TIME TO TAKE SOME CHIPS OFF THE TABLE

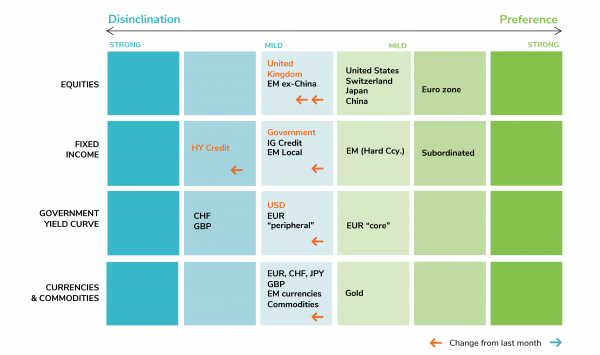

We are reducing part of our overweight equity stance in light of a more uncertain liquidity environment and the deterioration of some of our technical indicators.

- Equities are still the most attractive asset class given solid growth prospects and low interest rates

- Strong earnings growth will more than offset the coming gradual normalization in fiscal and monetary policy

- However, technical and liquidity prospects create a more uncertain environment in the short term, warranting a selective reduction of our strong equity overweight stance which has been in place since June 2020

- In light of ongoing inflationary pressures and monetary policy normalization, we see upward risks on long term rates and are downgrading the exposure to government bonds from positive to cautious

- We remain cautious on commodities. Our tactical asset allocation is summarized in the matrix at the end of the article

INDICATORS REVIEW SUMMARY

On an aggregated basis, our indicators are positive on risk assets but they are less favorable than during the previous months. While the macroeconomic cycle indicators remain well oriented, liquidity conditions are expected to become less supportive. Earnings growth remains a positive and will offset part of the normalization of fiscal and monetary policy. Equity valuations are neutral (equity markets remain expensive on an absolute basis but attractive relative to bonds) while market technical indicators are turning less favorable.

INDICATOR #1

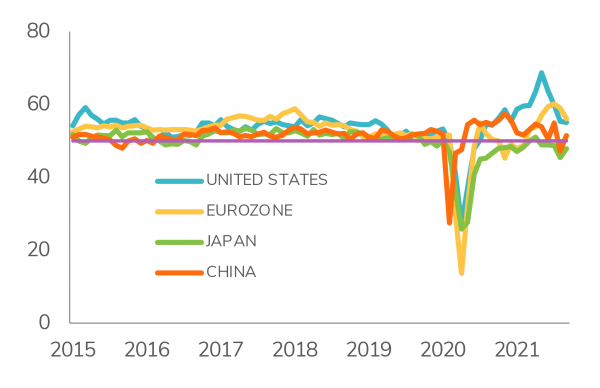

Macro Economic Cycle: Positive (unchanged)

The global economy has mostly completed a solid recovery now that Continental Europe has experienced the vaccine-driven activity outburst previously witnessed in the US and the UK. Developed economies are now entering a Growth phase where economic expansion will remain strong but less spectacular than in the past 12 months, increasingly fueled by private sector demand (household consumption and business investment) while pandemic-related governments and central banks support will be gradually withdrawn.

The recovery has been milder in large Emerging Economies, essentially due to pandemic developments. Growth prospects appear somewhat less attractive than in Developed Markets going forward in an environment where global liquidity growth will slow down, US interest rates should move higher and the US dollar get firmer.

Overall, around a high-probability central scenario of strong global growth going forward, the balance of tail risks is shifting toward some risks of disappointment and unexpected bad news for the months ahead.

In the meantime, inflation momentum appears to be peaking after the rebound witnessed in the first half of this year. 2020 base effects will start to fade away and will deflate current high inflation rates. On top of that, the June Fed meeting has capped the rise in medium and long term inflation expectations. By signaling that it is ready to start the normalization of its monetary policy, the US central bank has dampened concerns of a potential growth and inflation overheating. The ECB is also preparing for the beginning of its monetary policy normalization. With monetary policy and fiscal policy normalization ahead, growth and inflation will gradually converge toward their pre-pandemic trends in 2022. Energy price developments are a short-term upside risk for inflation but could rapidly turn into a headwind for growth if their rise is sustained.

INDICATOR #2

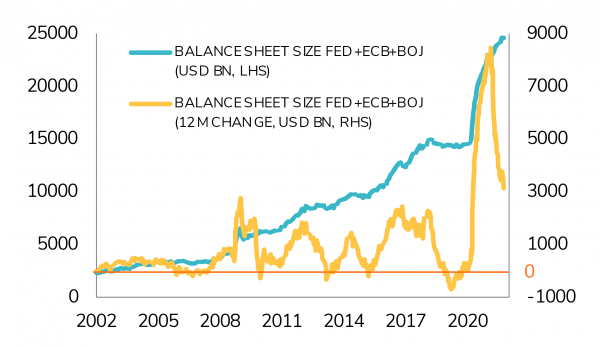

Liquidity: Neutral (was positive previously)

Monetary and fiscal stimulus have been identified as major drivers of the ongoing global economic recovery. On the monetary policy side, we note that G3 central bank balance sheets continue to expand but at a much slower pace than 12 months ago. The rate hike cycle has already started in emerging markets and some developed markets central banks are tempted to follow.

The impact of fiscal policy on GDP is turning negative especially in developed countries. The US, for instance, will face a fiscal cliff in 2022.

INDICATOR #3

Earnings Growth: Positive (Unchanged)

Both earnings growth momentum and revision remain positive although we note that MSCI World earnings per share revisions have peaked. In the medium-term, we expect strong earnings growth to more than offset the coming gradual normalization in fiscal and monetary policy.

INDICATOR #4

Valuations: Neutral (unchanged)

From an absolute valuations standpoint, US equity valuations have become slightly more attractive over the last few weeks – albeit from a high level. On a relative basis (compared to bonds), we haven’t seen much improvement as government bond yields have been rising. That said, equity valuations relative to bonds remain attractive. The picture is similar in Europe, the UK and Japan.

INDICATOR #5

Market Technicals: Neutral (was positive previously)

On an aggregated basis, our technical indicators have been deteriorating recently. This is valid in particular for Market breadth which is declining as the percentage of US stocks trading above their 200 days moving average is falling below 70%. Sentiment indicators (volatility, put-call ratio) are also giving negative signals, i.e investors are too complacent (despite negative newsflow). Volume of traded stocks is also in the red zone when considering volume divergence indicators.

ASSET CLASS PREFERENCES

EQUITY ALLOCATION

From preference to positive

For the coming months, maintaining a positive bias toward equity allocation is still warranted but short-term headwinds and uncertainties plead for slightly reducing the exposure.

Equities remain clearly the most attractive asset class in the current environment of positive economic growth and low interest rates. Earnings growth has been strong in Q2 and is expected to remain solid in the quarters ahead. It will take the baton from multiple compressions as the driver of rising equity indices. The transition from Recovery to Growth in the macro economic scenario implies that sectorial and geographical leadership may gradually return toward the secular “Japanification” trends. In this context, European markets are expected to particularly benefit from the solid global economic growth, given their more attractive valuations than US markets. Emerging Markets are expected to face headwinds from the combination of softer economic growth momentum for large Developed economies, a slowdown in global liquidity injections, a firmer US dollar and slowing momentum on commodity prices. The UK market is weakened by rising domestic inflation and growth concerns and should be tactically reduced.

Generally speaking, amid a positive environment for equity markets, the risk of a correction is increasing with central banks, downside risks to the economic growth outlook and earnings expectations that have been significantly raised. Selectively trimming equity exposure appears appropriate to navigate potentially more volatile markets in the short run.

FIXED INCOME ALLOCATION

Still cautious on duration, yield curve and spreads

US and Euro Yield curves are steepening while real rates are ticking up (but remain negative and historically low in the US). Long and medium-term inflation expectations are rising in Europe this year, but still below the ECB’s target. In the US, absolute inflation and growth levels warrant (sharply) higher yields and some technicals also turn in favor of rising US yields. In light of ongoing inflationary pressures and monetary policy normalization, we see upward risks on long term rates and are downgrading the exposure to government bonds from positive to cautious. In terms of preferences, we are upgrading the EUR Core curve and downgrading the USD Curve due to more pressure on EUR growth, more support from ECB and unfavorable technicals in US.

We remain cautious in all credit spectrum due to demanding valuations. However, a sell-off in US High Yield in sympathy with US equities could be considered as an opportunity to upgrade this segment. We remain positive on emerging markets (a sell- off in EM bonds materialized, offering a more attractive valuation) and continue to consider Asian High Yield as a buying opportunity. Our view on subordinated bonds remains positive. The segment looks mature and resilient and continues to offer some premiums while the current environment is still favorable to banks.

COMMODITIES

Still cautious and keep exposure to Gold

Commodities recent bull run remains overbought and seems to be somewhat driven by panic rather than pure fundamentals. We keep our cautious stance on the asset class. Gold’s upside potential still depends on how much lower US real rates can go.

FOREX

Bullish dollar

Real rates and macroeconomic momentum continue to weigh on the EUR/USD dynamics. Fundamental drivers still plead for a firm CHF over the medium term but the USD benefits from the current environment. UK stagflation risk weighs on GBP short term prospects.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

.png)