Principle #1 —

If you want to grow your wealth, you need to invest

Many households think that they can protect themselves financially by saving as much as possible. This is only partly true. Saving is certainly crucial, but without investing these savings, the 'nest egg' built up over time may not be enough to make up for the lack of income from work when the time comes. By investing, however, you can create a new source of income.

Remember that inflation, if left unmitigated, can significantly reduce the real value of your savings. Because of the time value of money, the portion of your salary saved today will be worth much less in ten, twenty or thirty years' time. Therefore, it is important to invest part of your savings in financial instruments that protect against inflation (e.g. shares, gold, TIPS, etc.).

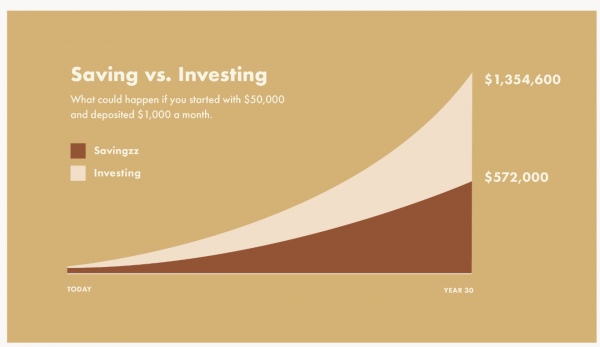

Graphique : Saving vs. Investing

Source: Wealthsimple

The first ("Savingzz") involves investing $50,000 and an additional $1,000 every month at a rate of 2% for 30 years. The second ("investing") involves the same initial and monthly amounts, but invested in the equity markets (note: past performance is not a guarantee of future performance).

Principle #2 —

It is much easier to cope with market volatility by being prudent with your personal finances

Investing can be an exciting and rewarding experience, but it is difficult for an investor to sleep soundly in times of high volatility, especially when their personal financial situation is "put at risk" by their investments. Emotions can get the best of almost any investor.

Because of past performance, investing in equities may seem like the most attractive investment for most savers. But in reality, it is not for everyone. For example, investors who are not already financially stable should avoid allocating too much of their savings to risky assets as they may be forced to sell them at the worst possible time - i.e. when markets have just undergone a sharp correction - or even a crash.

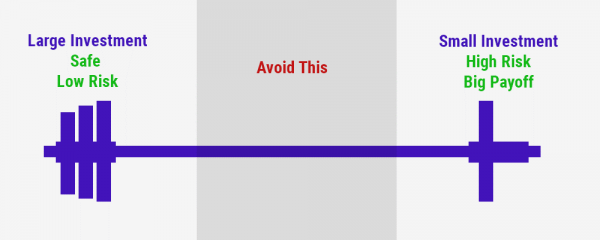

The "barbell" strategy is therefore an excellent approach to limit the risk of emotions jeopardising long-term investment performance. This strategy involves having little or no debt, a stable and reliable source of income (ideally several), a liquidity cushion in case of unforeseen events, and low-risk investments such as bonds from high-quality issuers. With the peace of mind that comes from having a secure financial position, you can then 'load up' the other side of the barbell with much riskier, high volatility investments (e.g. equities, options, venture capital, cryptocurrencies etc.).

Source: Market meditations – Nassim Taleb Barbell Strategy

Principle #3 —

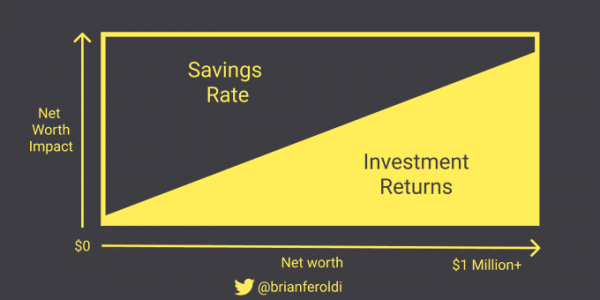

The performance of your investments will one day take precedence over your savings rate

At the beginning of your working career, your savings rate should ideally be as high as possible, because the earlier you save, the sooner you can start to grow your investments, which will result in exponential returns years later. As the graph below shows, the performance generated by your assets will one day become greater than the amount saved from your monthly salary.

Source: Brian Feroldi

Principle #4 —

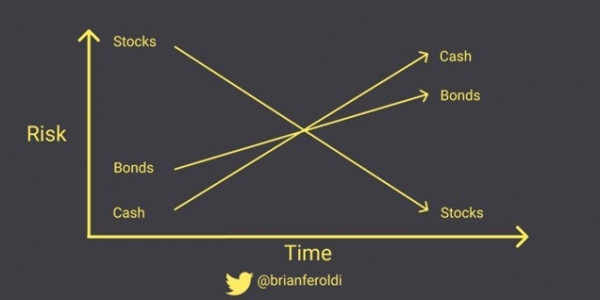

What is risky in the short term is much less risky in the long term. And vice versa

In the short term, shares are of course riskier than money market investments or bonds. But over time, this dynamic changes. Equities are a major contributor to real capital growth because they have the potential to grow faster than inflation over the long term. In contrast, cash and bonds do not offer this advantage over the long term and face the risk of loss on a real (i.e. inflation adjusted) basis.

Source: Brian Feroldi

Principle #5 —

Aiming for high performance has a cost

There is a link between performance and risk. In other words, risk-taking is rewarded (at least in the long term). But there is a price to pay: few investors can withstand short-term volatility and very often "break down" by getting rid of their risky assets at the worst possible moment, i.e. during a crisis.

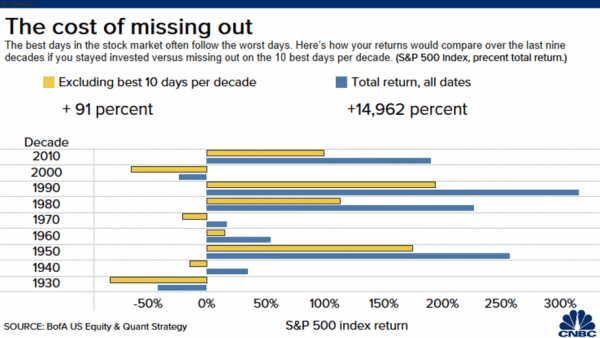

Source: CNBC, BofA

Chart: Here's why investors should avoid panicking. By selling their shares at the worst possible time, they risk missing the best daily performance. Over a 10-year period, missing the best 10 days reduces cumulative performance by a considerable amount.

Principle #6 —

Dollar cost averaging instead of market timing

Market timing can be lucrative for short-term traders, but it can be very detrimental to an investor who does not have the knowledge, experience or tools for this discipline. Can you imagine investing 100% of your assets in the equity markets in early 2008? Or waiting for a crash to occur before investing in the US market and missing out on all the performance generated by the S&P 500 Index during the bull market that lasted from 2009 to 2021?

One of the most effective ways to get around the problem of perfect timing is to invest gradually in the same type of assets over time. In this way, you get an average purchase price over the time period. If the markets rise sharply, you face an opportunity cost (i.e. the amount not invested), but you still make gains on the portion of your assets already invested. If the markets fall, you have the opportunity to re-enter the market at a lower purchase price.

Principle #7 —

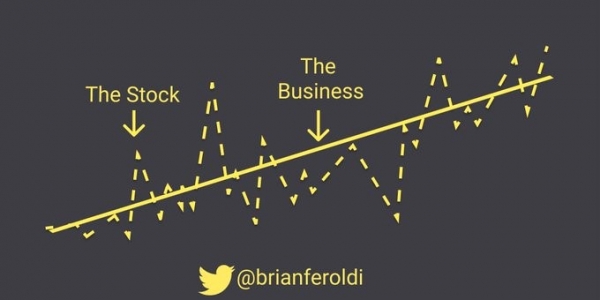

The fundamentals of a company and its stock price have a very strong correlation in the long-run

In the short term, the intrinsic value of a company certainly does not fluctuate in the same way as its share price. Therefore, price and value should not be seen as one and the same thing, but rather as entirely different concepts. However, in the long run, the two are very clearly correlated, as the ups and downs of a share price are justified by the evolution of the company's value.

Source: Brian Feroldi

Principle #8 —

Human nature has little control over the emotions caused by the volatility of equity markets

It is human nature to be emotional and often these emotions extend beyond family and friends to material assets and property. Whenever this happens, the investor is by default at a disadvantage as he/she may be in the grip of his/her emotions and make an irrational investment decision. Today, the flow of information is faster and more intense than it has ever been and it is common for investors to attach too much importance to isolated pieces of information that may ultimately have little or no impact on the long-term value of a company, creating greater volatility than in the pre-Internet age.

Humans are also more likely to overestimate losses than gains. Letting all these different emotions and biases guide and shape your investment strategy will probably not end well, neither mentally nor financially.

An investment decision should be based on your individual opinion of the current value of a company and your opinion of the potential future value of the company. As long as nothing fundamentally changes in the company, it is essential to stick to your initial opinion and follow the ups and downs of the share price.

Principle #9 —

Invest. Don’t trade

If you could look into a crystal ball and get the timing right on every trade, being a short-term trader would be far more profitable than being a patient investor. Luckily (or unfortunately), this is not the case, which means that you are far more likely to lose to the market by trying to find the right market timing than by identifying investments that you really believe in and can keep in your portfolio for the long term.

One of the key success factors of an investment strategy is to establish an investor's risk profile. This risk profile is based on your investment objectives, risk tolerance, time horizon, reference currency, liquidity needs, taxation and specific constraints. Risk tolerance is perhaps the most difficult element to assess.

Very importantly, this risk profile may change over time due to a change in personal circumstances (need for liquidity, change of residence or employment situation, etc.). But it should not be changed in any way based on market circumstances and how you feel about the recent performance of the markets or your investments.

Principle #10 —

Buying shares in the downturn leads to mixed fortunes.

Easier said than done. When investing, look for companies that are undervalued by the market.

When a stock falls, it does not necessarily mean that it has become less attractive from a fundamental point of view. In many cases, it is a change in the market's perception of the stock. As an investor, if you believe that the fundamentals remain attractive, then a falling share price becomes a buying opportunity.

On the other hand, sometimes a stock may fall for no apparent reason. But some investors have detected warning signs of weakness that are not yet widely known. Some investors then make the mistake of buying on the downside and later realise their mistake. You certainly know the famous expression: "Never try to catch a falling knife"...

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Plus, Berkshire Hathaway’s cash peaks as South Korea’s KOSPI rockets. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, the USD continues to lead transactions and China stockpiles gold. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, the Korean stock market surges to new levels. Each week, the Syz investment team takes you through the last seven days in seven charts.

.png)