Outlook summary

The Russia-Ukraine conflict has pushed geopolitical risk to a very high level and is having a meaningful impact on global financial markets today through 1/ the rise of equity risk premium; 2/ tighter financial conditions and 3/ higher inflation ahead due to rising energy costs.

We held an extraordinary investment strategy meeting this morning and would like to share our key takeaways below.

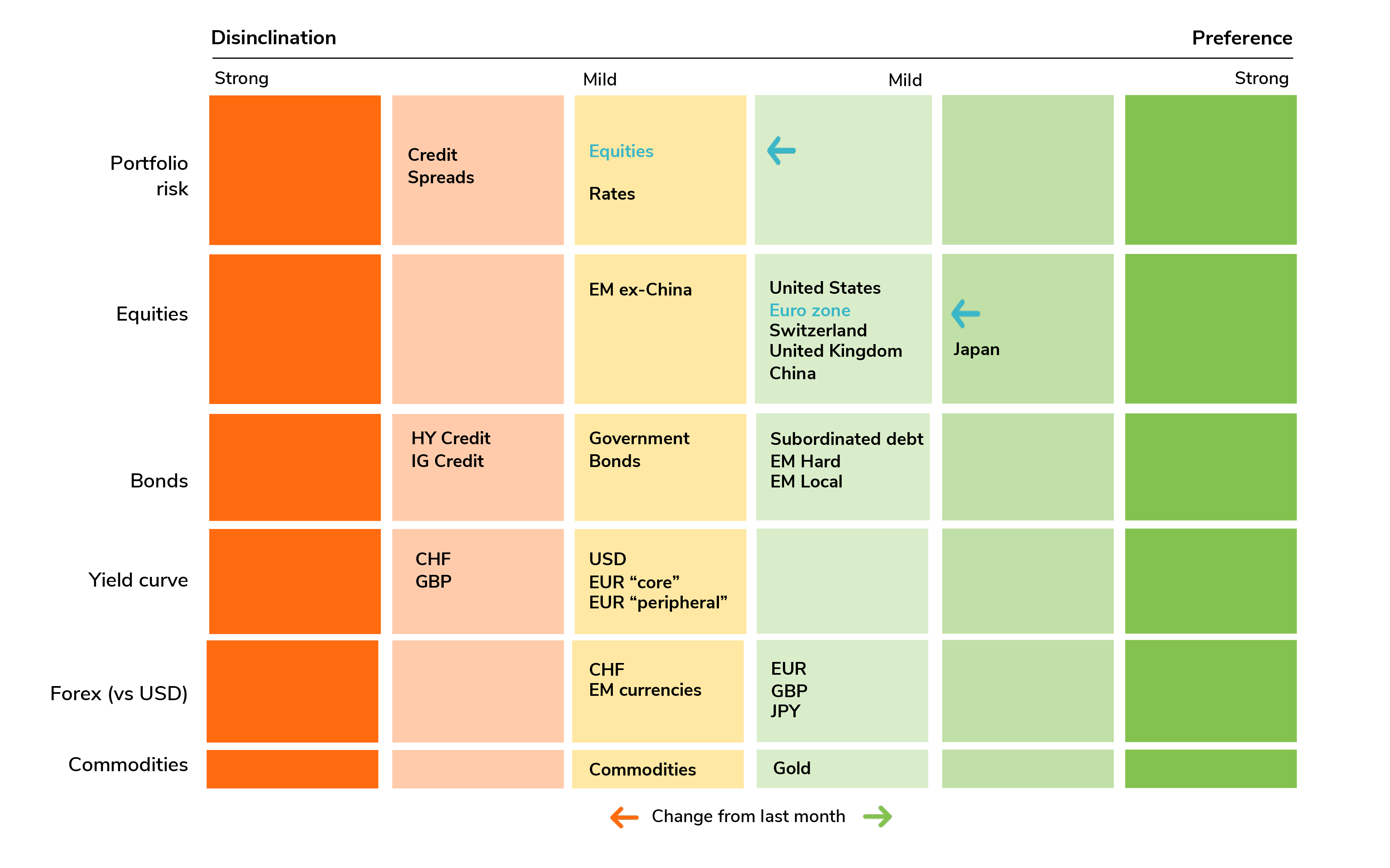

The weight of evidence (i.e the aggregated view of our fundamental & technical indicators) leads us to downgrade our stance on equities from positive to cautious. While global growth remains above potential, the Russia-Ukraine crisis creates downside risk at a time when monetary policy is unlikely to provide a strong support to the economy and financial markets. While earnings growth remains and equity valuations are slightly more attractive, our market technical indicators (trend, sentiment, etc.) have been deteriorating lately and thus lead us to reduce our stance.

An important point: we have been gradually reducing our exposure to equities and credit over the last few months based not only on fundamental & technical indicators but also on systematic risk balancing. This equity reduction comes as further step in this de-risking process.

In a nutshell:

- From a macro perspective, we continue to believe that normalization in growth and inflation rates remains the central scenario for 2022. By “normalization”, we mean that the impact of the post-pandemic recovery on consumption, business investment and supply chains will dissipate and create a fundamentally more normalized economic environment. However, downside risks on growth and upside risks on inflation are clearly increasing for the global economy now, mostly due to the prospect of sustained elevated energy and commodity prices, as well as potential shortages in key raw materials due to sanctions on Russia. ;

- Equities: from positive to cautious. In the current macro environment of positive economic growth and negative real bond yields, equities remain the most attractive asset class in the medium to long-run. However, our indicators lead us to be cautious in the near-term. We are downgrading our preference for the Eurozone one notch given the higher sensitivity of this region to the current Russia-Ukraine crisis. We keep a preference for Japan, for its attractive valuations and less direct exposure to Russia-Ukraine developments.

- Credit: we keep our disinclination stance. high yield and lower quality investment grade should continue to suffer from declining liquidity, rising interest rates (investors will be less likely to seek lower ratings for high yields) and tight valuations;

- We remain cautious on rates, as the inflation context will prevent central banks from responding as forcefully as in previous crisess with monetary policy easing. Flight to quality increases the attractiveness of “risk free” assets such as US Treasuries and German Bunds but upward pressures on inflation will continue to exert upward pressures on long term rates. Despite market volatility and geopolitical risks, we believe that central banks will roll out their plans to tighten monetary policy conditions;

- In Forex, we remain positive EUR, GBP and JPY against USD given current yield differentials, and cautious on the Swiss Franc and EM currencies. We stay cautious on Commodities and positive on Gold.

What Happened

The Russian invasion of Ukraine has begun. Russian president Vladimir Putin launched a “special military operation” in Ukraine Thursday morning aimed at the “demilitarization and denazification” of Ukraine. Russian attacks began on cities across the country, including Kyiv as AP reported big explosions in Kyiv and other areas of Ukraine. Russia’s Defense Ministry said the strikes are targeting Ukraine military infrastructure and that citizens have nothing to fear. President Putin added that Russia does not plan to “occupy” Ukraine, but Russia must “defend itself from those who took Ukraine hostage (...) the US and its allies who crossed Russia’s red-line with the expansion of NATO”.

Meanwhile, Ukraine President Zelenskiy said that Russia has “launched a full-scale invasion” and his Interior Minister warned that the capital was under attack from ballistic missiles. US President Biden talked about an “unprovoked and unjustified attack” and that the US “will be imposing severe sanctions on Russia”.

At the time of our writing, European equity markets and US stock futures are plummeting while Gold, oil and government bonds are soaring. An invasion of Ukraine by Russia was seen by markets (including us) as a tail-risk event and investors thus need to re-price the consequences of this event on global macro, financial conditions and investors’ sentiment.

A high-level summary of our extraordinary ISG (Investment Strategy Group) meeting to assess the effects of this geopolitical crisis is shared below.

Indicators review summary

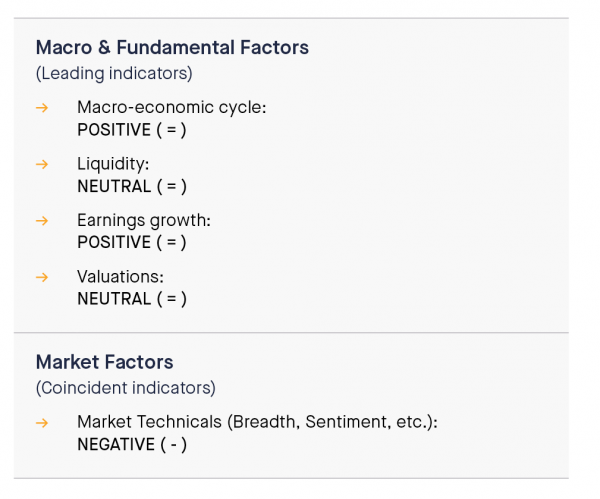

On an aggregated basis, our indicators are positive on risk assets.

Indicator #1

Macro Economic Cycle:

Positive (unchanged)

Global growth remains firmly positive but has been slightly losing momentum recently. The Russia-Ukraine conflict is adding additional downside risk to our 2022 outlook. For the US economy, the direct effects should be limited because trade links are weak (less than 1% of import/export) but also because the rise of energy prices has less impact on the US than on Europe (America is a net exporter of natural gas and any spillover effects on US gas prices should be modest). However, the rise of oil and natural gas prices puts upward pressure on inflation and should weigh on consumer sentiment (at least until the end of winter). According to Goldman Sachs’s rule of thumb, a $10/bbl increase in the price of oil boosts core inflation by 3.5bp and headline inflation by 20bp, but lowers US GDP growth by just under 0.1% (10bp)

This crisis is likely to lead to higher collateral damages in Western Europe. With US and European economic sanctions against Russia being inevitable, Moscow will seek retaliation most likely by restricting Russia’s energy exports. The EU currently has just six weeks of gas supply in storage. Under EU emergency plans, national authorities might decide to curtail the supply of gas to large industrial users in order to maintain the flow to households and small businesses. This should have some negative impact on European growth. Still, according to DB, a pessimistic scenario of oil hitting $150 and natural gas doubling from yesterday’s level will impact European growth by between -2% and -3%. This is meaningful but would still keep the EU economy just in expansion territory. However, there is some high upside risk potential on inflation, which is complicating the role of central banks (see next point).

Indicator #2

Liquidity:

Neutral (unchanged)

Given the strength of recent economic data in the US, it is indeed urgent for the Fed to act. We expect rate hikes and quantitative Tightening (QT) later on. And the recent geopolitical developments are unlikely to change this stance. While recent market expectations (between 6 and 7 rate hikes) might now look too aggressive, we still expect the Fed to move rapidly in the first part of its tightening cycle. Perhaps with 0.25% rate hikes at each meeting through H1, before considering a more gradual pace of hikes, especially if inflation starts to moderate more meaningfully in the second half of the year.

The fact that monetary policy tightening is expected to remain in place despite the current market stress is a major difference with previous bear markets (2008, 2020). Major central banks (Fed, ECB) are not in a position to hold off their hands from policy tightening and is one of the reasons we favor a more cautious stance on equities.

Indicator #3

Earnings growth

Positive (unchanged)

Earnings growth momentum remains positive and we are not downgrading our estimates based on recent events. With more than 80% of companies having already reported their Q4 results, S&P 500 earnings are on pace to hit another record high for the 4th straight quarter. GAAP earnings increased 60% year-over-year while operating earnings increased 38%. However, we note that the percentage of US companies beating EPS and sales estimates have fallen this quarter. Moreover, those who beat expectations are doing so with less margins than in the recent past. Still, we expect the S&P 500 earnings growth is expected to hit a high single digit for the full year. In Europe, companies are beating EPS and sales estimates more than in the past. Earnings revision remains well oriented – as is the case in Japan. Emerging Markets stocks underperformance (vs. developed markets) remain justified by lower earnings growth.

Indicator #4

Valuations

Neutral (unchanged)

It has been a tale of two equity markets so far this year. Cyclicals, Value, Financials and Commodities-related stocks had a very strong start to the year while the various growth segments – especially the most speculative ones - have pulled back. Overall, valuations have been improving in US markets but are still far from being cheap. On a relative basis, value stocks remain much cheaper than growth stocks. European markets are fairly valued but is likely to suffer more from meaningfully from the Russia-Ukraine crisis than their US counterparts.

Indicator #5

Market technicals

Negative (Downgrade)

The majority of our proprietary technical indicators (technical, volume, sentiment, trends and breadth) have turned from positive to negative over the last few days. Some sentiment indicators are showing signs of stress but seems to indicate that further deterioration is plausible. The low frequency / long-term indicators indicate that the long-term bull trend (price above 200 days moving average) might not hold. The market breadth signal is negative. European indicators give an even more negative picture than the US ones.

Tactical Positioning: Our Asset Allocation Matrix

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

.png)