Chart #1 —

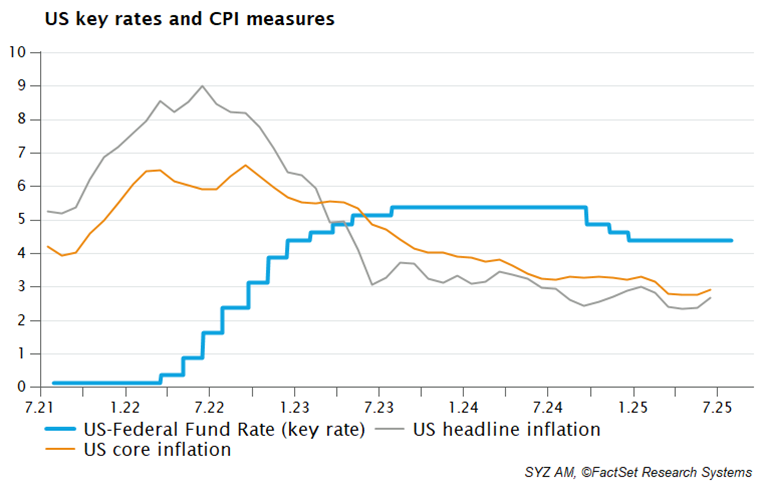

US central bank keeps rates steady amid pressure to cut them

The US central bank did not change its current policy stance and kept its key rates between 4.25%-4.5% as widely expected. It was also anticipated that two of the seven Federal Open Market Committee (FOMC) governors would dissent in yesterday’s vote: Michelle Bowman and Christopher Waller. Both, appointed to the Federal Reserve Board of Governors by President Trump, voted in favour of a 0.25% cut to the key interest rate.

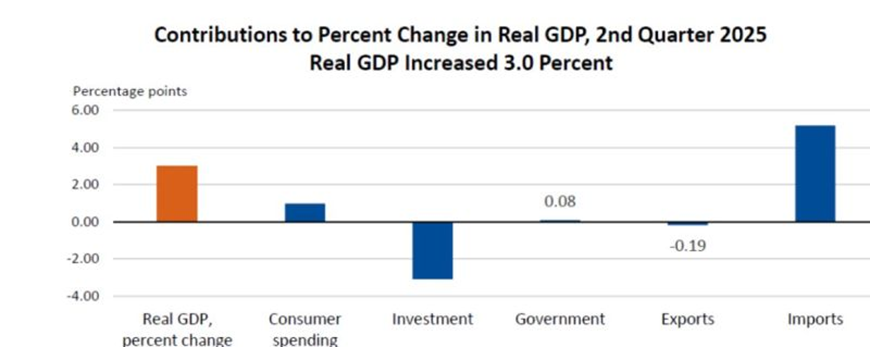

Despite the non-unanimous vote with the two dissenters, the FOMC’s written statement emphasised that the majority of the members deem the current policy stance as appropriate. The text states that “The unemployment rate remains low, and labour market conditions remain solid. Inflation remains somewhat elevated.” There were also two notable changes in the statement—the part regarding the uncertainty about the economic outlook has diminished—was removed. It reads now “uncertainty ... remains elevated”. Also, the text states now that “... growth of economic activity moderated in the first half of the year”, reflecting the latest GDP release for Q2.

During the press conference, Fed-Chair Jerome Powell clarified that the majority of the FOMC members think that it is “still early days ... but a substantial amount of tariffs has already been collected ... and the evidence seems to be that not importers but rather people upstream in the chain pay for this and this shows up in the CPI.” Yet, Powell had to acknowledge that “... the process seems to be slower than expected at the beginning.”

He continued by arguing that under these conditions, a “wait and see” approach remains appropriate, as the FOMC has to be efficient in setting rates – striking a balance between setting rates neither too high nor too low. He added that the committee wants to ensure “...tariff induced price pressures do not become permanent”.

Powell also added that the “labour market is still in balance – you see slowing job creation but also the supply side of the job market is slowing and so ... the labour market is solid.” At that point, he identified the unemployment rate as the single most important factor for assessing the employment side of the equation, and that “... the labour market is still at or close to maximum employment”.

Interestingly, when asked about the recent rise in credit card delinquencies, Chairman Powell said that “if you ask credit card companies, they are telling you that the US consumer is in solid shape … and that delinquencies are not a problem”.

When questioned about the upcoming September meeting, Chair Powell emphasised that the FOMC did not pre-discuss the next meeting, and that they will focus on the two main reports on inflation and employment for July and August.

Before today’s FOMC decision, the market probability for a September rate cut was about 60%, and a bit less than 2 rate cuts were priced until the end of the year. After the press conference, the odds for a September rate cut dropped to below 50%, and the probability for 2 rate cuts in the remainder of the year decreased further. It seems that financial markets repriced the odds of a rate cut because Chair Powell indicated—at least between the lines—that the FOMC currently views the risk of cutting rates too early as a greater than the risks of cutting too late.

.png)