What happened last week?

Central banks

Last week, the Federal Reserve (FED) raised interest rates by 25 bps, as expected. The FED suggested that this could be the last rate hike of this cycle, while leaving the door open for further tightening of monetary policy if no progress is made on inflation. On Friday, St Louis Fed President Bullard said he favored a rate hike to slow inflation, while Chicago Fed President Gollsbee said it was too early to judge what policymakers should do at the next (June) meeting. In Europe, the ECB announced its seventh consecutive rate hike and plans to end reinvestment (QT acceleration) under the APP from July 2023. Despite a smaller hike (25 bps), Ms Lagarde stressed that the ECB was not stopping at the current level. The market now expects two more hikes in June and July, which would bring the final ECB deposit facility rate to 3.75%. In Norway, Norges Bank raised its key rate by 25 bps to 3.25%, as expected, while in Australia, the RBA made a surprise 25 bps increase to 3.85%, but also changed its forecast to suggest that further tightening is no longer the base case.

Credit

It was a difficult week for US credit, with investment grade (IG) bonds falling 0.6% while high yield (HY) bonds lost 0.4%. This negative performance was due to the rise in weaker investor sentiment which led to a widening of US credit spreads: +10bps to 146bps for IG and +20bps to 471bps for HY. In Europe, corporate bonds held up better with only a modest widening of credit spreads (around 5bps) allowing small gains for IG (+0.1%) and HY (+0.2%) bonds. The week was more complicated on the AT1 market in the face of the First Republic Bank failure in the US. The iBoxx Europe AT1 index lost 0.9% over the week.

Rates

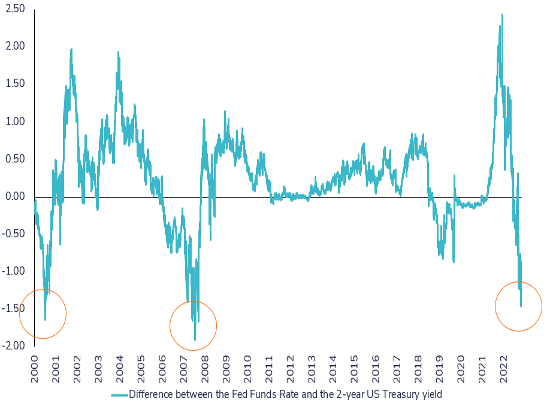

In the US, Treasuries erased almost all of their weekly gains on Friday after the release of strong economic data (employment and wages). The 10-year US Treasury yield ended the week up 2 bps at 3.45%, while the 2-year yield fell 9 bps to 3.91%. It is worth noting that the difference between the 10-year and 5-year Treasury yields ended the week in positive territory for the first time in a year. It is worth noting that this part of the curve was the first to turn negative in March 2022. In Europe, the situation is similar to that in the US, with a slight bull steepening of the German yield curve. The German 10-year yield ended the week down 2 bps at 2.29%. Peripheral spreads widened following the ECB's QT acceleration announcement, with the difference between Italian and German 10-year yields reaching 190bps for the first time since mid-March. In China, the 10-year government yield fell to 2.74%, the lowest point in 2023.

Emerging market

In local currency terms, emerging market bonds were the best performers of the week, with a gain of 0.8%. This performance was mainly due to the weakness of the US dollar against emerging market currencies. In hard currency terms, emerging market sovereign bonds fell by 0.1% while corporate bonds were flat for the week. Chinese real estate bonds continued to fall (-7% on the week). Finally, the Brazilian Central Bank maintained the SELIC rate at 13.75% for the sixth consecutive period.

.png)