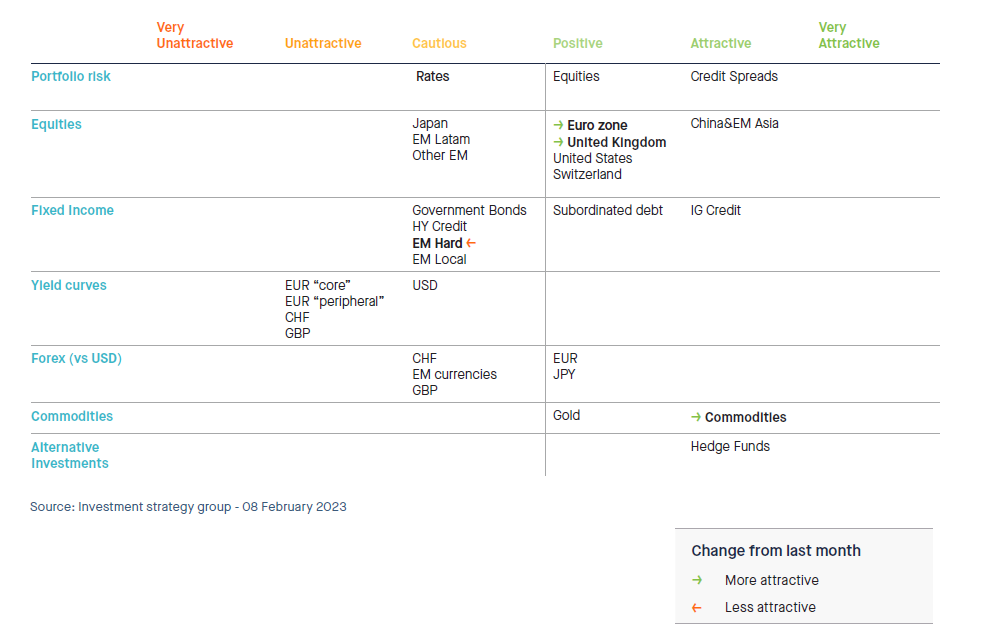

Key changes to our asset allocation (one-month view)

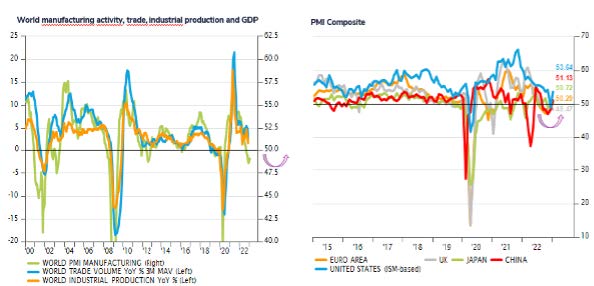

First, the macroeconomic context is improving. True, global economic growth is expected to slow down in 2023. However, the pace of growth is likely to be stronger than initially expected. The probability of a US recession has dropped over the last few weeks on the back of a more resilient than expected US consumer, and a diminishing drag from fiscal and monetary policy tightening. The energy crisis in Europe proves to be less severe than initially expected which leads to a positive economic surprise. In China, we expect real GDP growth to accelerate throughout 2023, driven by the country’s rapid reopening and likely to be further aided by policymakers’ recent refocus on growth.

Meanwhile, global inflation is cooling down. In the U.S., an easing in supply chain constraints, a peak in shelter inflation and slower wage growth should lead to a continued decline in the inflation rate. The fact that Fed Chairman Powell keeps mentioning that “the disinflationary process has started” is perceived by the market as the first step towards a Fed pivot (pause or rate cuts). In Europe, headline inflation should also ease significantly, reflecting sharply lower gas prices. Core inflation might however remain stickier due to continued services inflation pressure.

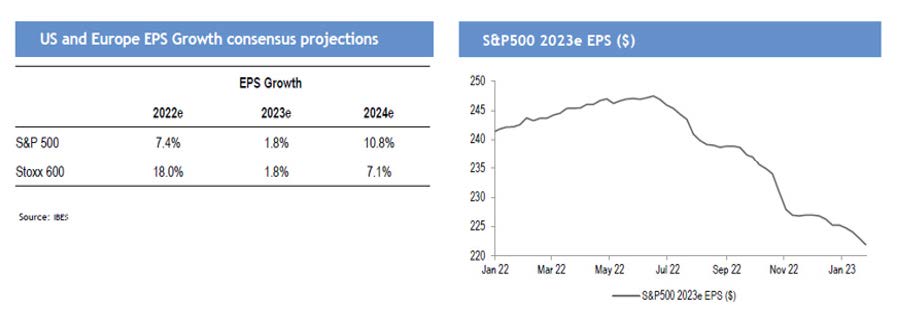

Overall, the growth / inflation mix is thus improving compared to 2022. And while global monetary policy remains hawkish, the cooling down of inflation is leading investors to anticipate a pivot (pause or rate cuts) later this year. While global earnings might not be able to avoid a recession in 2023, markets are forward looking and are starting to anticipate an earnings recovery in 2024.

Our one-month tactical view is based on the weight of the evidence i.e. the aggregation of our fundamental and market indicators. Compared to the previous months, we believe there is indeed a marginal improvement in some of our leading indicators (e.g macroeconomic outlook – see next section). Despite a light deterioration in our market dynamics indicators (from positive to neutral), we have kept a positive stance on global equities with a few changes in terms of regional preferences.

We are shifting our view on eurozone equities from cautious to positive. The European economy is benefiting from milder weather than expected and from the reopening of China. We note that valuations remain fair to cheap despite the recent rally. We are also upgrading our stance on UK equities from cautious to positive. Despite the gloomy macro outlook for the domestic economy, the FTSE 100 benefits from its high exposure to value / cyclicals sectors and from the weakness of the Pound.

We keep an attractive view on EM Asia / China. Our favourable thesis on this region is reinforced by the reopening of China after 3 years of strict lockdown. Chinese consumers have substantial savings; this should benefit not only the local economy but also the demand for domestic stocks.

We remain positive on Switzerland and the US. We are cautious on Japan, EM Latam and other EM.

Within Fixed Income, we have kept a cautious stance on rates and an attractive view on credit. Within rates, we favour the front end as it offers a decent carry and low-rate sensitivity, while the historical level of yield curve inversion argues for staying away from the long end. In addition, recent positive economic surprises in the US, technical analysis and recent deterioration in liquidity could argue for further upward pressure on long-term yields. Within government bonds, we keep a preference USD over EUR (unattractive) where ECB has yet to catch-up. Ms Lagarde confirmed a further 50 bps hike at the next ECB meeting (March) and a higher terminal rate than market expected. The ECB expects "very strong" wage growth in the coming quarters, while no recession is expected anymore in the eurozone in 2023. Peripheral yields should benefit from the ECB's new tool (IPT) and Italian yields have shown resilience after the country’s election results.

The QT program should run smoothly and not affect peripheral yields too much. We note that periphery valuations are expensive as the difference between Italian and German 2-year yields is close to 0.

Within credit, despite the recent spreads tightening, the risk-reward remains appealing due to the high level of carry and potential for further spreads compression. We are moving to longer investments in the 5–10-year segments due to the steepness of the credit spread curve which fully offsets the inversion of the U.S. Treasury yield curve. We also favor high quality paper (A- rating or higher) where absolute yields are still offering attractive entry point. European high yield remains relatively more attractive than US high yield due to persistent exogenous factors (war in Ukraine, electricity prices).

However, we note that the European premium is evaporating rapidly. We remain very cautious on U.S. high yield, as absolute (spreads) and relative (to Investment Grade bonds and U.S. Treasuries) valuations are sinking into expensive territory. Subordinated debt is one of our favorite fixed income positions. This asset class is now mature, resilient, and is supported by strong fundamentals. It still offers premiums and attractive valuation (in relative terms) despite the recent rally. The sector continues to benefit from strong capital position, low non-performing loan ratios and balance sheets that remains well provisioned. However, we recognize that banks are accelerating share buybacks and dividend payments.

We are downgrading emerging market debt (hard currency) from positive to cautious due to valuation concerns. Emerging market bonds have rallied impressively, outperforming investment grade US corporate bonds by more than 5% over the past six months. But rising idiosyncratic risks and the tight premium to investment grade bonds make us tactically cautious.

We are upgrading our stance on commodities from POSITIVE to ATTRACTIVE. Supply remains constrained on a number of commodities while China re-opening should increase demand for key raw materials such as oil and metals. With regards to energy, We acknowledge that prices are likely to remain volatile in the near term, however, we believe that the OPEC+ will continue to manage the market and mitigate any material downside risk to oil prices while waiting for the improving global economic outlook to bolster demand. We remain positive on the metals complex for the above-mentioned reasons.

We remain positive on Gold. After rallying from its September lows, gold sold off following the last FOMC meeting as Powell indicated that the Fed will continue its rate increases through H1 in order to fight inflation. The Fed lifted its benchmark’s target by 0.25 bp to the 4.5-4.75 range. However, we continue to believe that gold is positioned for gains starting in H2 as the Fed will probably stop its rate hikes then (in line with the bond market and US –Treasury yield forwards) as well as the softer US dollar.

On the forex side, we have kept our positive stance on the euro and the yen against dollar. The resilience of the eurozone economy will most likely incentivize the ECB to keep increasing rates while quantitative tightening will effectively start in March. At the same time, the Fed is getting closer to the end of its monetary policy tightening cycle. Interest rate differentials is thus becoming more favourable to the euro. The macroeconomic and liquidity context is also shifting in Japan. While the Bank of Japan was reluctant to lose its grip on yield curve control last year, rising inflation and selling pressure on JGBs is forcing the BoJ to adopt a more hawkish tone. This should benefit the yen.

With regards to hedge funds, macro and CTA strategies remain among the best portfolio diversifiers.

.png)

Source: IBES, JP Morgan

Source: IBES, JP Morgan