What happened last week?

Central banks

As the U.S. economy continues to exhibit resilience and the 'last mile' of inflation proves stubborn, doubts are intensifying around the Federal Reserve's December pivot to ease monetary policy. Following a disheartening U.S. CPI report, Federal Reserve officials have collectively emphasized a cautious approach. Boston Fed President Susan Collins noted that recent data have not significantly shifted her economic outlook, advocating for patience due to the unpredictable and uneven nature of disinflation. She suggested that less policy easing may be needed this year than initially expected. Atlanta Fed President Raphael Bostic considers the economic risks as balanced, hinting at the possibility of postponing rate cuts if the robust U.S. economy sustains its momentum. However, he remains flexible to policy adjustments should labor market issues arise. In contrast, Chicago Fed President Austan Goolsbee warned that maintaining high interest rates for an extended period could exacerbate unemployment, describing the current phase as a "normal boom time." Additionally, the latest FOMC minutes indicated a broad agreement among policymakers to halve the pace of the Fed's balance sheet reduction, signaling a more deliberate approach to policy changes. Market expectations have since adjusted, now foreseeing fewer than two rate cuts in 2024, with the first likely in September. In Europe, the ECB's bank lending survey revealed a significant drop in Eurozone firms’ loan demand in Q1 2024, amidst high borrowing costs. Upcoming ECB discussions may suggest that rate cuts could commence as early as June, underscoring the ECB’s independence from Fed policies and its commitment to a data-driven approach tailored to the Eurozone's specific economic conditions. This could lead to quicker rate reductions in Europe compared to the U.S., given the relatively subdued European economic growth. The market now expects the Fed to reach its neutral rate well after the ECB, contributing to a 2% differential in short-term interest rates between the U.S. and Germany, further pressuring the Euro. In the UK, BOE's Megan Greene has echoed hawkish sentiments, cautioning against premature rate cuts amidst enduring inflation risks, contrasting with optimistic market expectations. Meanwhile, the Bank of Canada maintained its rate at 5% but signaled openness to reductions at its next meeting if the data supports such a move. In Japan, former BOJ official Maeda suggested that the terminal rate could exceed 1%, indicating a more aggressive potential trajectory for Japanese interest rates.

Credit

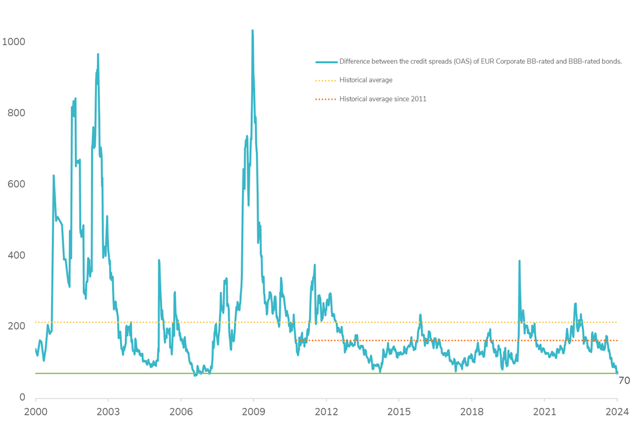

In the U.S., Investment Grade (IG) credit remained stable despite the volatile economic landscape, with credit spreads holding steady at 89bps. However, the rise in U.S. interest rates led to a 0.7% decline in the Vanguard USD Corporate Bond ETF, bringing its year-to-date loss to nearly 2%. In the High Yield (HY) segment, spreads widened modestly, with cash bonds increasing by 7bps and the CDX HY index—a benchmark for U.S. HY CDS—widening by 15bps. Consequently, the iShares Broad USD High Yield Corporate Bond ETF dipped by 0.5% over the week, though it maintains a slight year-to-date gain of +0.6%. European credit markets reflected concerns triggered by weaker economic data, impacting credit spreads. IG spreads in Europe widened slightly by 2bps to 110bps, while the iTraxx Europe index, which tracks EUR IG CDS, saw a 6bps increase. This resulted in a 0.2% weekly loss for the iShares Core EUR Corporate Bond ETF, despite supportive movements in European government bonds. The high yield sector faced more significant challenges, with the iTraxx Xover index—tracking EUR HY CDS—widening by 25bps, marking its most challenging week in 2024. The iShares EUR High Yield Corporate Bond ETF consequently recorded a 0.4% loss. Recent trends have highlighted a growing decompression between investment grade and high yield segments. According to JPMorgan, the past month has seen the high yield index spreads widen by 5% compared with an 11% tightening in IG. Such divergences are relatively rare, with only 17 occurrences since 2004 where high yield spreads have significantly lagged behind investment grade by this measure. Subordinated debt sectors also experienced setbacks, with financial and corporate subordinated debts declining by -0.6% and -0.8%, as evidenced by the performance of the Invesco Euro Corporate Hybrid ETF and the WisdomTree AT1 CoCo Bond ETF respectively.

Rates

The U.S. government bond market faced a challenging week, declining by 0.6% amid surging inflation figures. On Wednesday, the 10-year U.S. Treasury yield experienced its most significant daily increase since May 2023, rising by 20bps. This surge was exacerbated by disappointing results from a 10-year bond auction where dealers retained 24% of the offerings—the highest take-up since November 2022—highlighting weak investor demand. The week concluded with the 10-year yield at 4.52%, up 12bps, and the 2-year yield, which is closely tied to monetary policy expectations, advancing 15bps to 4.90%, the highest since November. The increase in the front-end of the yield curve was notably influenced by a 10bps rise in market inflation expectations, as indicated by the breakeven rate reaching 2.91%, a year-high. This adjustment reflects a market recalibration of U.S. inflation expectations following three consecutive months of intense inflation data. Despite rising real rates, Treasury Inflation-Protected Securities (TIPS) continued to relatively outperform, with the 10-year real yield surpassing 2% for the first time in 2024. Conversely, European government bonds saw gains, spurred by dovish signals from the ECB, a disheartening Europe bank lending survey, and lackluster economic indicators including weak industrial production and subdued CPI figures. Despite upward pressure on U.S. rates, the 10-year German bond yield showcased a marked divergence, finishing the week 4bps lower at 2.35%. This has widened the yield gap between U.S. and German 10-year bonds to 216bps, the largest since 2019. Meanwhile, the spread between Italian and German 10-year bonds remained stable at 140bps. The iShares Core EUR Government Bond ETF benefitted from these conditions, rising by almost +0.5% over the week. Finally, the UK bond market struggled, influenced by strong economic ties with the U.S., positive domestic economic data, and a hawkish tone from BOE’s Megan Greene, who advised caution on early rate cuts. This resulted in a 5bps increase in the UK 10-year yield, closing the week at 4.13%.

Emerging market

Emerging market bonds faced significant headwinds last week, with corporate bonds falling by -0.7%, sovereign bonds by -1.2%, and local currency bonds by -0.8%. Bloomberg reports the largest short positions on EM USD bonds in over a decade, with short interest in the iShares JPM USD EM Bonds ETF surpassing 20% for the first time since 2014, indicating a growing bearish sentiment. In China, the economic landscape remains precarious. Fitch has revised China's outlook to negative due to a persistent rise in debt levels, while the real estate sector continues to struggle. The Markit iBoxx USD China Real Estate Index dropped by 0.5% over the week. Adding to the sector’s woes, Shimao Group Holdings Ltd., a defaulted developer previously rated as investment-grade, faces a wind-up petition from China Construction Bank, with a court hearing set for June 26. Moreover, S&P has downgraded China Vanke to BB+, placing it in the speculative grade, mirroring earlier negative revisions by Fitch and Moody’s, highlighting intense liquidity pressures facing state-backed developers. In Latin America, there are mixed economic signals. Brazil's CPI fell to 3.9% from 4.5% last month, offering some relief to the Central Bank of Brazil amid tightening financial conditions. Conversely, Uruguay's central bank cut its key interest rate by 50bps to 8.5% following the slowest inflation increase since 2005, now at 3.8%. This move reflects a proactive approach to stimulating economic activity in light of subdued price pressures. Argentina continues its aggressive rate-cutting strategy under President Javier Milei's administration. The Banco Central de la República Argentina (BCRA) reduced its main policy rate to 70% from 80%, marking the third cut since December. Economists are closely watching the upcoming CPI release, anticipated to show a third consecutive month of easing inflation, which could further influence the BCRA's monetary policy decisions.

.png)