What happened last week?

Central banks

This week, central bank officials delivered a strong and unified hawkish message, signaling the likelihood of higher interest rates for an extended period. The Federal Reserve (Fed) appears to have already abandoned its rate hike pause, with Chair Powell expressing reluctance to prolong the pause and opening the discussion for multiple rate hikes starting in July. Powell emphasized the need for "two or more hikes" to combat inflation. Market reactions were swift, as rate cut expectations for 2023 vanished, with only one rate cut anticipated in the first half of 2024. In tandem, ECB President Lagarde confirmed that rate hikes were not yet over, aligning with market expectations of a hike at the upcoming ECB meeting in July (90% probability). She cast doubt on an imminent peak in rates, suggesting the possibility of another hike in September (70% probability). Some ECB officials are considering options to accelerate the reduction of the bond portfolio, aiming to tighten excess liquidity. Potential measures include discontinuing reinvestment of the Pandemic Emergency Purchase Program (PEPP), which may impact Eurozone fragmentation, or actively selling assets from the Asset Purchase Program (APP), potentially resulting in notable losses for the ECB. Meanwhile, the Swedish central bank continued its tightening trajectory by raising rates by 25bps to 3.75%, aligning with expectations.

Credit

In June, corporate bonds once again outperformed government bonds, driven by tightening credit spreads. Among the credit segments in developed countries, high yield (HY) bonds stood out as one of the best performers. This segment benefits from lower duration exposure, higher carry, and significant tightening of credit spreads. In the US, HY corporate bonds delivered a return of approximately 1.5% in June, surpassing a total return of 5% year-to-date. This performance can be attributed not only to the resilience of the US economy and the solid financial health of corporations but also to technical factors such as limited activity in the HY primary market. On the other hand, US investment grade (IG) bonds remained flat in June, as the positive excess return from credit spreads offset the impact of higher interest rates. It is worth noting that the US leverage loan segment posted a monthly performance of +1.5%. In Europe, overall performance was relatively unchanged, with a slight positive note for European HY bonds while European IG corporate bonds experienced small negative returns. The best performers in Europe during June were European bank junior subordinated debts, which gained over 1% for the month. Overall, both the US and European credit markets have been pricing in a soft-landing scenario, and the current performance reflects this sentiment.

Rates

The rate market has been embroiled in a battle between hard data and soft data in the US, but it seems to be leaning towards a surprising path as the soft data surprise index experiences a sharp rebound. This resilient US economic data, coupled with the second-largest Treasury issuance in history, surpassing $800 bn in June, has once again exerted pressure on the US yield curve. The market reacted strongly to Powell's speech, leading to significant repricing. The 2-year US yield dipped just below 5%, while the US 10-year yield broke through the 3.80% level, which had served as a ceiling since the SVB crisis, signaling the potential for higher yields in the coming weeks. June concluded on a bitter note, with the Bloomberg US Treasuries bonds index closing the month with a decline exceeding -1%. Notably, for the first time in this cycle, the US 5-year TIPS yield crossed 2%. In Europe, a hawkish speech from Lagarde at the Sintra forum sent the German yield curve (2s/10s) to -80 bps, the most inverted level since 1992. The German 2-year yield surged by 50 bps in June, reaching 3.2%, while the 10-year yield increased by 20 bps but remained below the key level of 2.5%. German Treasury bonds lost nearly 1% in June. Despite this context, peripheral bonds have performed well, with Italian government bonds successfully managing a positive performance during the month. In the UK rate market, June was also challenging, with a negative performance of approximately -0.5%. Year-to-date, it stands as one of the worst-performing segments in fixed income, with a YTD performance of -4% and an accumulated loss of almost -30% since the end of 2021. In comparison, US Treasuries bonds were down 11% over the same period.

Emerging market

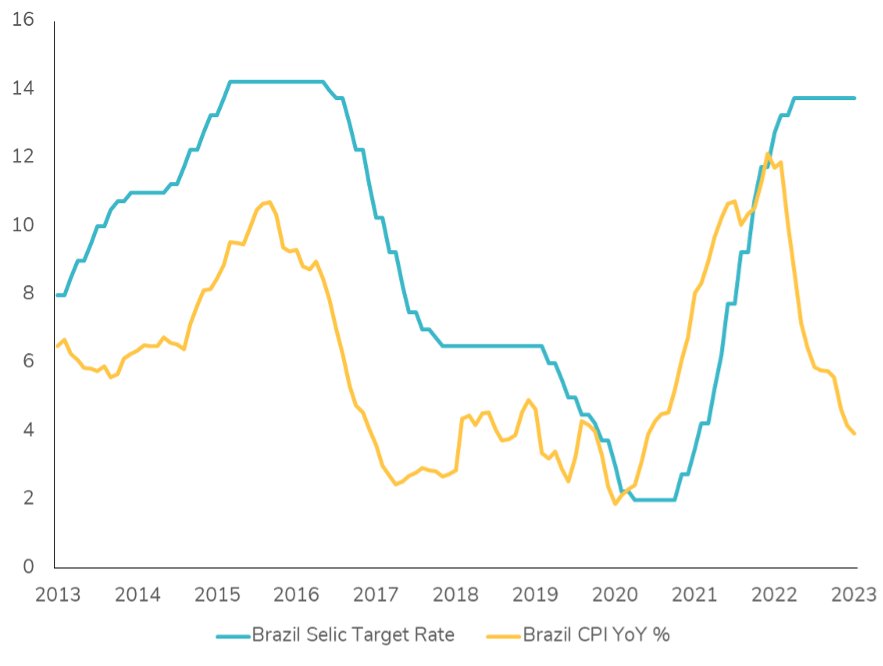

In June, the overall picture in Emerging Markets (EM) reflects a similar trend to developed markets. EM credit spreads tightened by 30 bps, enabling the index to offset the rise in interest rates and achieve a positive performance of 0.7%. The performance was driven by Asia and Eastern Europe, which contributed to the positive outcome. Notably, the resilience of Turkish assets following President Erdogan's reelection played a role in the overall performance. In China, the real estate sector initially posted a positive gain, although it somewhat dissipated towards the end of the month. The situation in the Chinese real estate market remains critical, and additional policy measures are anticipated to stabilize the sector, including potential reductions in the down-payment ratio and loan rates for home purchases. On the downside, EM bond funds experienced outflows of close to -$1 bn this week, the 20th consecutive week of outflows from EM hard currency funds. However, the impact of these headwinds has been offset by a relatively calm primary market thus far. In local currency, EM debt performance in June was muted, driven by negative performance by Asia and the weakness of the Chinese yuan (CNY). In other regions, such as Latin America and Eastern Europe, central banks have yet to initiate monetary policy accommodation (cut) despite significant progress on the inflation front. This allows investors to currently benefit from relatively large real interest rates.

.png)