Summary of Fed decision (9/20/23)

- Fed PAUSES rate hikes, leaving rates unchanged - Holds benchmark rate in 5.25-5.5% target range.

- 12 Fed officials see 1 more rate hike by the end of this year/ 7 Fed officials see no more rate hikes (one Fed member is projecting a 6.125% End 2024 rate...)

- Fed sees rates higher for longer -> Dot plot of rate projections shows most policymakers still foresee one more hike this year, but median 2024 and 2025 rate projections rose by a half-percentage point, a signal that the Fed expects rates to stay higher for longer

- Fed still sees “core” inflation at 2.6% in 2024. Median projection for economic growth in 2023 jumps to 2.1% from 1% in June; officials significantly reduce unemployment rate forecasts and now expect jobless rate to peak at 4.1%, rather than 4.5%.

Statement repeats prior language saying officials are considering “the extent of additional policy firming that may be appropriate”; Fed acknowledges job gains have “slowed” but says they “remain strong”.

Interestingly, Powell added that he would not call soft landing a base line expectation, hence sharing his fears that keeping real rates for a long period of time creates some downside risks for the economy and the markets. This sentence is slightly surprising given the generally hawkish statement.

Market action

The dollar rose, US Treasury real rates rose (especially at the front end, leading to further curve inverting) and equity markets pulled back on the session (especially long duration stocks, with Nasdaq underperforming).

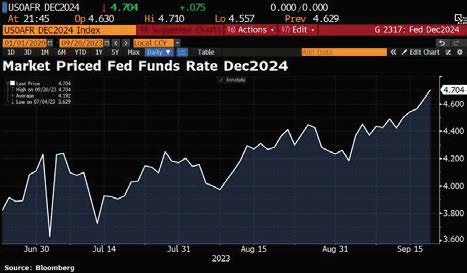

Fed futures now, no longer price rate cuts until September 2024.

To put this in perspective, three months ago, futures were expecting 4 rate cuts in 2023. Now, interest rates are expected to be on pause for at least 1 year.

This chart tells the story: the rate priced in for the Fed’s December 2024 meeting hit a new high for this cycle at 4.7%, meaning investors have sharply trimmed their hopes of interest rate cuts in 2024.

Our take

A "Goldilocks" scenario, characterized by a cooler economy that's neither too cold nor too hot, and the anticipation of the Fed pausing and then cutting rates, was what the market started to factor in during the first half of the year.

While certain macroeconomic indicators suggest an economic slowdown (e.g., the latest job market data), concerns about a higher fiscal deficit (resulting in more supply), a sustainable rebound in oil prices, and an upward trend in long-term US rates are disrupting this equilibrium. This disruption is triggering a shift toward the narrative

of "persistent inflation and sticky interest rates", placing pressure on equities and valuations.

Yesterday's statement by the Fed and Powell further supports this less optimistic narrative by signaling the Fed's clear intention to maintain higher rates for an extended period. In this context, we cannot rule out the possibility of another rate hike by the end of the year and an upward repricing of the US yield curve, as the market is still expecting even more rate cuts than what the Fed anticipates for 2024.

Our core scenario remains unchanged. While market volatility may persist in the short run, especially during the historically turbulent months of September and October, we view equity pullbacks as the opportunity for buying. Additionally, we continue to gradually extend the duration of our fixed income portfolio.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Flash note

.png)