What happened last week?

Central banks

The central banking narrative for February was underscored by a call for prudence and patience from Federal Reserve members, reflecting concerns over prematurely easing interest rates amidst a resilient U.S. economy and persistently high inflation, with core PCE at 2.8%. This cautious stance was reiterated this week, with Fed officials like Daly and Collins open to rate reductions under worsening economic conditions, while others, including Bowman and Schmid, urged patience, advocating for a thorough assessment of inflation trends and the economic impact of prior tightening before contemplating rate cuts. Market expectations have adjusted to anticipate only three rate cuts in 2024, aligning with the Fed's outlook, with the first expected in June—a stark contrast to the six cuts previously anticipated for as early as between March and May. In Europe, ECB members such as Panetta and Vasle acknowledged the swift inflation decline, hinting at a forthcoming easing cycle, dependent on inflation and wage growth data. Despite differing opinions within the ECB, with some members advocating for early rate cuts to foster growth and others, like Luis de Guindos, advising a wait until inflation nears the 2% target, the consensus veers towards a cautious and patient approach. Market expectations for the ECB have also been recalibrated, with the first rate cut now seen in June rather than April, and predictions of 3 to 4 rate cuts in 2024, down from nearly 7 forecasted a month ago. In the UK, BOE's Dave Ramsden highlighted that certain inflation indicators remain high, necessitating further evidence of a downward inflation trend before considering rate adjustments. Market expectations remain largely unchanged for the UK, with a first rate cut anticipated in August, though the total expected cuts for 2024 have been revised down to three from five. In Japan, BOJ Board Member Takata hinted at a potential shift away from the negative interest rate policy, citing progress towards the inflation target and suggesting a move towards less accommodative monetary policy. However, Takata clarified that any policy shift would not automatically trigger continuous rate increases, ensuring that policy settings would stay supportive of the economy. Finally SNB Chairman Thomas Jordan announced his departure at the end of September 2024, amid speculation among some market participants that the SNB might lead in rate cutting efforts.

Credit

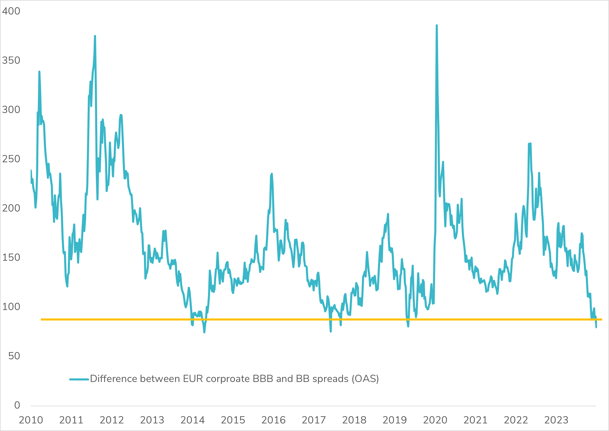

In 2024, high beta credit segments have emerged as the standout performers in the fixed income arena. The U.S. high yield (HY) market, in particular, has seen gains, contrasting with the more subdued performance of U.S. Investment Grade (IG) corporate bonds. The Vanguard USD Corporate Bond ETF exemplifies this trend, with a downturn of -1.3% YTD, shedding -1% in February alone. Despite this, the credit market remains robust, underpinned by record-setting U.S. Corporate Bond sales exceeding $150 billion in February. The demand is evident from oversubscribed books and minimal concessions, showcasing the market's health and investor confidence. Money market fund flows, although decelerating, continue to be positive, reflecting a cautious but optimistic investor sentiment. The iShares USD HY Corporate Bond ETF, benefiting from spread tightening and shorter duration, has recorded a modest increase of 0.2% in February, contributing to a +0.8% gain YTD. This performance is supported by a tightening differential between US BBB and BB spreads to 113bps, the narrowest since September 2021. However, USD HY funds have observed modest net inflows, suggesting a careful optimism among investors. As of February's end, IG and HY credit spreads stood at 96bps and 312bps, respectively. In Europe, the narrative mirrors that of the U.S., with HY and subordinated debts leading the pack. The iShares EUR HY Corporate Bonds ETF and the WisdomTree AT1 CoCo Bond ETF have seen positive movements in February, up 0.4% and 0.3%, respectively, and maintaining positive momentum YTD. The primary market for AT1 has remained vibrant, highlighted by Abn Amro's issuance of a new AT1 bond, marking its first since 2020. European fund flow technicals bolster the sector's strength, with EUR IG funds and HY counterparts experiencing net inflows of $6 billion and $2.1 billion, respectively. Nevertheless, the rise in interest rates has placed pressure on the iShares EUR Core Corporate Bonds, resulting in a -1% performance YTD. IG and HY corporate spreads in Europe closed February at 121bps and 348bps, reflecting a market that, while facing rate challenges, continues to find pockets of resilience and opportunity in high beta segments.

Rates

U.S. Treasuries closed the month with a modest gain of 0.2% over the week for the Bloomberg U.S. Treasuries Index. February saw a notable increase in yields, moving from 3.91% to 4.25%, influenced by a recalibration of rate cut expectations and a more resilient U.S. economy. Consequently, U.S. Treasuries declined by 1.3% in February, exacerbating a year-to-date performance of -1.6%. The U.S. yield curve flattened slightly in February, from -30bps to -37bps, maintaining a consistent year-to-date slope of -37bps. Notably, the yield increase was distinctly characterized by differing factors across the curve. Intermediate and long-term rates surged primarily due to real yield increases, with the 10-year U.S. Treasury real yield rising from 1.66% to 1.94%, whereas long-term inflation expectations, as measured by the 10-year U.S. breakeven rate, only ascended by 8bps to 2.32%. Conversely, the short end of the curve experienced a rise predominantly driven by breakeven rates, escalating from 2.33% to 2.78% in February. Last week's record-breaking U.S. 2-year auction saw strong market reception, while the 5-year auction exhibited slight softness, evidenced by a 0.8 bp tail. To date, U.S. TIPS have outperformed nominal bonds in 2024, registering only a 0.7% loss compared to the 1.6% decline in nominal Treasuries. European government bonds faced a sharper drop of 1.6% in February, influenced by recalibrations similar to those in the U.S. and signs of a more robust European economy. The 10-year German yield climbed from 2.05% to 2.43% in February. However, the German yield curve significantly flattened, with the spread between the 2-year and 10-year yields narrowing to -50bps from -26bps at the month's start. Despite slowing inflation, the Eurozone CPI unexpectedly came in at 3.1%, prompting markets to adjust their ECB rate cut expectations. Peripheral bonds outperformed, benefiting from a risk-on environment, with the spread between the 10-year Italian and German yields closing at 143bps, a two-year low, down from 156bps a month prior. In the UK, government bond yields rose, mirroring trends in the U.S. and Europe, despite inflationary improvements. The Bloomberg UK Government Bond Index fell by 1.2% in February, with the 10-year UK yield increasing by 32bps over the month. The UK yield curve experienced a significant steepening to -18bps from -47bps. In Japan, the 2-year yield reached a 14-year high at 0.18%, following BOJ Board Member Hajime Takata's hints at ending the negative interest rate policy. Meanwhile, the 10-year Japanese yield remained stable at 0.7% throughout the month.

Emerging market

2024 has unveiled a surprising standout within the fixed income landscape: the Emerging Market (EM) corporate bonds index. Demonstrating robust performance with gains exceeding 1% YTD and +0.4% in February alone, this segment has outshone its counterparts thanks to significant spread tightening. By the close of February, the Bloomberg EM Corporate Bond Index showcased a notable compression, with spreads narrowing to 236bps, reflecting a substantial 30bps tightening over the month. This tightening has propelled EM corporate bonds to the forefront of fixed income performance this year. EM sovereign bonds, on the other hand, have shown resilience with a sharp rebound in February, culminating in a +0.7% gain. Despite this uptick, the segment has yet to fully recover from its January setbacks, posting a -0.6% performance YTD. The strength of the US dollar has posed challenges for EM local debt, resulting in a -0.9% YTD performance, although February saw a modest recovery of +0.2%. China's real estate bond segment continued its upward trajectory in February, achieving a +2.7% gain, buoyed by additional financial support to the sector. Nevertheless, the backdrop remains challenging, as evidenced by a 60% year-over-year decline in new home sales from the country's top 100 real estate firms. Amid these mixed signals, significant developments have emerged elsewhere in the EM spectrum. The United Arab Emirates' monumental $35 billion investment commitment to Egypt stands as a pivotal move to mitigate the nation's foreign-exchange crisis. This landmark agreement, Egypt's largest to date, is expected to catalyze over $150 billion in subsequent investments for the projects, drawing Egypt nearer to clinching a new accord with the International Monetary Fund. This substantial inflow of investment capital is poised to substantially elevate investor confidence in Egypt's economic prospects. In Latin America, Costa Rica's credit profile received a boost from Fitch, which upgraded the country's long-term issuer default rating to BB from BB-, enhancing its creditworthiness albeit still below investment grade. The week also brought focus to Braskem, a leading global petrochemical producer based in Brazil, which faced a downgrade to junk status by S&P. Citing challenging industry conditions and a slow recovery outlook, S&P adjusted Braskem's rating to BB+ with a Stable outlook. While this downgrade places additional pressure on Braskem, the stable outlook and recent positive operating trends suggest potential resilience amidst the industry's broader challenges.

.png)