Story #1 —

A ‘technical’ recession?

In the space of a few weeks, investors' fears have changed. They are now more focused on the 'r' in recession than the 'r' in rates. The flattening of bond curves, collapse of confidence surveys and GDP figures for the second quarter (published in July) all point to a very clear slowdown in the global economy.

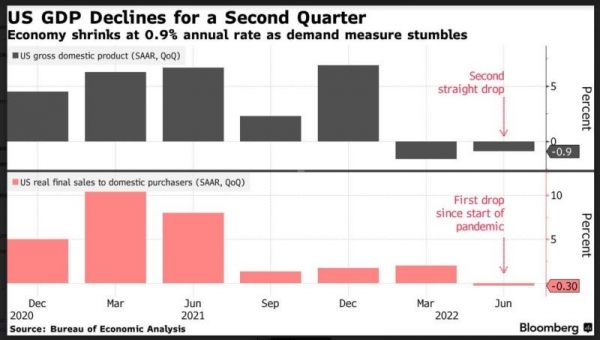

The US is now officially in a technical recession after two quarters of negative GDP growth. Following a 1.6% decline in the first three months of the year, US GDP fell at an annualised rate of 0.9% in the second quarter as inventories and residential investment contributed negatively to growth.

Source: Bloomberg, BEA

In Europe, Germany is in 'stagflation' (see next point), while the rest of the continent has exceeded growth forecasts. Spain and Italy both announced growth of 1% or more in the second quarter, escaping a technical recession - for now. However, with the energy crisis coming to a head this winter, there are signs of complicated quarters ahead for the whole of the European continent.

Story #2 —

Inflation reaches record levels

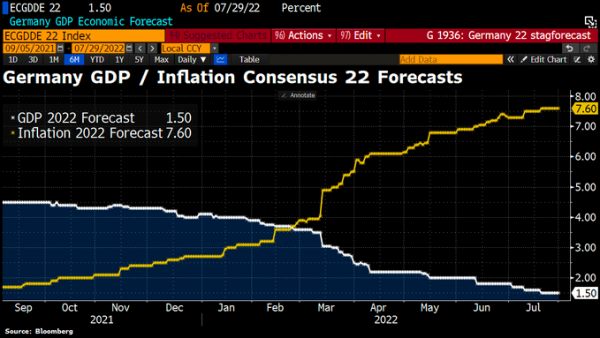

Despite the very clear signals of a slowing global economy, inflation rates continue to break records in most developed countries. In the US, inflation reached 9.1% in June, the highest level in four decades. Europe is also experiencing record inflation rates due to soaring energy costs and higher prices for imported goods and services as a result of the weakening euro. Germany faces ‘stagflation’: for full-year of 2022, the consensus now points to very low GDP growth (+1.5%) and a very high inflation rate of 7.6%.

Source: Bloomberg

Story #3 —

Monetary tightening continues

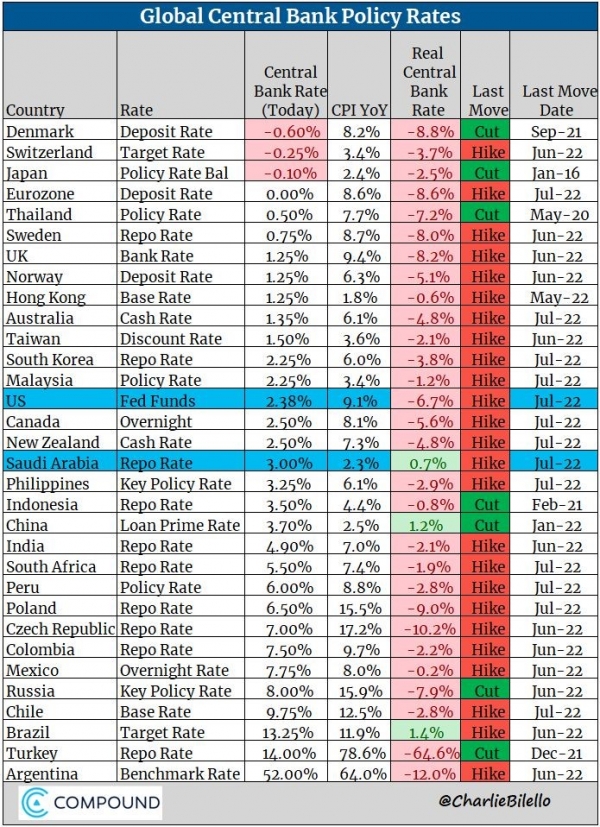

As part of its ongoing efforts to curb inflation, the US Federal Reserve raised its key interest rate by 75 basis points on the last Wednesday of the month to a range of 2.25% to 2.50%. This is the second consecutive 0.75% increase in the Fed's interest rates and the fourth rate hike since the beginning of the year. Countries with currencies pegged to the dollar such as Saudi Arabia followed suit.

The monetary tightening movement has taken on a global dimension. After the Bank of England, the Fed, and the Swiss National Bank, it was the turn of the European Central Bank (ECB) to raise rates. The first tightening since 2011 was even higher than expected, with a 50 basis point increase compared to the 25 basis points initially planned.

Among the major central banks, Japan is the only one to have maintained an expansionary monetary policy.

Source: Charlie Bilello

Story #4 —

Downward revision to earnings growth expectations

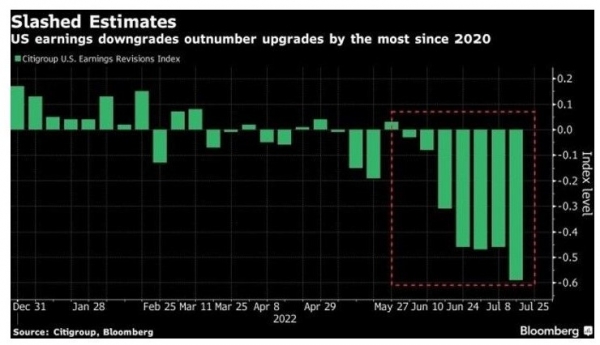

One of the few ‘strengths’ of the first half of 2022 was the resilience of corporate earnings and the upward revision of consensus expectations for earnings growth – despite the complicated macroeconomic and geopolitical backdrop.

Yet even this haven of stability now appears under threat as earnings growth expectations for the companies making up the S&P 500 now face their most severe negative rate revisions since the 2020 Covid crisis.

These negative revisions are much more severe in the US than in Europe or Japan. This is because of the dollar’s strength, which weighs on about 40% of the aggregate revenues of American companies. On the other hand, the rise in the US dollar is boosting European and Japanese companies, as 24% and 15% of their sales, respectively, are in the US.

Source: Bloomberg

Story #5 —

Best month for equity markets since November 2020

After a very poor first half of the year for equity markets, the main US and European indices recorded their best monthly performance since November 2020. In the US, the Nasdaq rose by 12.5% while the S&P 500 gained 9.3%. The MSCI Europe ex-UK was up 7% while Japan’s Topix gained 3.7% (both in dollar terms).

How can we explain such a rebound, in the face of recession fears, record inflation rates, multiple rate hikes by central banks and downward revision of earnings growth expectations?

It seems that investors now see the accumulation of bad news as good indicators for markets. In other words, the very sharp slowdown in the global economy may force central bankers to end monetary tightening very soon.

It should be noted that the outperformance of the growth style (+11% for the global growth index) compared with the value style (+4.6%) occurred at the same time as the fall in bond yields.

Not all equity markets recovered in July as the MSCI Emerging Markets and the MSCI Asia ex-Japan both recorded slightly negative returns during the month.

Source: Bloomberg

Story #6 —

Bond yields fall and credit spreads tighten

Despite interest rate hikes by most central banks, bond markets performed very well in July. Fears of recession, or a sharp slowdown in the global economy, allowed the entire US Treasury yield curve to fall during the month. The drop in intermediate duration yields (which saw a 39 bp drop in the 7-year yield) outperformed both the shorter (7 bp drop in the 2-year) and the longer (19bp drop in the 30-year).

The return of investors to risky assets has led to a tightening of credit spreads. The investment grade bond index (in USD) rose by 4.2% over the month, while the high yield index (in USD) recorded a performance of 6.3%. The JP Morgan Emerging Market Bond Index in USD rose by 3.1%. In contrast, emerging market bonds in local currency declined slightly due to the strength of the dollar and the reluctance of investors to invest in this segment following the Sri Lankan default.

In Europe, the political crisis in Italy led to a widening of spreads between Italian bond yields and the German Bund.

Source: Bloomberg, www.zerohedge.com

Story #7 —

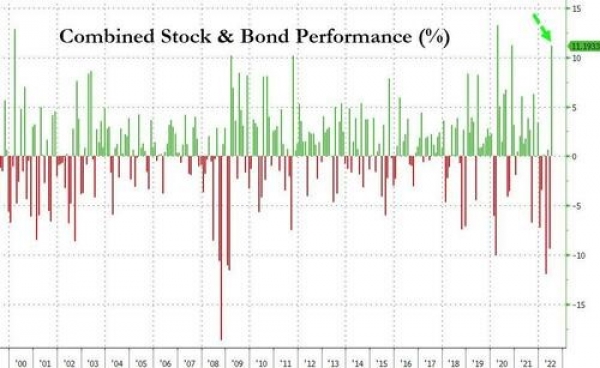

An outstanding month for multi-assets portfolios

The first half of 2022 was the worst ever for a so-called ‘60/40’ portfolio (60% invested in US equities and 40% in dollar bonds). The rebound in equity and bond markets in July led to a spectacular performance in this type of portfolio. In fact, this is the second-best monthly performance since March 2000 with a gain of 11.2% (the best performance dates from April 2020). It should be noted that despite this spectacular rebound, the performance of a 60/40 portfolio since the beginning of the year (-10.7%) is still the worst in history at this point in the year. Globally, the market capitalisation of the equity and bond markets has appreciated by USD 7 trillion over the last two weeks of the month.

Story #8 —

Commodities correction

Commodities experienced a tremendous bull market between March 2020’s Covid low and March 2022, with the commodities index increasing threefold in value over the period. Between March and June 2022, the asset class entered a consolidation phase reflecting the effect of monetary tightening by central banks and the rise of the dollar. But in recent weeks, investors have become concerned that the withdrawal of liquidity will have drastic effects on future demand for commodities, triggering a correction in the S&P GSCI Commodities Index. Industrial metals and agricultural commodities posted the biggest declines. Thanks to a recovery in the last week of the month, the index is only slightly down over the period.

Oil remains the best-performing asset since the beginning of the year with a 31% gain.

The good news is that lower commodity prices should result in lower inflationary pressures in the coming months.

Source: businessinsider.com, Bloomberg

Story #9 —

The month of parity for the euro

In July, the euro continued to weaken against the dollar but also against the Swiss franc. The single currency is now trading below parity against the Swiss franc (around 0.97 at the end of the month) despite the ECB’s rate hike. The euro briefly touched parity against the dollar before strengthening slightly at the end of the month.

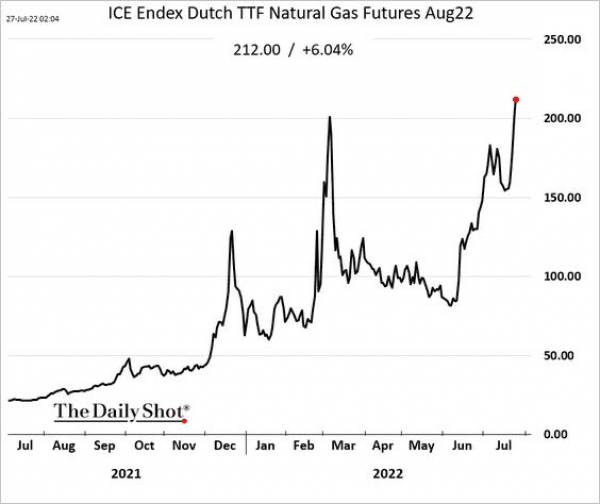

The reasons for the weakness of the euro are multiple: Italian politics (and Mario Draghi's resignation), the market’s positioning, which does not yet seem to have integrated all the bad news and, especially, the high risks of recession linked to the energy crisis. President Vladimir Putin is using Russian natural gas exports to Europe as an economic weapon. The drastic drop in energy exports to Europe is causing gas prices to rocket, as well as electricity prices throughout Europe, even though it is the middle of summer. Record prices this winter would lead to electricity rationing with impacts on production, which would in turn plunge the European economy into recession with negative consequences for the euro.

Source: businessinsider.com, Bloomberg

Story #10 —

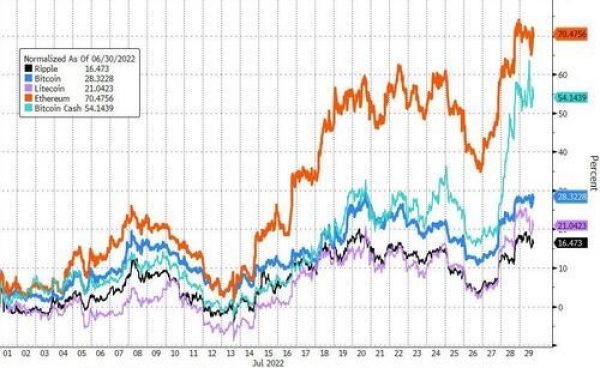

Bitcoin had its best month since January 2021

The rebound in risky assets also includes cryptocurrencies, whose total market capitalisation has risen well above the USD 1 trillion mark.

Bitcoin is up around 28% in July after touching USD 24,000 again at the very end of the month. It remains down 48% since the beginning of the year.

As for ether, it is back in the USD 1,700 range and is up over 70% in July. The crypto-currency's rebound is now 100% since its June low ahead of ethereum’s change in operating mode and the event called ‘the Merge.’

Note that both bitcoin and ether benefited from massive liquidations of short positions at the end of the month, which generated forced purchases by those speculators positioned on the downside.

Source: Bloomberg, www.zerohedge.com

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Plus, Berkshire Hathaway’s cash peaks as South Korea’s KOSPI rockets. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, the USD continues to lead transactions and China stockpiles gold. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, the Korean stock market surges to new levels. Each week, the Syz investment team takes you through the last seven days in seven charts.

.png)