THE FACTS

- After today’s hike, The Fed Funds rate will have increased by the most amount since the six months ending March 1981.

- As expected, Fed hiked rates by 75bps while the Committee reiterates its previous language that it is “highly attentive to inflation risks.”

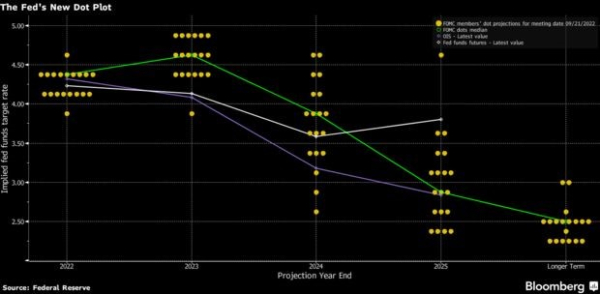

- What was even more important than the rate hike was the new Dot Plot which is very hawkish: median forecast shows rates at 4.4% BY END-2022 (i.e a further 1.25 percentage points of tightening before year-end), At 4.6% IN 2023, 3.9% IN 2024. The most hawkish dots (and there are six of them) now see the Fed funds rate reaching nearly 5% in 2023. While Wednesday’s decision was unanimous, the dot plot shows 10-9 majority in favor of hiking above 4.25% this year, suggesting a fourth straight 75 basis-point increase in November is possible.

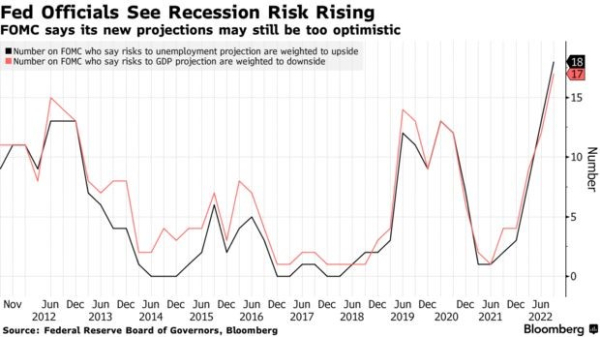

- Looking at economic projections, Federal Reserve officials gave their clearest signal yet that they’re willing to tolerate a recession as the necessary trade-off for regaining control of inflation. The "pain" that Powell hinted at during Jackson Hole seems to be coming... Chair Jerome Powell repeatedly spoke of the painful slowdown that’s needed to curb price pressures running at the highest levels since the 1980s.

- The Fed substantially revised GDP forecasts down, with the median estimate for growth this year at just 0.2%, down from 1.7% forecast in June. The median forecast among the 19 Fed officials is for unemployment to reach 4.4% next year and stay there throughout 2024, from the current rate of 3.7%. Powell told reporters several times that a softer labor market may be necessary to sufficiently bring demand down.

- Both headline and core PCE forecasts are up for this year and next. The Fed doesn’t see inflation returning to its 2% target until 2025.

- Last but not least the Fed said it will NOT outright sell Mortgage Debt from its balance sheet anytime soon.

MARKET REACTIONS

Dots higher than 4.5% for 2023 and Powell signaling recession might be the price to pay for crushing inflation were both badly interpreted by the markets.

- Major US equity indices were down around 1.5% and closed at the lows of the day. The S&P 500 broke back below 3800, its lowest since 14th of July;

- Bank stocks were pummeled after Powell admitted a housing correction was coming (and they weren't helped by further inversion of the yield curve);

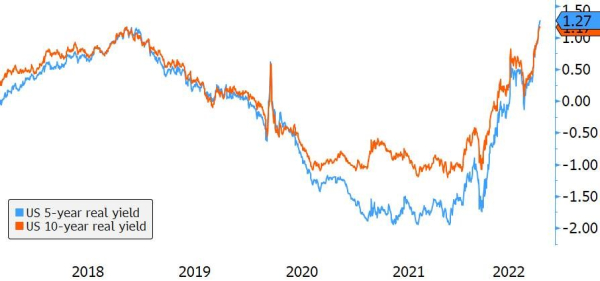

- The US yield curve indeed inverted further: 2Y yields jumped 7bps (topped 4.00% for the first time since Oct 2007 and hit 4.11% intraday high) and 30Y yields fell 8bps. UST yield curve 2s30s collapsed to its most-inverted level since 2000. The 2s10s curve hit -52bps intraday, very close to its most inverted level since 1982 (during Volcker).

- The dollar had another big rally day (and is trading even higher this morning on the back of the BoJ’s inaction). The euro plunged further below parity with the dollar;

- Oil ended the day practically unchanged as the global war premium from Putin was erased by inflation-fighting fears...

- Gold surged back up near $1700 - erasing the post-CPI plunge...

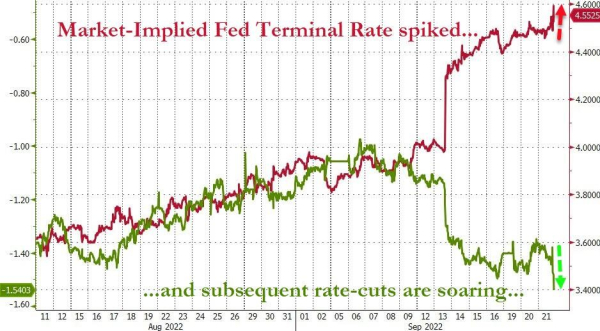

- In terms of rates expectations, the market is now pricing in 75bps for November, 50bps for December, and 25bps for Feb 2023, pushing the terminal rate above 4.60% and also sending subsequent rate-cut expectations soaring (i.e the market doesn’t believe that the Fed will CUT rates in 2023 instead of continuing to hike…)

OUR OPINION

Yesterday’s sober assessment is in sharp contrast from six months ago, when Fed officials first started raising rates from near zero and pointed to the economy’s strength as a positive - something that would shield people from feeling the effects of a cooling economy. Via their more pessimistic unemployment projections, Fed officials implicitely acknowledge that demand will need to be curtailed at every level of the economy, as inflation has proved to be persistent and widespread.

We believe that Mr Powell wants to make sure that markets take him more seriously than in July (his speech was seen as dovish and markets talked about a "Fed pivot"). He seems to be unhappy with markets pricing a rate cut next year – hence the need to push the market to re-assess the future direction of rates.

The Fed remains in a tightening mode with rates and inflation likely to stay higher for longer. The market has been complacent with the normalization of inflation and rates. Stagflation environment is characterized by inflation staying high despite the drop of output. Powell’s mission is to force the market to re-price this risk. They will hike until something breaks. In the meantime, real rates are expected to continue rising, which should weigh further on the valuation of risk assets. We keep our “unattractive” stance on equities and “cautious” stance on rates and credit spreads (see our August Asset Allocation insight “Not a time to be brave”).

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Flash note

.png)