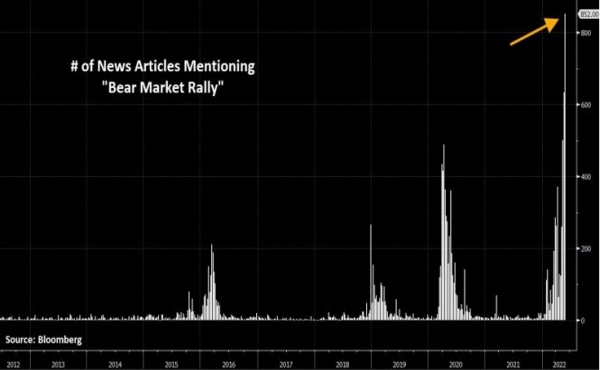

Global equities gave up some of the previous week's strong gains. Investors remain sceptical about the Fed's ability to moderate inflation without pushing the US economy into recession. It is interesting to note that the idea of a "bear market rally" appears to be relatively consensual, as evidenced by the number of press articles mentioning the term. The consensus is very rarely right at major market turning points. How can we interpret such a strong consensus? That the bear market rally is already over (in other words that it didn't really happen)? Or that the bear market is now behind us (we are at the beginning of a new bull market)?

Chart #1 - Is the « bear market rally » already coming to an end?

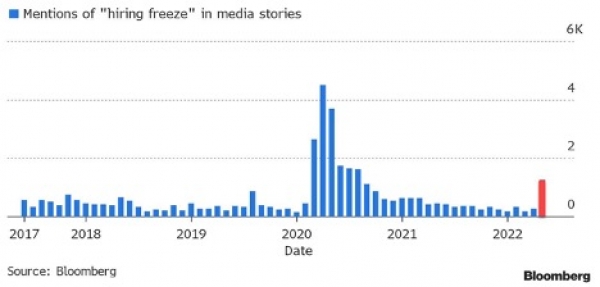

Chart #2 - The end of the upturn in the US labour market?

JP Morgan CEO Jamie Dimon downgraded his economic outlook from "clouds on the horizon" to an "impending hurricane". Following this, Goldman Sachs chairman John Waldron noted that "the shocks to the system are unprecedented" while Elon Musk warned that he had a "very bad feeling" about the economy, ordering a hiring freeze and warning of future job cuts at Tesla. The warning signs in the US labour market are not limited to these three major companies, as the number of news articles mentioning a "hiring freeze" has recently reached a level not seen since the early months of the pandemic in 2020. Yet the May US employment data released last week was rather reassuring: 390,000 jobs were created in the month and the unemployment rate remained unchanged at 3.6%. Average hourly earnings rose by 0.3%, a figure that was welcomed by economists: it allows employees to offset some of the rise in prices without signaling a further overheating of wages.

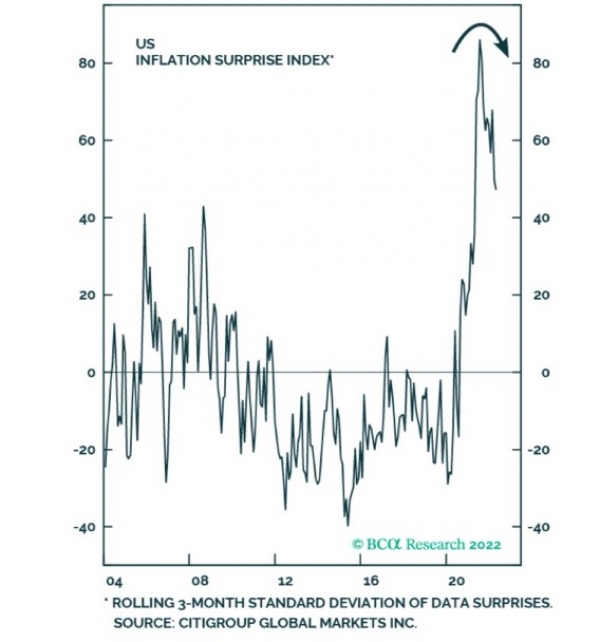

Chart #3 - US inflation no longer surprises on the upside

There are always two levels to consider with US figures: the absolute level and the level relative to expectations. Hence the usefulness of constructing economic "surprise" indices. When the figures published are better than expected, we speak of positive surprises. The opposite is called a negative surprise. As the chart below shows, after months of strong growth, the US inflation surprise index has just turned around. Inflation remains at very high levels but is now below market expectations. One explanation: US wage growth probably peaked initially but has since moderated and should de facto ease the pressure on inflation.

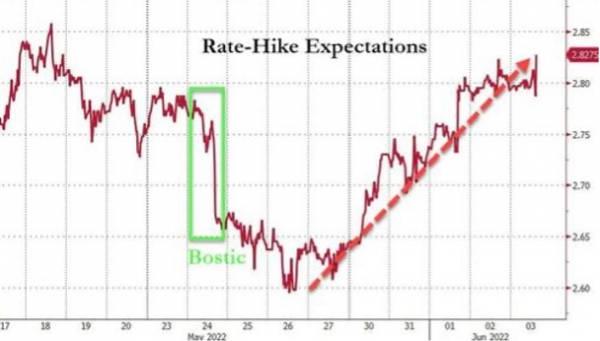

Chart #4 - Fed turns hawkish again

In between monetary policy meetings, members of the Federal Reserve have a habit of speaking out. While the Atlanta Federal Reserve President had toned down rate hike expectations the week before, the rhetoric this past week was geared towards a decidedly restrictive monetary policy. The market adjusted rate expectations upwards for this year. As a result, US Treasury yields resumed their upward path, with the medium-term portion underperforming (+23 basis points for 5-year yields) compared to the long basis points for the 30-year).

Chart #5 - European inflation rises sharply; peripheral bonds spreads widen

Eurozone inflation reached 8.1% in May, the highest level ever, even though the European Central Bank is still holding interest rates at negative levels. Such a dichotomy between inflation rates and monetary policy has probably never been seen in developed economies. However, the market is anticipating the first steps towards the normalisation of monetary policy this year (a rise of more than 110 basis points currently expected by the bond yield curve). Market participants also anticipate the beginning of stress on "peripheral" zone bonds (Italy, Spain, Greece, etc.) Indeed, Italian 10-year yields jumped last week to 3.24%, their highest level since 2018, while Spanish 10-year yields reached their highest level since 2015.

Chart #6 - Financial repression is alive and well in Germany

It's not just peripheral bond yields that are tightening. Last week, German 10-year yields reached 1.24%, their highest level since 2014. Despite this rise, the real "Bund" yield (yield to maturity of the German 10-year - the inflation rate) has fallen to an all-time low. Indeed, the acceleration of inflation in Germany (7.9% in May, its highest level since 1952) is outpacing the rise in nominal bond yields. Real yields have been in negative territory for 73 months in a row.

Chart #7 - Divergence in the commodity bull market

Commodities continue to outperform global equities significantly. In relative terms, the S&P 500 Index relative to the CRB Commodities Index is at its lowest level in five years. But since the beginning of the year, there has been a significant divergence in performance between energy (orange line), agricultural commodities (blue) and metals (white) ...

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Plus, Berkshire Hathaway’s cash peaks as South Korea’s KOSPI rockets. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, the USD continues to lead transactions and China stockpiles gold. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, the Korean stock market surges to new levels. Each week, the Syz investment team takes you through the last seven days in seven charts.

.png)