EQUITIES

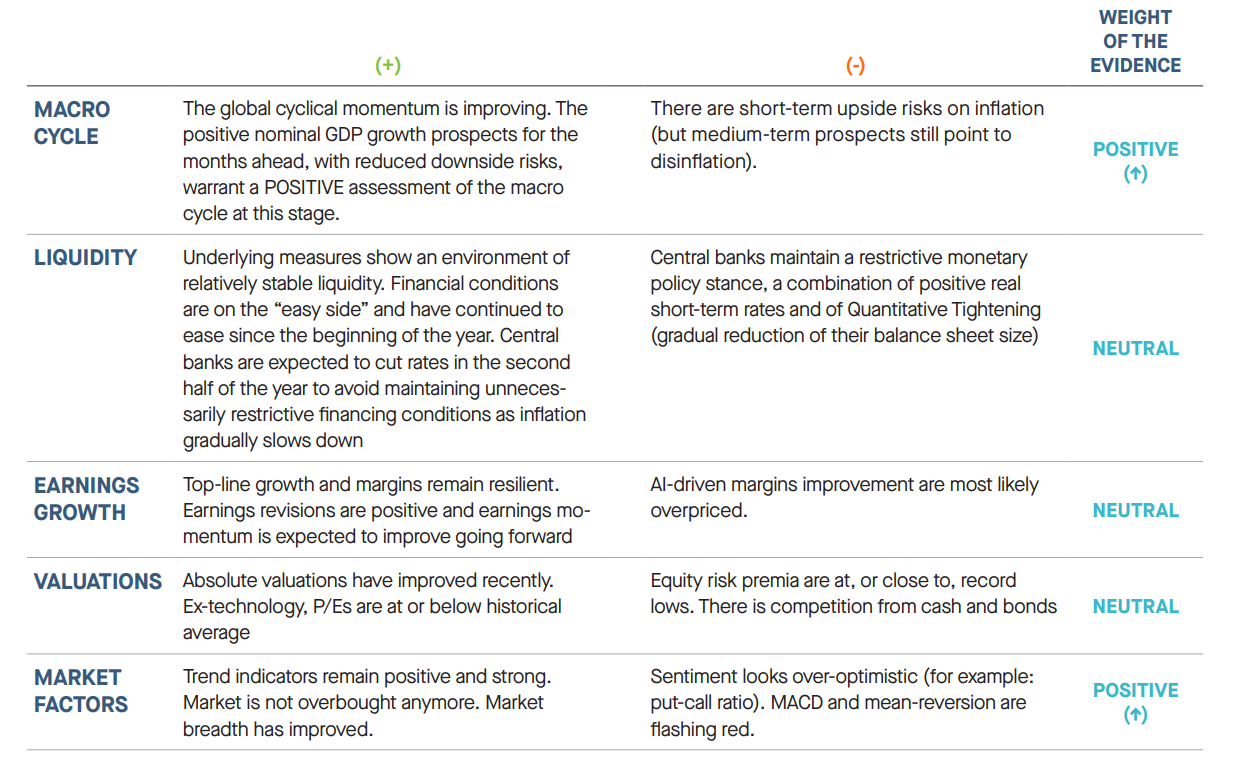

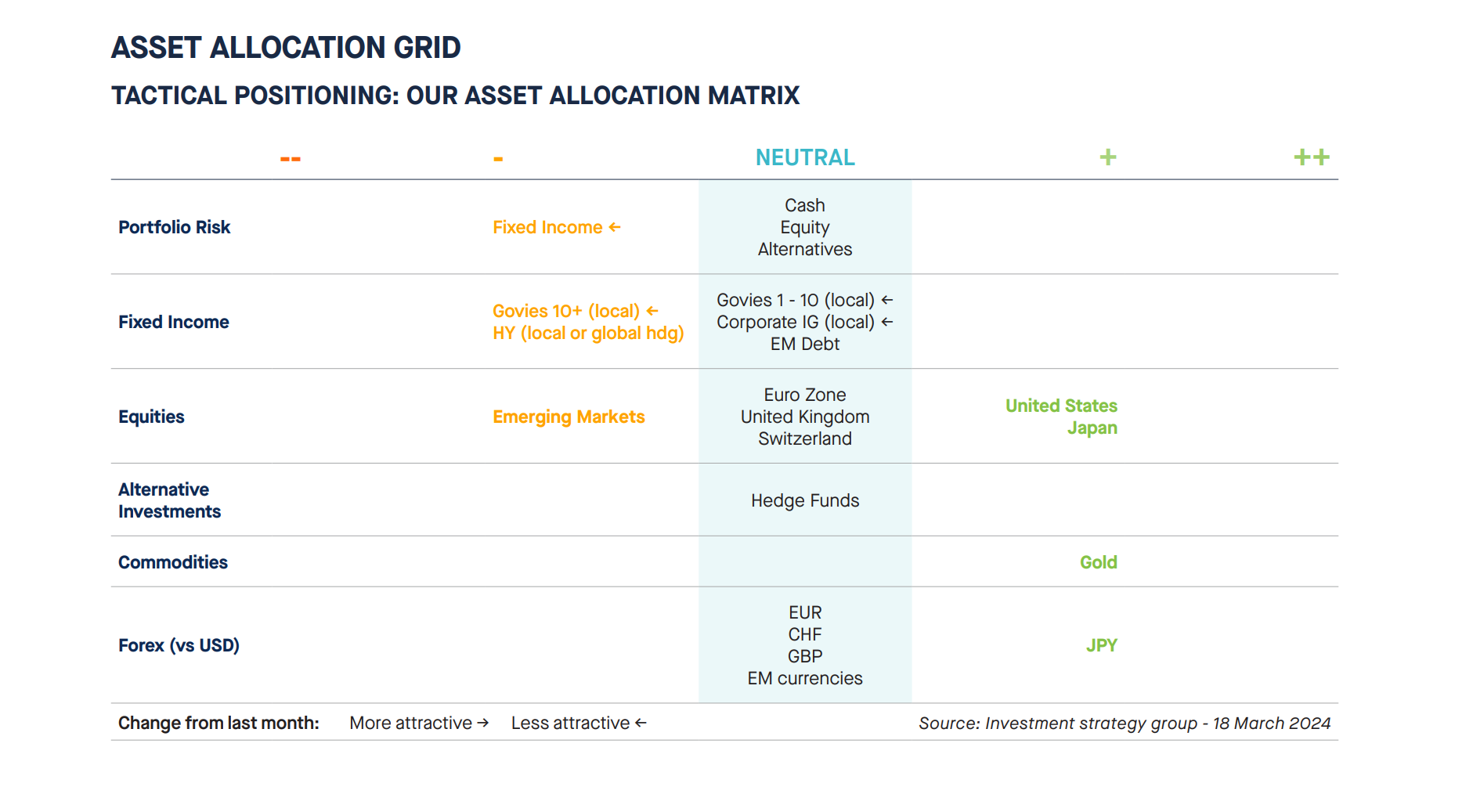

We remain NEUTRAL on equities as we think the strong performance of the past few months already reflects most of the improving macroeconomic outlook. The earnings momentum remains favourable. However, market sentiment and valuations seem a bit overstretched.

The macro regime remains supportive for equities as an asset class as global leading indicators are showing signs of a rebound and China is stabilising. Valuation is high in US large caps but remains more reasonable elsewhere while earnings are supportive.

1. The macro regime remains favourable for equities

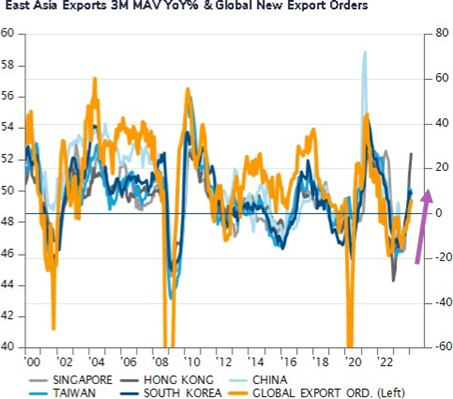

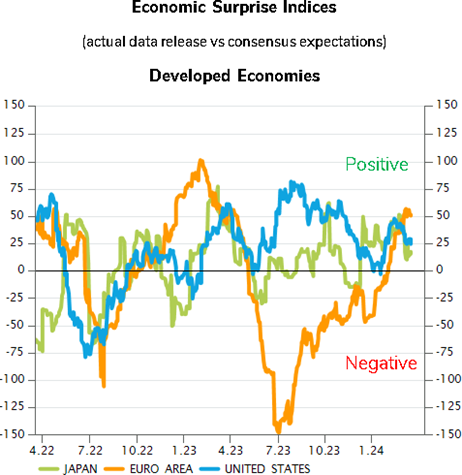

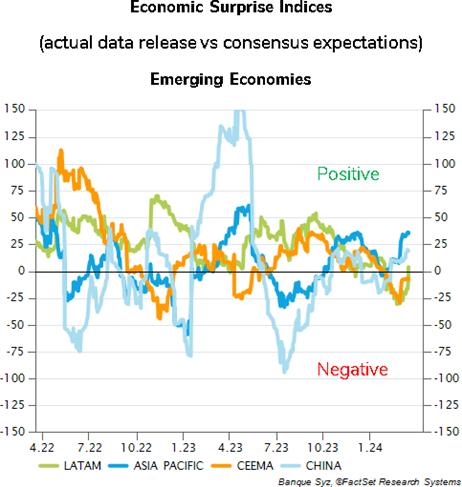

The global cyclical momentum is improving as shown by global leading indicators and this reduces the likelihood of downside risk in the near-term.

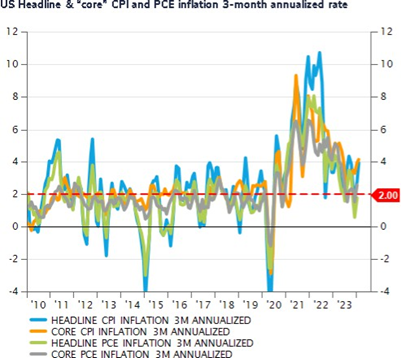

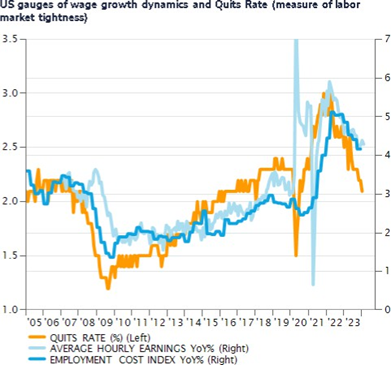

There is still near-term inflationary pressure, but medium- term prospects still point to disinflation, which is a support for equities and any interest cut by the Fed to reflect lower inflation will be a positive.

2. Positive earnings outlook

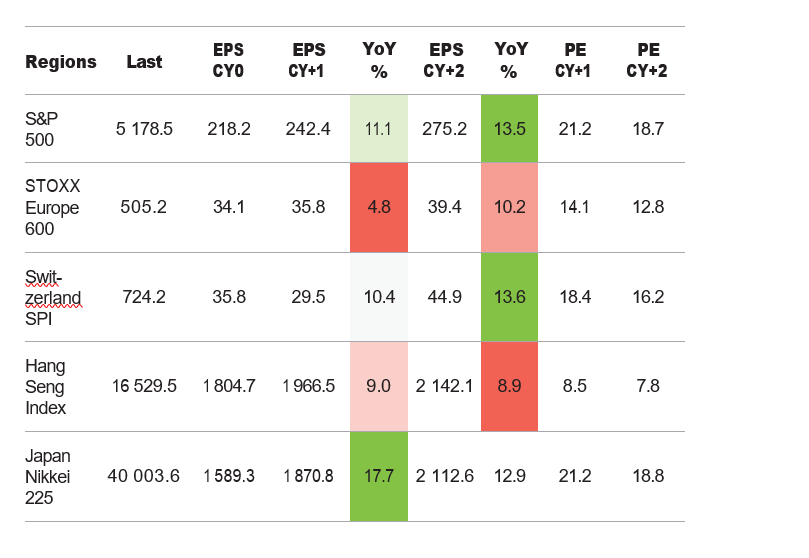

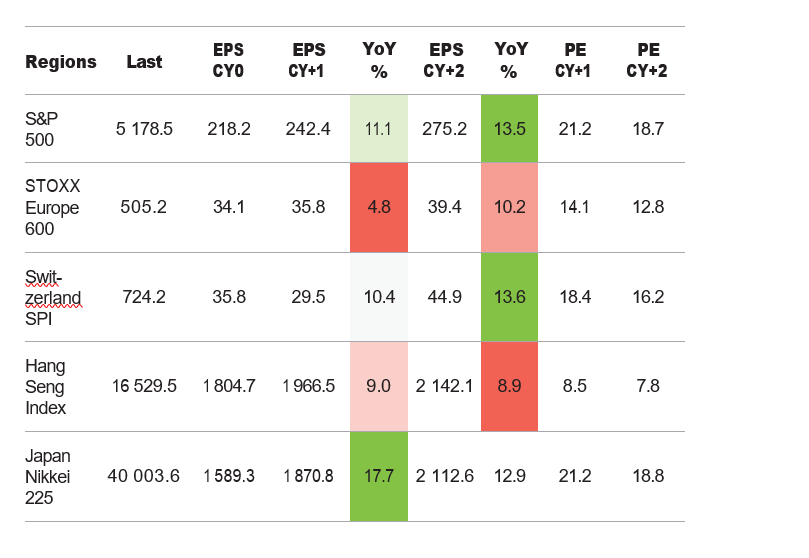

Earnings momentum remains strong with 11% and 17% yoy growth respectively for US and Japanese equities this year. For 2025, earnings growth is expected to accelerate in the US (+13% yoy), Europe (+10%) and Switzerland (+13%) while China is expected to remain steady (+9%).

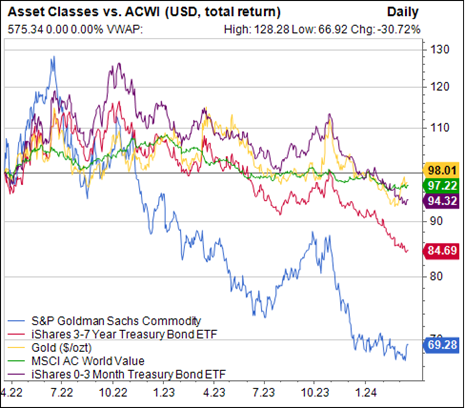

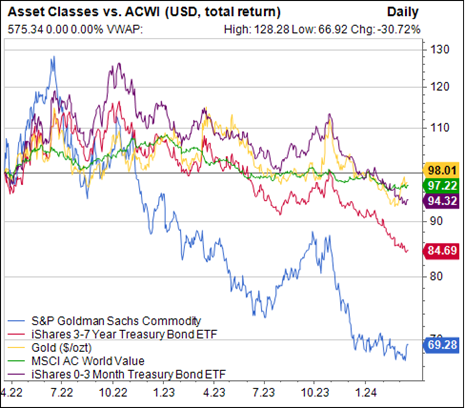

3. Good momentum vs. other asset classes

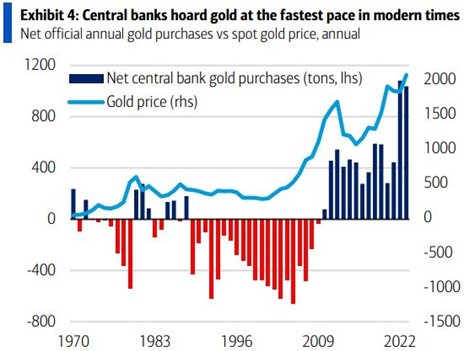

Equities continue to benefit from a favourable macro regime and are seen as an “edge” against inflationary pressure and money debasement. Most large companies have been able to pass through inflation pressure via price increases during the last couple years.

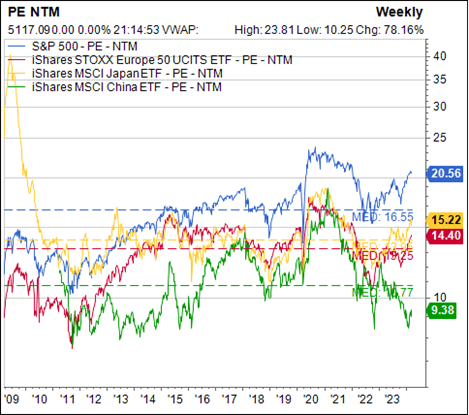

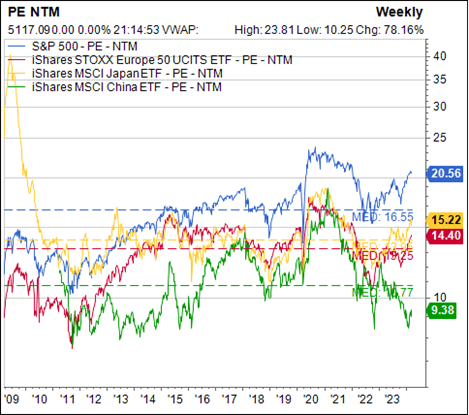

4. Valuation varies greatly within equity markets.

Valuation is stretched amongst US large cap names, but appears more reasonable when looking at Europe or Japan.

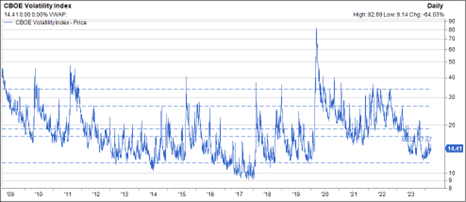

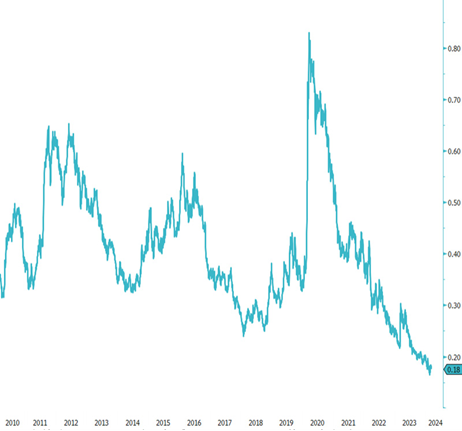

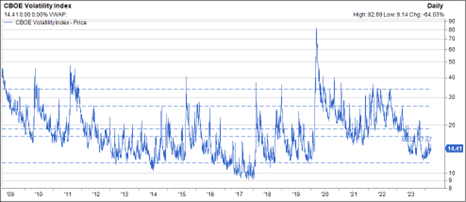

5. Risk environment and seasonality remains supportive.

The risk environment can quickly change, but the current low volatile environment combined with still a positive seasonality, remains in favour of the equity asset class.

From a regional/country standpoint, we maintain our slight preference for the US and Japan as earning growth is expected to continue this year and next.

We are neutral on Swiss equities. We also keep our neutral stance on the Eurozone/UK as earning momentum remains muted.

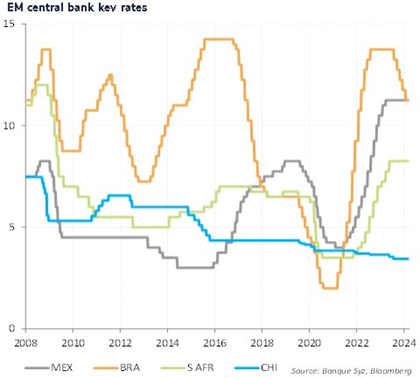

We are under exposed Emerging and Chinese equities as the dollar remains strong and, in the case of China, the lack of consumer and corporate confidence keeps us at bay for the time being. We note however that the market momentum has improved recently.

In the US, market concentration remains high, but we have seen some improvement in market breadth recently. The S&P 500 index remains expensive with an aggregate at PE at 20x. However, adjusted for the concentration, the S&P500 equal weight PE stands at 16x which is more in-line with historical averages.

FIXED INCOME

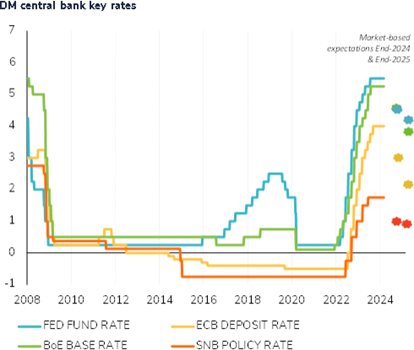

Our preference has moved from neutral to negative on Fixed Income. This is primarily influenced by our bearish perspective on the long end of the yield curve, coupled with a cautious approach towards Credit markets. Specifically, we have adjusted our rating on Investment Grade (IG) bonds from positive to neutral, while maintaining a slightly negative view on High Yield (HY) bonds.

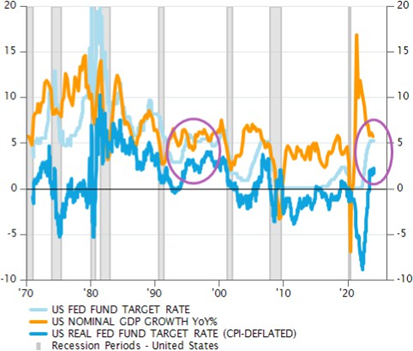

Our evaluation of government bonds is nuanced, taking into account the maturity of the securities. For bonds with maturities of less than 10 years, we hold a neutral stance. This position is supported by the presence of high real yields, an anticipated peak in central bank’s tightening, a shift towards disinflation, their relative value when compared to equities, and an improvement in correlations.

On the other hand, we exercise caution towards bonds with maturities exceeding 10 years. The presence of an inverted yield curve and negative term premiums diminishes their appeal, especially amidst ongoing interest rate volatility.

Although initial apprehensions regarding the supply of long- term bonds in early 2024 were notable, recent successful auctions — including the record-setting 10-year US Treasury issuance — and reassurances from Treasury Secretary Yellen regarding supply stability have introduced a degree of optimism. The market is adjusting to the realities of quantitative tightening, albeit a moderation in its pace is anticipated. Market expectations are now aligned with the Federal Reserve regarding the anticipated number of rate cuts in 2024.

.png)