ECB decision

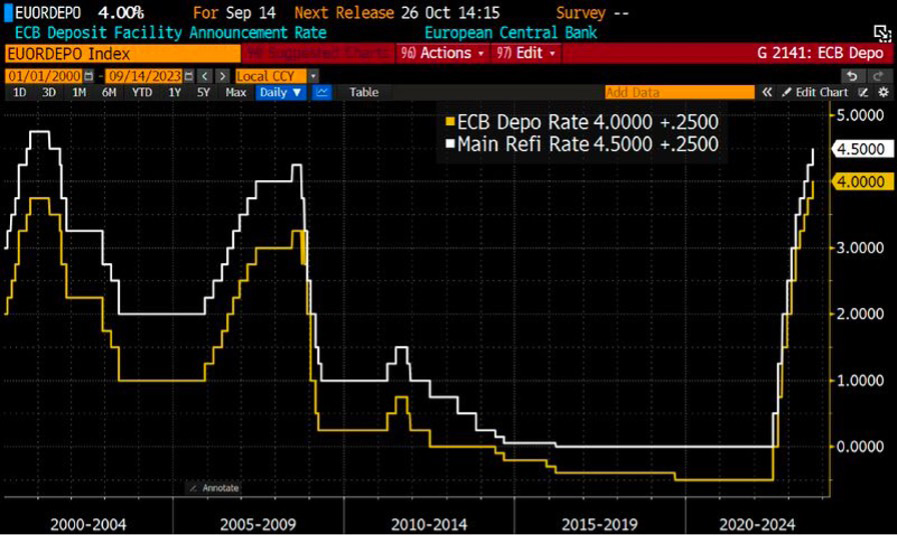

The ECB just raised its key rates again today, by 25bp (main Refi rate at 4.50%, deposit rate at 4.00%).

Concerns around the underlying inflation dynamic appear to have overwhelmed the ongoing negative (and concerning) dynamic in Europe’s economic growth: "inflation continues to decline but is still expected to remain too high, for too long. The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. In order to reinforce progress towards its target, the Governing Council today decided to raise the three key ECB interest rates by 25 basis points.

" The ECB said that "the Governing Council’s future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary" and "will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction.

" In particular, "interest rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission."

Moreover, the ECB has revised UP their 2024 HEADLINE INFLATION forecasts (from 3.0% to 3.2%), a level far

from being consistent with their single mandate’s target (2%). That basically left no choice today for the ECB but to continue to hike, even if this appears to be a clear negative risk for growth given the ongoing slowdown (we note however that 2024 CORE INFLATION has been revised DOWNWARD from 3.0% to 2.9%) Meanwhile, the ECB revised its GDP growth forecast for 2024 DOWNWARD, from +1.5% to 1.0%.

Given the most recent dynamics, this still appears relatively optimistic as it rules out the prospect of a recession, despite most coincident indicators being already in “recession territory”. With regards to PEPP purchase the Governing Council intends to reinvest the principal payments from maturing securities purchased under the programme until at least the end of 2024 (as they probably want to keep BTP-Bund spread under control)

Conference call

Ms. Lagarde’s press conference confirmed what could be interpreted from the rate hike decision: the ECB remains focused primarily on inflation. This was visible in Ms. Lagarde’s comments regarding the outlook for interest rates.

She left the door open to potential additional rate hikes if necessary to bring the inflation trajectory to target. She explicitly ruled out any potential reversal in rates, saying that the word “rate cut” hasn’t even been pronounced during discussions. She mentioned that the duration of the restrictive monetary policy stance will be important.

Our take

In the current context of clear economic growth slowdown, this can be summed up by saying that the ECB currently intends to bring back inflation toward target, regardless of the negative impact it may have on Eurozone economic growth.

It seems however that the discussions around the decision to hike were difficult within the Governing Council, with probably a pronounced divide between:

“Doves”, worried that monetary policy had already been tightened sufficiently (or too much?) and that the ongoing deterioration in growth conditions will drag inflation lower in the near future, and “Hawks”, who stuck to the monetarist approach/Bundesbank heritage and thought that more tightening was needed for as long as inflation remains too elevated.

The “hawks” apparently won the debate, but Ms. Lagarde’s mention of a “solid majority” is much less impressive than the “overwhelming” or “large” majority previously mentioned for other decisions.

In a nod to “doves”, the ongoing PEPP, reinvestment of maturing sovereign bonds held by the ECB, was maintained, and those reinvestments will be made “with flexibility”, which might give the ECB some capacity to contain a potential continuation of the widening in sovereign spreads (especially Italy).

Yesterday’s decision was probably a difficult one to take for the ECB, as the risk for the central bank to be blamed for causing, or amplifying, a recession appears elevated and might tarnish the ECB’s perception across the population and several European governments. Let’s hope that this isn’t another “Trichet moment”, like in July 2008, when the ECB hiked amid an already severely slowing economy, only to have to reverse course in a few months later.

In any case, the combination of an ECB still in restrictive mode, and of the ongoing negative growth dynamics, is not encouraging for the Eurozone outlook in the months ahead and next year.

Our scenario for ECB rates is that this was likely the last hike of the cycle and that short term rates will now be held at current levels until there are clear signs that inflation is slowing down. However, given the tone of Ms. Lagarde’s conference, one cannot completely rule out one more rate hike, if inflation remains too high and doesn’t slow down. Rate markets are pricing a small chance of this happening at one of the two remaining ECB meeting this year. If that were to be the case, our view is that it would only reinforce the downside risks around the 2024 Eurozone growth outlook.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Flash note

.png)