Chart #1 —

A strong month for risk assets

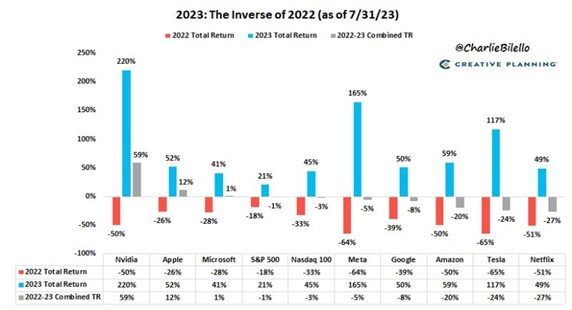

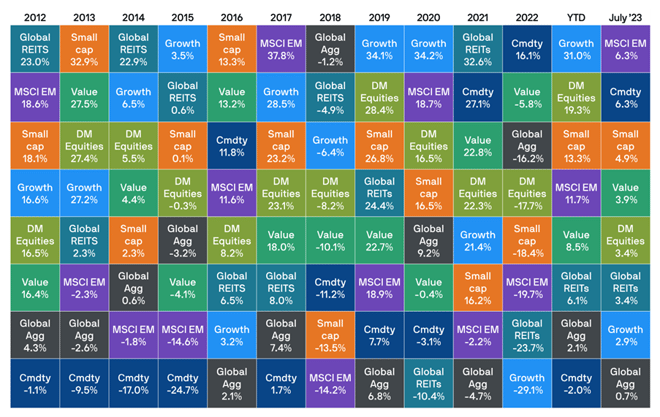

After a mixed performance in June, July was largely positive for assets across the board. The MSCI World (in $) recorded a 3.7% gain over the month. The S&P 500 was up 3.1% ; a 5th straight monthly gain while the Nasdaq advanced by 4.1%. While the strong equity performance in H1 was mainly sparked by the enthusiasm around Artificial Intelligence (AI ), market leadership has been broadening recently as economically sensitive parts of the market, including small-cap stocks and cyclical sectors, have outperformed in recent weeks.

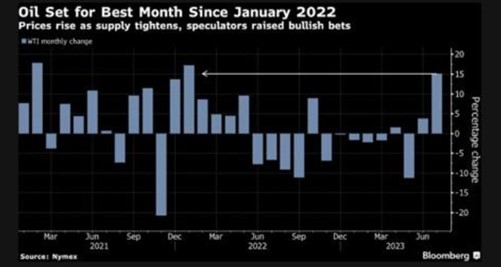

From a regional perspective, the MSCI Emerging markets (+6.3%) outperformed the MSCI Developed markets (+3.4%). Fixed income also recorded positive returns overall, with global bonds rallying 0.7% over the month. Commodity prices reversed some of their year-to-date losses, with the broad Bloomberg Commodity Index rising 6.3% over July (see chart #9).

Source: JP Morgan

.png)