Executive summary

- The return of inflation marks a break with the environment of the past two decades. Central banks have to re-learn to live with inflationary pressures and to normalize their monetary policy (end of QE, end of ZIRP or NIRP, accelerated rate hike cycles…). Households are concerned by a decline of their real purchasing power, but healthy consumption levels can hold as long as unemployment remains low and wages increase. Businesses are seeing their profitability threatened by rising input costs. However, so far they have been able to pass them onto consumers with higher selling prices to defend their margins.

- The trajectory of inflation in the months ahead will be a key variable of the economic environment. It will drive central banks’ actions and either force more restrictive policies, or ease the pressure to normalize rapidly. It may ultimately dampen households’ consumption and force a negative growth scenario, or ease the recent rise in anxiety. It may erode the profitability of businesses if the slowdown in demand makes passing on higher costs in sales prices more difficult.

- Global growth remains positive across large economic areas but is slowing down this year due to several factors: 1) Lockdowns in China amid a resurgence of Covid; 2) The impact of inflation on sentiment and the risks on final consumption and; 3) The effects of monetary policy normalization by central banks. We still believe that a “soft landing” is achievable, especially as fiscal policy remains available to help stabilize the economy and avoid a crash. But the risk of a “hard landing” cannot be ruled out if inflation forces central banks to tighten monetary policy aggressively, especially in a context of high political and geopolitical uncertainties. Overall, our macro-economic indicator remains negative.

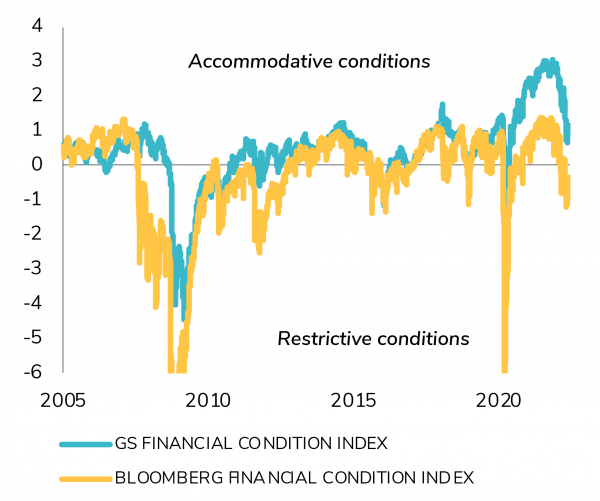

- Central banks are facing a trade-off between growth and inflation. If they tighten monetary policy too much, they could trigger a recession. If they don’t do enough, there is a risk of inflation expectations to continue moving higher. Currently, they have no other choice than putting in place large and rapid increase in interest rates in order to dampen demand. While they might pause in the second half of the year to evaluate the effects on growth, central banks are unlikely to come to the rescue of the economy and financial markets in the short-term. As such, our liquidity indicator remains negative for risk assets.

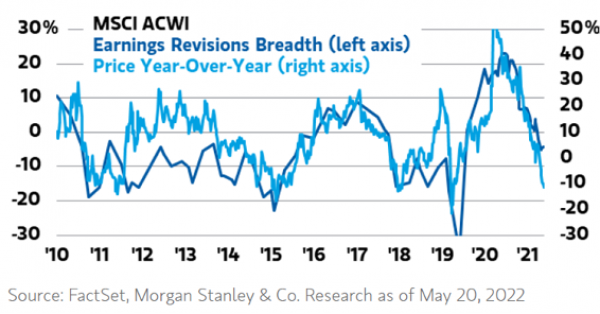

- Earnings growth expectations remain surprisingly strong as the consensus now expects MSCI World earnings per share to grow by 10.9% in 2022e and 7.8% in 2023e. However, some downward earnings revisions are likely later this year as high input costs can hurt individual companies and some specific sectors. The extent of negative earnings revision will play a major role in the direction of equity markets in the coming months. The first leg of the equity market downturn was valuation compression. The next shoe to drop could be earnings, in which case equity markets risk falling further. At this stage, we remain neutral on earnings growth.

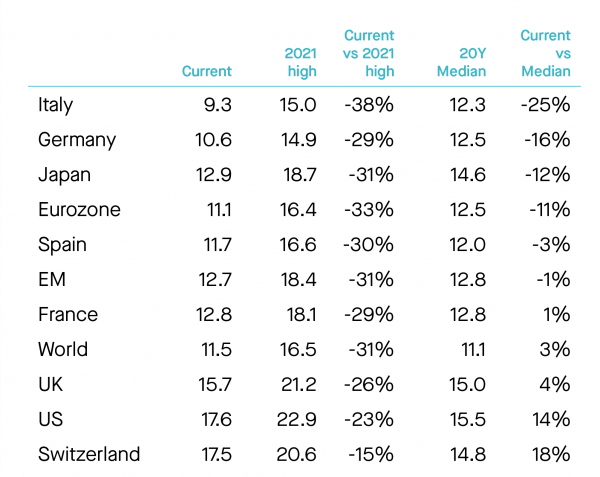

- Global equity valuations have eased and are below the 20-year median in the vast majority of countries except in the US and Switzerland. Looking across geographies, U.S and Switzerland continue to trade at a premium vs. MSCI World while Japan, the UK, Emerging Markets and the Eurozone trade at a steep discount. Compared to bonds, global equity markets remain attractive but the gap is starting to close as bond yields rise.

- Our coincident indicators (market factors) have been improving recently. Nevertheless, they don’t seem to indicate that the recent equity markets rebound is robust enough to be sustained.

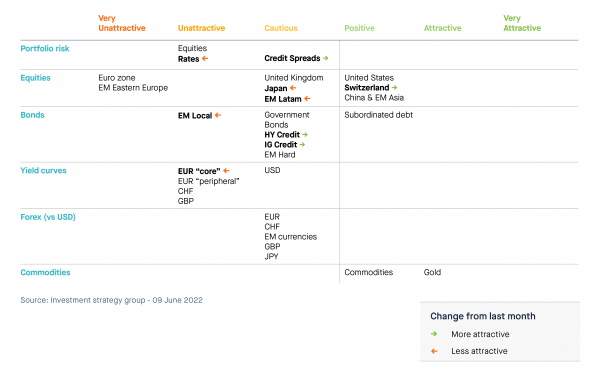

- Overall, the weight of the evidence (i.e the aggregation of our fundamental and market indicators) remains negative. As such, we maintain an “unattractive” view on equity markets. We do a have a positive stance on US equities. Our least favored market remains Eurozone equities (very unattractive). We are upgrading Switzerland from cautious to positive and downgrading Japan and Emerging Markets Latam from positive to cautious.

- In Fixed Income, we are upgrading credit spreads from unattractive to cautious and downgrading rates from cautious to unattractive. The bright spot in fixed income seems to be the 0-2 year investment grade & high yield segment.

- In Forex, we are cautious on all currencies against the dollar. We maintain a positive view on Commodities and a “preference” stance on Gold.

Indicators review summary

On an aggregated basis, our indicators are pointing towards an “UNATTRACTIVE” view on risk assets.

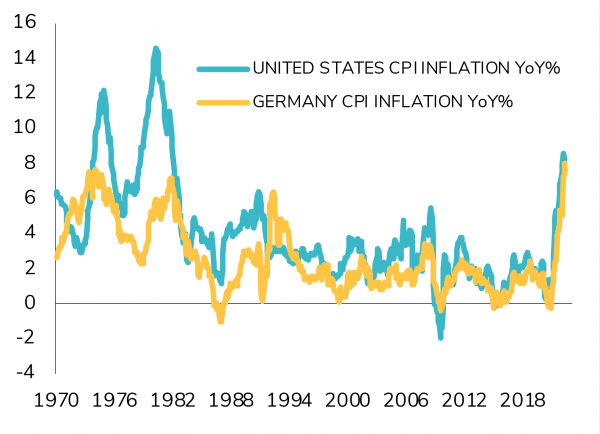

Global growth is softer but remains positive for the time being in all large economic regions. Rising prices have become the main concern for households, but consumption spending holding for the moment. China is gradually reopening which should lead to some improvement in its PMI score. Global manufacturing activity remains firm and in expansion across large economies. The service sector is slowing down but keeps growing in developed markets. Activity is picking up in China and remains strong in India and Brazil. We note that economic surprises have turned negative in the US and China. Inflation continues to rise in the US and in Europe and is at multi-decade highs across developed economies. Upward price pressure is visible across the entire good & services spectrum. Commodity and energy prices are not the only culprit. The succession of supply and demand shocks since 2020 has broken the «low inflation equilibrium» of the past 25 years. Higher inflation is feeding into households and business expectations, creating «second round effects» that may fuel inflationary pressures for some time. Inflation may currently be peaking, but it will remain elevated in the months ahead. Wages are rising at their fastest pace in decades across developed economies. Post-pandemic changes in labor market dynamics create worker scarcity in many sectors.

Labor shortages improve workers’ bargaining power for wage increases. Strong post-pandemic demand improves businesses’ pricing power and capacity to pass higher costs to preserve margins – at least for now. While medium-term expectations appear to stabilize, they are doing so at a level above central banks’ target. On a positive note, inflation surprises have started to decline in the US.

We believe that 2022 will be a year of slowing global growth on the back of global trade disruptions, elevated inflation and tighter credit conditions. As such, our macro indicator is NEGATIVE. Our core scenario is a “soft-landing” of the global economy but the risk of a “hard landing” cannot be ruled out in a context of elevated uncertainties.

Indicator #2

Liquidity: Negative

As mentioned above, central banks have no choice but to react forcefully to catch up with inflation, regain credibility and seize a window of opportunity to exit ZIRP (Zero Interest Rate Policy) / NIRP (Negative Interest Rate Policy). We note that global liquidity growth measured in USD has already stopped growing. The ECB and the Fed are now both on track to quickly normalize monetary policy. The big difference stems from the drivers of inflation. In the euro area, inflation is driven primarily by higher energy and food costs that were exacerbated by the tragic war in Ukraine. This should dissipate in the medium terms. In the U.S., inflation is more broad-based, with increases driven by goods and energy in almost equal parts. U.S. inflation is likely to be more persistent and should settle at higher levels than pre-Covid. We thus believe that US monetary policy is unlikely to provide much support to the economy and financial markets. The Fed will stick to its plan to hike rates and tighten liquidity despite the Russia-Ukraine conflict. The market currently anticipates 50 basis rate hikes during the next two meetings. Beyond that, and as it should always be, the continuation of the rate hike cycle will depend on growth and inflation data. In Europe, the ECB is on path to exit its negative interest rate policy. During 9 June ECB meeting conference call, Christine Lagarde signaled the end of QE and left the door open to a 50bps hike in July. In Japan, the BoJ's monetary policy remains decidedly expansionary. It stated that it will keep its main policy rate - which has been at a historic low of -0.1% since January 2016 - at the current level (or lower) for the time being and that it will continue its asset purchases (quantitative easing), in order to cap the yield on Japanese 10-year government bonds at a maximum of 0.25%. However, this mechanism (known as "Yield Curve Control") looks less and less sustainable in the face of a sharply weakening yen which is increasing the cost of imported goods (including energy) and which could thus create an inflationary spiral. Overall, we view the liquidity conditions as NEGATIVE.

Source: Banque Syz, FactSet

Source: Banque Syz, FactSetIndicator #3

Earnings growth: Neutral

To the surprise of many, earnings growth expectations have been resilient so far this year. The consensus expects a 10.9% EPS growth for the MSCI World in 2022e and 7.8% growth in 2023e. We note that even by stripping out commodities, median EPS growth expectations are close to 10% for both 2022e and 2023e. We note that US corporate margins currently stand at a record high, which means that companies have so far been able to pass on input cost increases to consumers. Balance sheets remain solid as well and companies have room for more share buybacks.

As such, we continue to see earnings growth as being a tailwind for US equities but still believe that some downward earnings growth revisions could happen later this year.

As shown in the chart below, earnings revision breadth is now barely positive and it seems that the market starts to anticipate further deterioration. Indeed, after a very strong earnings rebound in 2021, base effects are no longer very favorable. While profit margins have been resilient until now, high input cost pressures can hurt individual companies and some specific sectors. That being said, we still expect high single digit earnings growth. Share buybacks provide strong support while value / cyclicals sectors benefit from rising commodities prices. In Europe, we expect low to mid-single digit growth for European earnings this year. This indicator remains NEUTRAL for equity markets.

Indicator #4

Valuations: Neutral

Global equity valuations have eased and is below the 20- year median in the vast majority of countries except in the US and Switzerland (see table below). Indeed, the current equity market drawdown was driven by valuation multiples compression rather than earnings revision. Looking across geographies, U.S and Switzerland continue to trade at a premium vs. MSCI World while Japan, UK, Emerging Markets and the Eurozone trade at a steep discount. Compared to bonds, global equity markets remain attractive but the gap is starting to close as bond yields rise. We also note that with the return of inflation, investors consider stocks as being a much better hedge against inflation than bonds. As such, asset allocators are rotating from fixed income funds into equity funds. This can push equity valuations higher. On a more cautious note, we feel that increased geopolitical risk, growing economic sanctions to Russia and downgrades in earnings are not fully priced in yet. As such, this indicator remains NEUTRAL.

Indicator #5

Market Technicals: Neutral (upgrade)

Our market indicators have been improving over the past few weeks. Nevertheless, they don’t seem to indicate that the recent equity markets rebound is robust and sustainable. Indeed, the low frequency / long-term indicators show that the long-term bull trend (price above 200 days moving average) has been broken and exhibit the characteristics of a bear market (lower lows and lower highs and moving average declining). Sentiment indicators are not showing any sign of capitulation yet. Indicators such as MACD and mean reversion show that the market is not hitting oversold levels. Overall, despite the improvement of some indicators (e.g market breadth), it looks like a fragile bear market rally.

Asset Class Preferences

Equity allocation

Unattractive

Based on the weight of the evidence, we keep an unattractive stance on equities. The U.S. economy has moved into the late cycle ‘slowdown’ phase, after spending the last 18 Months in Mid-Cycle ‘Expansion’. Late-cycle ‘slowdown’ is consistent with below-average equity market performance, owing to slower earnings growth and multiple compression. Earnings growth remains a tailwind but we believe that the risk of downgrades in earnings is not priced in yet. From a regional perspective, we keep a positive stance on US equities and are upgrading Swiss equities from cautious to positive. Switzerland benefits from a stable and attractive environment (including a flexible corporate sector). Inflation is moving up but remains much lower than in Europe. We are downgrading Japan equities from positive to cautious. Despite low valuations and a weak JPY, the short-term outlook is negative because of policies of a new administration. We are also downgrading Emerging Markets Latam from positive to cautious. After a very strong performance YTD thanks to the commodity tail-wind, we see a risk of profit taking in the short-term. Our least favored market remains the Eurozone (strong disinclination). There is due to significant geopolitical risk and heavy energy dependency. Outside the Eurozone, we maintain a cautious view on the UK. From a sector perspective, cyclicals and value have been leading over the last few months but defensives have been doing better more recently, which is consistent with where we stand in terms of macro-economic cycle. We have an overweight stance on Energy, Financials and Consumer Staples. We upgraded the latter recently from neutral to overweight. Indeed, despite the pressure due to input costs squeeze and rising bond yields, the sector’s defensiveness should attract investors in this uncertain market. We downgraded materials from overweight to neutral. Metals & Mining companies should benefit from continued strong demand coupled with supply constraints (some due to the Russia-Ukraine situation). Nevertheless, Chemicals are at risk of suffering from higher input costs as well as lower demand from end-users in the context of a slowdown. We remain underweight Utilities, Real Estate and Consumer Discretionary.

Fixed income allocation

Unattractive

On the fixed income side, we are downgrading rates from cautious to unattractive in favor of credit spreads. We believe that the new inflation cycle is being repriced despite the current implicit pricing of tightening monetary policy in the US. Within government bonds, we have seen some divergence across government bonds markets. US short rates are now set on a very aggressive path while the EUR curves need to catch-up. The EUR Peripheral curve is moving up, due to a PEPP/APP early exit (end of June). We believe that core EUR curve yields will continue to move up as well due to record high inflation level and a more hawkish ECB. We are thus downgrading this segment from cautious to unattractive.

We are upgrading credit spreads from unattractive to cautious. The recent revaluation of credit spreads added value to the segment, especially in the short-term bucket. However, High Yield is still not cheap relative to current volatility, low liquidity and lack of central bank support, while Investment Grade is just starting to get out of expensive territory. We do see a bright spot in the 0-2y segment in Investment Grade & High Yield. We stay positive on subordinated debt. This matured and resilient asset class is still offering some attractive yield premiums and this despite solid capital position.

We remain cautious on Emerging Markets Debt. Valuations are attractive overall but we need to see some stabilization in Emerging Markets capital flow before turning positive on this segment. We are downgrading Emerging Markets Local currencies from cautious to unattractive avoided as Emerging Markets’ Central Banks continue to tighten monetary policy aggressively while inflation data continue to surprise on the upside.

Commodities

Positive overall. Keeping a preference stance on Gold

We believe that commodities might be short-term overbought but remain long-term under-owned. After years of capex underinvestment, many commodities are facing a supply shortage while demand is firm. The invasion of Ukraine by Russia and the sanctions are worsening the situation. Energy and commodities are needed for virtually everything, yet Russia exports everything, and unlike in 1973, it isn’t just the price of oil, but the price of everything that is surging. And the supply shock might be a long lasting one. Indeed, despite ongoing negotiations between Russia and Ukraine, a stalemate with prolonged economic impacts looks likely. We are thus positive on broad commodities. We keep our preference stance on Gold. The yellow metal is one of the few portfolio diversifier remaining. It benefits from lower real bond yields, geopolitical uncertainty and tight supply.

Forex

Positive on the dollar against all currencies

In Forex, we find all currencies unattractive against the dollar. The Ukrainian War weights on EUR and GBP prospects from several angles: macroeconomic growth prospects, interest rate differentials and flows of funds. However, ECB normalization could support the EUR in the coming months. A hesitant Bank of England is also weighing on the GBP. Fundamental drivers support the CHF over the medium term but short-term drivers support the USD, especially widening rate differential. Growth momentum and monetary policy differentials are weighting on the yen.

Tactical positioning: our asset allocation matrix

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

.png)