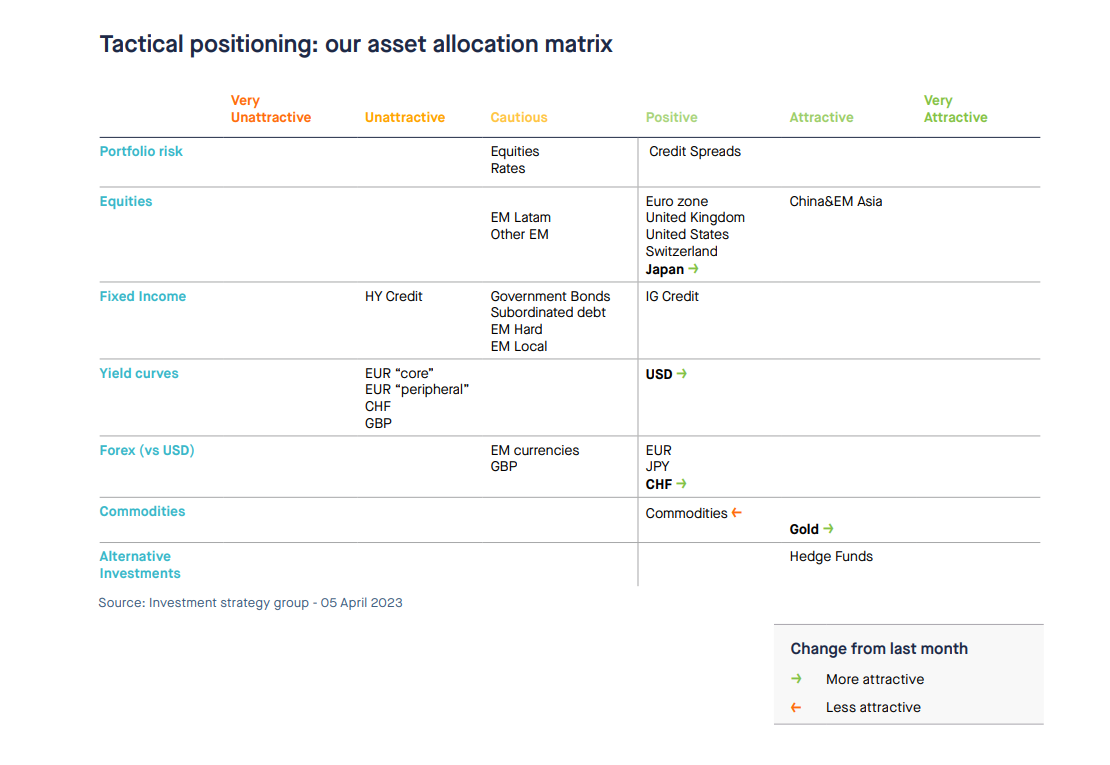

We are also keeping our positive view on credit, while upgrading the USD yield curve preference from cautious to positive. Other changes include a downgrade of our view on commodities from attractive to positive, and upgrading Gold from positive to attractive. The CHF is also upgraded against dollar from cautious to positive. Last but not least, we are upgrading Japan equities from cautious to positive.

The big picture

Six months have passed since the S&P 500 index touched a 25% peak to through drawdown last year. The main US equity benchmark is up more than 17% from its 12th of October 2022 closing low. Can we thus declare the bear market over?

There are indeed some reasons to be cheerful. First, the technical situation is improving for equities including for the most watched benchmark: the S&P 500. Since mid-March, the downtrend in the S&P 500 has been broken. We also note that the index is now trading above the 200-day moving average, which is actually changing direction (from bearish to bullish). Finally, the index’s lows continue to be higher.

Second, the sentiment on equities is too bearish (which is good from a contrarian perspective). Large speculators, traditionally hedge funds, saw last week their net short positions in S&P 500 e-mini futures increase to the most bearish reading since November 2011. The latest BofA Fund manager survey also shows that underweight equities and overweight cash is now a “crowded trade”. This bearish positioning means there is a lot of dry powder to be invested in equity markets if the bearish / cautious managers get wrong-footed.

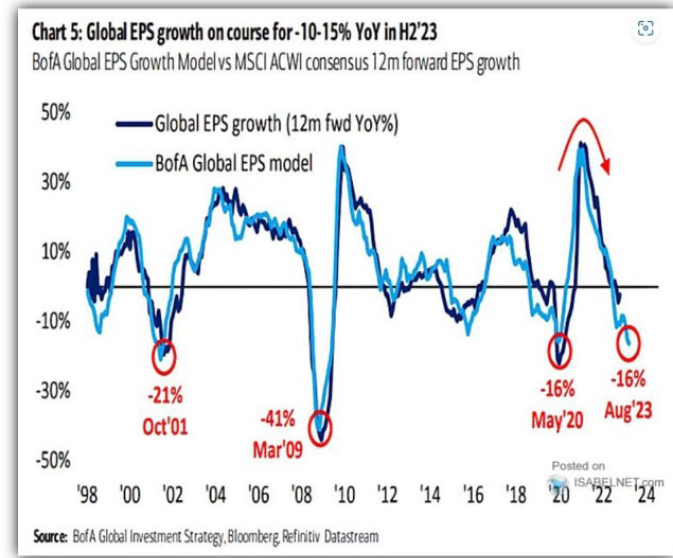

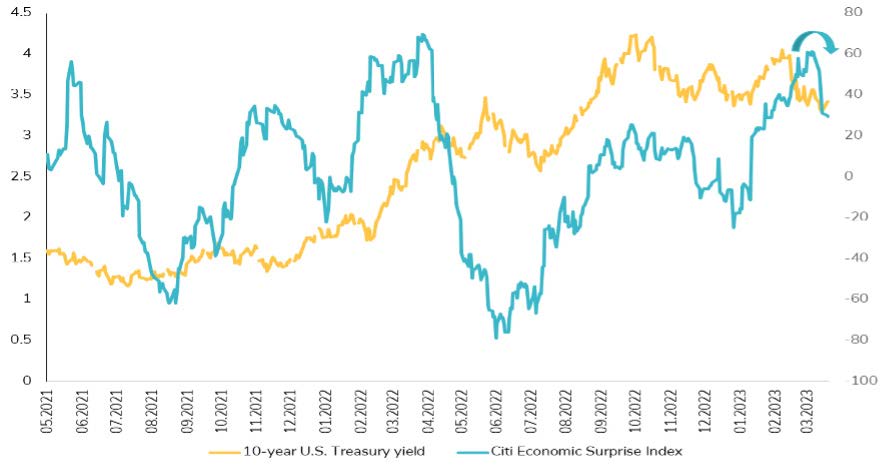

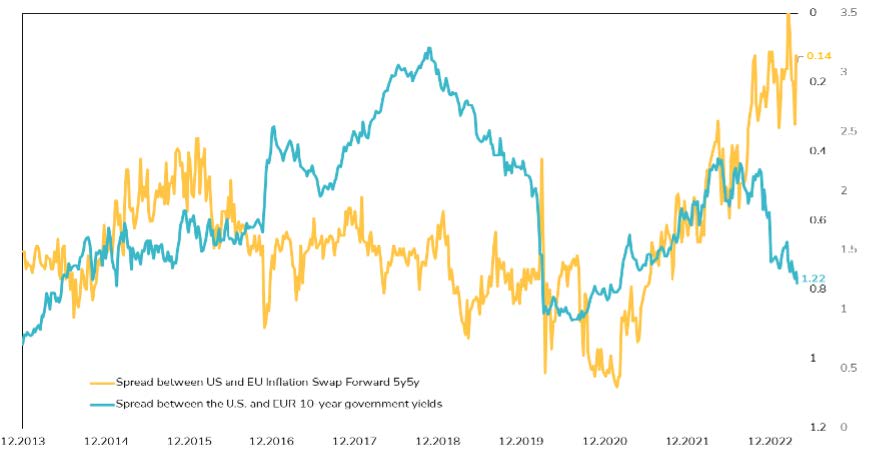

On the macro and fundamental side, there are also reasons for some optimism. Global economic growth has been resilient in the first quarter. A warmer Winter than expected led to a sharp drop in European natural gas prices, decreasing the odds of a hard landing for the economy. Various consumer sentiment indicators surprised on the upside in the US and Europe. China’s post-covid reopening continued, boosting hopes that global growth would be accelerated more broadly. Meanwhile, global inflation continues to ease. Last but not least, earnings continue to surprise on the upside: high nominal growth (real growth + inflation) remains a tailwind for companies’ top-line. Meanwhile, profit margins have been resilient, which means that on a net aggregated basis, companies are able to pass higher costs onto the consumers. This has been nicknamed as “greedflation”, a situation where companies increase their prices more than necessary in order to make as much money as they can (while they can still afford to do it).

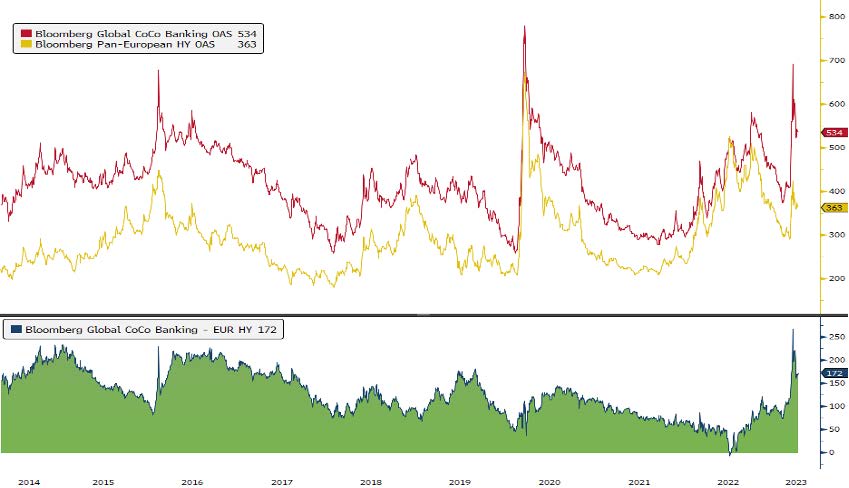

But despite the bull case, there are also reasons to be fearful. To start on the technical side, let’s keep in mind that recent market leadership is less supportive than it was a few months ago. Discretionary vs. Staples, Transports vs. Utilities, Small vs. Large, Copper vs. Gold, and High Beta vs. Low Beta are meaningfully softer today compared to earlier this year. Notably, the equity market’s leadership profile looks more consistent with an economic slowdown, as does the continued message from the bond market (i.e. the entire yield curve is inverted).

The current growth/inflation mix cannot be seen as supportive for risk assets. While inflation is declining on the back of favourable comps and lower energy prices,

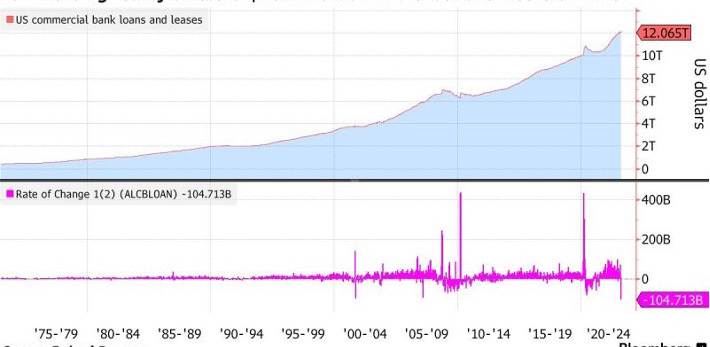

we expect global growth to decelerate as well. The recent banking crisis in the US (but also in Europe due to Credit Suisse woes) should significantly tighten lending standards. This will have consequences on economic activity at a time when consumers are facing higher mortgage, higher credit card interest payments and declining real wages growth.

.png)