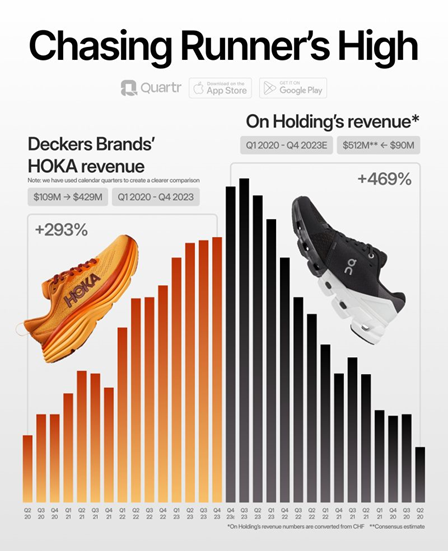

Chart #1 —

Bitcoin crosses the $60,000 mark; it is now the 14th most valuable currency in the world

On Wednesday, the price of bitcoin passed the symbolic $60,000 mark for the first time since November 2021. Over the past 12 months, the price of bitcoin has risen by 160%.

What are the factors behind the craze for the 1st digital currency in recent weeks?

1/ The recent surge in bitcoin's price can be attributed to a significant increase in institutional interest, following the approval of 10 bitcoin (cash) exchange-traded funds (ETFs) in the US earlier this year. The approval of these ETFs facilitates institutional investors' access to the cryptocurrency asset class. ETF purchases involve the acquisition of bitcoin for equivalent amounts. After just a month and a half of existence, Blackrock's iShares Bitcoin ETF holds over $8 billion in bitcoin assets.

2/ The much-anticipated "bitcoin halving" event, scheduled for April this year, acts as a further catalyst. Historically, halvings have triggered massive rises in bitcoin, as the rewards for mining are halved, effectively reducing the marginal supply of bitcoin.

3/ Hedge funds are anticipating a future imbalance between bitcoin supply and demand due to increased demand from ETFs and the halving of the marginal supply of bitcoin. A few figures to bear in mind (based on recent activity): assuming that net buyer flows from ETFs remain the same (or even increase), and considering that there are only 2 million bitcoin available on the exchanges (based on today's liquidity), this would mean that in 8 months' time, there will literally be no bitcoin available for sale on the exchanges...

4/ The return of retail investors to the crypto market. While bitcoin spot ETFs had received a rather lukewarm reception from individual investors, bitcoin's recent surge is attracting speculators, including retail investors.

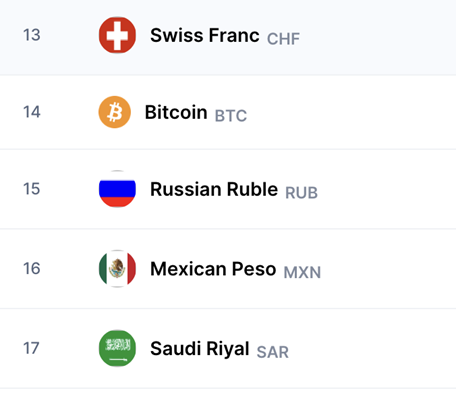

Based on market capitalization, Bitcoin is now the 14th largest currency in the world.

.png)

Source: r/IndianStreetBets on Reddit

Source: r/IndianStreetBets on Reddit