What happened last week?

Central banks

Central banks were in focus this week, with the widely expected 25bps rate hike by the Federal Reserve (Fed). However, the Fed emphasized that all options are on the table for the next FOMC meeting, indicating a cautious and data-dependent approach. The US economy demonstrated unexpected resilience in Q2, with economic growth picking up steam, driven by strong consumer and business activity. Market expectations for another rate hike by year-end stand at only 38%. In Europe, the European Central Bank (ECB) delivered a 25bp rate increase, raising the depo rate to 3.75%. The ECB highlighted the forceful transmission of past rate hikes, but also acknowledged the tightening of financial conditions, which are increasingly dampening demand. ECB President Lagarde expressed concerns about the near-term economic outlook and emphasized the need for an open mind regarding decisions in September and beyond. Consequently, market expectations for another rate hike by year-end have slightly decreased to a 70% probability. The main event of the week, however, came from the Bank of Japan (BoJ), which made a significant move by amending its yield curve control. The BoJ shifted away from the previous rigid 50 bp band in 10-year JGBs, now considering it a reference point, and instead opted for fixed rate purchases at +100 bp.

Credit

The credit market continues to reflect its optimism towards the current economic situation, with decreasing inflation and a resilient economy, resulting in tighter credit spreads for both Investment Grade and High Yield bonds. US Investment Grade spreads tightened by 5bps to 117bps, while High Yield spreads tightened by 6bps to 370bps, reaching their lowest level since April 2022. The CDX HY index is now just above 400bps, a level not seen since early February. US HY has posted an impressive 1% gain this month and 6.5% year-to-date. However, this remarkable performance in the US HY market has triggered massive hedging activities, with $7 billion of shorts materialized in the two largest junk bond ETFs. In Europe, despite slightly negative performance for government bonds, the European credit market managed to stay in positive territory, with a 0.1% gain for Investment Grade and a 0.5% gain for High Yield bonds. The Markit iTraxx Xover index broke the lowest point of the year (378) and ended the week at 376bps, the lowest level since April 2022. Additionally, despite the ECB's decision to remove interest on minimum reserves for banks, AT1 bonds saw a remarkable gain of close to 1% this week, demonstrating their resilience and positive performance in the current market conditions.

Rates

The week saw the reverse stagflation scenario materializing as softer inflation and solid growth and unemployment data drove the US yield curve out of the -100bps territory. The front end of the curve remained steady, with the US 2-year yield trading just below 4.9%, up 4bps over the week. However, the long end of the curve responded to two main factors: the strong economic data of the week and the Bank of Japan's decision to leave yield curve control. Consequently, the 10-year US yield surged more than 10bps over the week, briefly crossing 4% before settling just below. While there were the first signs of inflows to US TIPS (inflation protection) since August 2022, US breakeven rates (inflation expectations) remained relatively stable over the week. In Europe, ECB President Lagarde did not discuss the balance sheet, and there were no changes to PEPP, which supported peripheral spreads. The spread between Italian and German 10-year yields close below 160bps on Thursday. However, the BoJ's decision put some pressure on spreads, particularly on peripheral (+3bps) and France (+2bps), and on curves, with the German yield curve (2s10) now inverted at about -55bps, the highest point since early June. In Japan, the 10-year yield reached 0.59%, its highest level in 9 years. It's worth noting that US Treasuries will become even less attractive for Japanese investors as the yield of the 10-year US Treasury is now at -1.7% in Yen-hedged terms compared to +0.6% in the local Japanese market, incentivizing further outflows from US Treasuries.

Emerging market

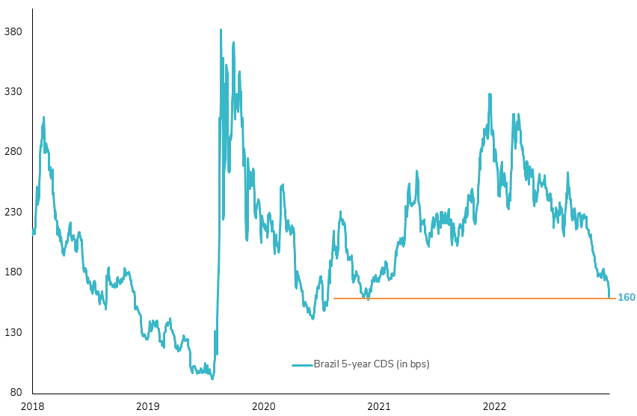

EM debts had a good week in terms of excess returns but ended the week flat due to the negative performance of US Treasuries. In China, the week was marked by high volatility, with Chinese high yield bonds experiencing their largest Monday's losses (-9%) of 2023, driven by JPM's warning that liquidity concerns are unlikely to ease anytime soon in the real estate sector. However, the market rebounded one day later after the Politburo signaled more real estate support alongside pledges to boost consumption and resolve local-government debt, even as it fell short of announcing large-scale stimulus. The China real estate market closed the week in positive territory. In Latin America, positive news came with the rating upgrade of Brazil to BB by Fitch. The Brazil 5-year CDS hit 160bps (down 14bps over the week) for the first time since June 2021. While Fitch downgraded PEMEX to B+ last week, the company has received a USD 4.2 bn capital injection from the Mexican Finance Ministry to help fund upcoming debt maturities. EM local debt was up 0.3% over the week, benefiting from a slight weakness in the US dollar.

.png)