OVERVIEW

From our point of view, market volatility initially spiked as investors need to adapt to a new interest-rate regime and the potential negative consequences on long-term economic growth. While we believe the uncertainty around the interest-rate and economic outlook should persist in the coming months, we also would like to highlight the importance of avoiding the natural tendency to overreact to short-term market volatility.

Successful investing needs thoughtfulness and composure, and we continue to rely on our macro, fundamental and market indicators instead of reacting ex-post to market action. Despite a potentially less supportive liquidity outlook in the months ahead, the weight of evidence leads us to maintain a positive stance on risk assets and equity in particular. Global growth remains above potential, financial conditions remain supportive, global earnings growth remains well oriented and some segments of the market remain reasonably valued. Our market technical indicators (trend, sentiment, etc.) continue to react rather nervously to recent market volatility but are not flashing red yet.

Key takeaways:

- From a macro perspective, we continue to believe that normalization in growth and inflation rates remains the central scenario for 2022. However, downside risks on growth and upside risks on inflation are increasing;

- We maintain a positive view on equities. The January pullback has reset investor expectations to more reasonable valuations. The most speculative fringe of the market is starting to look less pricey. Meanwhile, value and cyclical sectors continue to benefit from rising interest rates (Financials) and higher commodity prices (e.g Energy stocks);

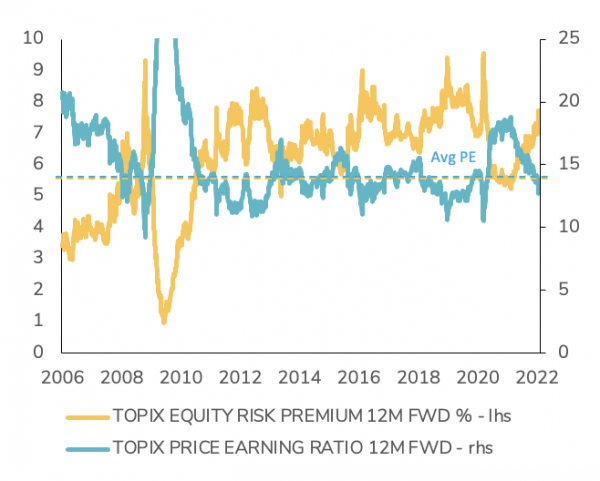

- Our preference remains for Eurozone and Japan equities, as both regionshave a positive bias towards cyclical and value sectors. We also remain positive on US, UK, Swiss and Chinese equities but keep a cautious stance on Emerging ex-China stocks;

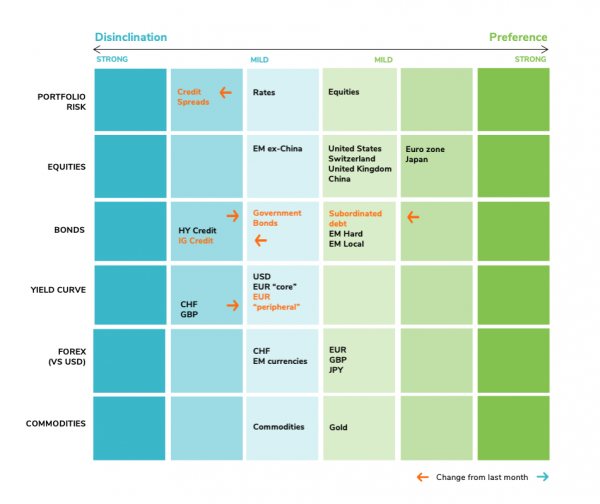

- While we believe that equity markets could stabilize in the short-run, high yield and lower quality investment grade should continue to suffer from declining liquidity, rising interest rates (investors will be less likely to seek lower ratings for high yields) and tight valuations. We are thus downgrading credit spreads from “cautious” to “disinclination”. We remain cautious on rates;

- Within bonds, we are upgrading government bonds from “disinclination” to “cautious”, as we believe that the recent spike in benchmark bond yields has been quite brutal. We are downgrading Investment Grade Credit one notch to “disinclination”. From a yield curve perspective, we are cautious on USD, EUR “core” and EUR “peripheral”. Regarding the latter, our “disinclination” call last month proved to be correct and we are now upgrading EUR “peripheral” by one notch as we believe recent spreads widening already prices the hawkishness of the ECB;

- In Forex, we remain positive EUR, GBP and JPY against USD while still cautious on the Swiss Franc and EM currencies. We stay cautious on Commodities and positive on Gold.

INDICATOR #1

Macro Economic Cycle: Positive (unchanged)

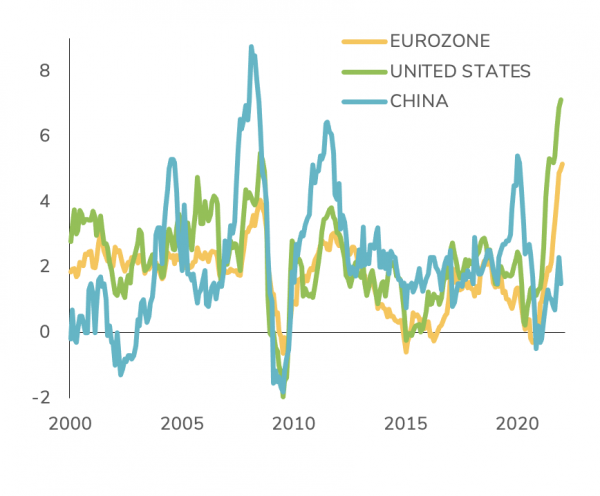

Global growth remains firmly positive but is losing momentum. Manufacturing activity continues to expand across large economies but service sector activity is slowing down, with Omicron acting as temporary headwind (this is likely to change as of March, when several countries will drop most Covid- related restrictions). We believe it is too early to tell whether high inflation also plays a role in this slower growth dynamic. We note that economic surprises are still positive (or neutral) across large economies. The United States continues to benefit from strong underlying growth but the momentum is slowing down and consumption is facing downside risks due to rising inflation which is eroding purchasing power. In the Eurozone, services have been weakening recently due to Omicron, which looks similar to what was observed during the previous Covid peaks in Q2 and Q4 2020. In China, GDP growth momentum took a hit in January - due to Omicron and Lunar New Year - and may require additional monetary policy easing.

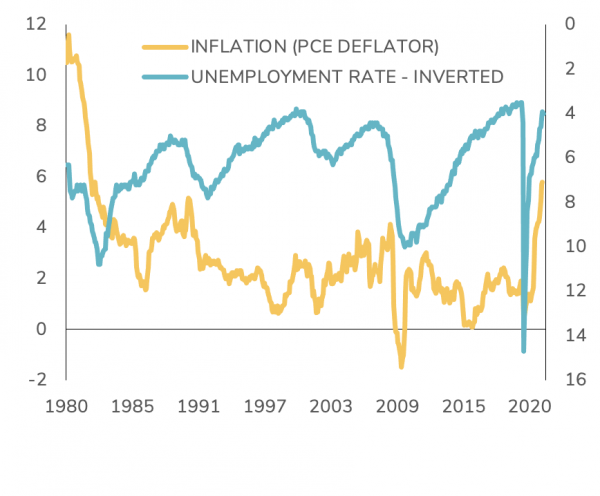

Inflation is still clearly above central bank targets across Developed Markets (see chart below), while it is softer in China and Japan. While inflation keeps rising and exceeding expectations in the US and in Europe, medium-term expectations are edging lower as central banks turn hawkish.

INDICATOR #2

Liquidity: Neutral (unchanged)

Monetary policy remains very accommodative across the board. While China even has some room to ease, inflation dynamics pushed developed markets’ central banks to bring forward monetary policy normalization. The Fed is front-loading rate hike expectations as employment is strong and inflation way above target (see chart below). Even the ECB is now forced to take a hawkish stance, faced with higher-than-expected inflation, low employment and the risk of upward wage pressures. Global liquidity may soon stop expanding as the Fed considers Quantitative Tightening in the second half of the year and as the ECB aims at stopping Quantitative Easing.

INDICATOR #3

Earnings Growth: Positive (unchanged)

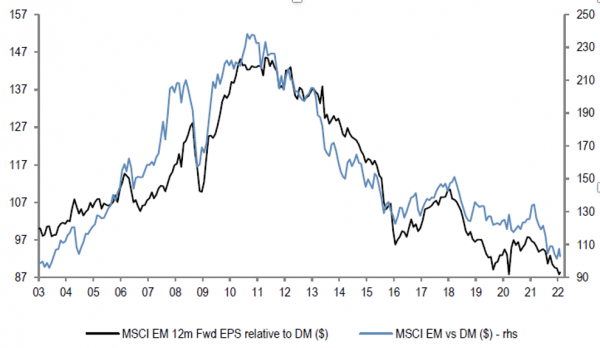

Earnings growth momentum remains positive. With 67% of companies having already reported their Q4 results, S&P 500 earnings are on pace to hit another record high for the 4th straight quarter. GAAP earnings increased 60% year-over-year while operating earnings increased 38%. S&P 500 sales are up 12.3% over the last year. However, we note that the percentage of US companies beating EPS and sales estimates have fallen this quarter. Moreover, those who beat expectations are doing so with less margins than in the recent past. Moving forward, the comps become much more difficult as we will be comparing earnings to record high EPS in Q1 2021. The S&P 500 earnings growth is expected to slow to 10% YoY in Q1 2022 and should hit a high single digit for the full year. In Europe, companies are beating EPS and sales estimates more than in the past. Earnings revision remains well oriented – as is the case in Japan. Emerging Markets stocks underperformance (vs. developed markets) remain justified by lower earnings growth (see chart below). However, we note that the earnings momentum is slightly improving. Historically, Emerging Markets did not tend to suffer when the Fed would hike its rates.

INDICATOR #4

Valuations: Neutral (unchanged)

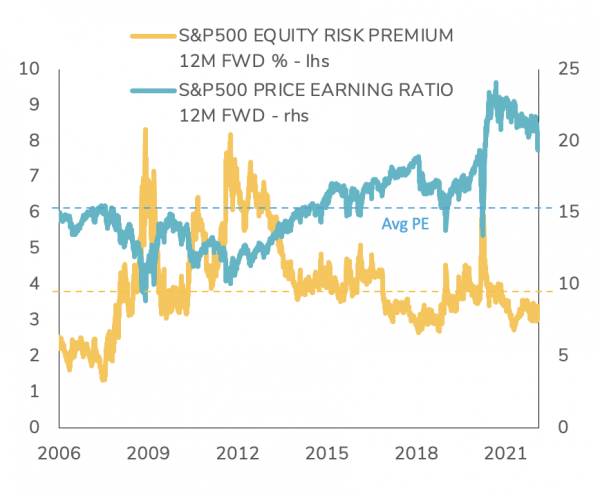

It has been a tale of two equity markets so far this year. Cyclicals, Value, Financials and Commodities-related stocks had a very strong start to the year while the various growth segments – especially the most speculative ones - have pulled back. Overall, valuations have been improving in US markets but are still far from being cheap (see chart below). On a relative basis, value stocks remain much cheaper than growth stocks. European markets are fairly valued. The Swiss market remains quite above its historical valuation while the UK market is cheap in absolute terms. Japan equities remain attractively valued.

Indicator #5

Market Technicals: Neutral (downgrade)

At the time of our writing, the vast majority of our proprietary technical indicators (technical, volume, sentiment, trends and breadth) offer a rather positive picture. Some sentiment indicators are showing signs of stress and our market dynamic indicators show oversold conditions (which is a positive from a contrarian point of view). The low frequency / long-term indicators continue to indicate that the long-term bull trend (price above 200 days moving average) still holds albeit very marginally. We also note that the rate of change (low frequency indicator) is not as positive in 2020-2021. The volume signal is giving a negative signal but this is mostly explained by a seasonality dimension (low volume around year-end). The market breadth signal is still negative but has shown some improvement recently.

ASSET CLASS PREFERENCES

EQUITY ALLOCATION

Positive

For the coming month, we are maintaining a positive bias toward equity allocation. In the current environment of positive economic growth and negative real bond yields, equities remain the most attractive asset class. The January pullback has reset investor expectations to more reasonable valuations. The most speculative fringe of the markets is starting to look less pricey. Meanwhile, value and cyclical sectors continue to benefit from rising interest rates (Financials) and higher commodity prices (e.g Energy stocks). From a regional point of view, we keep our preference for Eurozone and Japan equities, as both regions have a positive bias towards cyclical and value sectors. In the Eurozone, earnings growth is strong and valuations are in-line with the historical average. Meanwhile, Eurozone earnings base is still below pre Global Financial Crisis highs, which is mainly accounted for by domestic sectors. We also have a preference on Japan, on the basis of 1) Strong operational leverage (high sensitivity to growth); 2) Record low valuations (see chart below); 3) Improving macroeconomic growth and; 4) New political leadership. We are positive on US equities. Valuations are expensive, but the Return on Equity is on aggregate above the rest of the world. From a sector standpoint, we continue to maintain a long-term preference for secular growth story in addition to some tactical exposure to value / cyclical names. Indeed, while the latter are more attractively valued and are benefiting from the steepening of the curve, the recent pullback of growth names (especially in the small & mid-caps segment) may actually offer investors the opportunity to buy into growth and technology sectors. The risk-reward at these price levels seems interesting and even more compelling if the sell-off continues in the near- term. We stay positive on US, UK, Swiss and Chinese equities but remain cautious on Emerging ex-China stocks.

FIXED INCOME ALLOCATION

Tactically downgrading spreads to “disinclination”

While we believe that equity markets could stabilize in the short-run, high yield and lower quality investment grade bonds should continue to suffer from declining liquidity, rising interest rates (investors will be less likely to seek lower ratings for high yields) and tight valuations. We are thus downgrading credit spreads from “cautious” to “disinclination”. We remain cautious on rates. We have seen another sharp upward movement in yield curves, driven by real yields in the US and in Europe. Valuations of government bonds are improving, even if macro trends continue to support higher rates. We are upgrading government bonds from “disinclination” to “cautious” as we believe that the recent spike in benchmark bond yields has been quite brutal. We are downgrading Investment Grade Credit one notch to ”disinclination”. From a yield curve perspective, we are cautious on USD, EUR “core” and EUR “peripheral”. Regarding the latter, our “disinclination” call last month proved to be correct and we are now upgrading EUR “peripheral” by one notch on the belief that the hawkishness of the ECB is already priced in. We remain positive on Emerging Markets debt (in dollar and local currencies) although we note that the segment is off to a poor start of the year. We are downgrading subordinated debt from “preference” to “positive”. While subordinated debt is benefiting from an improving outlook for European banks, the liquidity reduction by central banks should also weigh on this asset class.

COMMODITIES

Still cautious

We remain cautious on commodities. While in 2021, the asset class recorded its best year since the oil crash in 1973, we believe the recent bull run is overbought and somewhat driven by panic rather than pure fundamentals. We keep an exposure to Gold. The upside of the yellow metal still depends on how much lower US real rates can go. But it was encouraging to finally see some firming recently, as investors look for some diversifiers in their multi-asset portfolios.

FOREX

Still positive on the euro, sterling and Japanese yen against the dollar

While we were bullish on the dollar throughout 2021, we now believe that the greenback is forming a top and that the EUR, GBP and JPY have some upside potential. The ECB has started its «hawkish pivot» like the Fed had done a few month before. Along with macroeconomic dynamics and real interest rate differentials, this supports a stronger EUR going forward. The beginning of the BoE rate hike cycle supports the GBP. Growth momentum differential has turned clearly in favor of the yen recently, which is cheap from a valuation standpoint. Fundamental drivers plead for a firm CHF over the medium term and short term drivers are turning less favorable for the USD. But the CHF is still expensive from a valuation standpoint.

Tactical Positioning: Our Asset Allocation Matrix

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

.png)