What happened last week?

Central banks

Last week, the Bank of England (BOE) raised interest rates by 25 basis points to 4.5% and indicated that more rate hikes are likely, in line with market expectations. The market currently anticipates another hike in June with a probability of over 80%, and there is still a probability of more than 50% for another hike in August. This would bring the BOE's terminal rate to 5%, which is the current level of the Fed Funds rate. In the United States, as the debt ceiling deadline approaches, all attention is focused on this matter, and the market does not foresee a rate hike at the upcoming Federal Open Market Committee (FOMC) meeting. While Fed members have left the door open for another hike in June, the overall trend suggests a pause and no rate cuts in 2023, as indicated by the recent comment from Fed member Bostic. In Europe, although the market is still expecting two more rate hikes in June and July, some European Central Bank (ECB) officials have hinted at the possibility of another rate hike in September, which would bring the ECB's terminal rate to 4%.

Rates

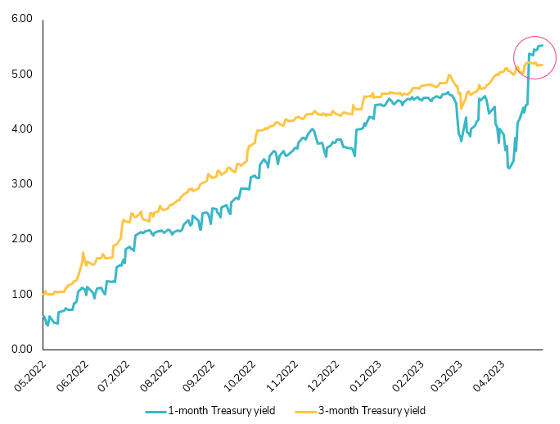

In the U.S., Treasury yields increased slightly during the week, as progress in the U.S. Consumer Price Index (CPI) and worsening initial claims were not enough to offset the highest level (3.2%) in the University of Michigan's long-term inflation survey since 2011. The 10-year U.S. Treasury yield finished the week up by 2 basis points at 3.47%, while the 2-year yield rose by 8 basis points to 3.99%. It's worth noting that the MOVE index, which measures volatility in interest rates, reached a one-month low of 120.5. In Europe, government bonds ended the week with a positive performance, with core rates returning +0.1%, while peripheral rates remained stable. The front-end of the German yield curve underperformed, as the 2-year yield increased by 2 basis points, while the 10-year yield decreased by 2 basis points to 2.27%. Surprisingly, rates in the UK remained stable despite the monetary policy decision announced by the Bank of England on Thursday. The British 10-year yield concluded the week at 3.79%, and the 2-year yield at 3.80%. It's worth noting that the difference between the 2-year and 30-year yields was less than 5 basis points.

Credit

The deterioration in US credit continued last week, with investment-grade (IG) bonds experiencing a 0.2% decline, while high-yield (HY) bonds lost 0.1%. However, credit spreads remained relatively stable in cash bonds, ending the week at 145 basis points for IG and 471 basis points for HY. In the synthetic market (CDS market), there was a slightly weaker sentiment, with CDX HY spreads increasing by 5 basis points to 497 basis points. In Europe, the week was more positive for corporate bonds, benefiting from the positive performance of European rates. High-yield corporate bonds outperformed investment-grade corporate bonds, with both posting positive returns of 0.3% and 0.1%, respectively. It's worth noting that certain segments in European high yield are starting to trade at tighter levels, as the B-rated segment is at its tightest level compared to the BB-rated segment since 2017. The AT1 (Additional Tier 1) market also saw positive performance, with the iBoxx Europe AT1 index gaining 0.2% over the week.

Emerging market

Emerging market corporate bonds fell 0.2% last week, as did U.S. Treasuries. In local currency terms, emerging market bonds retraced half of their earlier gains for the month, primarily due to the strengthening of the U.S. dollar. Chinese real estate bonds faced ongoing challenges and recorded another drop of 6% last week. However, the People's Bank of China (PBOC) maintained the 1-year MLF (Medium-Term Lending Facility) rate unchanged. In Turkey, volatility persisted as the initial results of the presidential election suggested a run-off in two weeks' time. Meanwhile, Chile's central bank decided to keep its key rate unchanged at 11.25% on Friday, as expected. On the other hand, Argentina raised its key rate by 600 basis points to 97% as inflation accelerated to 109%.

.png)