The downgrade

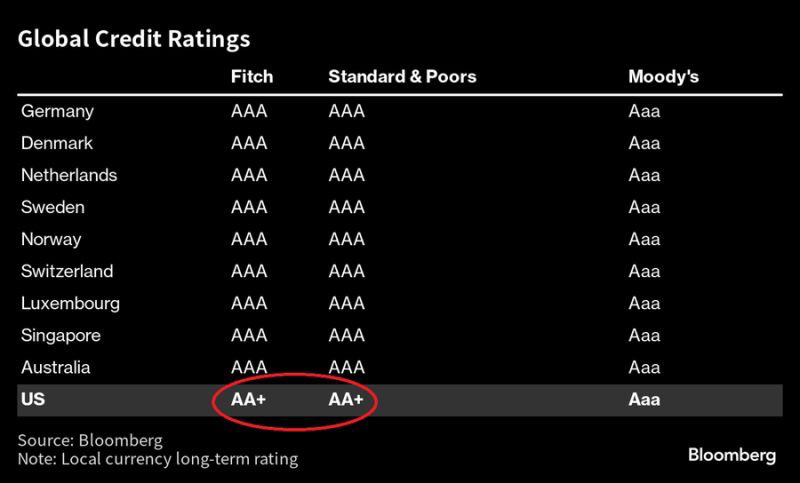

Fitch Ratings cut the United States’ long-term foreign currency issuer default rating from AAA to AA+ on Tuesday. The agency had placed the country’s rating on negative watch in May, citing the debt ceiling issue.

In a note, the Fitch analyst behind the U.S. downgrade explained the decision and how the country can regain

the top rating. He said that "repeated debt-limit political standoffs and last-minute resolutions" are to blame. He noted that debt ceiling standoffs have "eroded" confidence in fiscal management.

It’s not a growing jobs market, strong U.S. dollar or a resilient economy that will help the U.S. regain the top rating from Fitch. According to the firm, it’s going to take a major step up in governance.

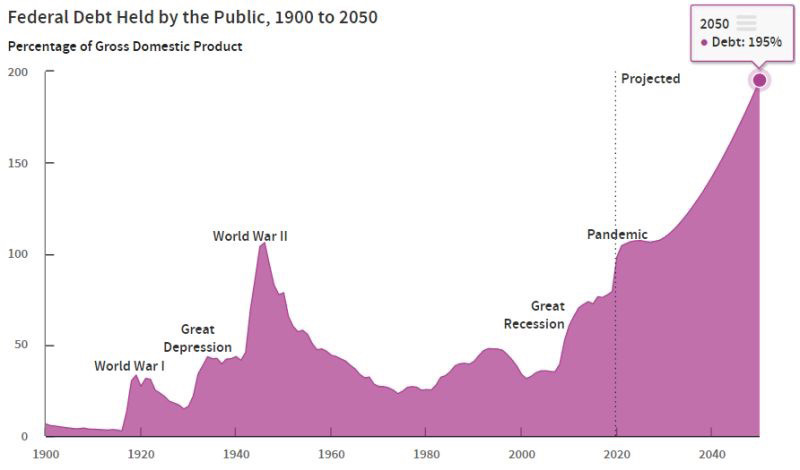

“This is a steady deterioration we’ve seen in the key metrics for the United States for a number of years. In 2007, general government debt was less than 60% and now it’s 113%, so there has been a clear deterioration,” Richard Francis, Fitch’s co-head of the Americas sovereign ratings, said.

“Furthermore, we’re expecting fiscal deficits to rise over the next three years and we expect debt to continue to rise over the next three years.” Francis said that, in addition to the Jan. 6, 2021 insurrection, the rating agency has noted a “constant brinkmanship” surrounding the debt ceiling among both Republicans and Democrats. That has hindered the U.S. government from coming up with meaningful solutions to deal with growing fiscal issues, particularly around entitlement programs such as Social Security and Medicare, he said.

Some high profile figures disagree with the

decision

Treasury Secretary Janet Yellen called Fitch’s credit downgrade “surprising” considering the nation’s strong economic recovery from the Covid pandemic. Yellen touted recent robust U.S. economic numbers and said, “Treasury securities remain the world’s preeminent safe and liquid asset.” Warren Buffet said he will continue to buy US Treasuries despite the downgrade.

JPMorgan CEO Jamie Dimon called Fitch Ratings U.S. downgrade ‘ridiculous’ but said it ‘doesn’t really matter’, because it’s the market, not rating agencies, that determines borrowing costs. Still, it is “ridiculous” that other countries are rated higher than the U.S. when they depend on the stability created by the U.S. and its military, Dimon added.

Markets negative reaction

Bond yields have been on the rise this week as the 30 year Treasury bond yield surged by 30 basis points in two days. As the correlation between US bond markets and US equities is positive again, stocks have been under pressure as well and in particular the long duration ones (e.g Tech stocks).

However, it is not very clear if the rise in bond yields can be solely attributed to the Fitch downgrade event. Indeed, several factors have been leading to a bond sell-off over the last few days:

1. The surprise announcement of an increase in supply, mainly on the long end of the cuve, from the US Treasury;

2. The repricing of the curve to a more favorable economic scenario (as Bill Gross pointed out on Thursday, the steepening of the yield curve could possibly happen due to an upward shift of the long end of the curve as short-term rates are likely to remain high for at least another year);

3. The BOJ starting to normalize its monetary policy (the rise of the long-end of the JGB curve has ripple effects on the yield curve of other developed countries).

The effect of these factors might have been exacerbated by the fact that liquidity is currently fairly low due to summer holidays but also Quantitative Tightening.

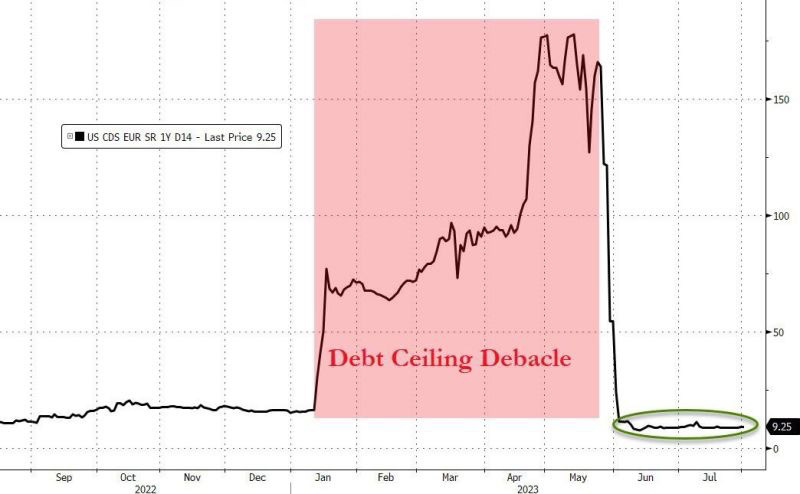

We note that US Sovereign risk (aka CDS on 1-year US Treasury) was completely unmoved by the Fitch downgrade (see chart below).

US CDS 1 year

Source: Bloomberg, www.zerohedge.com

Why this time could be different?

Twelve years ago, Standard & Poor’s announced a similar rating downgrade from AAA to AA+ (Moody’s is now the only rating agency keeping a AAA rating on the US). Back in 2011, the main reasons for the downgrade was the passing of a legislation that cut spending by $2 trillion.

At the time, the news didn’t have much impact on US Treasury yields – quite the contrary as US Treasuries yields fell due to their status of safe haven for investors when the European debt crisis hit.

However, It is also worth to remember that the macroeconomic context was very different 12 years ago: the US had low inflation, low interest rates and budget changes which were deemed to stabilize the debt-to-GDP ratio.

Fast forward to 2023: the debt-to-GDP ratio is approaching 120%, the surge in inflation has triggered the most aggressive rate hike cycle since the 80s (which makes debt issuance more costly) and the latest debt ceiling deal did little to rectify the US fiscal situation. According to the CBO, the Debt-to-GDP in the US is expected to hit an alarming 195% by 2053.

US interest expenses have surged by about 50% in the past year, to nearly $1 trillion on an annualized basis. The net interest costs is currently 3% of GDP and 14% of tax revenues (source: Strategas), a level where markets might start to anticipate a shift back to budget austerity by US policymakers.

Since the debt ceiling deal announcement, the US Treasury has been issuing more than $2 Trillion of US T-bills at a 5%+ rate to finance government operations. The Fitch rating downgrade took place a day after the US Treasury said new debt issuance would rise to US$1,007bn in 3Q23, up from US$733bn, with another US$852bn to come in 4Q23...

Could the Fed be soon forced to cut rates to help Treasury, despite the fact that inflation remains above the Fed’s target? This could lead to a crisis of confidence for the Fed by investors and trigger fears of renewed inflation.

The Fitch decision might also be used as a pressure point in the upcoming budget negotiations. Last but not least, the probability of a government shutdown this Fall is now increasing.

Investment implications

Despite Jamie Dimon and Janet Yellen mocking the Fitch decision, this downgrade seems indeed justified in light of the fiscal deterioration, a growing general debt burden and bad governance due to repeated political standoffs over the debt ceiling issue. For sure, there is no doubt that Uncle Sam can easily meet near-term payments. Moreover, investors are well aware of the reasons for the downgrade. Furthermore, the downgrade is unlikely to affect the use of US treasuries as a bedrock asset (US treasuries remain the Federal Reserve’s top choice of collateral for its lending facilities).

But debt sustainability is becoming a growing concern. Let’s keep in mind that US fiscal deficit is growing to 6% of GDP despite that fact that we are in a boom period. What level will this ratio hit if the US falls into recession ? Still, the real question for investors is whether the market can absorb all the new US Treasury issuance coming without triggering a surge in yields. In other words, who can be the buyer of last resort for US Treasuries?

As we have already discussed in previous FOCUS notes, the “new normal” implies that some large foreign “natural” buyers of US Treasuries are progressively shifting to other reserve assets. For instance, the percentage of US treasuries as a total of China reserves keeps declining.

Another important development is the trend towards de-dollarisation even when it comes to the currencies being used in oil trades. Last but not least, recent developments in Japan can have some impacts on the demand for US Treasuries. Indeed, the BoJ needs to increase the target yield which is set for their Yield Curve Control (YCC) monetary policy. As JGB yields rise and as the yen appreciates against dollar, there is less incentive for Japan institutional buyers to buy US Treasuries.

As we are currently witnessing in Japan, central banks of highly indebted economies have no choice but to become the ultimate buyers of their own government debt. The Fed is not exempt from this. As explained by Crescat Capital, the current monetary policy in the US (still hawkish) is starkly misaligned with the surge in Treasury issuances and the prevailing levels of fiscal irresponsibility. And while the Fed’s ownership of US federal debt has recently plunged to 2014 levels, the Fed probably needs to reverse this trend pretty soon.

There are other US Treasury “buffers” than direct buying by Fed though – at least in the short and medium-term. When it comes to T-bills issuance (the short-end of the curve), any rise in yields could attract demand from US money market funds and commercial bank deposits. They have plenty of cash parked at the Fed right now and might redirect this cash into higher yielding T-bills. When it comes to the long-end of the curve (i.e if the government chooses to raise funds using longer-dated Treasuries), the real yield offered by US treasuries has became quite attractive relative to equity earnings yield (see chart below). As such, domestic and international asset allocators could be tempted to buy long-dated US Treasuries (despite the downgrade and the long-term debt sustainability concerns), especially if US economic growth start to slowdown meaningfully. We keep a neutral stance on US rates and would use pullback as an opportunity to lock in attractive yields.

Where to find AAAs ?

For investors willing to be invested in the AAA club (as the US is now split-rated AA+), the table below (courtesy of Jim Bianco and Bloomberg) shows the 9 sovereign issuers with Credit Ratings being triple A with the three agencies.

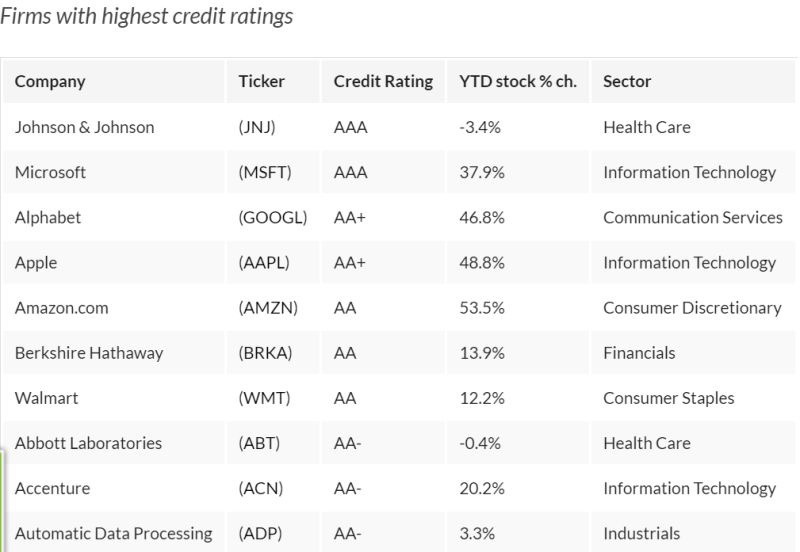

Within US corporate issues, just two AAA-rated companies remain in the S&P 500: Johnson & Johnson and Microsoft (see table below – source: investors). This is a startling decline in the number of AAA companies from past years.

More than 60 U.S. companies carried the coveted AAA credit rating from S&P Global Market Intelligence in 1980. And that dropped to just six in 2008. Since then,

ExxonMobil, General Electric, drugmaker Pfizer, and Automatic Data Processing have all been downgraded.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Flash note

.png)