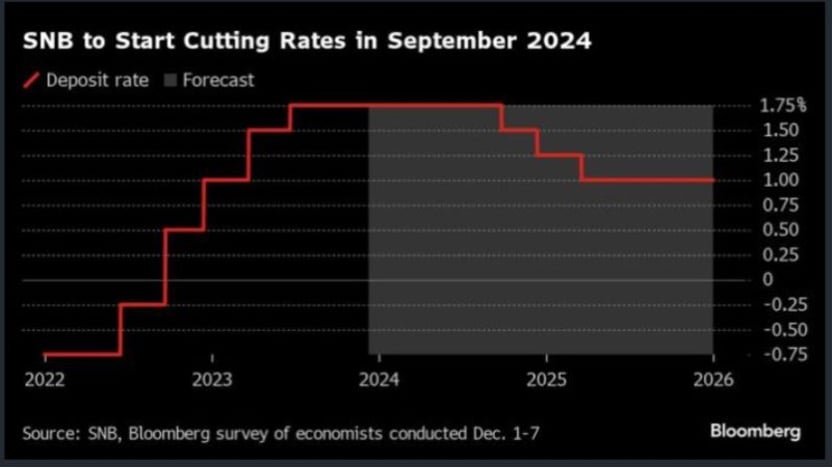

Unsurprisingly, last Thursday the SNB left its key rate unchanged at 1.75%, the rate that has prevailed since the last rate hike in June.

The main lesson to be learnt from the central bank's announcement last week is that the SNB has abandoned any form of bias or guidance on the outlook for its monetary policy.

Back in September, the SNB had already left its key rate unchanged, but had clearly communicated a persistent "tightening bias" by explicitly mentioning the possibility of further rate hikes and by signalling that foreign exchange interventions were "focused on selling foreign currencies" (i.e., supporting the CHF).

These two references were no longer mentioned, making the SNB's position as neutral as possible. The SNB simply stated that it is prepared to adjust its monetary policy "if necessary" to keep inflation within the target range. It should also be noted that there is no longer any indication of the preferred trend in foreign exchange interventions, although the SNB remains prepared to be active on the foreign exchange market if necessary.

It should be noted that inflation projections have been revised slightly downwards due to weaker-than-expected price dynamics in Switzerland. This softer inflation outlook has probably strengthened the SNB's resolve to eliminate any "tightening bias" in its stance and adopt this very "neutral" stance.

As things stand, short-term Swiss franc rates are compensating for the inflation observed in Switzerland, leaving real rates around 0, a level that is neither accommodative nor restrictive for the economy. The global dynamic of slowing inflation is reducing the risk of imported inflation, thus reducing the incentive and benefits of a stronger CHF.

According to a Bloomberg survey of a panel of economists (see chart below), the Swiss Central Bank could cut rates for the first time in September. Two further cuts of 25 basis points are forecast by this consensus in December 2024 and March 2025. Some economists believe the SNB will act sooner. Analysts at UBS said last week that they expected action as early as June. For BlackRock, March is even a possibility.

For our part, with 2024 looking very uncertain, and given the rather benign growth and inflation environment in Switzerland, we believe the SNB will adopt a "wait-and-see" stance, which will be appropriate as long as growth and inflation dynamics do not deviate significantly from the currently projected trajectory. Whereas the Fed or the ECB may have to ease monetary policy after having to tighten it sharply in an inflationary context, the SNB may not have to follow suit, given the milder inflation and interest rate environment in Switzerland.

Source: Bloomberg

Source: Bloomberg

.png)