.

Fixed income and monetary policy

Global bonds faced headwinds from improved economic activity and shifting central bank expectations. In the United States, front-end rates sold off as markets recalibrated, pushing the anticipated timing of the next Federal Reserve rate cut further into the future. Concurrently, Japanese long-term bonds experienced their most significant January decline since 1994, driven by intensifying fiscal concerns.

Credit posted modest gains while US Treasuries are slightly down.

Geopolitical volatility

Geopolitical tensions escalated following the US intervention in Venezuela and administrative threats of tariffs against European nations over the Greenland sovereignty dispute. While the World Economic Forum at Davos facilitated a temporary easing of these frictions, the impact on specific asset classes was pronounced:

• Gold: appreciated by 13% as a primary safe-haven play.

• European defence: the sector saw an 18% surge.

• Volatility indices: curiously, the VIX and EUR/CHF movements remained relatively muted despite the underlying friction.

Equity market dynamics: the "broadening" trend

January marked a significant shift in equity leadership, defined by a broadening of market participation away from US mega-cap technology.

• Global equity markets gained +3.0%.

• US markets: small-cap stocks outperformed, rising 5%, while the "Magnificent Seven" lagged with a loss of -0.3%.

• Regional performance: emerging markets led global returns with a 9% increase, followed by Japan’s Topix at 5%. UK (+5.2%), China (+4.7%) and Euro area (+4.1%) outperformed the US as well.

Commodities and energy

The commodities sector delivered robust returns, with the Bloomberg Commodity Index rising 10%. Energy was a primary driver; WTI Crude climbed 14.3%, while natural gas prices in both Europe and the US surged in response to unseasonably cold winter weather. Silver is up +11.65% and gold +8.8%

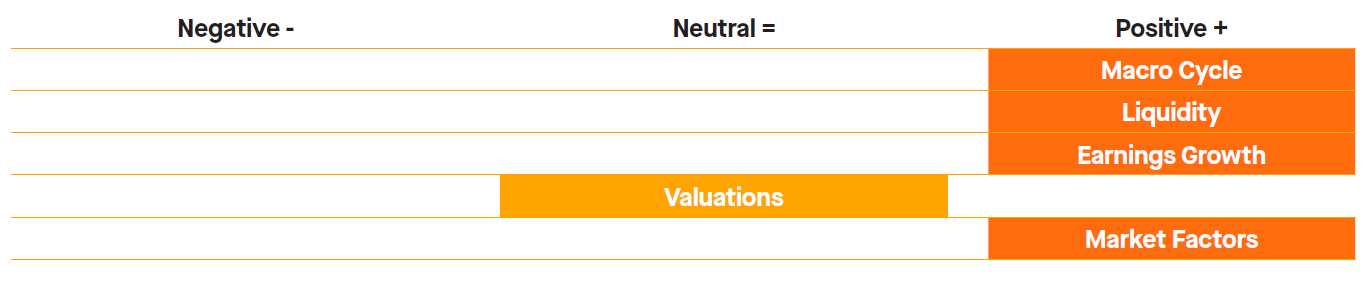

Indicators review summary - our five pillars

With 4 pillars (macro, liquidity, earnings and market factors) signalling an overweight and 1 in neutral (valuations), the weight of evidence is positive for equities.

THE WEIGHT OF THE EVIDENCE

• Liquidity (POSITIVE): liquidity conditions for financial markets remain positive overall. The Fed has ended quantitative tightening and will purchase Treasury bills to ease short-term funding conditions. Continuing global M2 growth and the weak US dollar contribute to maintaining a supportive liquidity environment.

• Earnings (POSITIVE): earnings remain a tailwind for equities with more sectors to show earnings growth improvement. Technology stocks will continue to benefit from the adoption of AI, while the “old economy” is set to recover from a low base.

• Valuations (NEUTRAL): US large capitalisation stocks remain expensive while international equities are more reasonably valued. However, equity risk premiums remain low by historical standard in both the US and Europe.

• Market Factors (POSITIVE): symphony indicators are positive at 75% allocation to equities (50% US / 25% EU).

TACTICAL ASSET ALLOCATION (TAA) DECISIONS

We remain overweight equities with a preference for emerging markets and the US.

We stay overweight gold and overweight commodities.

We stay neutral hedge funds.

Within Fixed Income, we are underweight Govies (1-10 years) and neutral Corporate Investment Grade.

We are also neutral High Yield and EM Debt.

We are neutral the USD against all currencies.

On the EUR/USD, we still expect a weaker USD trajectory over the long-term. This is due to a most likely looser monetary policy versus the EUR and a higher accumulated inflation. Meanwhile, political intentions to weaken the USD remain—attempts to dismantle the institutional set up behind the USD—and the twin deficit persists.

Short-term factors balance each other out, but economic policies are key:

• An inflation differential outlook, with US prices rising faster than Eurozone inflation, argues against USD

• A higher interest rate differential, alongside stronger economic activity in the US relative to the EMU, supports the USD

• The Fed is unlikely to turn more dovish than currently anticipated by markets, in contrast to an ECB that is expected to remain on hold

We thus expect the USD to move sideways versus the EUR in the short-term and stay negative USD over the longer term.

These short and long-term views are also valid for the USD/CHF.

ASSET ALLOCATION GRID

TACTICAL ASSET ALLOCATION (TAA) – 23.1.2026

INVESTMENT CONCLUSIONS

✅ January trade was all around the “Fed is losing independence, will print money and cut rates like there is no tomorrow, the dollar will keep declining” => all of this led to the following trades: long commodities, long precious metals, long EM, long value, long small caps. Many of these trades were leveraged.

✅ Kevin Warsh’s nomination as next Fed chair came as a surprise as he was NOT the frontrunner. Markets suddenly realise he is a “Hawkish dove” and that he might be willing to reduce the size of the Fed balance sheet. There is also a lot of uncertainty related to Fed composition, when he will become Fed Chair and how/if he will implement this “privatisation” of QE. Markets hate uncertainty – hence the deleveraging and the sell-off.

✅ We think the shift of monetary policy (rate cuts + reduction of Fed balance sheet + financial deregulation) is not going to happen any time soon. First, because Warsh is still not the Fed chair and is not guaranteed to have the majority at the Fed board. Second, there is such an abundance of US Treasuries and corporate debt issuance that the Fed will probably need to continue supporting the bond market. Remember April 2025?

✅ However, we expect some volatility in the short term. There were a lot of leveraged and crowded trades. Bottoming is a process and markets could stay bumpy during a few weeks.

✅ While we expect some volatility, the fundamental pillars of broadening market participation and accommodative policy support a constructive stance for Q1 2026. Global economic growth remains solid, inflation is cooling, and earnings growth remains strong.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

.png)