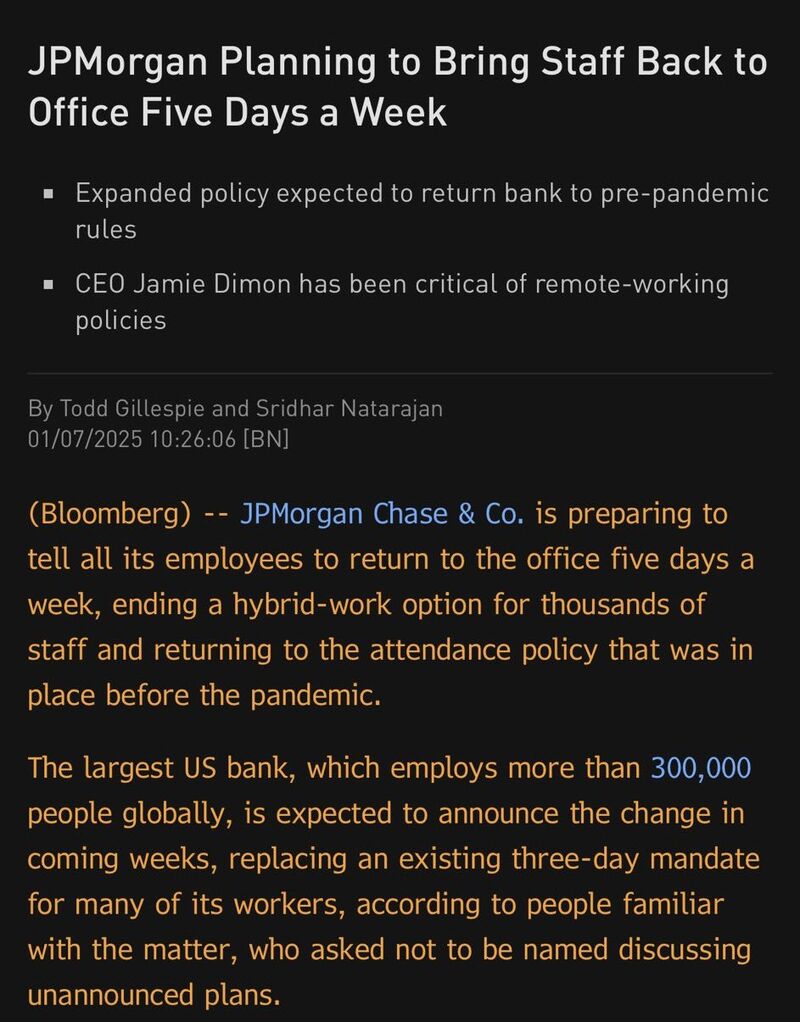

$JPM JPMorgan is preparing to tell all its employees to return to the office 5 days a week

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

👉 Morgan Stanley (NYSE: MS) has become the latest financial giant to abandon the Net-Zero Banking Alliance, a UN-backed coalition aimed at aligning banks’ financing activities with global net-zero emissions targets. The move follows recent exits by Citigroup (NYSE: C) and Bank of America (NYSE: BAC), and earlier departures by Goldman Sachs Group (NYSE: GS) and Wells Fargo (NYSE: WFC), marking a significant retreat from collective climate commitments by some of the world’s largest banks. 👉 These high-profile defections, driven by intensifying political and market pressures, cast doubt on the ability of voluntary financial coalitions to sustain ambitious climate action in a polarized environment. 👉 Launched in 2021, the NZBA aimed to transform the financial sector’s role in combating climate change. As part of the broader Glasgow Financial Alliance for Net Zero, it united over 140 banks across 44 countries, with members committing to reduce greenhouse gas emissions linked to their financing activities and to achieve net-zero emissions by 2050. 👉 NZBA members pledged to set interim 2030 emissions targets for high-impact sectors, including energy, transportation, and heavy industry, aligning their portfolios with the 1.5°C warming limit set by the Paris Agreement.. Source: Bloomberg, thedeepdive.ca

Credit card defaults are now up over 50% year-over-year. Defaults of seriously delinquent credit card loan balances have more than doubled over the last 2 years. Bottom-income consumers were hit the hardest due to years of elevated inflation and interest rates. Additionally, the savings rate of the bottom third is now 0%, according to Moody’s. Source: FT, The Kobeissi Letter

With Powell stating that there won’t be significant rate cuts next year and the yield curve un- inverting along with BTFP going away banks were hammered yesterday as most of them have BILLIONS worth of unrealized LOSSES in BONDS. Source: The Coastal Journal