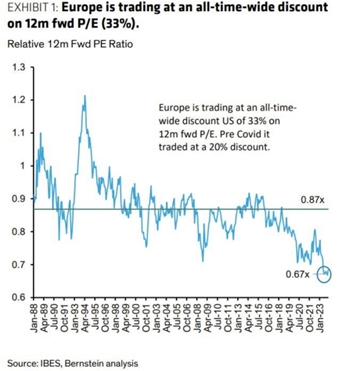

Chart #1 —

The Fed keeps rates unchanged but still surprises the market

As expected, the US Federal Reserve voted unanimously to leave the benchmark rate unchanged in the target range of 5.25% - 5.5% for the fourth consecutive meeting.

Importantly, the Federal Open Market Committee removed language that indicated a willingness to continue raising interest rates until inflation has been brought under control and is on track to meet the Fed's 2% inflation target.

However, the statement was much more hawkish than expected, as the Fed aggressively countered the market's dovish stance: "The Committee does not believe that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is approaching 2% on a sustainable basis".

The Fed did, however, leave the door open to reductions at some point: "The Committee believes that the risks to the achievement of its employment and inflation objectives are coming into balance."

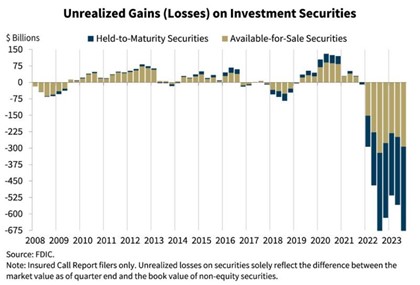

Perhaps more importantly, the Fed removed the following sentence from the statement: "The US banking system is sound and resilient". This sentence has had a negative impact on investor sentiment as it comes at a time when a new US bank is experiencing difficulties. (see next point).

Source: Bloomberg, HolgerZ

.png)

Source: Barchart

Source: Barchart