The big picture

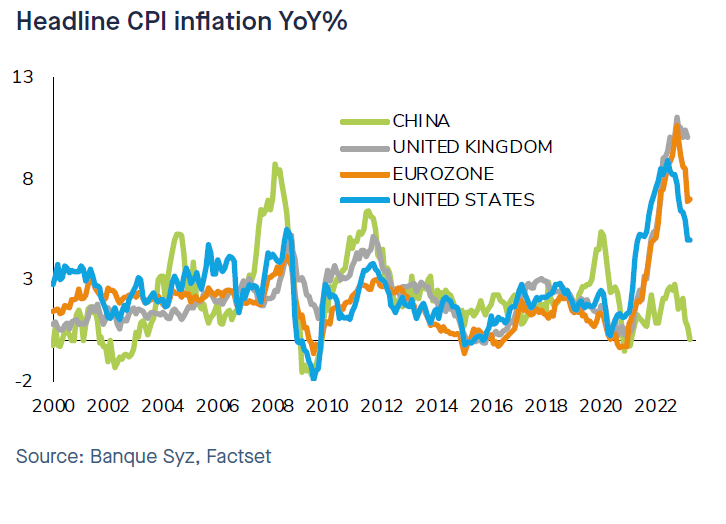

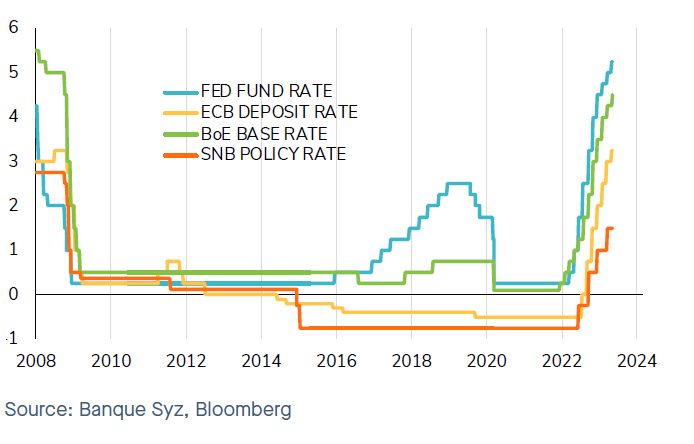

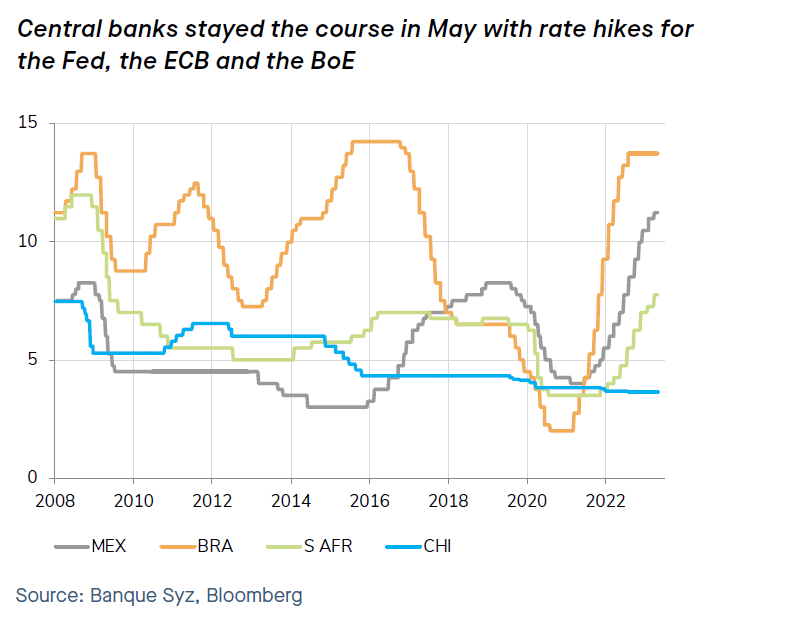

Rising inflation, rising interest rates, and rising bond yields were the main headwinds for financial markets last year. Fast forward to 2023 and it seems that they have all peaked, at least in the U.S. Last week, the Fed raised rates by 25bps, its 10th consecutive rate hike since March 2022. The Fed language indicated that a pause in rate hikes may be likely: while Chair Powell did not say it explicitly, some of the language in the Fed’s statement hinted that a pause may be coming. This week, US Consumer Price Index (CPI) came out at +4.9% yoy, the smallest 12-month increase since the period ending April 2021.

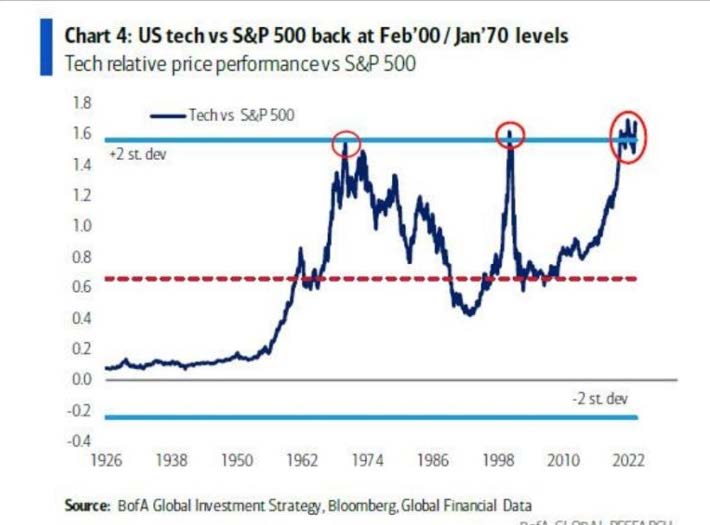

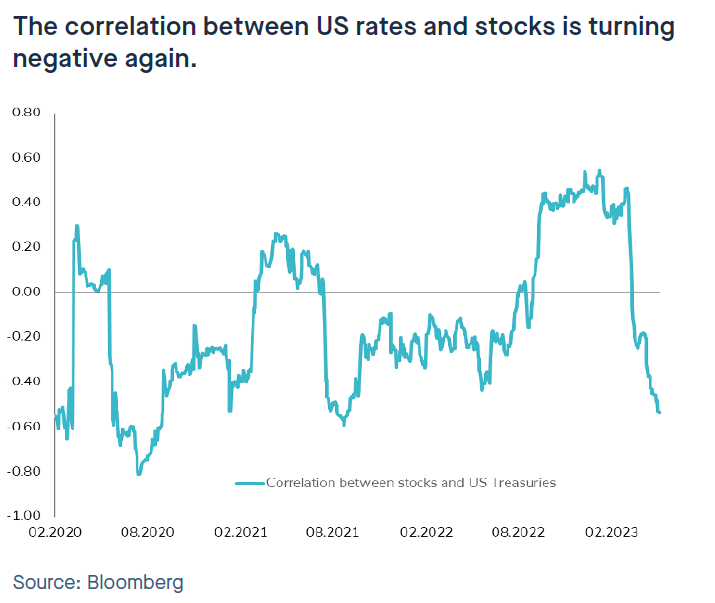

While inflation is still more than twice the Fed’s target, the progress made since June 2022 peak (+9.1%) demonstrates that the tightening of monetary conditions is starting to produce its effect on inflation. Meanwhile, US and global yields seem to have peaked as well as investors anticipate lower growth and less inflationary pressure ahead. The cooling down of inflation and easing of yields have been supportive for equity markets, in particular for the long duration stocks such as the mega-cap tech.

So, what’s next?

Overall, markets have moved higher this year, with the S&P 500 Index up over 8% and the Nasdaq up over 17%, but the rally thus far may be fragile. The equity leadership in the market is narrow, with quality growth and defensive sectors leading the way, while cyclical sectors (energy, financials) and small-cap stocks have been underperforming in a slowing economy. Treasury bond yields have also moved lower since their recent peaks in early March, perhaps as investors seek safe-haven assets and as growth concerns rise.

But after a nice start to the year, markets are now facing the impact of the Fed's 500 basis points tightening. Indeed, the fastest rate hike cycle since the 1980s may already be impacting the real economy. The regional bank crisis is so far the biggest casualty. Commercial real estate might be next. In the meantime, lending standards are tightening and this should impact macro-economic growth.

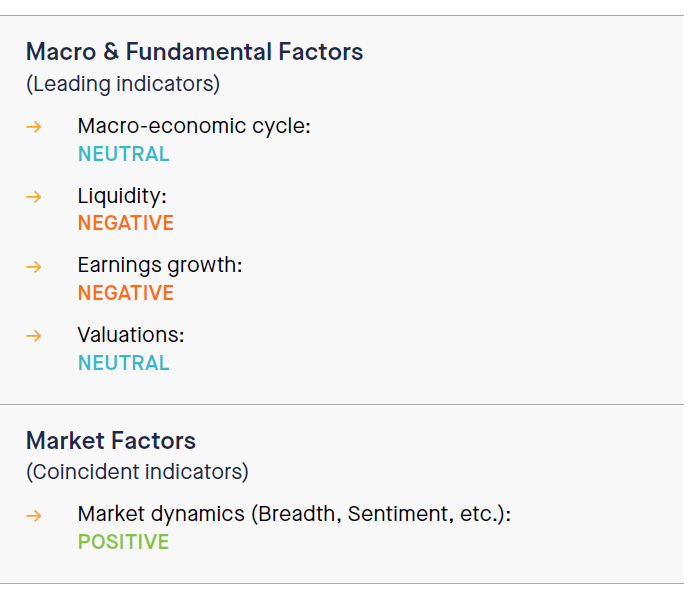

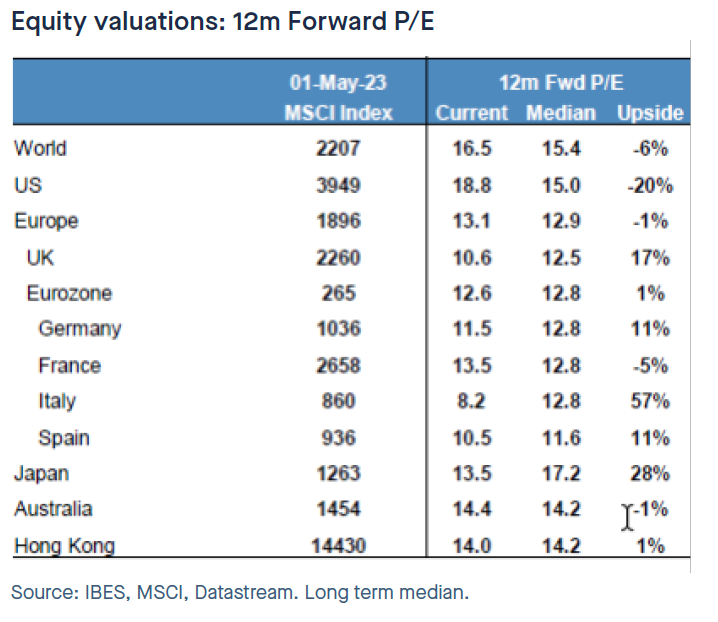

As such, we believe that we have entered a new period of uncertainty, which should lead to an Equity Risk Premium re-rating. Indeed, we believe that the “Goldilocks” scenario is at risk: while global inflation is softening, recession risk is increasing, and earnings/margins are likely to be under pressure. Liquidity conditions are still not supportive for risk assets. While the Fed is likely to pause, a “pivot” would be subject to macro deterioration, which will be in and of itself a negative for risk assets. We therefore expect market volatility to increase in the weeks ahead, especially if the economy heads into an economic downturn or the banking system requires more intervention. However, we believe that last year's 25% fall in the S&P 500 captured some of the mild recession that may lie ahead.

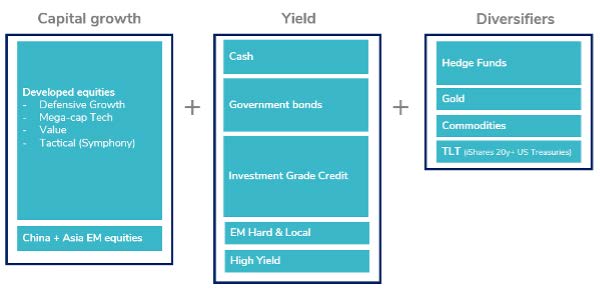

In this context, we maintain our total-return “all-weather” portfolio strategy. We keep our cautious stance on equities through a diversified exposure to developed equities and an allocation to China and Emerging Markets (EM) Asia stocks. Within Fixed Income, we keep our cautious stance on rate and a positive view on credit. Yield is generated through cash, investment grade credit, government bonds, EM bonds as well as a small allocation to High Yield. Diversifiers include hedge funds, gold, commodities and long duration US government bonds.

An illustrative view of a balanced portfolio (the size of the boxes roughly indicates the relative allocation of the various “buckets”)

.png)