Chart #1 —

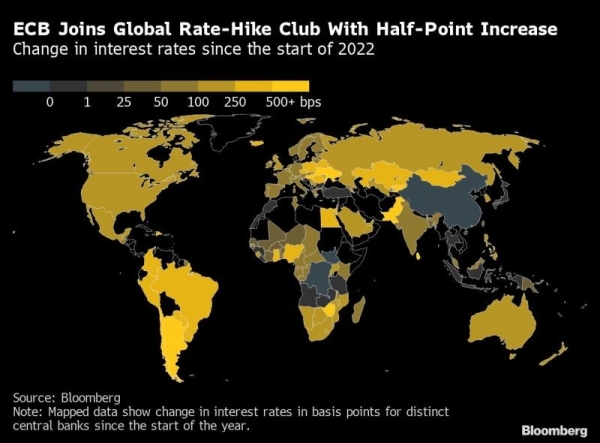

ECB joins Global rate-hike club

With its first rate hike since 2011, the ECB finally joined the club of central banks raising rates. The ECB is raising its main refinancing rate by 50 basis points to 0.50% and the deposit rate from -0.5% to zero (more than it had previously announced). The ECB also unveiled a new crisis tool called "Transmission Protection Instrument" (TPI), before limiting the yield spread between peripheral and core debt.

Source: Bloomberg

Chart #2 —

Bond markets have made up their minds

Both the Fed and the ECB have surprised the market with the size of their rate hikes over the last two months. In both cases, the reaction of the bond market has been similar. German Bunds and US Treasury yields have experienced the same price movement: a timid rise in bond yields, followed by a relatively sharp fall. The message from the bond market seems relatively clear: more rate hikes this year should have a more severe impact on growth and thus lead to lower interest rates thereafter.

Source: MacroAlf

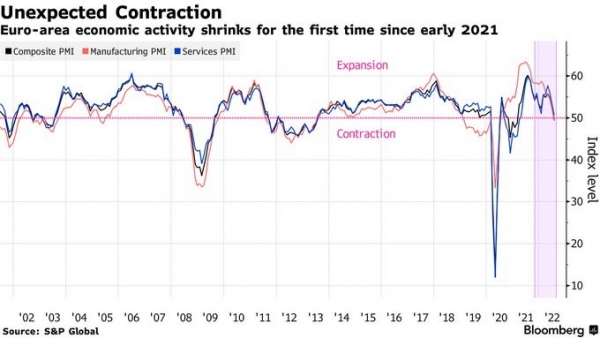

Chart #3 —

Very clear signals of economic slowdown

After a brief rebound, US macroeconomic data disappointed again last week, with a deterioration of PMI indices, initial jobless claims, housing data (homebuilder sentiment collapsed as existing home sales fell while housing starts and building permits for single-family homes plunged), as well as Philly Fed figures and leading indicators. The situation is even more worrying on the European continent, as activity in the eurozone has suddenly contracted, pointing to a possible recession.

Source: Bloomberg

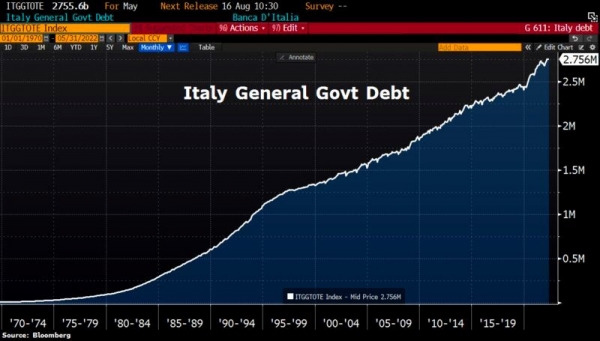

Chart #4 —

Another political drama in Italy

Italian Prime Minister Mario Draghi has failed in his attempt to form a government and stay in power. When Mario Draghi announced that Italians had persuaded him not to resign, for much of Wednesday it looked as if his national unity government had a good chance of surviving. He then called for a new pact and a vote of confidence in the Senate. But hours later, three coalition parties said they would not take part in the vote. After a year and a half in power, his government, which includes the right and the left, is collapsing.

Perhaps at the worst possible time, since the economic fundamentals are not good. Indeed, Italy's trade surplus has collapsed despite the weakness of the euro. It has fallen from 70 billion euros (for the last 12 months) to 10 billion euros. Since December 2021, monthly imports have exceeded exports, partly due to rising energy prices and a lack of willingness to become more energy independent through solar and wind power. The political crisis and widening deficits come at a time when debt is at an all-time high. Italy's public debt stood at €2.8 trillion in May, a debt-to-GDP ratio of over 150%. Italy is home to almost a quarter of the eurozone's debt and faces the risk of a sovereign debt crisis. Hence the importance of the TPI for investors.

Source: Bloomberg

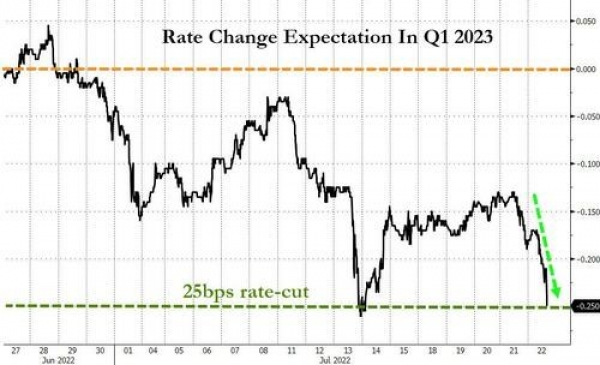

Chart #5 —

The US yield curve now expects rates to fall by 25 basis points as of Q1 2023

After last week's poor US macroeconomic figures, the market is now giving a 100% probability of a 25bp rate cut by the Fed in Q1 2023. The prospect of future rate cuts and rather reassuring earnings releases allowed the equity markets to record gains last week.

Source: www.zerohedge.com, Bloomberg

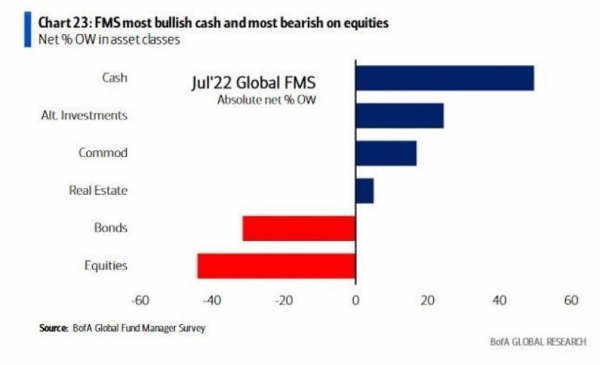

Chart #6 —

Have investors capitulated?

According to a Bank of America survey of fund managers, the vast majority of them are underweight equities and bonds and overweight cash and alternative investments. Sentiment is therefore rather pessimistic, even close to capitulation. From a contrarian point of view, this is rather good news.

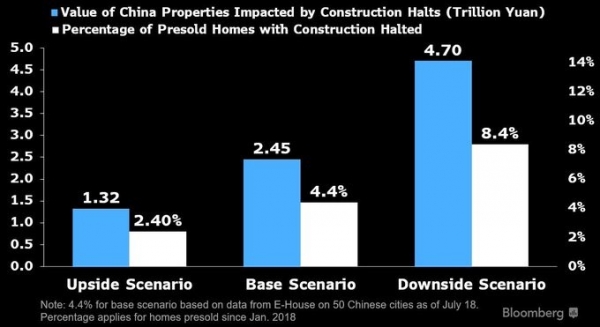

Chart #7 —

Construction halts in China could impact $700 billion worth of real estate

The property crisis in China is gathering speed. A growing number of buyers have defaulted on their mortgages, adding to the woes of China's already struggling property sector.

Property sales plunged for the tenth consecutive month in June, underlining the extent to which government relief efforts are failing to mitigate the crisis.

It is in fact a major shock to cash-strapped property developers who have long relied on pre-sales of flats to finance themselves.

The halt in construction in China could affect $700 billion worth of homes, says Kristy Hung, an analyst at Bloomberg Intelligence, in a research note. The percentage of pre-sold homes that have been stalled could rise to 8 percent from the current 4 percent, according to Hung's bearish scenario analysis.

Source: Bloomberg

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Plus, Berkshire Hathaway’s cash peaks as South Korea’s KOSPI rockets. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, the USD continues to lead transactions and China stockpiles gold. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, the Korean stock market surges to new levels. Each week, the Syz investment team takes you through the last seven days in seven charts.

.png)