To fully understand halving, we need to look at the foundations of the Bitcoin blockchain.

The blockchain is a distributed ledger that records all transactions on a network of thousands of computers worldwide. This ledger is both public and immutable, enabling bitcoin's transparency and security, without the need for a central authority.

Another important point: Bitcoin is a proof-of-work network. This is why it relies on miners to validate transactions and include them in blocks. Mining essentially consists of adding transactions to this ledger, using computers and software to solve complex cryptographic problems. When a miner succeeds in solving one of these problems, he or she adds a "block" of transactions to the blockchain and is rewarded with a predetermined amount of bitcoins.

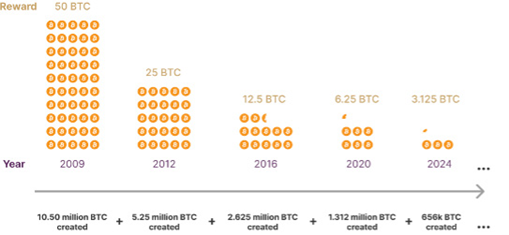

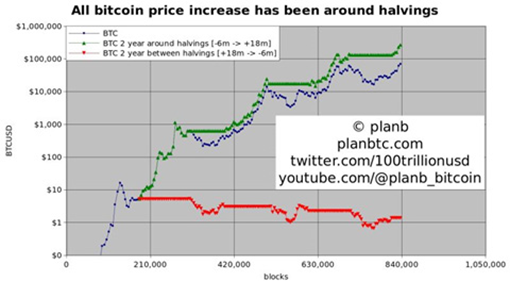

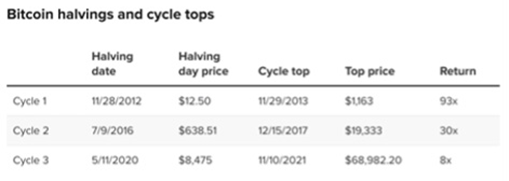

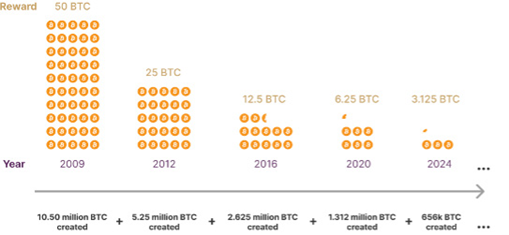

When Bitcoin was launched, miners were rewarded with 50 bitcoins for each block they mined. However, the Bitcoin protocol stipulates that every 210,000 blocks, the miners' reward is halved, a process that takes roughly 4 years.

During the first halving, in November 2012, the reward per block fell from 50 to 25 bitcoins. The second and third halving took place in July 2016 and May 2020, with the rewards dropping to 12.5 and 6.25 bitcoins respectively. This time, the block reward will drop from 6.25 BTC to 3.125 BTC.

Source : River Learn

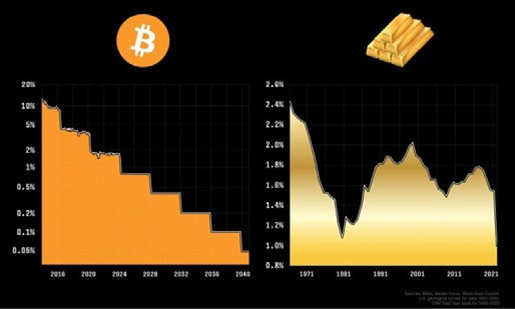

The importance of halving lies mainly in the scarcity effect it gives bitcoin. To understand this, let's look at bitcoin's supply and its deflationary model.

The total supply of bitcoins is limited to 21 million tokens. At the time of writing, over 93.7% of this supply is already in circulation, for a total of around 19.7 million BTC. The last

bitcoin is expected to be mined by 2140... Yes, you read that right, another 116 years until the final bitcoin is mined.

.png)