Executive summary

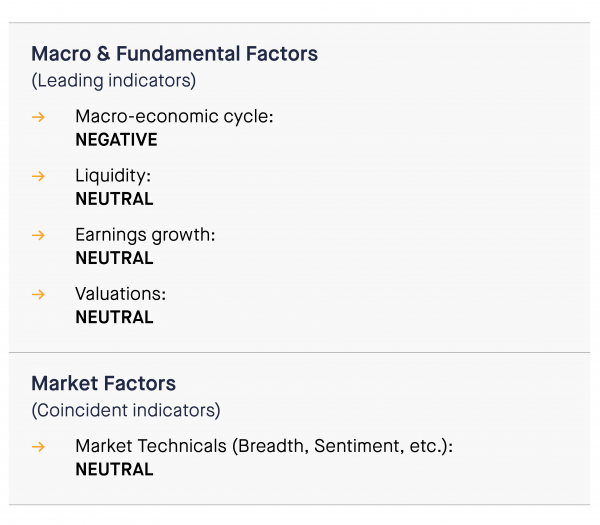

- The weight of the evidence (i.e the aggregation of our fundamental and market indicators) is turning increasingly negative. Our “core” scenario for 2022 is adjusted toward a lower GDP growth rate than initially anticipated and higher inflation. Still, we do not anticipate a “stagflation” scenario at this stage as global GDP is expected to grow roughly in line with long-term trend. Unlike previous market or macro shocks, central banks are not expected to provide decisive support to the market unless the crisis deepens significantly. Equity markets are getting cheaper but earnings forecasts have not been adjusted by consensus yet. Our market technical indicators provide a mixed picture: sentiment is getting more oversold but the long-term bull trend is now at risk of being broken.

- We are thus downgrading our equity view by another notch, from cautious to disinclination. We believe that a clear reduction in exposure to European markets is warranted in a context of huge uncertainty created by the war in Ukraine. We chose to sit on the sideline and wait for more visibility, on the geopolitical, economic and corporate earnings outlook. Eurozone equities, most exposed to this crisis, are moved from positive to strong disinclination, while UK and Switzerland markets are downgraded from positive to cautious and Japan from preference to positive. An important point: we have been gradually reducing our exposure to equities and credit over the last few months based not only on fundamental & technical indicators but also on systematic risk balancing. This equity reduction comes as a further step in this de-risking process.

- In Fixed Income, we remain cautious on rates and keep a disinclination stance on credit spreads. In Forex, we are downgrading our stance on EUR from positive to disinclination, here also to reflect the unusually high uncertainties around Europe’s outlook We are also downgrading GBP from positive to cautious for the same reasons, while upgrading the Swiss Franc from cautious to positive due to its safe haven status.

- We are upgrading Gold from positive to preference.

The big picture

The Facts

- Strong global economic growth up until February

-

- Dissipation of Covid / Omicron impact

- Strong domestic activity in Europe and the US, low unemployment rate supports consumption

- Stabilization in China, slowdown in Japan

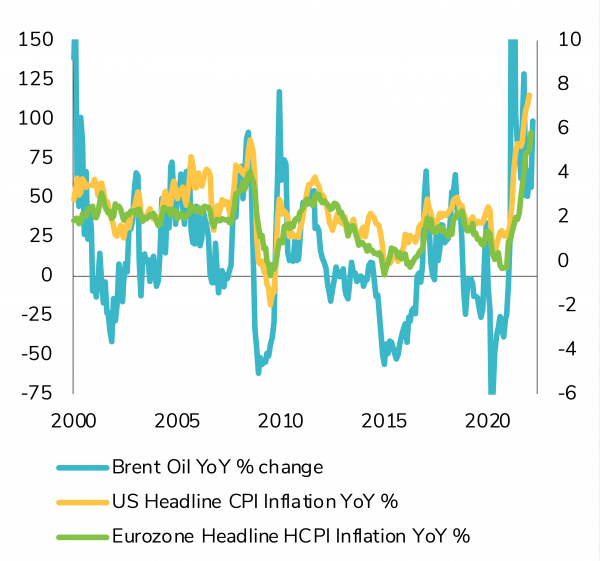

- Global inflationary pressures except in China & Japan

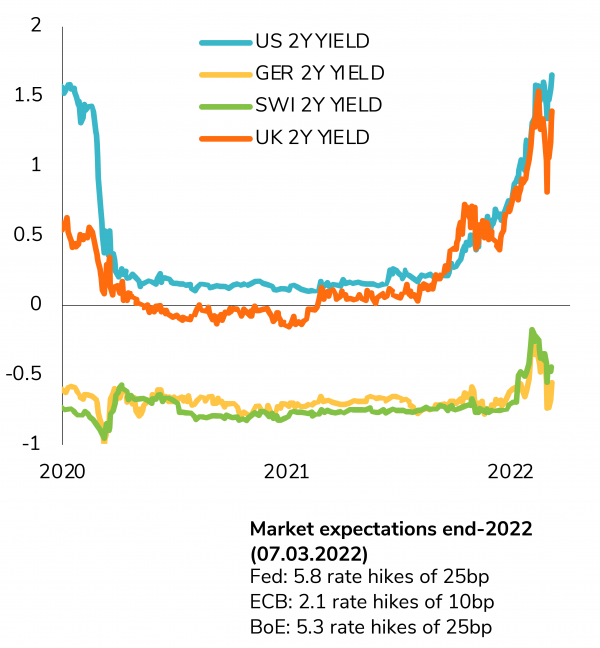

- Central banks contemplating monetary policy normalization

The Knowns

- Energy, industrial metals and agriculture commodities sharply up due to war in Ukraine

- Sanctions and broad based corporate withdrawal from Russia

- Inflation to rise further in Europe and in the US (no peak yet)

- GDP growth prospects for 2022 have to be revised down (energy prices dampen consumers’ purchasing power)

- Central banks become more cautious due to likely growth slowdown but high inflation still pushes them to normalize monetary policy (especially the Fed)

The Unknowns

- How far will the war escalate? (territories, humanitarian impact, financial sanctions, categories of weapons used, direct foreign involvement, regime changes…)

- How long will the «high alert» period last?

- What support can fiscal policy bring? How effective can it be? What impact / coordination with monetary policy?

- Be ready for the «Unknown unknowns»

Indicator #1

Macro economic cycle:

Negative (downgrade)

We believe that the macro perspective has deteriorated. Our “core” scenario for 2022 is adjusted toward slower growth and higher inflation. Global growth was expected to be above trend before the conflict. As of now, global growth remains firmly positive and the Omicron variant’s impact on the US and Europe has dissipated. However, the Ukraine/ Russia war is likely to decrease global real GDP growth by at least 1% due to rising energy prices, negative impact on global trade, deteriorating consumer and corporate sentiment and the risk of worsening financial and liquidity conditions. Meanwhile, inflation keeps rising in the US and in Europe and exceeds expectations. The Russia-Ukraine war is creating a supply shock with moderate to severe effects – depending on the sanctions. This should lead to higher inflation than expected. As such, our macro indicator has turned NEGATIVE (vs. positive previously).

Indicator #2

Liquidity:

Neutral (unchanged)

In the US, Monetary policy is unlikely to provide much support to the economy and financial markets. On the back of a strong job market and the highest inflation number over the last 40 years, the Fed will stick to its plan to hike rates and tighten liquidity despite the conflict. On the other hand, the European Central bank may be more cautious than expected regarding rate hikes and QE tapering. Should the geopolitical and financial crisis deepen, fiscal and/or monetary policy should come as a support not only in Europe but also in the US. For the time being, we view the liquidity conditions as NEUTRAL.

Indicator #3

Earnings growth:

Neutral (downgrade)

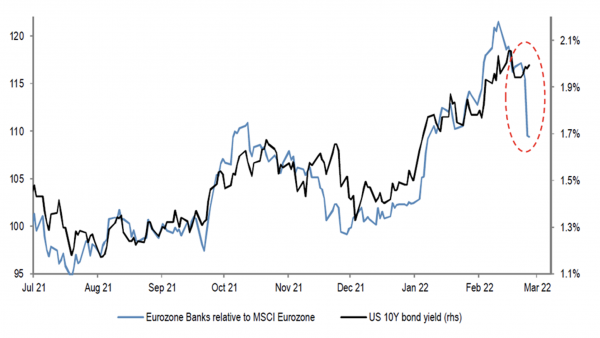

Earnings momentum remains positive but is likely to be revised downwards by sell-side consensus. As such, we are downgrading this indicator from positive to neutral. That being said, we still expect high single digit earnings growth in the US despite the downgrade. Share buybacks provide strong support, while value / cyclicals sectors benefit from rising commodity prices. In Europe, banks are suffering from Russian exposure and a flattening yield curve. We expect low to no growth for European earnings this year.

Indicator #4

Valuations:

Neutral (unchanged)

Equity valuations have eased but are still above historical average in the US. We feel that increased geopolitical risk, growing economic sanctions against Russia and downgrades in earnings are not fully priced yet. As such, this indicator remains NEUTRAL.

Indicator #5

Market technicals:

Neutral (upgrade)

Our market indicators are NEUTRAL, which is a slight improvement vs. last month in the US but not in Europe. At the time of our writing, our proprietary technical indicators on the US market offer a rather positive picture on an aggregated basis. Some sentiment indicators are showing signs of stress and our market dynamic indicators show oversold conditions (which is a positive from a contrarian point of view). The US Bull-Bear gives a buy rating (over- pessimism) but the Put to Call ratio doesn’t show extreme stress at this stage. On the negative side, market breadth keeps deteriorating. The low frequency / long-term indicators show that the long-term bull trend (price above 200 days moving average) is at risk of being broken. We also note that the rate of change keeps deteriorating but hasn’t reached extreme negative levels. The volume signal gives a buy rating. Unlike the US, our European indicators give a negative signal on an aggregated basis, echoing the negative picture for Europe painted by macroeconomic and earnings growth prospects.

Asset Class Preferences

Equity allocation:

Tactically downgrading to “disinclination”

Based on the weight of the evidence, we are downgrading our equity view by another notch, from cautious to disinclination. Eurozone equities are moved from Positive to strong disinclination, UK and Switzerland from Positive to cautious and Japan from Preference to Positive.

Fixed income allocation:

“disinclination”

On the fixed income side, we remain cautious on rates and keep a disinclination stance on Credit Spreads. Macro trends continue to support higher rates. Medium and long term inflation expectations spiked along with energy prices and amid fears of stagflation. EUR rates and sovereign spreads are capped by the pullback on ECB rate hikes expectations as uncertainty is high around Europe’s outlook. High yield and lower quality investment grade bonds should continue to suffer from declining liquidity, rising interest rates (investors will be less likely to seek lower ratings for high yields) and tight valuations. Investment grade spreads are back above 100 bps but are still below average in USD. We are downgrading Subordinated debt and Emerging Markets bonds (hard and local currencies) from Positive to cautious given uncertainties and likely downward revisions to the European and Global growth outlook.

Commodities:

Still cautious overall; upgrading Gold to preference

We stay cautious on Commodities although the upside risk on energy prices remain high depending on the severity of the sanctions against Russia. The asset class remains very volatile and geopolitically driven. We thus favor gaining exposure to the asset class through commodities-sensitive stocks rather than pure plays. We are upgrading Gold from positive to preference. The yellow metal is one of the few portfolio diversifiers remaining. It benefits from lower real bond yields, geopolitical uncertainty and tight supply.

Forex:

Upgrading our view on the Dollar and the Swiss Franc; downgrading the Euro

In Forex, we are downgrading our stance on EUR from positive to disinclination. The war in Ukraine weighs on EUR prospects from several angles: macroeconomic growth prospects, interest rate differentials and flows of funds.

We are also downgrading Sterling from positive to cautious while upgrading the Swiss franc from cautious to positive as Fundamental drivers plead for a firm CHF over the medium term. Flight to safety from European assets is a powerful support. Growth momentum differential has turned back negatively for the yen, which is still cheap from a valuation standpoint.

Tactical positioning: our asset allocation matrix

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

.png)