Story #1 —

The global economy’s resilience

While a severe recession in 2023 appeared to be a major risk last year, the global economy is proving more resilient than expected. U.S. consumption (80% of GDP) continues to surprise positively, thanks in particular to the labor market. The December report showed stronger than expected job creation and a drop in the unemployment rate to 3.5%, which is its lowest level in 53 years.

The relatively mild winter has eased the energy crisis in Europe and reduced the risk of a deep winter recession. At the end of January, gas stocks in the European Union (EU) were about three-quarters full, compared to only about 35% at the same time last year. The average purchase price of natural gas in January was also about 55% below the average price in the second half of 2022.

With the end of China's zero-covid policy, markets are now anticipating a strong recovery in the Chinese economy in the first half of 2023, which should benefit both China and its trading partners in the region. As in Europe and the U.S., there is a considerable amount of excess savings in China and significant potential for a recovery in consumption after the tight confines of recent years.

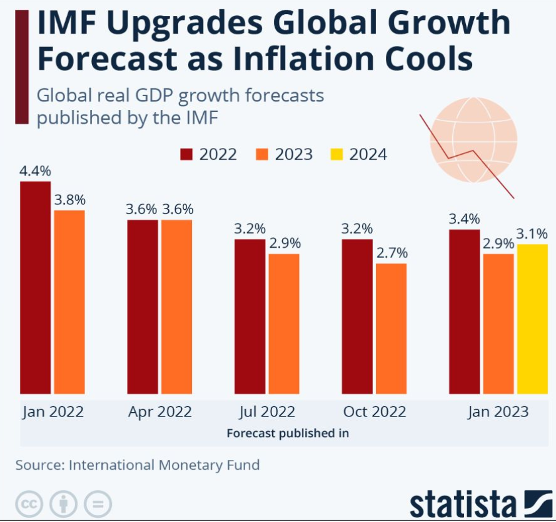

In its latest World Economic Outlook, the IMF paints a slightly less gloomy picture than it did three and a half months ago.

IMF Upgrades Global Growth Forecast as Inflation Cools

Source: Statista

.png)