What happened last week?

Central banks

This week, a wave of caution swept through the Federal Reserve as officials, including Chicago Fed President Goolsbee and Atlanta Fed President Bostic, advocated for patience in adjusting interest rates amidst ongoing inflation uncertainties. Goolsbee cited stalled progress on inflation as a reason to hold off on rate cuts, while Bostic expressed satisfaction with the current rates, suggesting that a reduction might be premature until year's end. Federal Reserve Chair Powell also tempered expectations, noting that recent economic data have diminished confidence in the near-term feasibility of rate cuts, pushing the likelihood of reductions further into the future. The market now anticipates approximately 1.5 rate cuts by the end of the year, with the first cut expected between September and November. In contrast, the European Central Bank (ECB) is poised to initiate monetary policy normalization sooner than the Federal Reserve, with markets anticipating a rate cut as early as June and three cuts throughout 2024. Some ECB officials, including ECB's Simkus and France’s Villeroy de Galhau, have suggested the possibility of consecutive rate cuts in June and July, advocating for flexibility in meeting schedules rather than restricting decisions to quarterly intervals. However, ECB's Rehn urged caution, advising against premature commitments to a specific rate path and recommending alignment with evolving inflation expectations. Discussions among other ECB members, like Germany’s Nagel and Latvia’s Kazaks, have also highlighted concerns over inflationary pressures and the potential impact of external shocks, such as fluctuations in oil prices. In the UK, Bank of England's Monetary Policy Committee member Greene warned that delaying monetary interventions could lead to higher future interest rates and a more severe recession. Her colleague, Mann, emphasized the challenges of global economic fragmentation, suggesting that it could lead to more frequent inflationary shocks and necessitate a more independent approach to monetary policy by central banks. Governor Andrew Bailey predicted a notable decline in UK inflation next month, attributed to unique dynamics in household energy pricing, while maintaining that the economy is experiencing disinflation even at full employment. The market currently anticipates the first rate cut in August, followed by one more within 2024.

Credit

In the U.S., the protracted tightening of credit spreads over the past year has left the investment grade credit market with minimal buffer against further interest rate hikes. As U.S. government bonds registered a -0.4% decline this week, the closely correlated Vanguard USD Corporate Bond ETF also fell by -0.7%. This drop was exacerbated by a slight widening of spreads, which increased by 3bps to 92bps. Notably, spreads are currently at their tightest levels in years, accounting for only 15% of the total yield of the U.S. credit index—a near-historic low. Additionally, fund managers have been offloading bonds at the fastest rate in over two decades, highlighting a growing cautious stance in the market. In the high yield segment, vulnerabilities were apparent as spreads expanded by 15bps. The iShares Broad USD High Yield Corporate Bond ETF saw a -0.6% dip, despite its lower duration risk which typically shields it from significant impacts of rising rates. Yet, this sector recorded its largest outflows of the year, reflecting increased investor reticence. Across the Atlantic, European credit markets faced similar challenges. The iShares Core EUR Corp Bond ETF, which serves as a barometer for European Investment Grade (IG) corporate bonds, declined by -0.7%. This was influenced by a 15bps rise in European interest rate swaps and a broadening of credit spreads. Specifically, the Bloomberg EUR IG corporate bond index saw its spreads widen by 4bps to 116bps, and European high yield spreads expanded by 15bps to 380bps. Consequently, the iShares EUR High Yield Corp Bond ETF experienced a -0.2% drop for the week. Despite the broader downturn, European corporate hybrids managed to buck the trend, ending the week with a modest gain of +0.1%. However, the WisdomTree AT1 CoCo Bond ETF wasn't as fortunate, recording a -0.7% loss as the broader European CoCo bonds market erased half of its year-to-date gains in April alone. This mixed performance in the credit sector underscores the intricate balance between spread dynamics, interest rate movements, and investor sentiment, further complicating the outlook for fixed income markets.

Rates

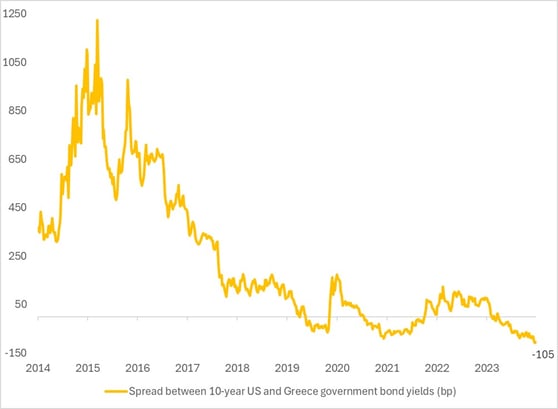

Despite recent geopolitical tensions, oil prices declined by 3% over the week, helping to stabilize US breakeven rates, which reflect market inflation expectations. The 10-year US breakeven rate remained unchanged, while the 10-year real yield increased by 10 basis points. Consequently, the 10-year US Treasury yield rose by 10 basis points, closing the week at 4.62%, driven by robust US economic indicators such as retail sales and initial jobless claims. The US Treasury yield curve (2s10s) remained flat at -36bps, with the 2-year yield approaching 5%. The 30-year US Treasury yield exceeded 4.7% for the first time since November. The MOVE index, which gauges interest rate volatility, was unchanged at 112, indicating continued high volatility and a positive correlation with equities in a persistently high inflation environment. This makes US Treasuries a challenging asset despite their attractive yields compared to equities. In Europe, signs of economic recovery are exerting pressure on European government bonds, while geopolitical tensions heighten the risk of renewed inflation impacts, especially due to Europe’s heavy reliance on commodity imports. The German yield curve saw a significant shift, with the 2-year yield closing at 2.62% and the 10-year at 2.5%, both up by 15bps over the week. Peripheral European bonds, such as Italian bonds, experienced slight widening, with the 10-year Italian yield increasing by 3 basis points relative to German bond yields, closing near 4%. Standard & Poor’s improved Greece’s credit outlook to positive from stable, acknowledging the country's robust economic recovery. Greece's debt-to-GDP ratio has dramatically decreased from 200% in 2020 to 150% in 2024, and its 10-year yield now sits approximately 50 basis points lower than Italy’s, at 3.5%. In the UK, the unemployment rate rose to 4.2% from 3.9%, marking the most significant monthly increase since the pandemic began. Alongside this, the UK's core CPI was reported at 4.2% year-over-year, slightly above the expected 4.1%, but tempered by weaker trimmed mean inflation figures. Despite these mixed signals, UK government bond yields aligned with US trends, with the 10-year yield rising by 10 basis points to 4.23%. This alignment reflects the global challenges in managing inflationary pressures and economic recovery trajectories.

Emerging market

Emerging market (EM) debts experienced a downturn this week, influenced by an uptick in US interest rates, with both EM sovereign and corporate bonds declining by 0.5%. Concurrently, a strengthening US Dollar exerted additional pressure on EM local currency debts, exemplified by a 4% year-to-date decrease in the JPM EM Currency Index. Notably, the Brazilian Real and Mexican Peso depreciated by about 4% and 2.7% in April, respectively. This resulted in a 0.5% weekly drop in the Bloomberg EM Local Currency Bond Index. In a positive note, the International Monetary Fund (IMF) in its recent World Economic Outlook, revised its 2024 growth projections for emerging markets up to 4.2% from 4.0% estimated last October. However, it cautioned that fiscal deficits might be broader than previously expected. Emerging markets are set to outperform advanced economies significantly, with forecasted growths of 2.7% for the US and 0.8% for the Eurozone this year. In China, amid ongoing struggles in the real estate sector, China Vanke is attempting to stabilize its finances by leveraging a 130 billion yuan asset package for new bank loans and divesting its stake in GLP Pte. Despite these efforts, the sector remains beleaguered with firms like Country Garden postponing bond payments and others slashing prices on premium properties in Hong Kong due to severe financial constraints and market competition. Furthermore, S&P downgraded the credit rating of Chinese developer Longfor to BB1 from BBB-, assigning a negative outlook but noted that the firm should manage its debt repayments over the next year. This week, Chinese real estate bonds plunged by 1.5%, marking one of their most challenging periods in 2024. In geopolitical developments, the U.S. has reinstated oil sanctions on Venezuela after a six-month hiatus, as the Biden administration concluded that President Nicolas Maduro's regime failed to meet agreements intended to ensure fairer electoral conditions for the upcoming July elections. In India, the electoral process commenced on April 19, with the main polling scheduled for June 1st.

.png)