Our conclusions are that:

• The debt ceiling debate and concerns will likely grow in intensity as we get closer to the deadline, likely to be hit during the summer

• Until then, and possibly beyond, concerns around a

“technical” default of the United States may continue to rise.

• As during previous episodes (especially summer 2011), this would likely cause volatility in financial markets, with downward pressures on US Treasury securities maturing in the summer, for which the reimbursement could be postponed till the debt limit is finally raised.

• Importantly, the impact should be felt essentially by those short-term US Treasury bonds (at risk of delayed reimbursement), and by assets linked to US economic growth (typically equity markets).

• Bonds issued by corporate, especially those with strong balance sheet/high investment grade ratings, should not be overly impacted by those potential developments. For the most solid companies, their bonds may even benefit temporarily from the situation as some investors are likely to see them as attractive alternatives to replace their customary holdings of short-term US Treasury Bills.

• Until then, and possibly beyond, concerns around a

“technical” default of the United States may continue to rise.

• As during previous episodes (especially summer 2011), this would likely cause volatility in financial markets, with downward pressures on US Treasury securities maturing in the summer, for which the reimbursement could be postponed till the debt limit is finally raised.

• Importantly, the impact should be felt essentially by those short-term US Treasury bonds (at risk of delayed reimbursement), and by assets linked to US economic growth (typically equity markets).

• Bonds issued by corporate, especially those with strong balance sheet/high investment grade ratings, should not be overly impacted by those potential developments. For the most solid companies, their bonds may even benefit temporarily from the situation as some investors are likely to see them as attractive alternatives to replace their customary holdings of short-term US Treasury Bills.

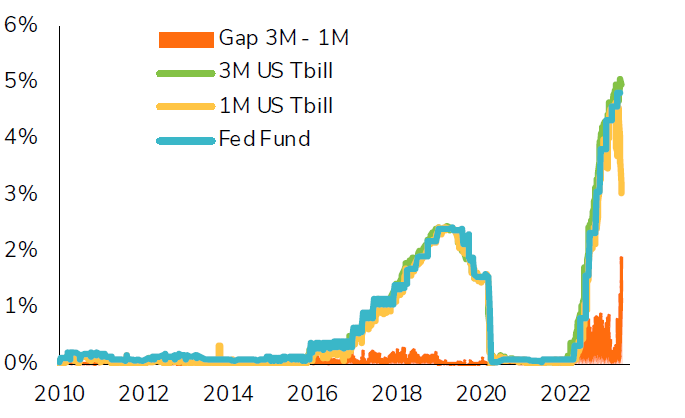

US short-term interest rates (Fed fund rate, 1-month & 3-month TBill rates) and 3m/1m differential

As concerns of a US technical default rise, investors are ready to give up some yield to avoid being exposed to a missed payment by the US Treasury. 1-month rates incorporate a large premium for TBill maturing before the summer, yielding only 3% while 3-month rates and Fed Fund rates are close to 5%. The widest gap ever recorded, and a good illustration of rising concerns around this issue.

.png)