Key changes to our asset allocation (one-month view)

2023 started with a mirror image of the trends that prevailed last year: the US dollar is weakening, bond yields are falling and stocks are rising. Are we witnessing a classical positive seasonal effect or is the improving sentiment a reflection of a macroeconomic and fundamental outlook improvement?

Our one-month tactical view is based on the weight of the evidence derived from the aggregation of our fundamental and market indicators. Compared to the previous months, we believe there is indeed a marginal improvement in some of our leading indicators (e.g macroeconomic outlook – see next section) while our coincident indicators (i.e market dynamics) continue to point towards positive developments in terms of trends, technicals and market breadth.

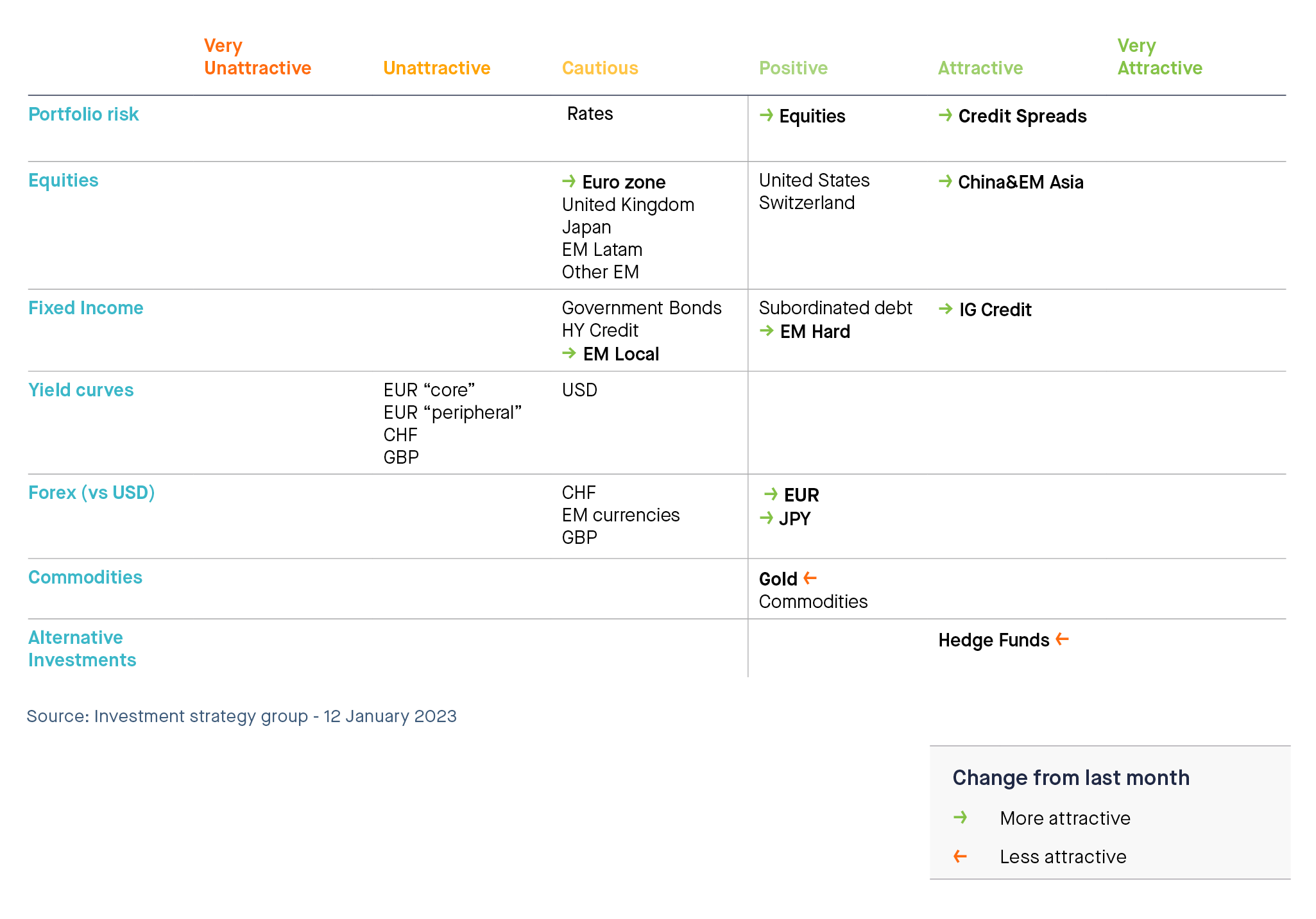

As a consequence, we are upgrading our stance on global equities from “cautious” to “positive”.

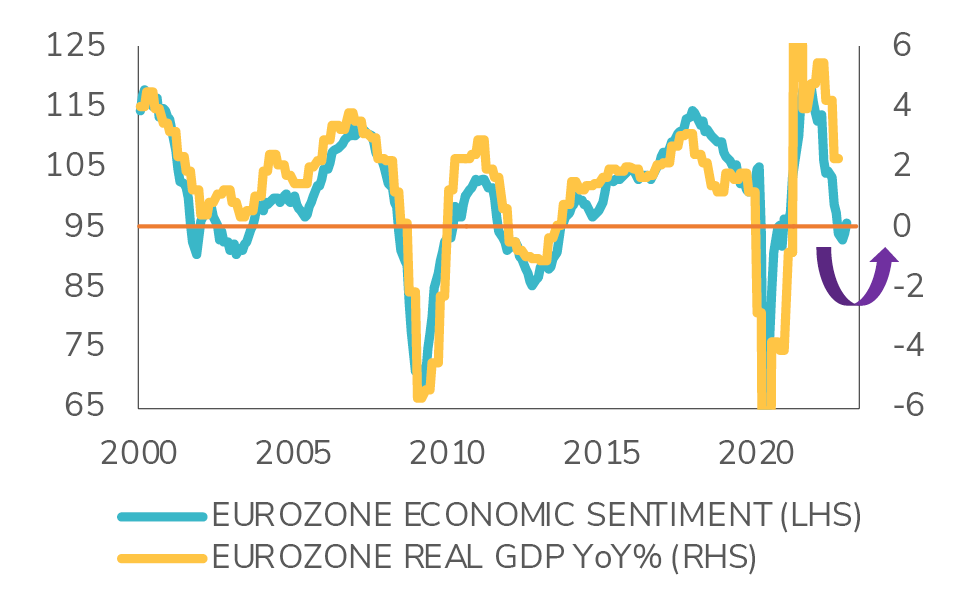

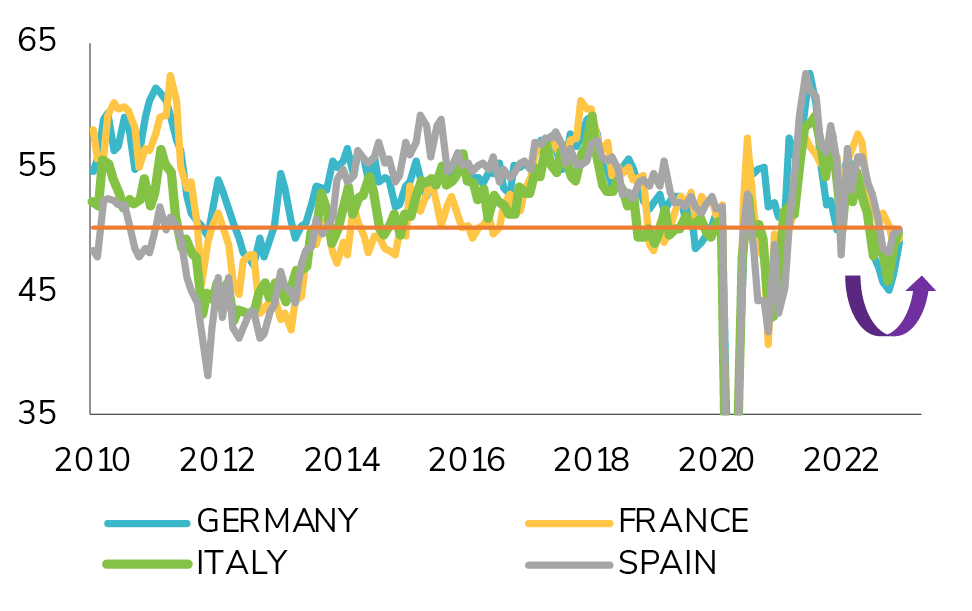

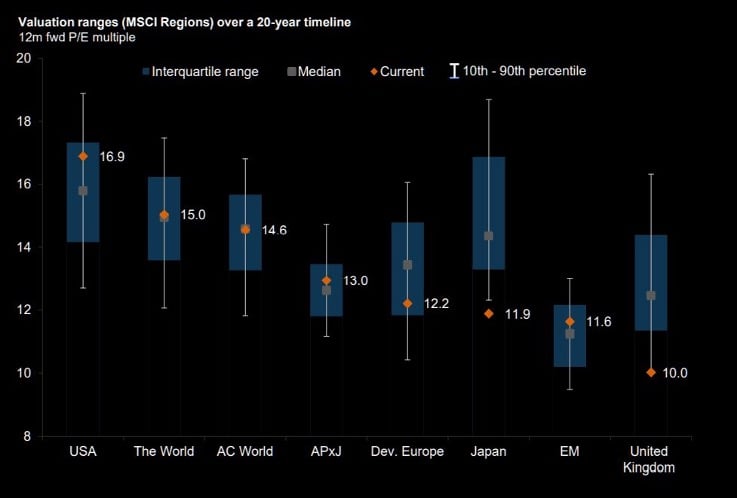

From a regional standpoint, we are shifting our view on Eurozone equities from unattractive to cautious (see asset allocation preferences page 5). The European economy is benefiting from milder weather than expected and from the reopening of China. We note that valuations remain cheap despite the recent rally. We are upgrading EM Asia / China from positive to attractive. Our favourable thesis on this region is reinforced by the reopening of China after 3 years of strict lockdown. Chinese consumers have substantial savings; this should benefit not only the local economy but also the demand for domestic stocks.

We remain positive on Switzerland and the US. We are cautious on UK, Japan, EM Latam and other EM.

In Fixed Income, we maintained a “cautious” stance on rates while upgrading credit from positive to attractive. Despite the recent tightening of spreads, the risk/reward remains attractive due to the high level of carry and lower volatility rate expectations. While we were already positive on credit, especially on the front end of the yield curve, we are moving to longer investments in the 5-10 year

segments. As a result, we are changing our view on investment grade credit from positive to attractive. Emerging Market hard currency debt offers attractive absolute yields and should benefit from declining inflation, robust fundamentals and a weaker U.S. dollar. We therefore upgraded this segment from cautious to positive. We are also upgrading our view on Emerging Market local currency debt from unattractive to attractive, as the rate hike cycle appears to be coming to an end in many emerging markets.

This slight increase in the risk of our model portfolios is financed by a downgrade of our positions in Gold (from attractive to positive) and hedge funds (from very attractive to attractive). The yellow metal seems to benefit from growing demand by central banks and the pullback from the dollar. We note a dichotomy between the rise in Gold prices and real interest rates (which are still not moving down). While we continue to like Gold as a portfolio diversifier, it is currently overbought – hence the downgrade. With regards to hedge funds, macro and CTA strategies remain among the best portfolio diversifiers. The downgrade in our preferences is thus only justified by the allocation increase to riskier segments.

We remain positive on commodities. China’s re-opening should increase demand for key commodities such as oil and metals.

Last but not least, we are moving our stance on the euro and the yen against the dollar from cautious to positive. The resilience of the eurozone economy will most likely incentivize the ECB to keep increasing rates while quantitative tightening will effectively start in March. At the same time, the Fed is getting closer to the end of its monetary policy tightening cycle. Interest rate differential is thus becoming more favourable to the euro. The macroeconomic and liquidity context is also shifting in Japan. While the Bank of Japan was reluctant to loosen its grip on yield curve control last year, rising inflation and selling pressure on JGBs is forcing President Kuroda to adopt a more hawkish tone. This should benefit the yen.

.png)